Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

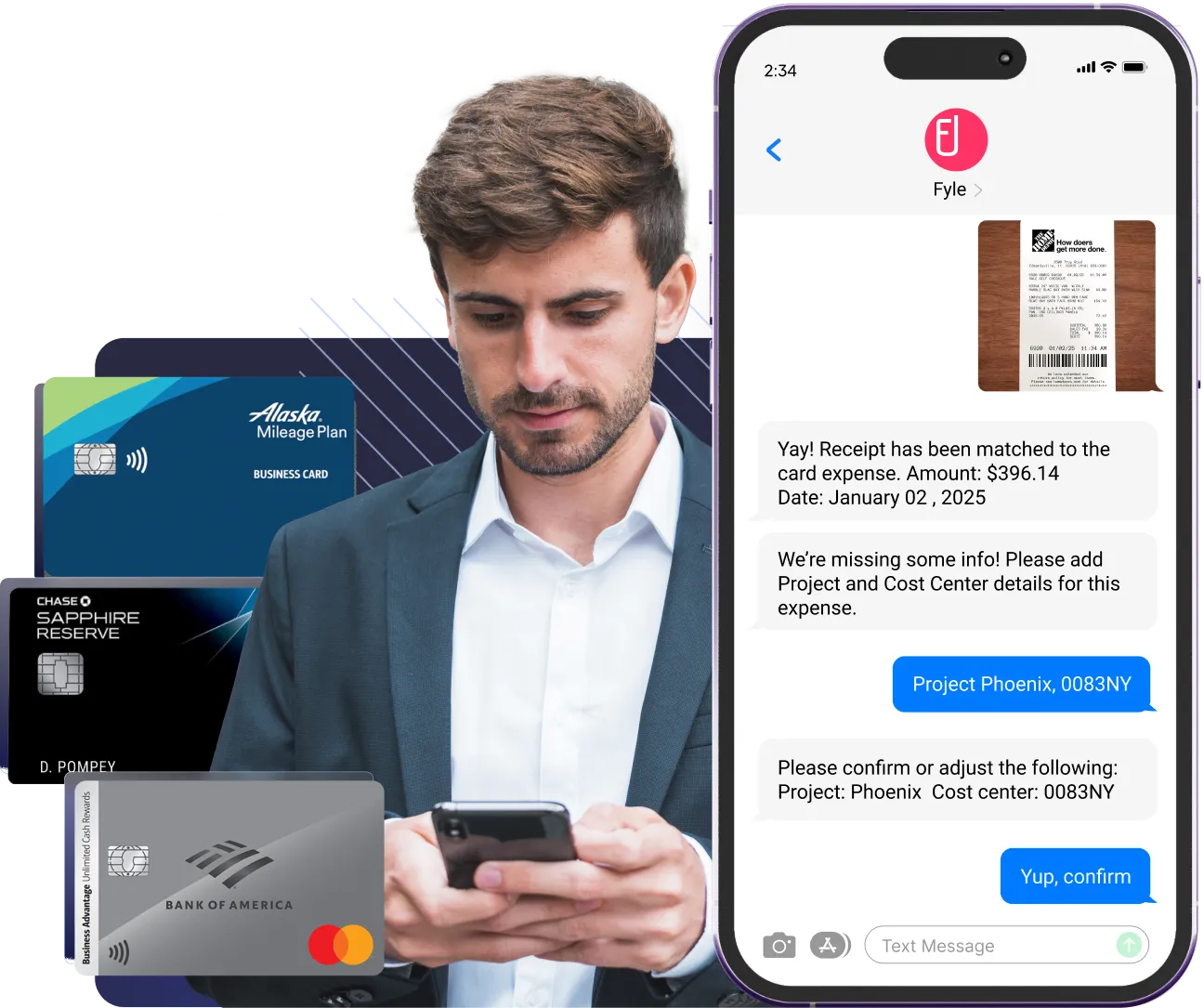

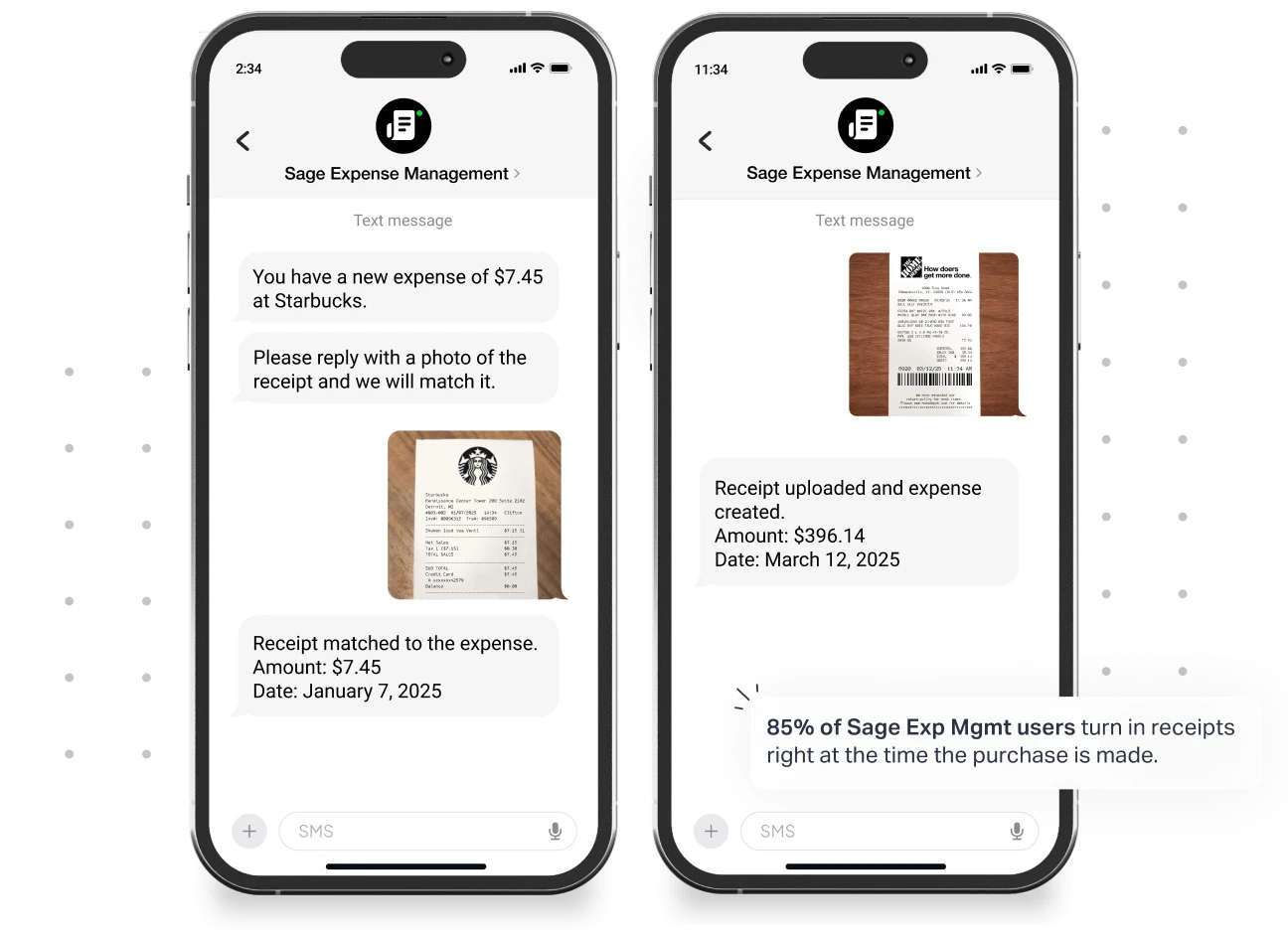

Get instant notifications and collect receipts via text for all credit card spend, and automate credit card reconciliations.

* Sage Expense Management directly integrates with your existing business credit cards

1775+ reviews

1775+ reviews

Sage Expense Management directly integrates with any Visa or Mastercard business card, regardless of the issuing bank, to notify you by text every time your business credit card is swiped.

Employees can reply with a receipt picture for instant reconciliation. Or, you can simply text the receipt picture, and we will automatically reconcile it when the card data flows in.

See how we automate credit card reconciliations

Text a picture of your receipt to Sage Expense Management and any additional details like projects, cost centers, memos and more. Our AI takes care of the rest, automatically creating and submitting your expense report.

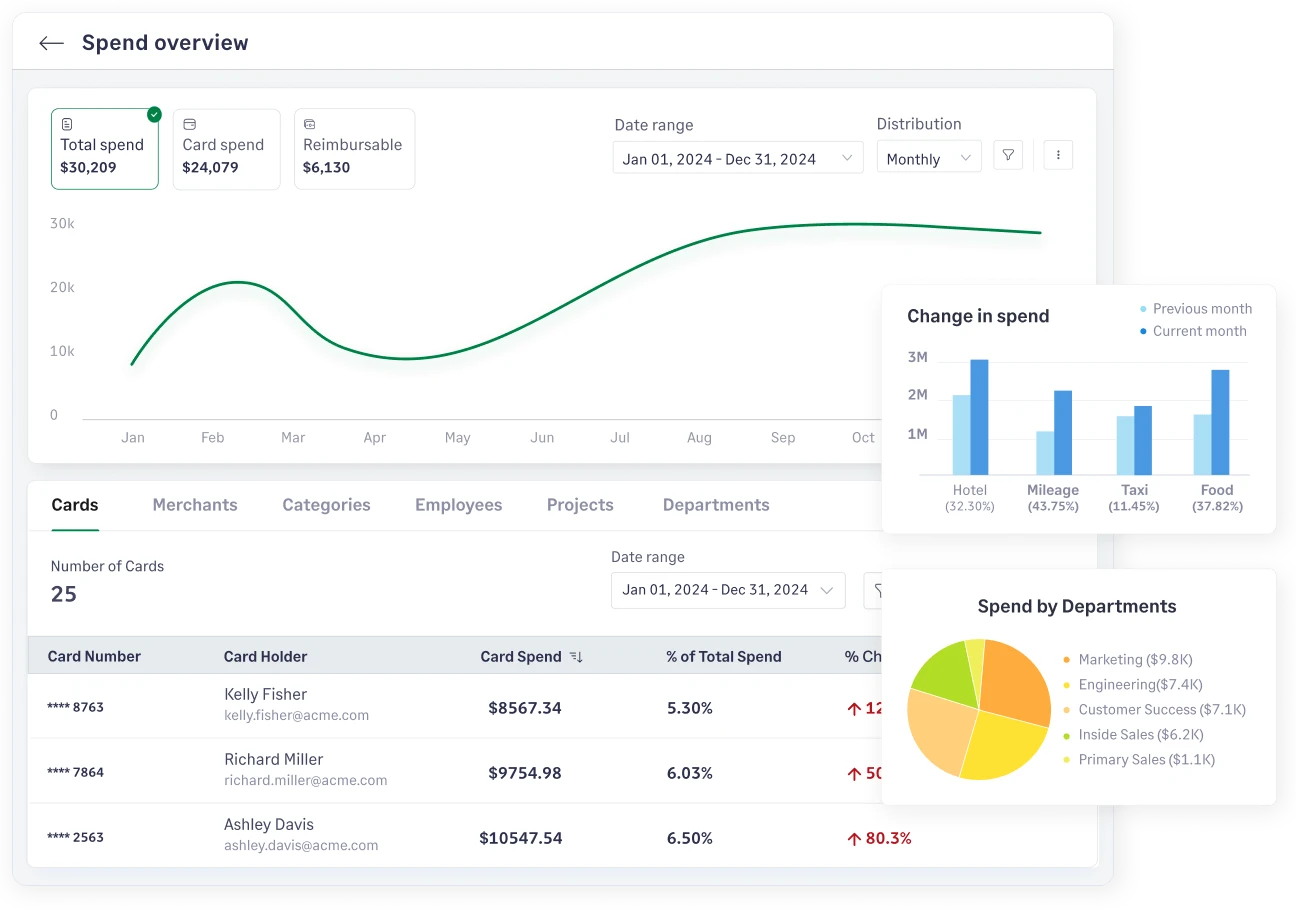

No more digging through reports, just ask Copilot for the spend insights you need. Whether it's tracking card transactions, out-of-pocket expenses, or spending by category, project, or department, Copilot gives you instant answers.

See how Sage Expense Management's Copilot can help businesses

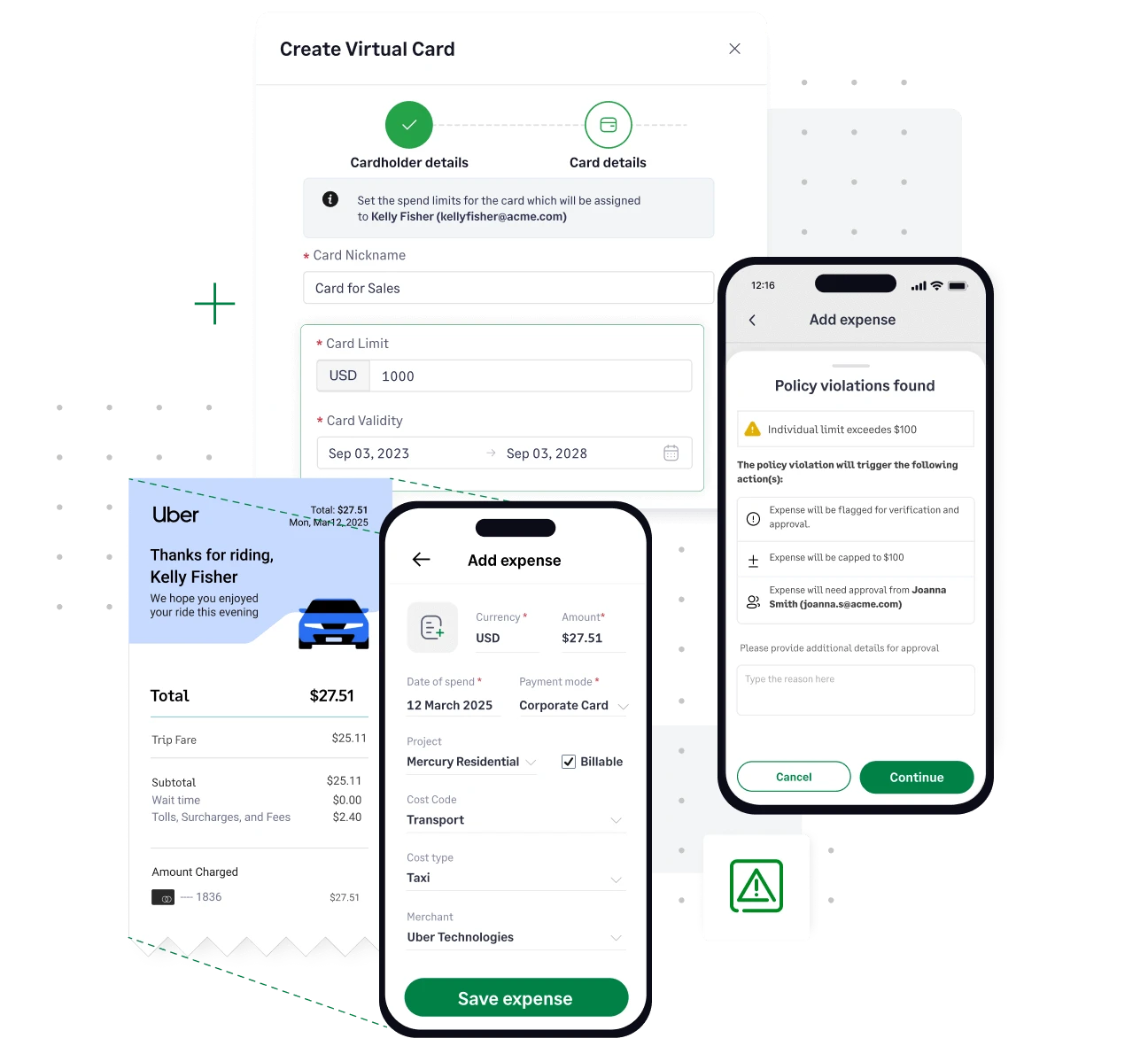

Sage Expense Management's policy engine lets you define complex spending rules for categories, employees, projects, and more. Additionally, our AI automatically detects fraudulent expenses even before they're submitted, saving you valuable time and money.

See how we automate complianceSage Expense Management seamlessly integrates with your accounting software, automatically syncing business mileage and expense reports. This eliminates manual errors and saves time for finance teams to focus on other important tasks.

Learn more about accounting integrations