A company’s travel and expense policy work as a guidebook for both the company and the employees. A typical company travel policy will include how expense reimbursement works, limits on expenses, costs covered by companies, etc. In some companies, T&E policies are made mandatory to follow, whereas in others it is more flexible.

However, there’s no denying that effective international travel policies help not only to control employee business expenses but also account for employee well-being. Policies allow employers to have some degree of control over employee experience and safety.

In this article, we will talk about why companies need an international travel policy for employees and what to include in it. We will also look into how you can enforce your policies effectively. So, let’s get right to it!

SUGGESTED READ:

Balancing expense policy compliance and happy employees

Why should your business have an international travel policy for employees

All established companies have an international travel policy for employees, but what about small businesses? Do they require one?

If your employees travel at least twice a year, it is advisable to create an international business travel policy for employees. With an effective T&E policy, travel arrangements can be made according to the company's financial standing. Additionally, finance teams can also achieve a certain level of compliance. Expense policy compliance is vital when it comes to cost-saving as well as for your traveler's safety.

SUGGESTED READ:

How can expense policy compliance benefit your business?

When you have a well-defined travel policy in place,

- Bookings such as transportation, accommodations, meals, etc. can be organized to meet the company's budget as well as employee satisfaction.

- By setting specific limits on expenses, the business can limit overspending and help the company avoid potential frauds.

- Having a company policy can enhance employee travel experience. Additionally, defined procedures protect employees; in case of any unaccounted incidents.

- Business trips account for expenses in different categories. With a clear policy in place, finance teams can streamline the expense reimbursement process for traveling employees.

What to cover in your international travel policy for employees?

There are multiple aspects to consider while making a corporate travel policy for your employees. Your travel policies should highlight vital points which can be of help to both your finance teams and employees. Some points to incorporate into your company’s policy are:

Listing expense categories and limits

The policy should highlight on what category of business expenses the employees can avail reimbursements. The expense categories would mostly include costs such as — food, hotels, rental car, etc. Also, your expense policies must communicate spending limits on specific expense categories, if any.

SUGGESTED READS:

Your guide to 2020 IRS mileage rate

International per diem guidelines for 2020

What is the standard per diem meal allowance for 2020?

Should you provide per diem pay for weekends?

Mentioning non-reimbursable items

A company can state what items it would not cover through the policy. For example, expenses like alcohol, child-care, hotel or airplane upgrades, etc. may not be covered by a specific company. These expenses should be mentioned clearly in a section of the expense policy.

SUGGESTED READ:

How to create an IRS compliant expense reimbursement policy

Defining procedures around reporting expenses

Expense reporting is a necessary procedure to make sure expenses are as per the set limit. Additionally, it is crucial to make sure the employees get reimbursed for personal expenses made for the business. Employees should know how to report their business expenses and what documentation is required to ensure they get reimbursed.

Here are some important aspects your travel policy must contain:

- How and where can employees report their expenses?

- What’s the timeframe within which they need to report it?

- What do employees have to include with their expense reports? (receipts, form, invoice, etc.)

- What are the expected timelines for employee reimbursements?

Pointers to keep in mind:

- For international travel, the currency also varies from region to region. The policy should state what is the preferred mode of payment (if any) and how to report it.

- In case your company would like to reclaim the VAT from a VAT-related country, the required procedure must state it as well.

- If reclaiming VAT, tax authorities are often very strict with providing proof of expenses. In such cases, your policy should mention the importance of documentation of all business expenses.

Streamlining the expense approval process

The entire process of international travel involves several departments working together to get work done. Starting from request to reimbursement, there are a lot of processes involved. For example, flight and hotel booking should all be taken care of before the official date of travel.

To ensure smooth functioning the entire process for approval and processing should be described clearly in your expense policy. This also helps employees have a pleasant experience while on business travel.

Pro-tip:

Most companies opt for a Travel Management Company (TMC) and some, an internal travel agent to ensure seamless international travel for employees.

Communicating safety policies and insurance details

Work travel has almost become a part of an employee’s work routine. But the risks associated with travel cannot be eliminated. Both the company and the employee have to be ready for unforeseen circumstances like natural disasters, riots, car accidents, political violence, etc. Businesses can mitigate these risks through insurance and risk management.

In case an employee is injured while away from home, several insurances may apply. This can be employee compensation, personal accident coverage, employee benefits program, etc. In such cases, the employee must be made aware of the same. Additionally, before travel, the finance teams should educate employees on how to tackle emergencies, if any. The potential for unexpected events that require remedy while staff are traveling is so varied, that it’s essential that they understand in advance how they are protected and what action to take, especially if they’re using a company car or a larger vehicle like a truck or semi-truck.

According to Shuman Legal, the majority of accidents regarding trucks result from human error, mechanical failure, drunk driving, or where the company has failed to maintain its vehicles to current inspection standards - so it’s imperative you take the necessary steps to protect your employees. Employees should know about the different types of insurances that cover them, emergency contacts and other such information.

How can an expense management software help enforce international travel policy for employees?

According to an Aberdeen Group report,

“Investing in an end-to-end travel expense management software can result in a 44% increase in compliance.”

Nowadays, businesses are actively moving towards expense management softwares to manage their business expenses. Automated solutions not only make the process of expense reporting a breeze but also ensure policy compliance. Hence, they are becoming the go-to solutions for all businesses looking to put a stop to their expense management woes.

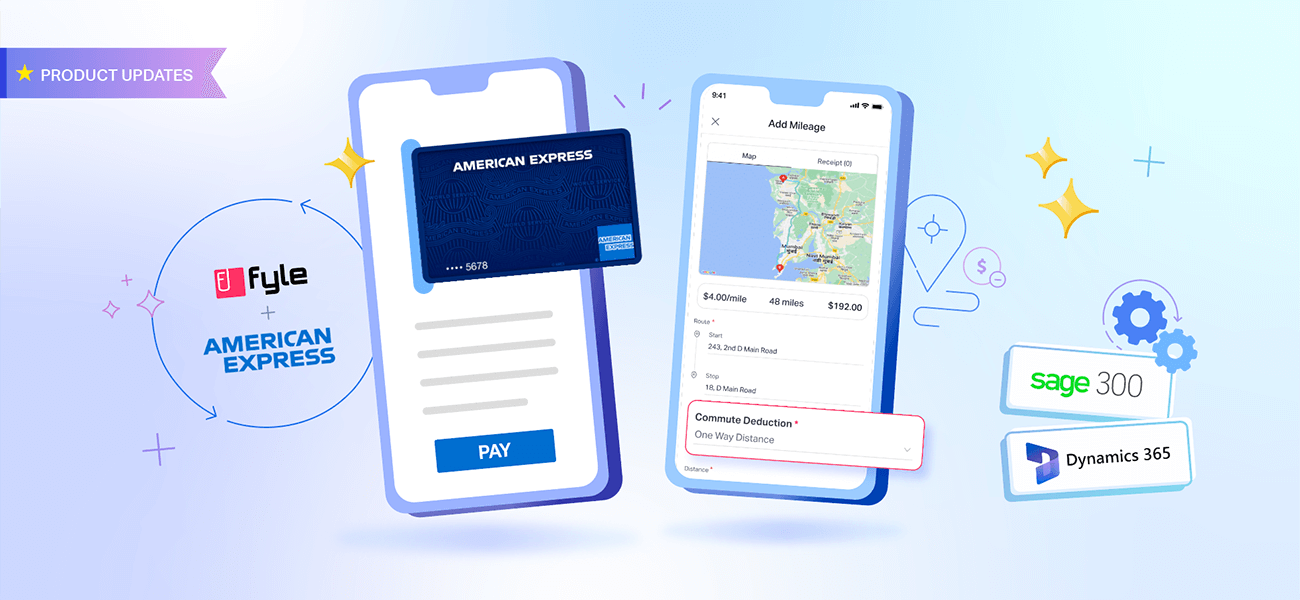

How can Fyle help enforce international travel policy for employees?

Automated travel request workflows

Once the employee has placed a travel request with all the required details (place, date, hotel preference, etc.), the manager reviews it. After review, it can then be sent to an internal travel agent to take care of the bookings. This reduces hassle and miscommunication between all the parties involved.

With effective policies in place, finance folks can monitor and control overspending. Additionally, real-time policy checks take place to ensure no policy violations, expense fraud, or out-of-policy expenses slip through. Any off-limit expenses are flagged immediately, which then can be marked and resolved by the approving managers. Automatic flagging of policy violations increases employee compliance and better policy enforcement.

Our receipt scanner allows employees to never worry about receipts. On using Fyle, a receipt can be instantly clicked, scanned, and saved to create an expense report. We also support multi-currency transactions. This means your employees can seamlessly report expenses irrespective of the country or city they traveled to. This makes the entire process a matter of just a few clicks.

The end result

Expense management is a cumbersome process. It requires multiple teams to pull strings to get work done. This translates to overlapping documents, miscommunication, and increased chances of error and fraud. This is why businesses resort to drafting policies. But enforcement of these policies is a whole different ball game. This is where an expense management software comes into play.

A travel and expense management software eliminates confusion by allowing all stakeholders access to one central dashboard to manage all reimbursements. It also comes with customizable policy engines that check for violations at the source of expense creation. This excludes any human intervention in the verification process. This allows for a seamless and unified process, which results in higher productivity.

We recommend you invest in a modern and intuitive expense management software like Fyle. We help businesses streamline and automate all aspects of expense management. We not only enable seamless expense reporting and policy enforcement but also empower businesses to keep track of all your business expenses.

Need a helping hand to fix your expense management roadblocks? Schedule a demo today to see how Fyle can get things done!

.png)