Keeping a meticulous record of all business credit card expenses is crucial for accurate bookkeeping, tax deductions, and budget management. Traditionally, this is a multi-step manual process:

- Collect every receipt: The first step is to diligently save every single physical and digital receipt for purchases made on company cards. This often involves asking employees to keep envelopes of paper receipts or upload photos to a shared drive.

- Maintain a detailed spreadsheet: You need to create a central log, typically in a spreadsheet, with columns for the transaction date, vendor, expense category (e.g., travel, software), amount, and the employee who made the purchase.

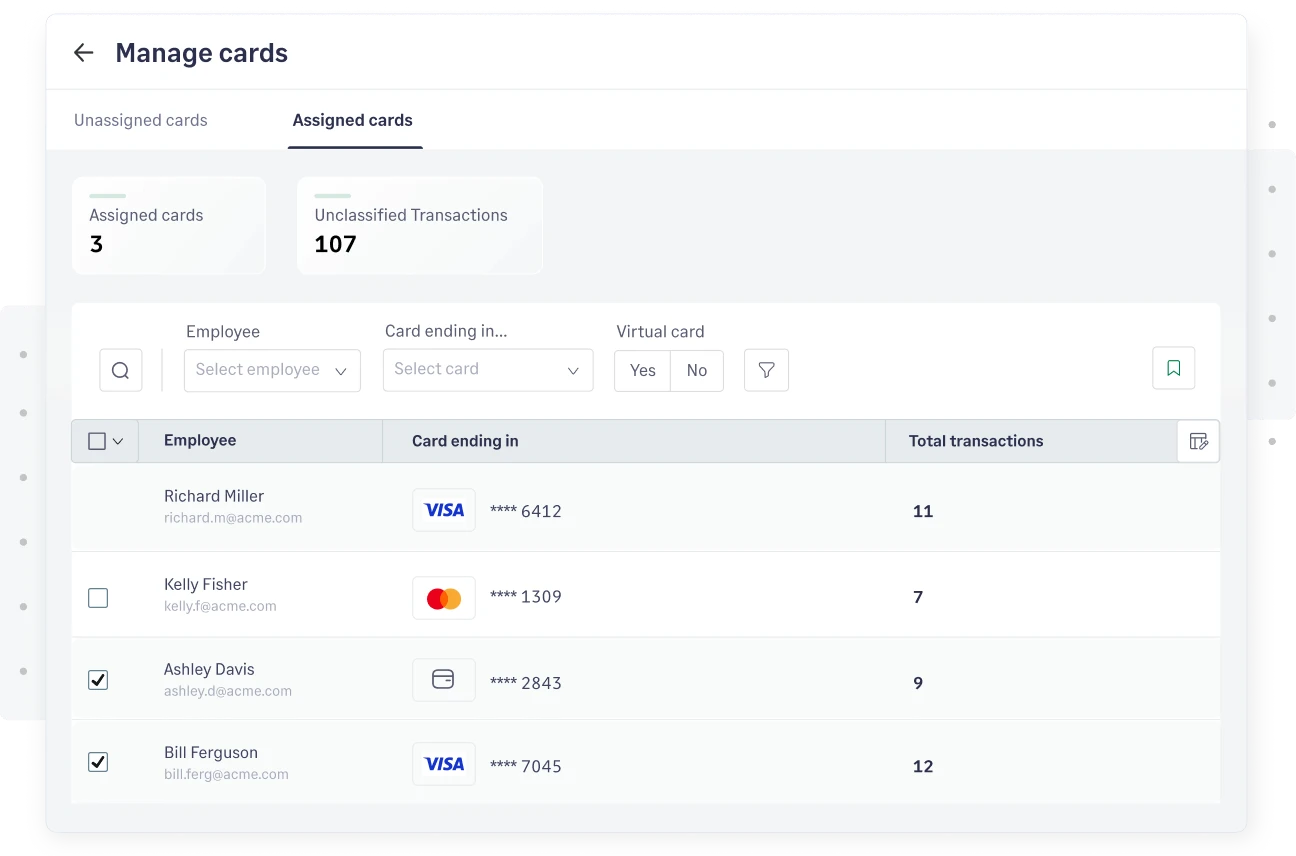

- Perform manual reconciliation: At the end of each billing cycle, you must wait for the official credit card statement. Then, you have to painstakingly match each line item on the statement against your spreadsheet log and the collected receipts, which can take hours or even days.

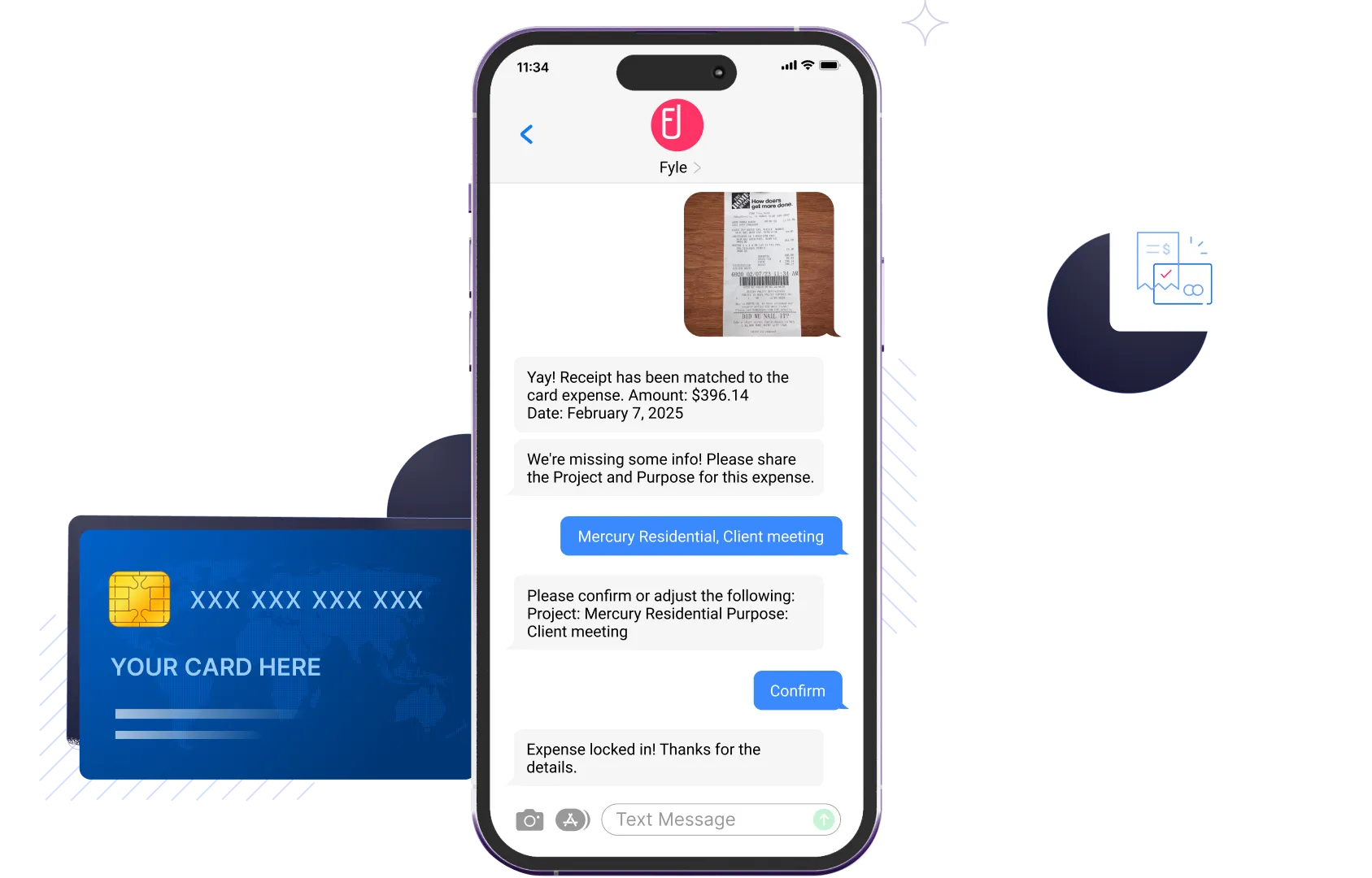

- Chase missing information: Inevitably, receipts go missing or details are incomplete. This requires you to spend additional time following up with employees to fill in the gaps before you can close your books for the month.

While this manual process provides a record, it is incredibly time-consuming and prone to human error.

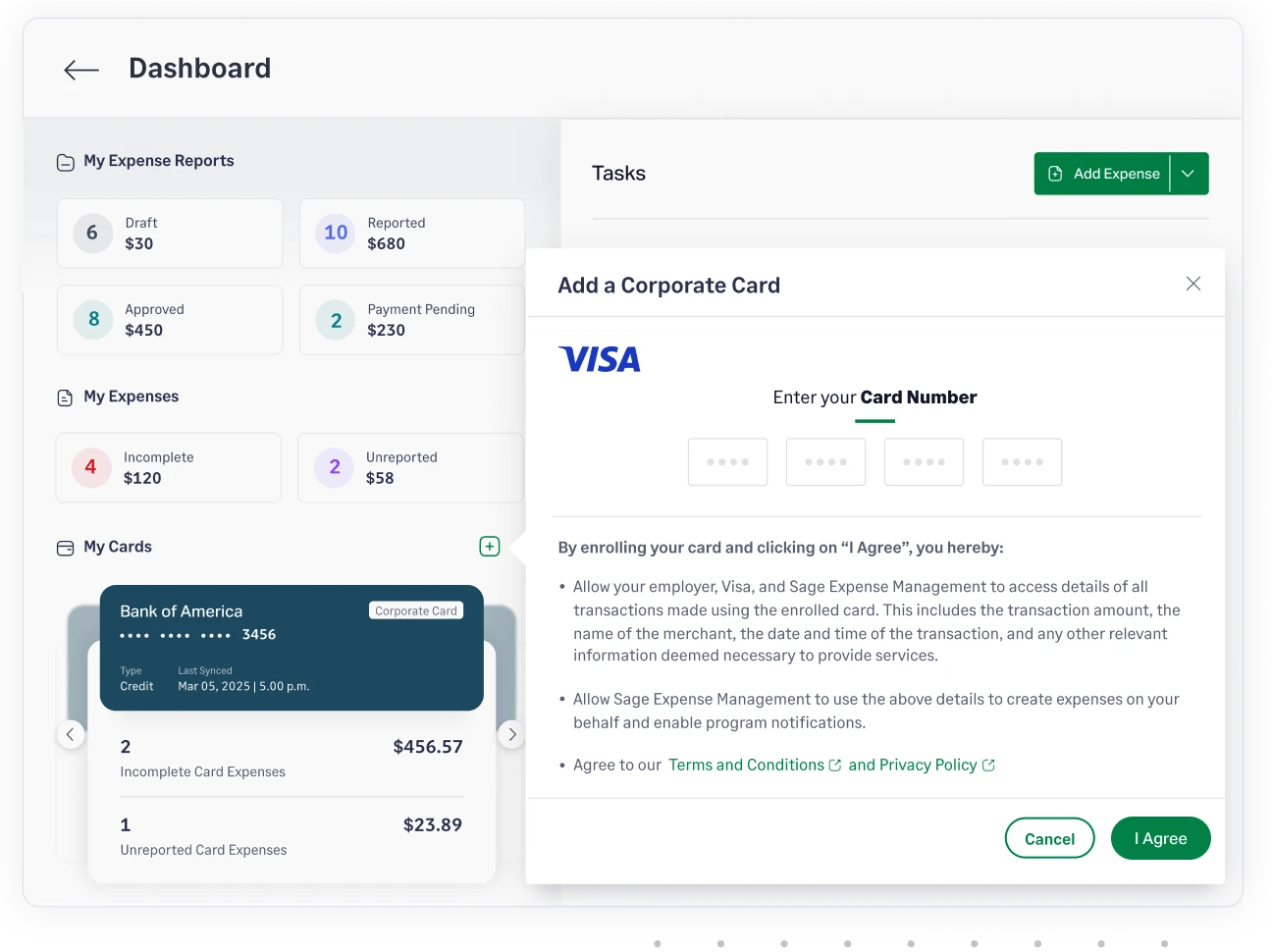

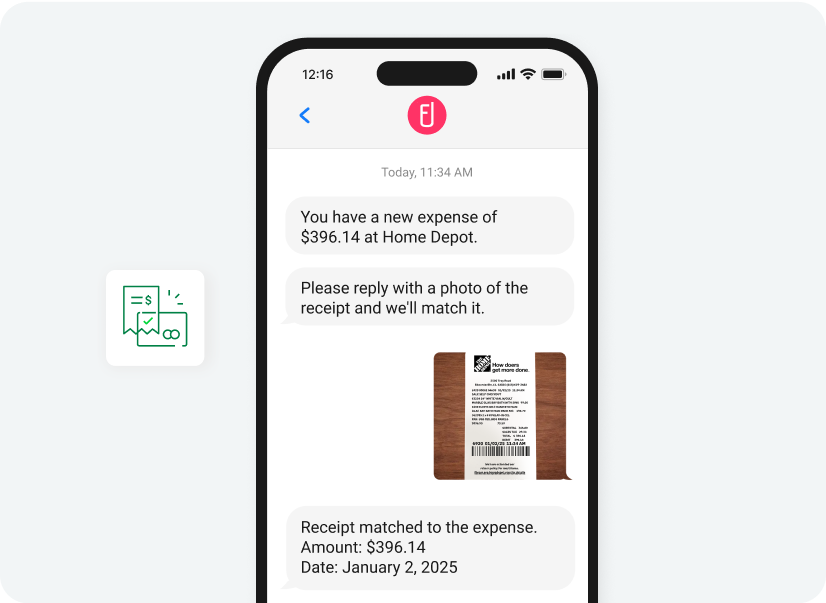

The most modern and efficient method is to use a platform that directly integrates with credit card networks. For instance, Fyle directly connects with all business credit card networks to receive transaction data in real-time, completely automating the entire reconciliation process.