Do your finance teams face challenges with tracking, validating and approving mileage logs?

In a business, if an employee uses his/her personal vehicle to run business errands, the employee has to be compensated. Mileage tracking is important for the employee for reclaiming expense reimbursement as well as for tax-deduction purposes.

Reimbursement expenses include gas price, insurance, registration fees, repairs, tire change, etc. The employee has to make sure to include all records of the trip in a logbook or a spreadsheet. The mileage log has to include details like date, start and end destination, purpose, miles, etc.

We know the process can take up additional time, but can it account for accuracy? With a self-reported mileage log, the finance team has no way to be sure if it’s filled correctly. Additionally, employees can easily find loopholes to make fraudulent claims for reimbursements. For example, making claims for a trip they haven’t taken.

In this article, we will talk about how easy and convenient mileage tracking can be when your expense management software is integrated with Google maps.

How to Track Mileage With Google Maps?

Google Maps is the most widely used and preferred navigation app used in the world today. This is primarily because it offers reliable directions as compared to other GPS apps. Google has also invested time and resources for developers to integrate Google Maps with their product to help provide users with a seamless experience.

Google Maps integrations help the modern expense management ecosystem to effectively address and tackle expense reporting challenges. It helps simplify the process while also adding a layer of security around it. This makes mileage reporting quick and easy.

SUGGESTED READ: How Fyle helps track Mileages & Per Diems efficiently

Automatic Mileage Rate Calculation

Traditional expense report templates come with the task of manual data entry and human intervention. Calculating the distance between places can be filled with errors when done manually. Further, the chances of error increase with the inclusion of multiple stops. This can cost your employees and finance teams a lot of time. Unfortunately, even after this entire ordeal, your finance team has no way to be sure it is accurate.

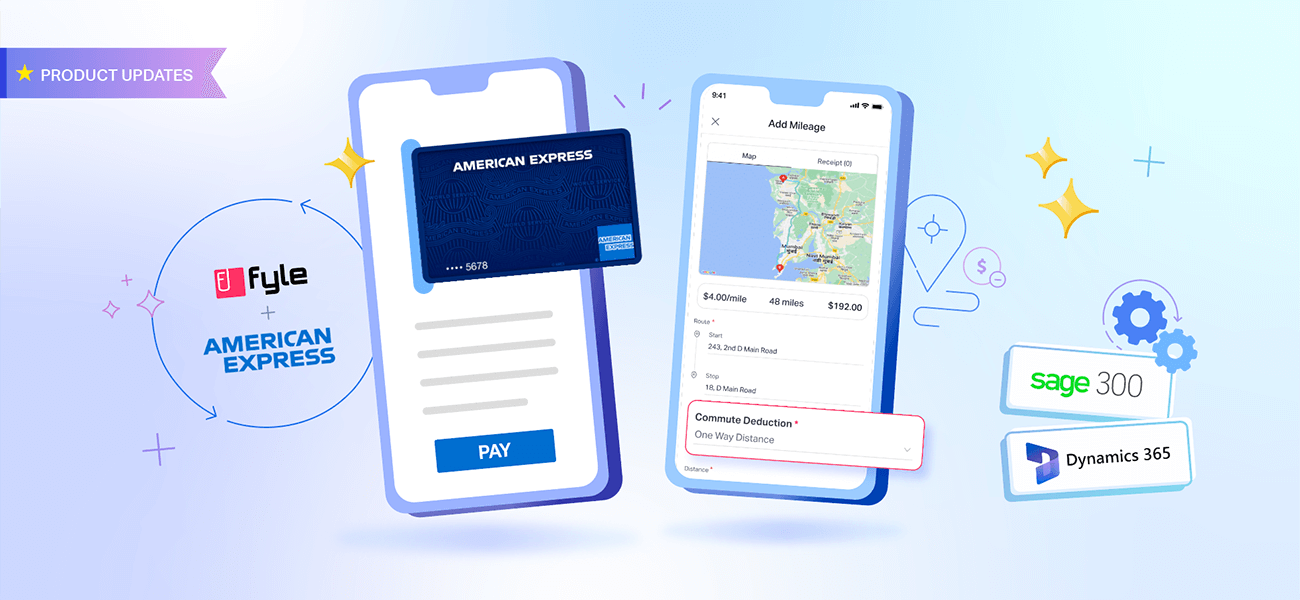

With Google Maps integrated software, the process of manually calculating distance and amount is done in one go. All the user has to do is input the start and end destination, and the distance is determined. The accuracy provided by Google Maps helps eliminate errors and incorrect mileage calculation.

Fyle assures you there's nothing to worry about even if your employees want to log multiple destinations at once. We provide the option of including additional stops into mileage logs. With this feature, employees need to only add the destinations and the road mapping while we take care of the mileage rate and calculations with the help of Google Maps.

Mileage Rate Based on Vehicle Type and Location

Did you know that the standard IRS rate varies depending on the type of vehicle you own?

Irrespective of whether your employees use a two-wheeler or a four-wheeler, there’s no need to worry about mixing up mileage rates. Fyle offers finance teams the flexibility to set mileage rates according to the vehicle type and location. With this feature, employees have to only define his/her vehicle type. In doing so, mileage rates are adjusted accordingly.

This means when an employee enters the start and end destination; the software automatically calculates the mileage rate according to the distance and vehicle type. This eliminates the confusion around different rate slabs for different vehicle types. It also helps produce accurate and IRS compliant mileage reports.

Maintain Mileage Logs Under One Tab

In traditional mileage tracking, employees have to fill lines of mileage logs. Employees also fill mileage forms for reimbursements. Additionally, they also need to fill another form to reclaim tax deductions. But with pages of mileage logging, it can be difficult to keep track of all the logs.

The plot thickens when it comes to the finance teams. With mileage forms coming from different employees, it can be a challenge for the finance team to keep track of all the reported business expenses. This can also result in them overlooking double entries or repeated expense claims.

But with Fyle, all the mileage logs are recorded under the expense tab. The employees can fill the mileage form with all details in a short amount of time and save it. The saved mileage logs are all stored under one system. After submission, the finance team can easily access and review it.

SUGGESTED READS:

Policy considerations for mileage reimbursement

Everything you need to know about per diems expense reports

With Fyle, you can seamlessly track mileage directly via Google Maps. This helps both employees and finance teams as it not only limits inaccurate mileage logs but also saves up on productive time. Additionally, we ensure businesses can be confident about their employee mileage reports.

Why Fyle?

- Employees have only to input the start and end points - Fyle helps automatically calculate the distance between the two locations. This reduces the chances of incorrect or fraudulent entries.

- Employees can add multiple stop locations in a single report - This mainly applies to sales reps who often travel to multiple sites on a single day. Allowing employees to report multiple pit-spots on one expense report reduces complications and confusion.

- Reduction of dishonest mileage reporting and calculation - Google Maps automatically tracks the distance traveled by employees based on the logged entries. This prevents financial leaks for your business.

- Effective enforcement of expense policies - The mileage rate is pre-defined under the company mileage expense policy set by the finance team. Since everything is automated, businesses can be assured that employees will stay compliant.

- Device agnostic reporting - Employees can report mileage via both the web app and mobile app. This gives users the flexibility to report expenses on time and accurately.

Do you wish to never worry about your expense reporting again? Schedule a demo with Fyle to see how we can help you streamline your expense management processes.