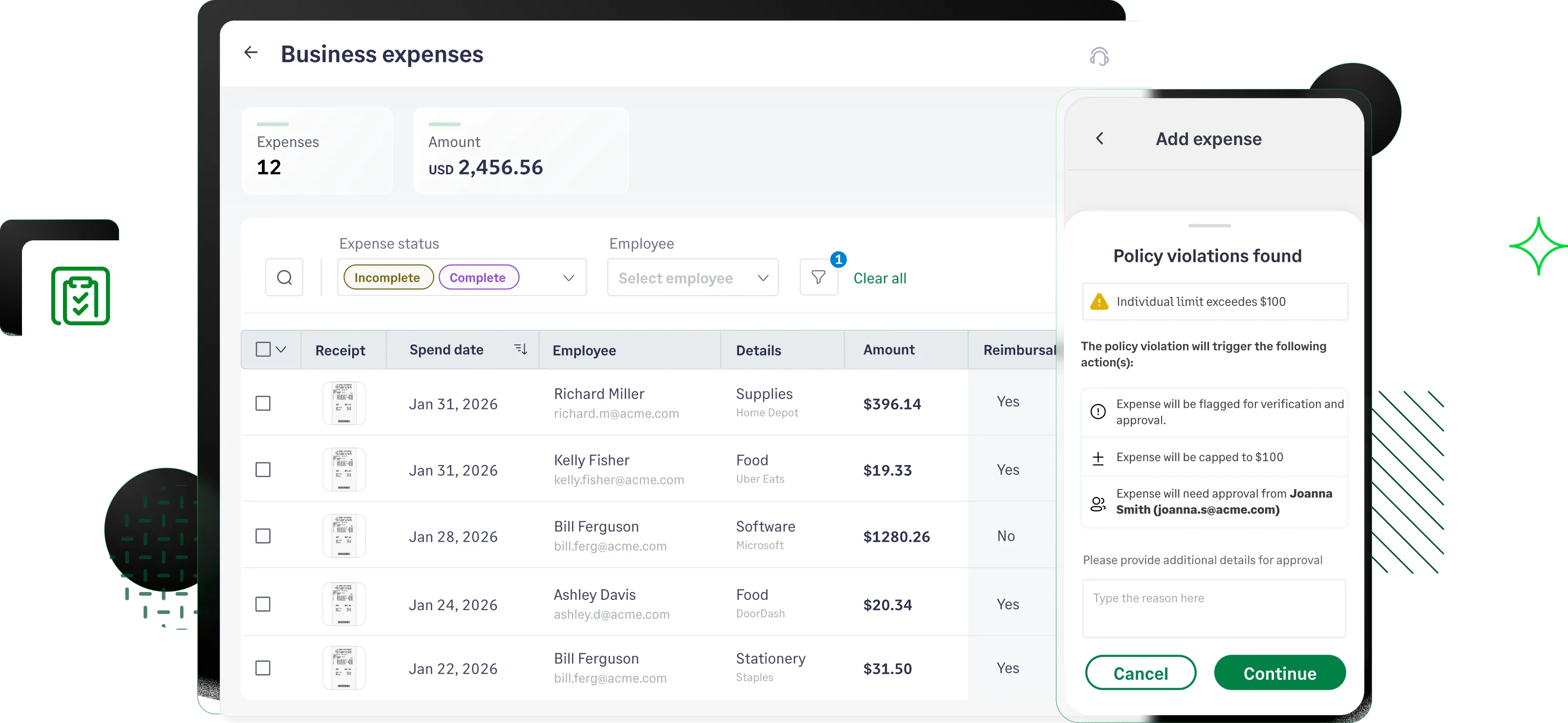

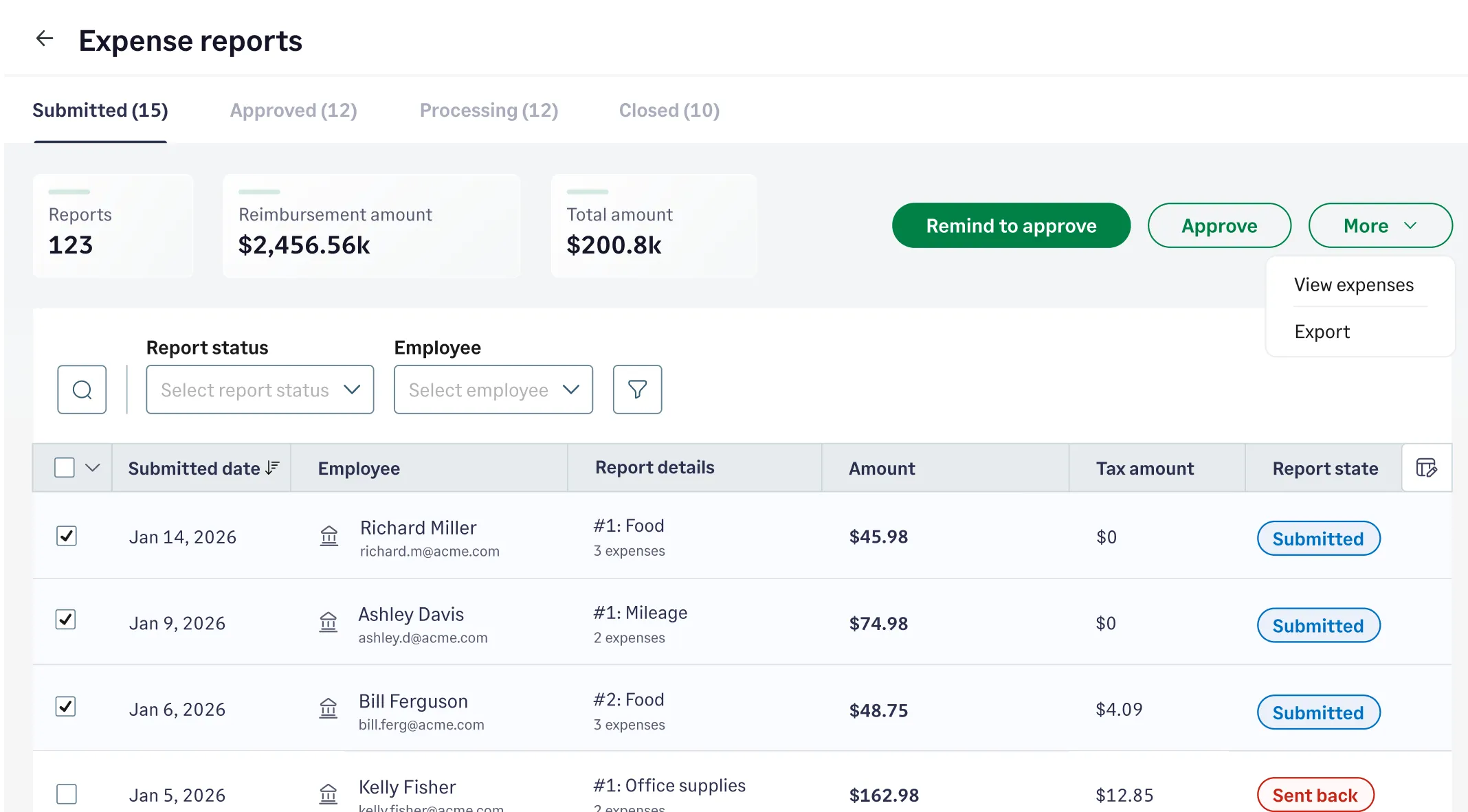

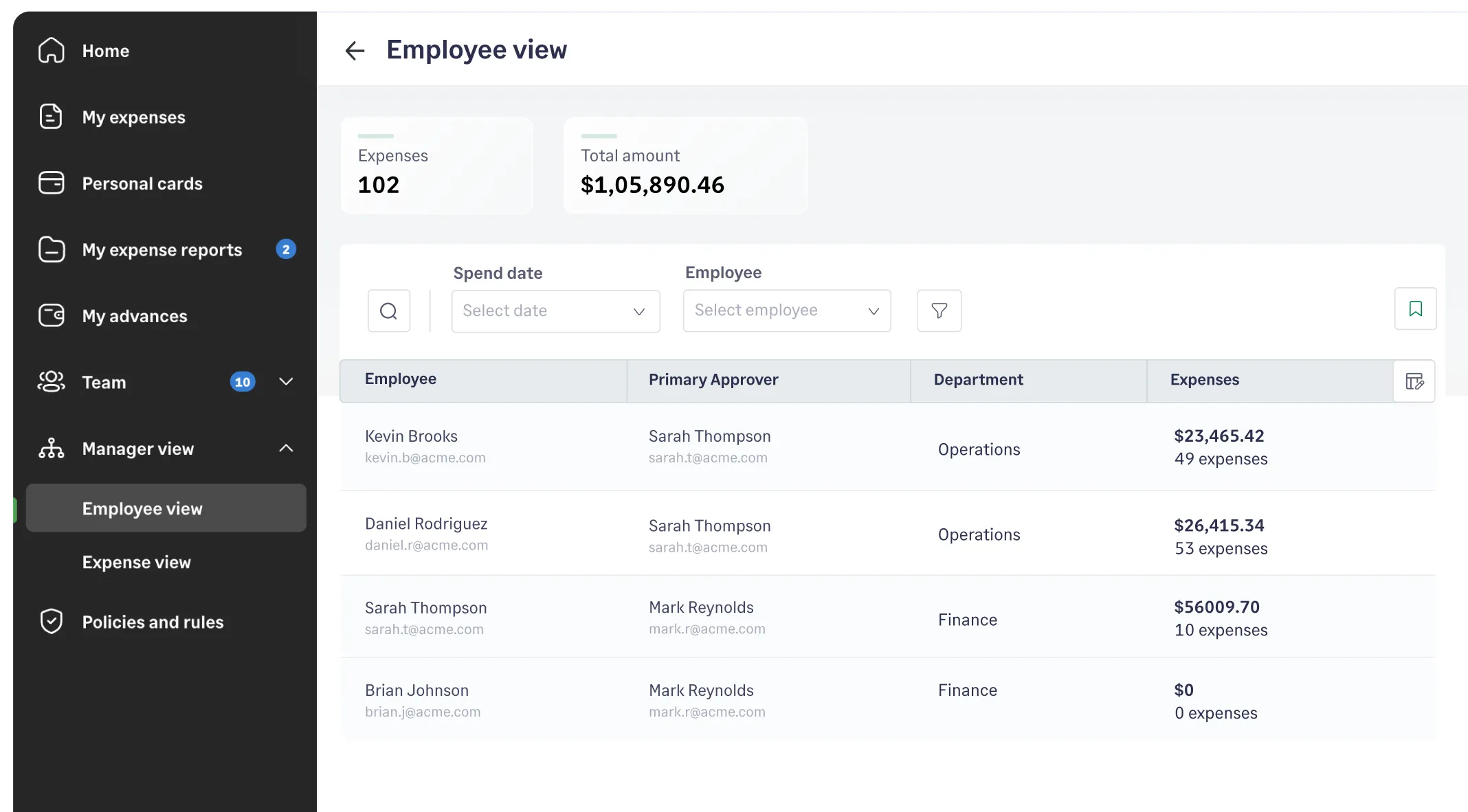

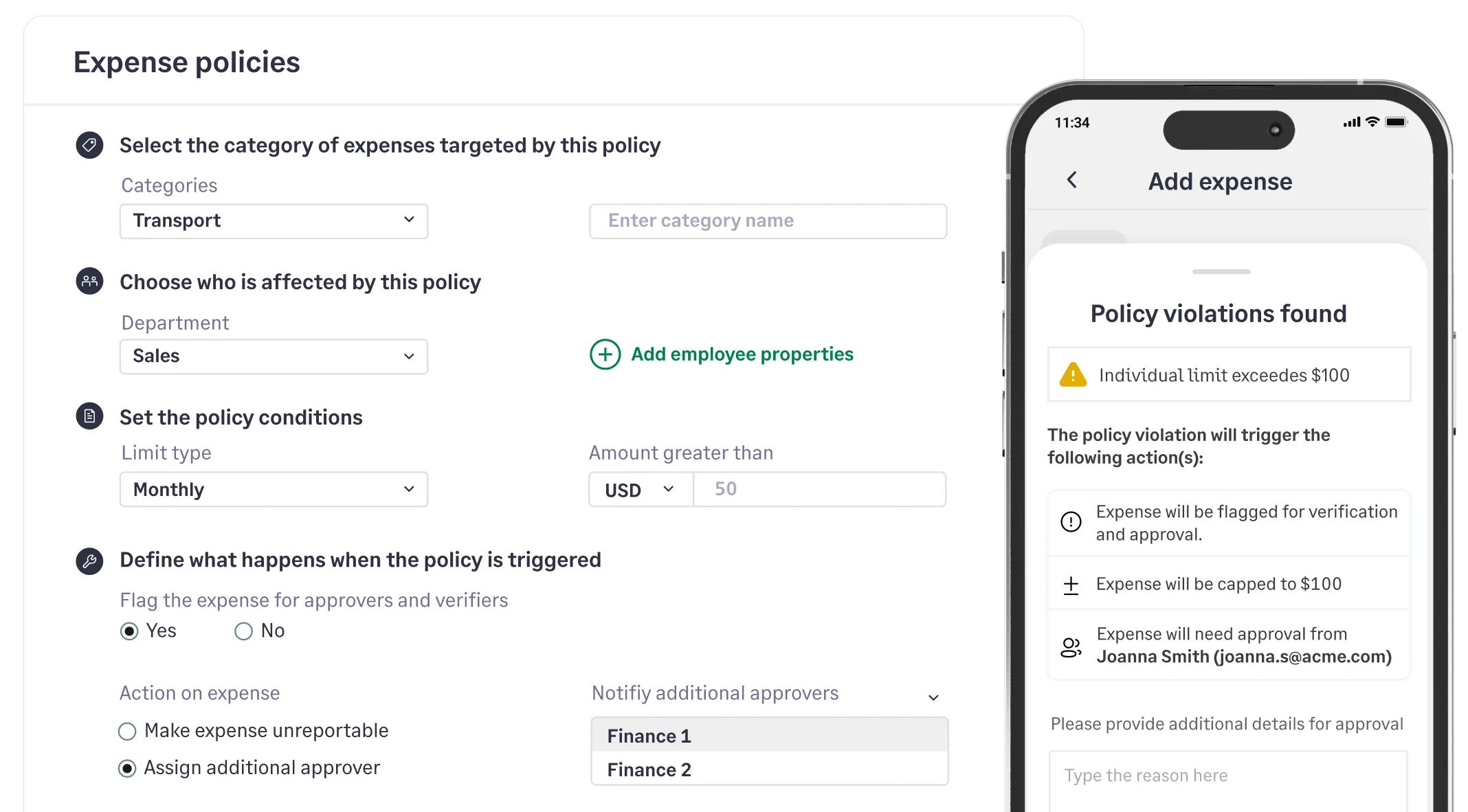

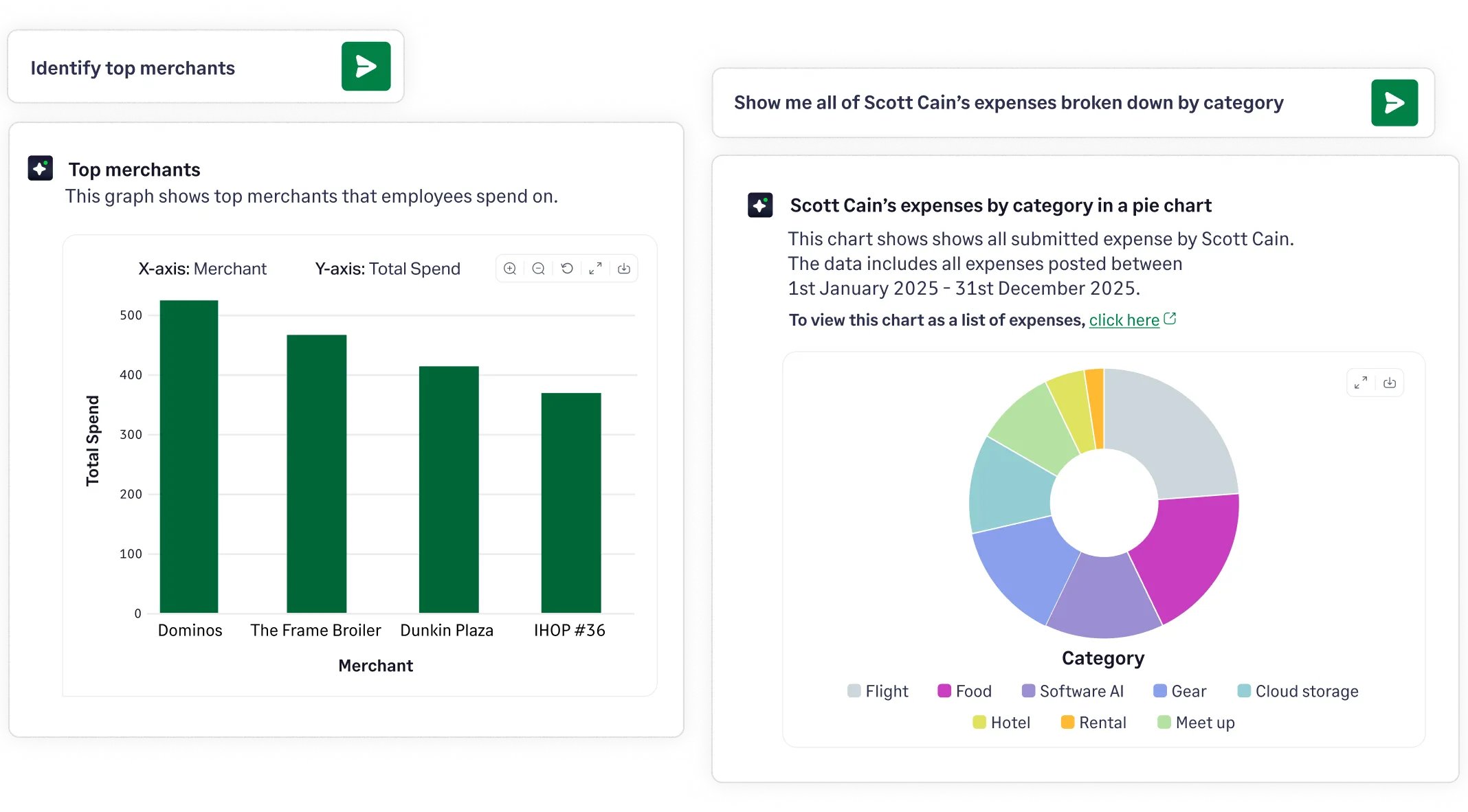

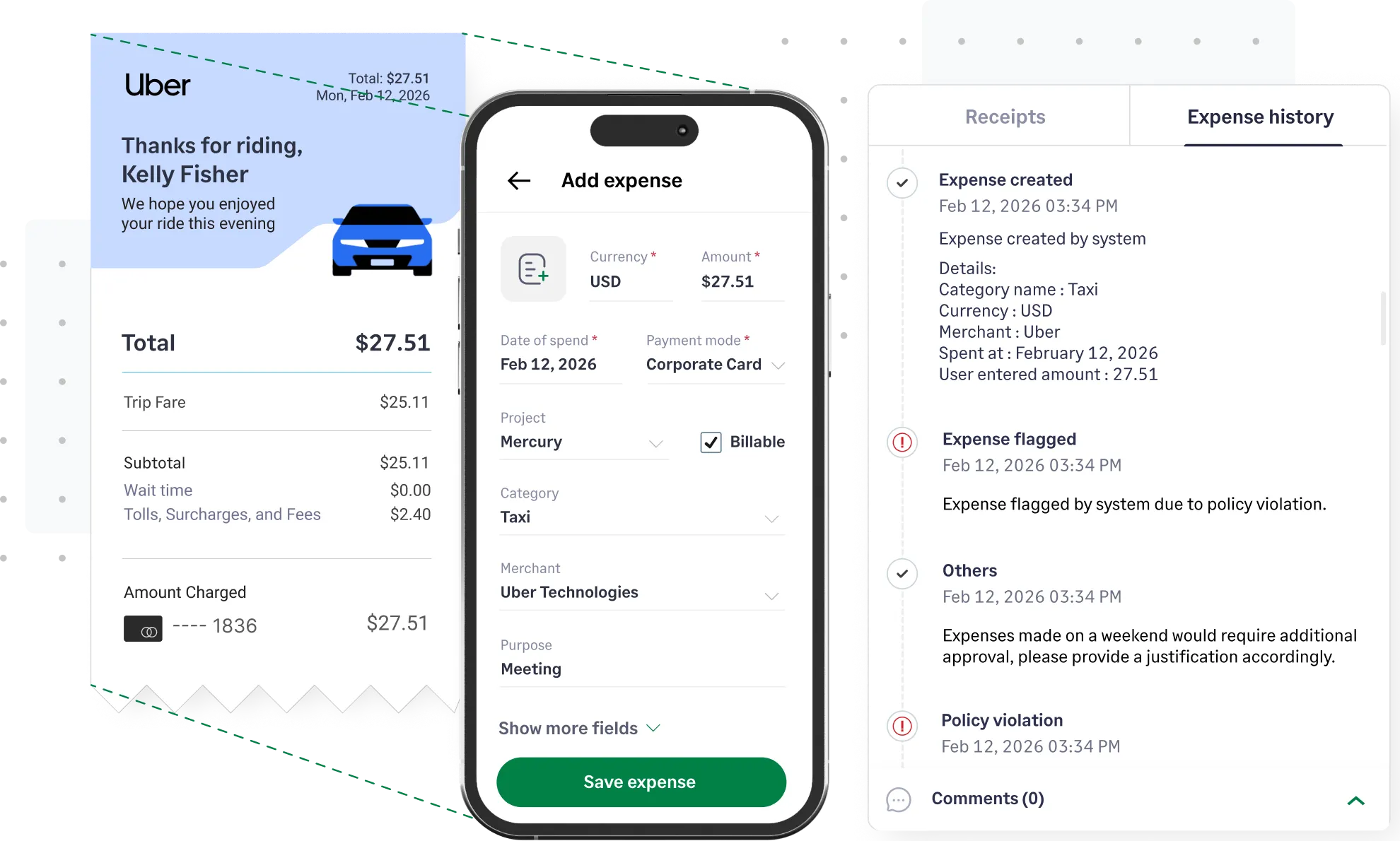

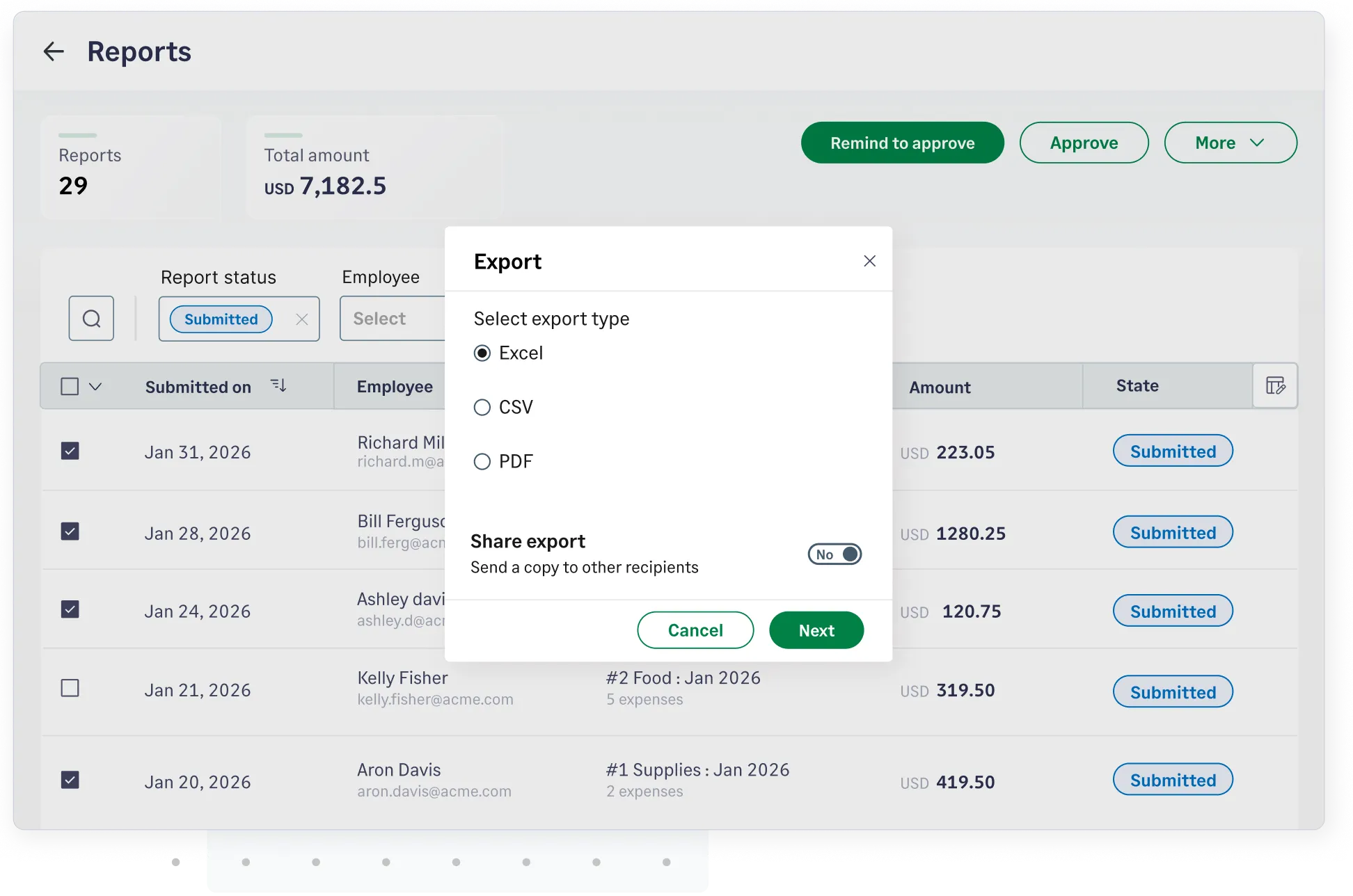

Know exactly what's being spent, in real time

We directly integrate with your existing business credit cards, to give you real-time spend visibility into every card transaction. Track corporate card spend, receipt submissions, and reimbursement requests in one unified view.