Use any corporate cards - no restrictions.

Users can connect their cards in minutes, and spend data starts flowing in instantly.

Get visibility and control over card programs and cash flow, all while you keep the bank rewards programs you love.

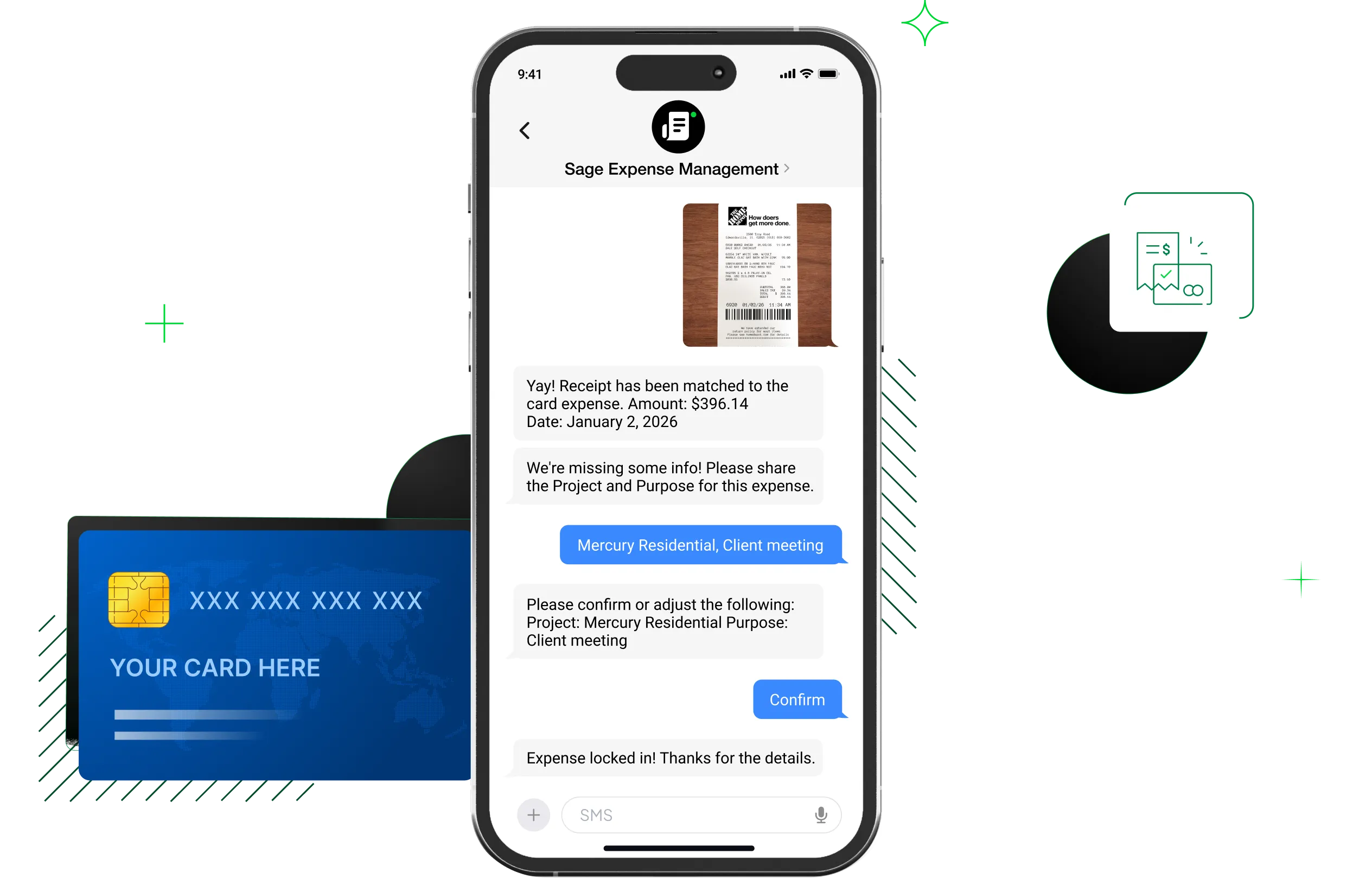

With Sage Expense Management (formerly Fyle), you can get instant notifications on all credit card spending, collect receipts via text, and streamline reconciliations - on your existing credit cards.

1775+ reviews

1775+ reviews

Effortless expense tracking for Visa business cards

Track and reconcile Mastercard expenses easily

Easy expense tracking for all your American Express cards

"We didn't want another complex tool, just something our team would actually use. Now, receipts come in instantly, expenses are tagged correctly, and I'm not spending hours cleaning up data."

Paul Broaddus, CIO & CFO

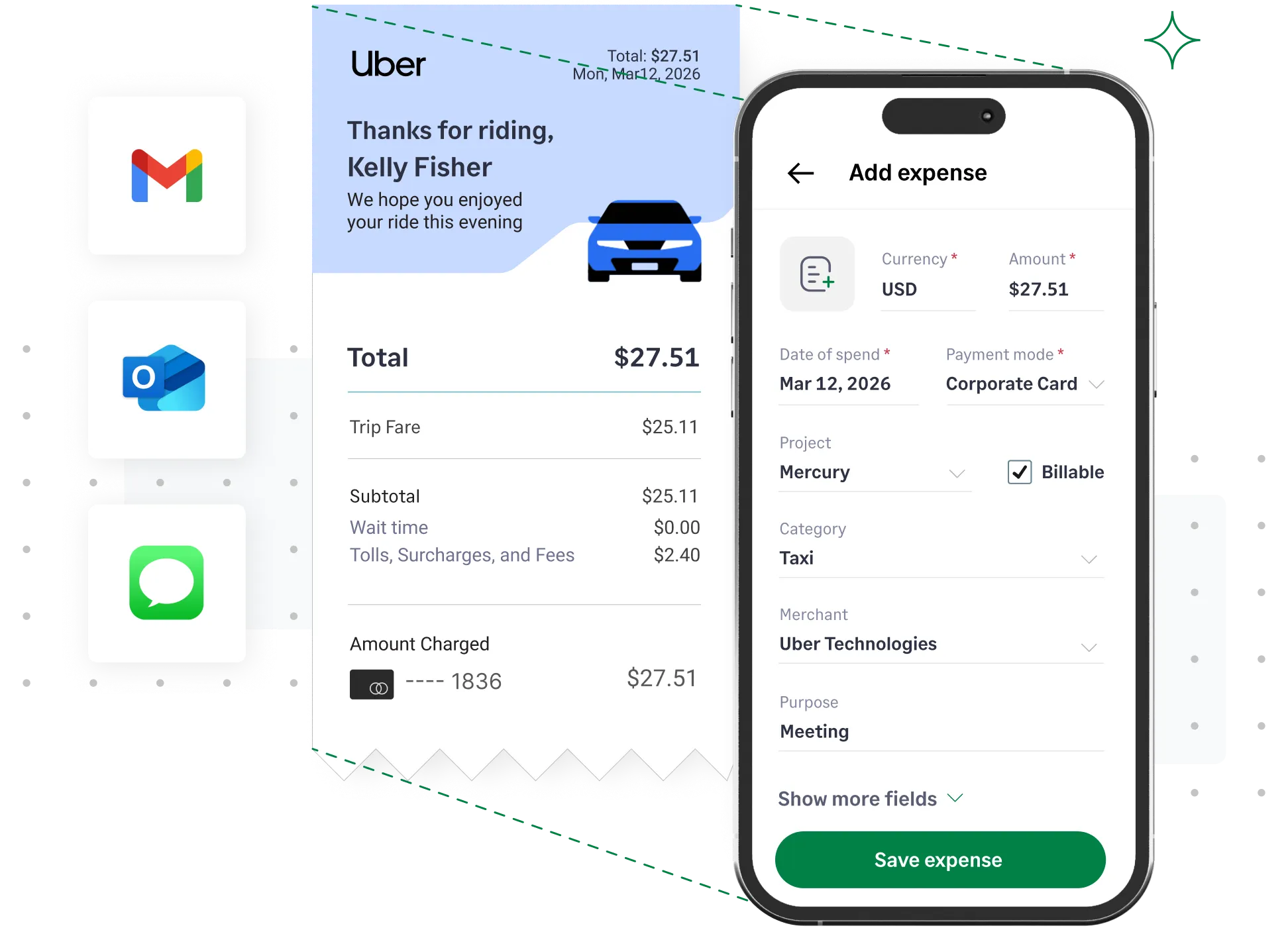

Ensure transactions are reconciled on time with simple one-click reminders. Employees can submit receipts via Text, Gmail, Outlook, our mobile app, or email forwarding, and every receipt is automatically coded and matched to the right card transaction.

Learn more

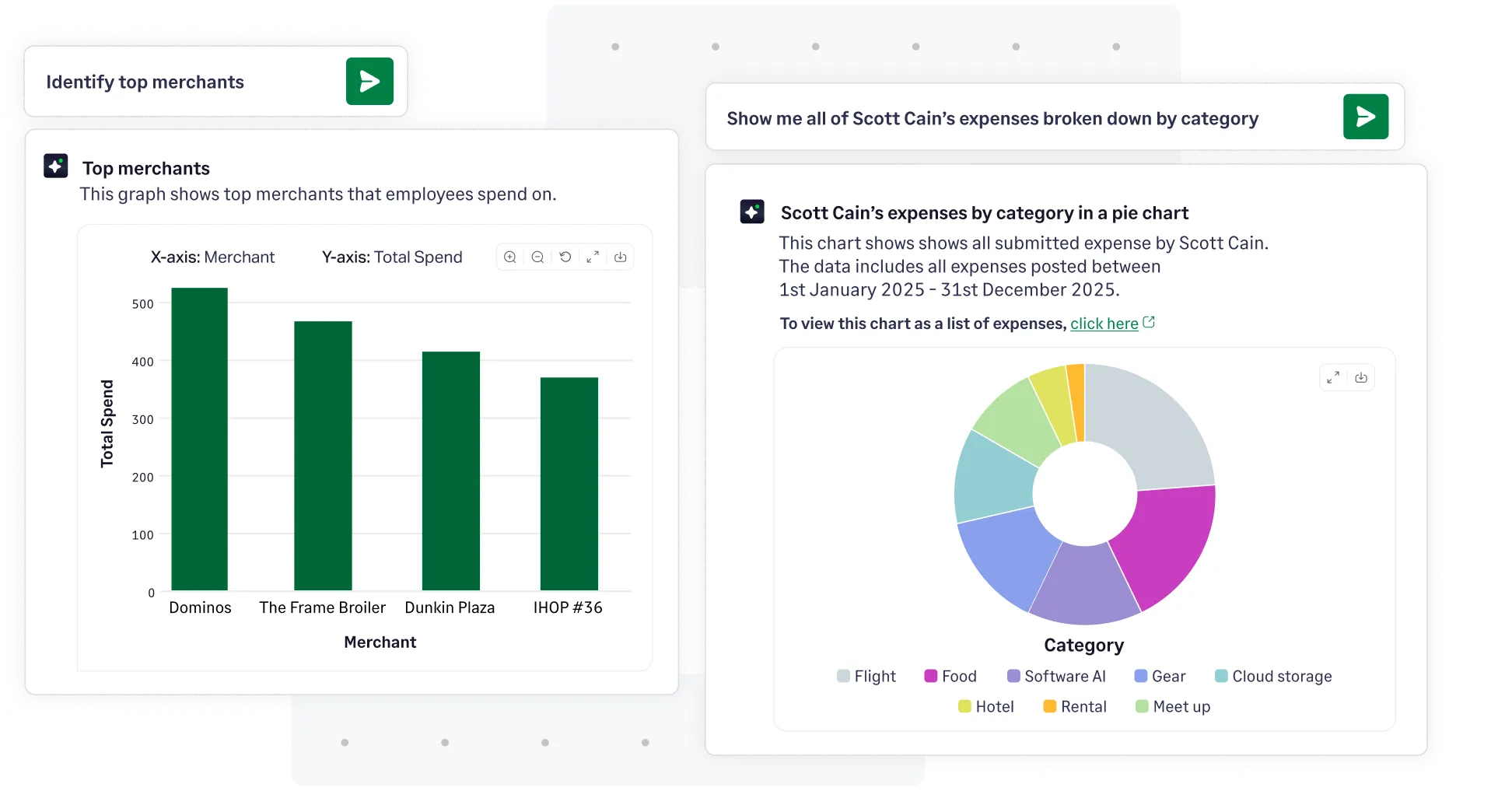

Our Copilot gives you AI-powered insights into your expenses, so you can break down spend by category, merchant, project, or department in real time.

Identify patterns, track spending, and set accurate budgets to manage cash flow.

Learn more about Copilot

Sage Expense Management automatically syncs your fully-coded and matched expense and receipt data to accounting software like QuickBooks, Sage Intacct, Xero, Sage 300 CRE, Sage 50 and NetSuite.

Learn more

Sage Expense Management is a modern, AI-powered credit card expense management software built to streamline expense tracking and reconciliations. Sage Expense Management offers a better ROI with 24/7 customer support, a unique pricing model based only on 'active users,' no lock-in contracts, and an experience designed to automate every step of expense management.

Sage Expense Management is for any business tired of manual expense reports and slow processes. It’s built for finance teams seeking real-time control and faster month-end closing, and for employees who want to track expenses and get their reimbursements on time easily.

Bank portals typically delay data by 24–72 hours and lack accounting context. Sage Expense Management provides real-time transaction feeds (for Visa/Mastercard), automated receipt collection via text, and deep integration with your ERP, eliminating any manual work.

Yes. We have a direct integration with America Express. For standard physical cards, transactions typically sync within 24 hours. If you need instant real-time text alerts for American Express, you can issue unlimited Virtual Cards directly through our platform using your existing credit line.

Our AI enforces policy in real-time. The moment an employee swipes their card, we check the transaction against your set expense rules. If an expense exceeds a limit, is missing a receipt, or violates a category rule, we instantly flag it for both the employee and the approver. This helps you prevent any 'blind approvals' and ensures compliance before the books are closed.

After a quick kickoff call with your dedicated account manager, most businesses are fully set up, and their teams are trained in under 30 days.

Sage Expense Management's biggest differentiator is our integration with major card networks, bringing real time purchase alerts to business credit cards you already use - no switching required. This ease of use, combined with an intuitive design that employees love, results in higher adoption and efficiency for your team.

A single user profile can have multiple cards (Visa, Mastercard, Amex) linked to it simultaneously. Employee transactions from all their cards will be visible in a single dashboard. They don't need to toggle between accounts or logins.

Yes, you can issue an unlimited number of virtual cards directly through our platform, provided you have an existing American Express business credit line. Virtual cards offer instant transaction feeds and real-time text alerts as soon as a purchase is made. Additionally, you can set spending controls for these cards.

You can connect the shared card to a central 'Department' profile in the system. When an employee spends on that card, they simply email or text the receipt to that profile. Our system automatically matches the receipt to the transaction, identifying the spender for you.

We use an Active User pricing model. You only pay for employees who actually submit an expense report or swipe a card during the month. You do not pay for users who are inactive, nor do you pay for Admins or Approvers who only review expenses.

Yes, they can. We directly import the chart of accounts and custom fields from your accounting software to Sage Expense Management.When an employee submits an expense report, they can select the correct department/GL code/project from a dropdown menu, ensuring accurate coding without any guesswork.