Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Streamline accounting processes and reporting to speed up your monthly close.

Save hours of time

Increased productivity

Accurate bookkeeping

1775+ reviews

1775+ reviews

Automated accounting guarantees accuracy in every line item, eliminating the risk of human error. As tax season approaches, you'll be well-prepared with automatically collected and coded receipts and expenses.

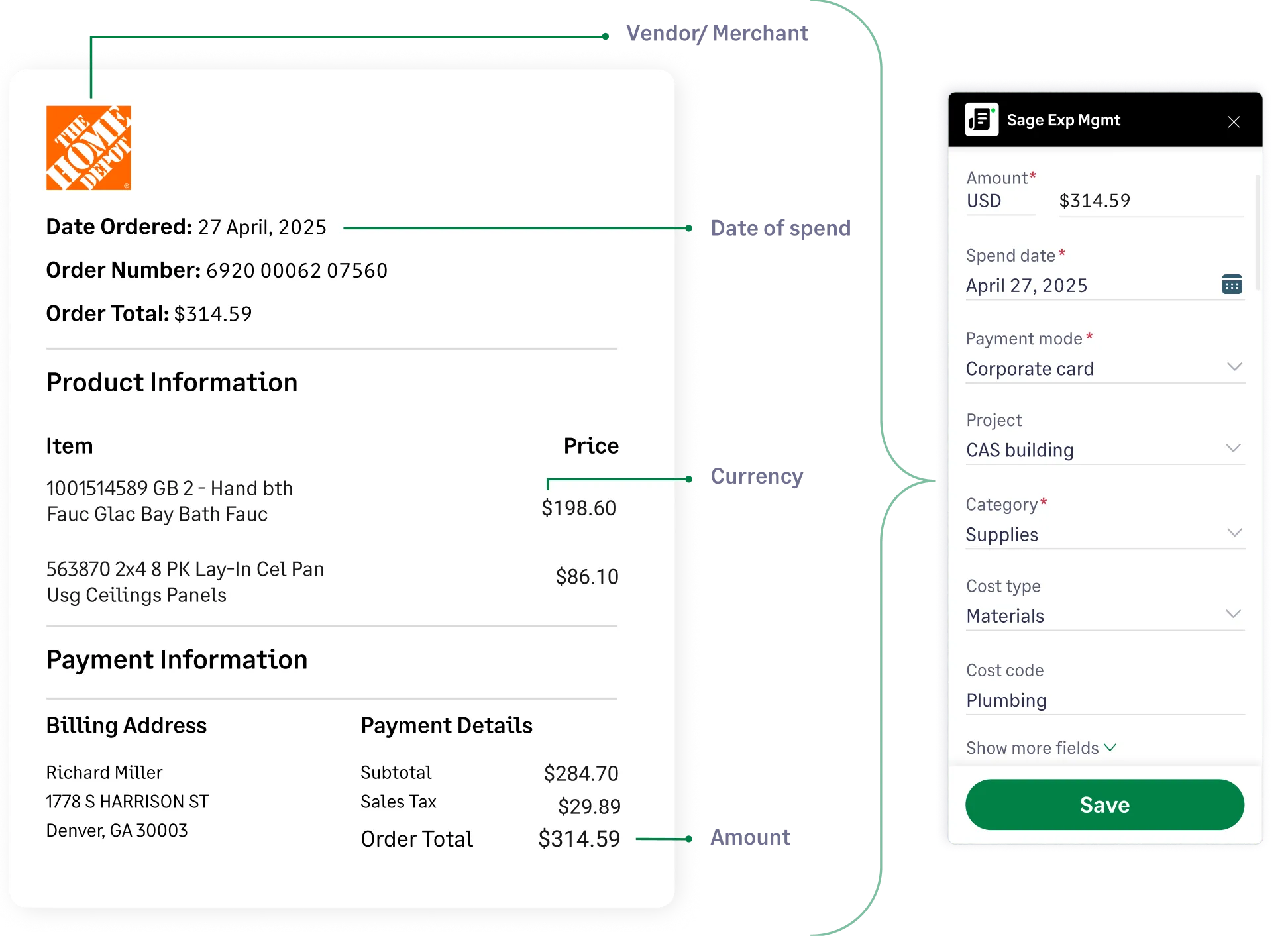

Simplify receipt collection

Automate manual, repetitive tasks like collecting and coding receipts, creating expense reports, reconciling credit card transactions, and more to save hours of time and effort.

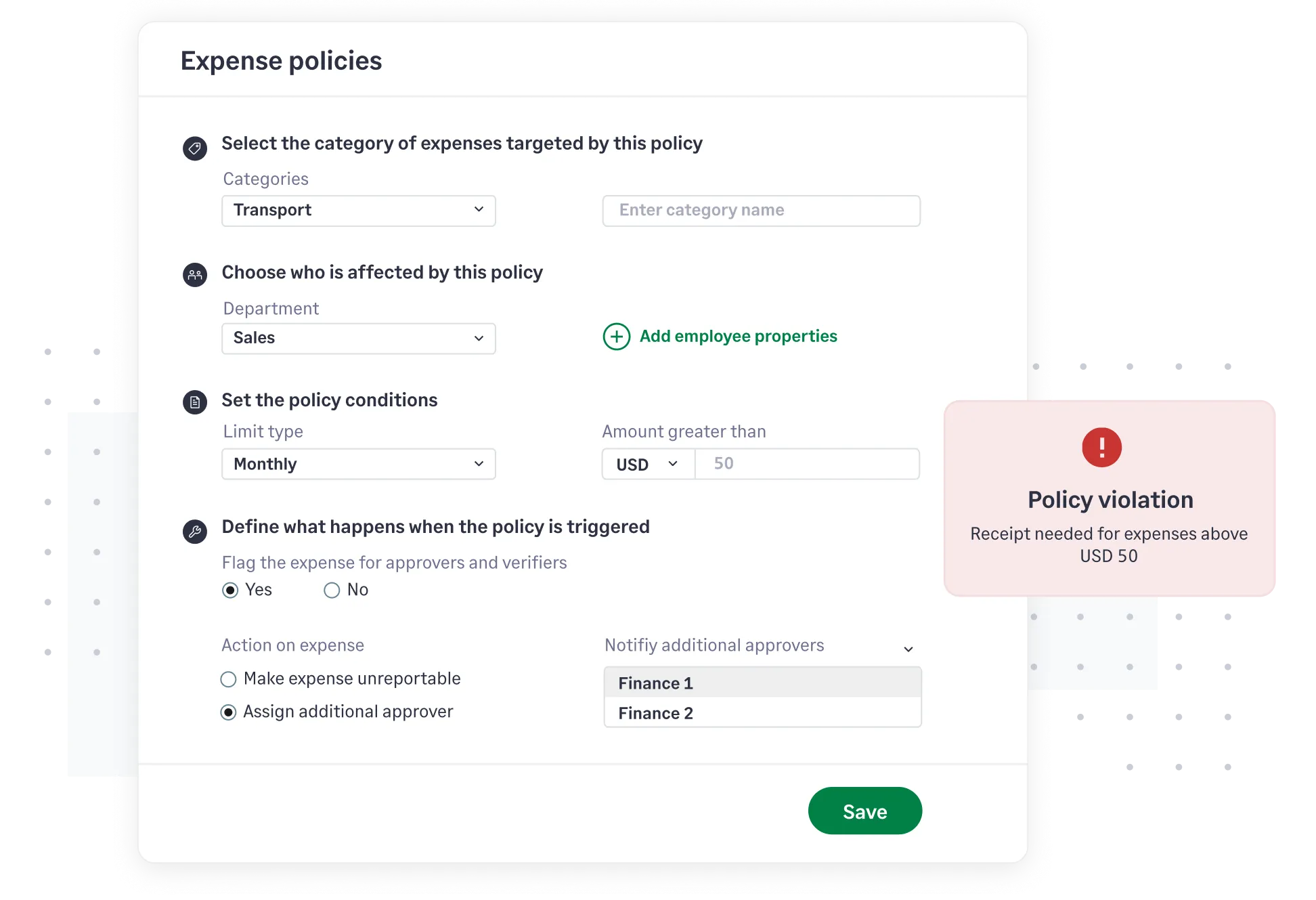

Our powerful policy engine ensures employee expenses are verified against company policies automatically, even before they are submitted for approval. This reduces fraud, identifies duplicates, and helps you ensure every expense is compliant.

Ensure continuous compliance

Ensure your accounting keeps pace with your business growth. Whether you're a small business just starting out or mid-market experiencing rapid growth, our platform adapts to your increasing needs and automatically syncs data securely to your accounting software.

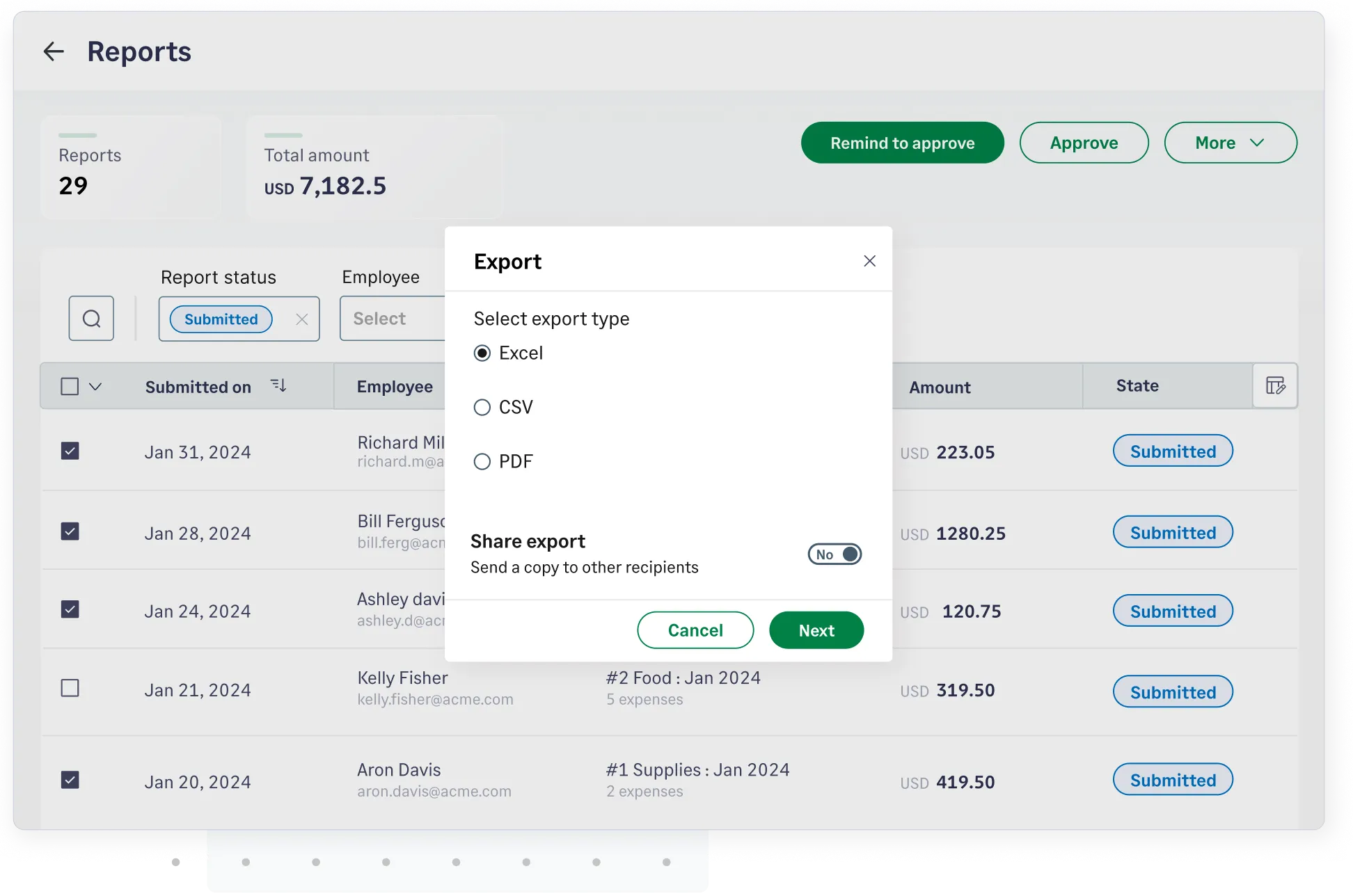

Two-way direct integrationsEffortlessly export expense reports and financial data in your preferred format—PDF, Excel, or CSV—with just a few clicks using Sage Expense Management.

Accounting automation is the process of utilizing software to streamline and simplify manual and repetitive accounting tasks, such as data entry, bookkeeping, expense reporting, and others, ultimately ensuring closing books on time.

You can automate your accounting using tools built to streamline the entire manual process, from tracking expenses to closing books.

No, automation enables accountants to eliminate manual and repetitive accounting tasks, so they can focus on other high-value tasks. This not only saves time but also enhances productivity.