Expense report approval is necessary to ensure your business stays audit-ready at all times. It also plays a crucial role to ensure that no fraudulent expense claims slip by. But is it as easy as it sounds?In this article, we discuss the various types of business expenses that need approval. Additionally, we look into the nuances of an expense report approval workflow. Lastly, we compare how an automated approval workflow pans out against the traditional ones.

What Type of Business Expenses Require Approval?

An employee incurs various types of business expenses during work. Most of these expenses require approval before going into the payment processing cycle.

The following are the expense categories that require expense report approval:

- Travel expenses are the most common business expenses after employee payroll. They comprise all the justifiable business expenses an employee incurs while on a business trip, e.g., hotel booking and airfare.

- Cash advances are issued to employees when a substantial business expense is anticipated that would require them to possess additional funds, e.g., travel advances.

There are many other miscellaneous business expenses like food, entertainment, and local transport that also require approval(s) for reimbursements.

What Is an Approval Workflow?

An approval workflow refers to the defined series of steps that an approval mechanism entails. It includes the structure, levels, and procedure of verifying and approving an expense report. A well-defined approval workflow optimizes approvals by making them consistent and standardized. It also helps boost efficiency by providing every report a fixed route through all approvers in a systematic manner.

Types of Approval Workflow Structures

- Sequential: A sequential structure consists of a set sequence of approvers wherein the report goes through a linear chain of approval levels. This is more common in tall organizational structures where the hierarchy has many levels and fewer people at every level.

- Parallel: A parallel structure does not follow a set sequence of approvers. It consists of multiple approvers at the same level, any one of whom can approve the report and pass it on to the next level. This is more common in a large organizational structure where the hierarchy has less number of levels and many people at the same level.

- Customized: A customized structure varies with the organization’s requirements and preferences. A typical example is a structure that escalates a flagged expense report directly to a higher authority for appropriate actions.

Common Types of Approvers:

An approval workflow involves specific levels of approvals to ensure that a report is scrutinized from every angle and by every stakeholder systematically.

The most common types of approvers are as follows:

- Managers - They are the primary stakeholders concerned with an employee’s business expenditure. They check the reports for policy violations and evaluate the nature of the expenses.

- Finance and accounting team - They verify the receipts on the expense report and make sure the expenses are in line with the accounting and auditing standards.

- Travel agents and admins - In the case of business travel, external travel desks are also involved in the approval process.

- External verifiers or admins - In case of integration or coordination with an external vendor or service provider, external verification also comes into account.

SUGGESTED READS:

Things to consider while designing an expense approval workflow

A guide to streamline your travel request approval workflow

What’s the Procedure for Expense Report Approval?

Today, expense report approval happens in multiple ways. While many companies still employ ancient approval practices, some companies are actively upgrading to expense management software. Let’s have a look at both the manual and automated procedures and the impact they have on your employees and finance teams.

How does traditional expense report approval work?

Due to the lack of technological advancement and artificial intelligence, traditional practices involve a lot of manual intervention. Although companies have incorporated conventional devices in their expense reporting and approval procedures, a significant portion of the work is still manual.

- Physical receipt collection and cataloging

Before computers became a standard professional tool, expense report approval was done by manually verifying every physical receipt and accounting for it on a physical ledger. Sadly, for many companies, the time has stood still. Although they use computers to keep track of every expense report, they still manually collect physical receipts from their employees. Once done, they sort and catalog these receipts. Once categorized, they store them in separate folders before they go through the manual verification process.

- Manual verification and validation

In most companies that resort to using the traditional means for expense report approval, the employees usually update their business expenses on a computer application. The managers and other verifiers then tally and match every receipt with the respective entry manually. The reported business expenses then go under scrutiny for policy violations. If flagged, the finance team or the approving managers need to understand the reasons behind the violation. Based on these justifications, they can either approve or disapprove the particular expense report.

The traditional means to expense report approval not only cost you money but also cost you your resources. Your employees and finance team waste a lot more time than needed on these mundane tasks. Additionally, even though your employees spend their time and effort it, visible leaks still persist. In the long run, this could prove to be threatening to the financial and productive health of your company.

How does modern expense report approval work?

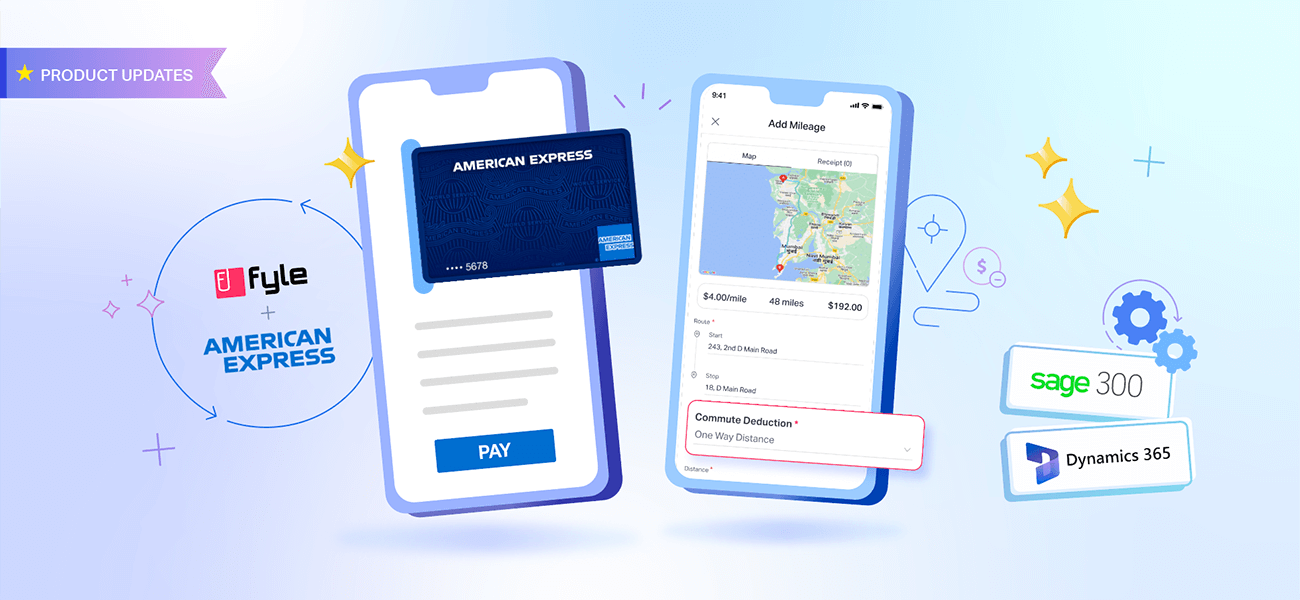

Modern expense management software like Fyle has simplified expense report approvals. With automation, every aspect of the expense report approval workflow is streamlined to reduce the time, effort, and risks involved in expense reimbursements.

- Receipt management and storage

Instead of submitting physical receipts manually for approval, the software allows employees to upload a soft-copy of every receipt. Approvers can accept or reject all the e-receipts via a single dashboard itself. Every business expense has its receipt attached to it, so storing and sorting all business expenses becomes straightforward. The software also automatically catalogs, sorts, and arranges them as per your business needs.

- Automated policy checks and verification

As soon as an expense is updated, the expense management software checks it for policy violations in real-time. In this way, the software filters the expenses at the initial stage itself and eliminates inappropriate submissions.

Every business expense and receipt is laid out for the approvers to review expense reports quickly. Once approved, they move to the finance team for the last lap of approval. The whole process is highly efficient as tracking and validating expenses become effortless due to automation.

Advantages of Automated Expense Report Approval

- Minimal manual efforts and time consumption

- Automated policy violation checks at the source of expense creation

- Real-time notifications and prompts to specified stakeholders

- Immediate flagging of expenses which violate your policies

- Custom reminders for any unreported or unapproved expenses

- Direct bank feeds to reconcile and verify credit card transactions

- Automated matching of card expenses with bank statements

- Integration with HRMS to update approvers instantly

- Integration with travel desks to approve travel expenses

- Automated verification of expenses against issued cash advances

- A single unified storage for all expense reports and receipts

SUGGESTED READ:

How to simplify the Expense Approval Process with Fyle

Why Is Expense Report Approval Essential?

Without an expense report approval process, reimbursements would happen either without sufficient verification or the verification process would be a time-consuming ordeal. Setting an approval workflow simplifies the validation and approval of expense reports by reducing discrepancies among the multiple stakeholders and approval levels.

An automated expense management software evaluates reports against mandatory guidelines and policies before the approval. Expense report approval is essential for maintaining the reliability of reported expenses and standardizing the treatment of expense reports once employees submit them.

T&E management software like Fyle can help you automate your entire expense approval process. With Fyle you can integrate your company travel and expense policies no matter how complex it is. This can ensure all your expense reports are compliant and your finance team reimburses employees on time. Interested to see how Fyle works? Schedule a demo with us today.