Dear Small Business Owner,

There are 4 things you need to know about expense reporting:

- They are important for businesses of all sizes.

- They are not just for employee reimbursements.

- They contain data that’ll help you cut costs and plan better.

- They help you stay compliant.

Sincerely,

Every finance team ever.

Even a small team incurs business expenses like transportation, meals, travel, and other incidentals essential for business operations. It is vital to record these expenses and have accurate reports of the same. We’ll tell you how to create an expense report in under 5 minutes and ways to make it easier too.

SUGGESTED READ:

What is a T&E report and why is it important?

How to create an Expense Report?

Simple, you can just google it. You’re spoilt for choice when it comes to easily downloadable options. In fact, you can even find expense report templates in Microsoft Excel.

But is a generic template off-the-internet the best choice for your company?

Here’s a list of essentials that your expense report must contain:

- Name, department, project name and contact information

- Names/ codes for expense itemization

- Date when the expense was incurred

- Purpose of expense

- Receipt as proof of expense

- Actual expense amount, i.e., how much the company has to pay.

This checklist can be a start, but you should tailor your expense report to fit your business’s needs. If you don’t, it becomes an unproductive, time-consuming task for all stakeholders involved.

A to-do list for employees:

- Safekeeping of all receipts related to business expenses.

- Recording and reporting one receipt at a time through manual data entry.

- Matching receipts with corresponding spends and projects.

- Chasing expense report submission deadlines.

- Chasing the financial team in case of policy violations or delayed reimbursements.

A to-do list for finance teams:

- Chasing employees to submit expense reports.

- Manually verifying receipts, both paper and digital.

- Checking for policy violations and compliance issues.

- Understanding and reporting spends to business owners and other stakeholders.

- Facing the wrath of IRS in the event of non-compliance.

That’s a lot of chasing and back and forth for a simple report.

Enter Expense Management Automation. Enter Fyle.

Fyle helps you save your crucial productive hours to tend to other daunting business tasks.

Does your business need expense automation?

In recent years new technology has not only made expense reporting and processing easier for employees, but it has also made it much more efficient and cost-effective for employers. A modern expense management solution is a must for any business that wants to ease the burden of tracking and reporting expenses for employees. Additionally, you need to make sure your business isn’t overpaying for fraudulent or non-compliant expense claims.

SUGGESTED READS:

Benefits of online receipt management over traditional methods

How to achieve faster reimbursements for travel expense reports?

How to manage receipts to ensure your team is always audit-ready?

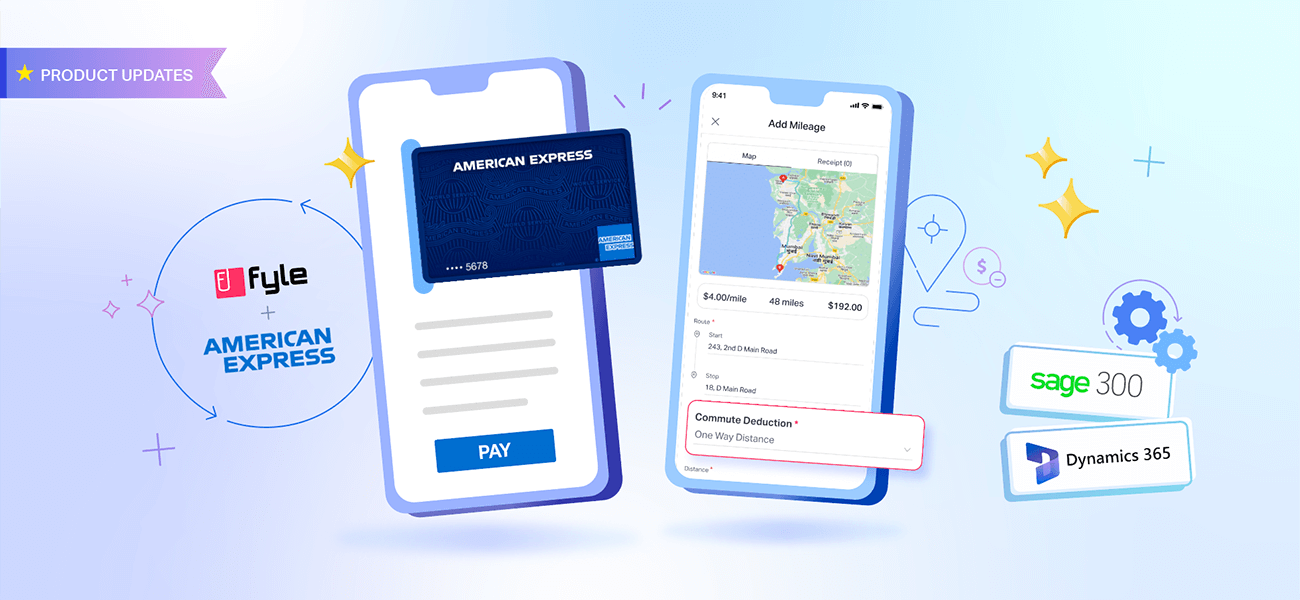

Here’s how Fyle helps make Expense Reporting easy!

We’ll just let our mission statement do the talking here.

“We’re creating a receipt management and expense reporting suite so good that you never have to think about managing business expenses, ever.”

The numerous ways in which Fyle allows reporting is a small testament to the sincerity of this statement.

Got a paper receipt?

- Scan it with smart OCR in the Fyle app.

- Click a picture and send it to Fyle directly from your gallery.

- Or, manually upload from your computer, Dropbox, or Google Drive.

- Send your receipt as a text message and see it in Fyle as an expense.

Got an e-receipt?

- Fyle expenses directly from your inbox using our Chrome extension, G-Suite, or Microsoft Outlook add-on.

- Submit recurring expenses from apps like Uber and Lyft directly using Fylemail.

- Or, simply click on “Find my receipts” and sit back while Fyle discovers and categorizes receipts from your Gmail.

Got multiple receipts?

- Upload multiple receipts anywhere, anytime, and from a device of your choice using BulkFyle.

Fun Fact: One of our users once fyled 2609 expenses in a single go!

Traditionally, once you have uploaded all your receipts, you would then need to match the expenses to corresponding projects or categories manually. Once this is done, you would have to stitch them together to create and submit an expense report.

But Fyle handles this as well for you. Once you have matched the expenses, you can simply save or submit your expense report for approval.

On creating the expense report, it can be sent to the approver for approval. Fyle also runs real-time policy checks on all submitted expense reports to detect and flag duplicate and fraudulent expense claims. We also flag and notify both the user and the approver in case of a policy violation.

With Fyle as your expense reporting software, you can make a historically time-consuming task like expense reporting, a breeze.

Don’t believe us? Allow us to demonstrate. Schedule a demo now!