Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Sage Expense Management (formerly Fyle) automates processes like receipt tracking, credit card reconciliation, employee reimbursements, and more!

1775+ reviews

1775+ reviews

Now see what automation can do for you.

Traditional expense reporting templates enable you to fill up information manually, as long as the template download is completed.

We automate all previously manual tasks, allowing your expense management process to run on autopilot.

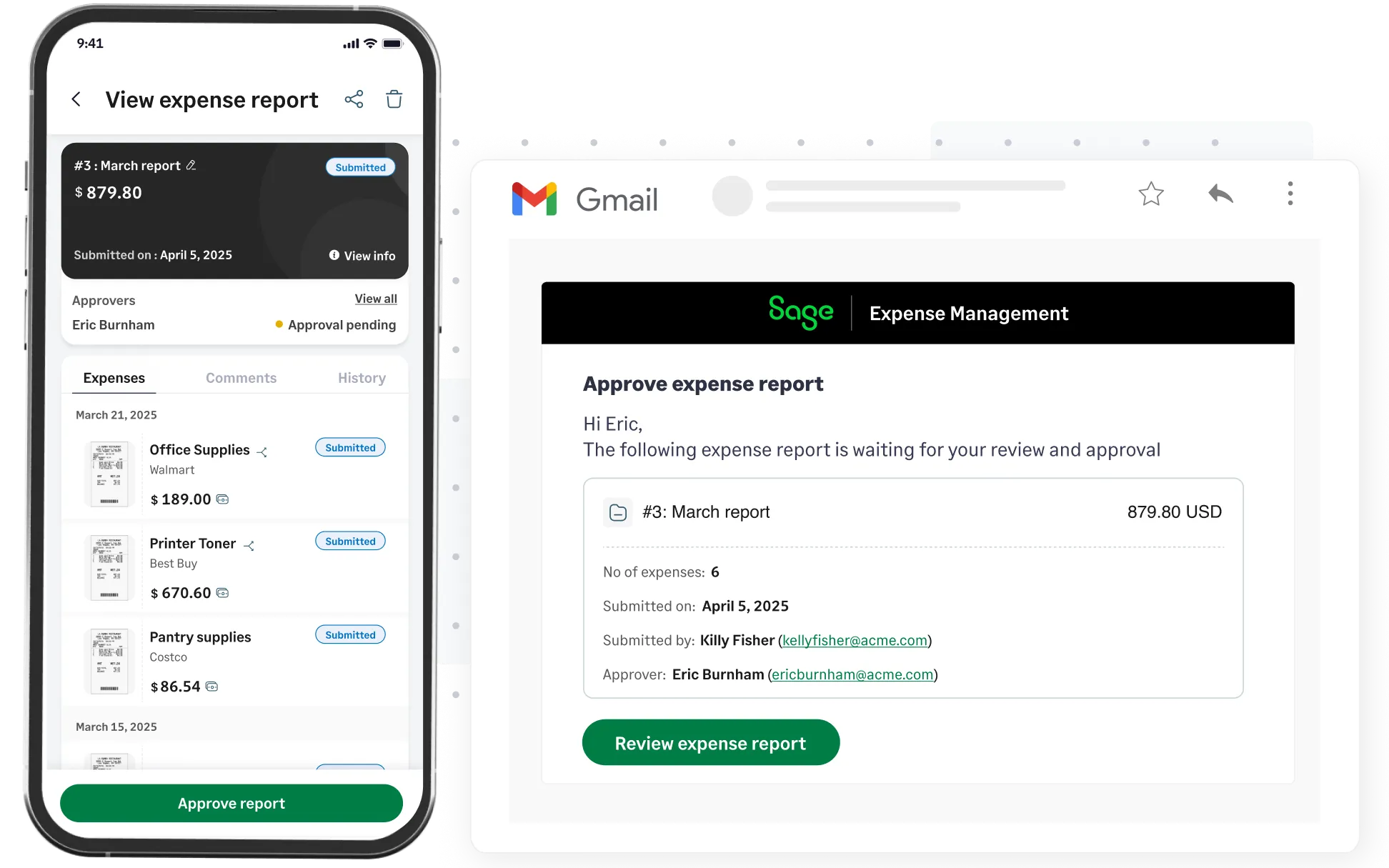

Expense reports are crucial for tracking business spending. With Sage Expense Management, employees can track, create and submit expenses on the go, while admins can approve with single click.

Users can submit receipts via Text, Gmail, Outlook, Slack, email forwarding, or via our mobile or web app. Our expense data is extracted, coded and tracked automatically.

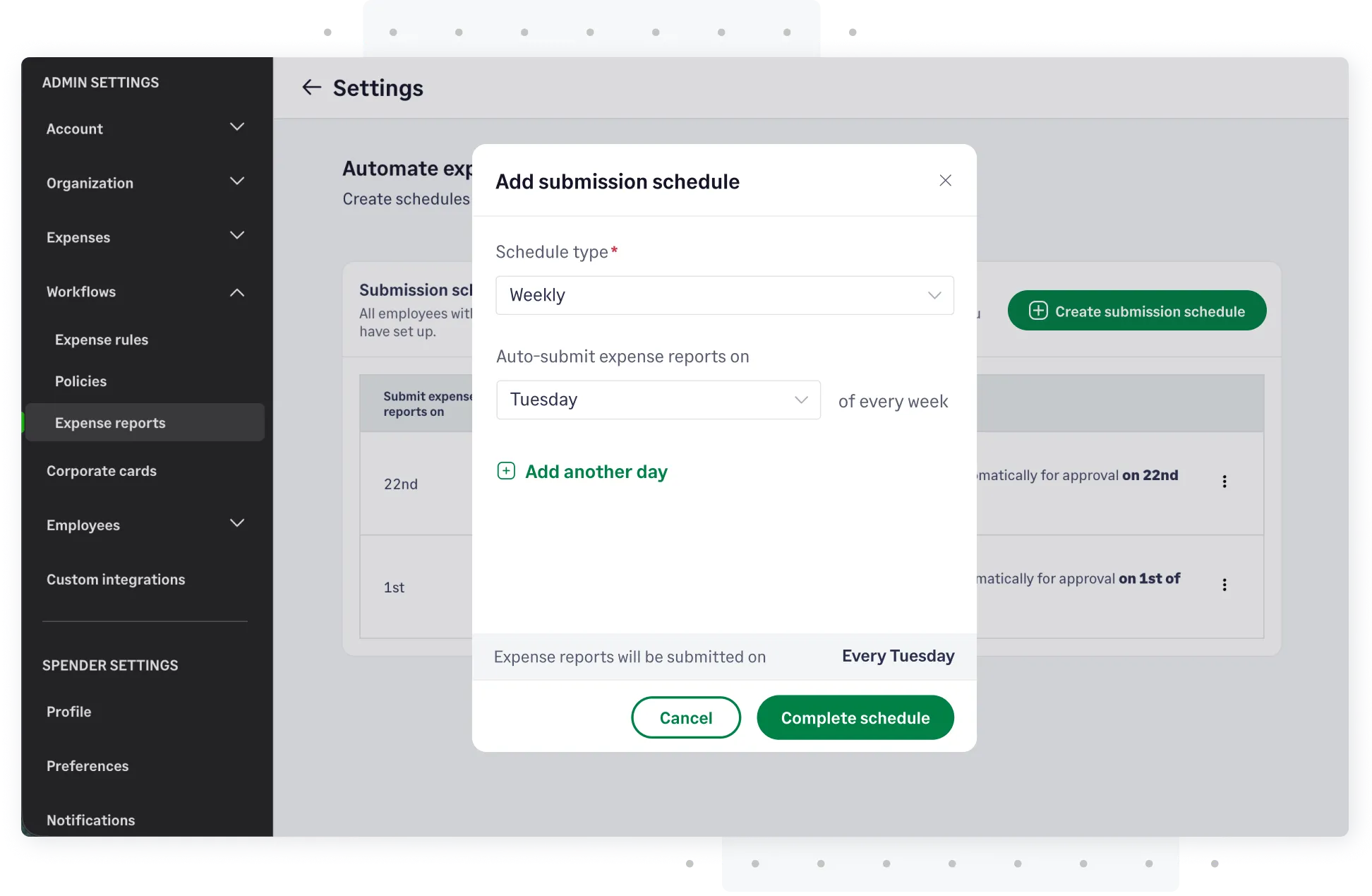

Explore receipt tracking featuresSchedule automatic expense report creation and submission for approval based on a frequency you set. No more followups or reminders.

Explore report submission features

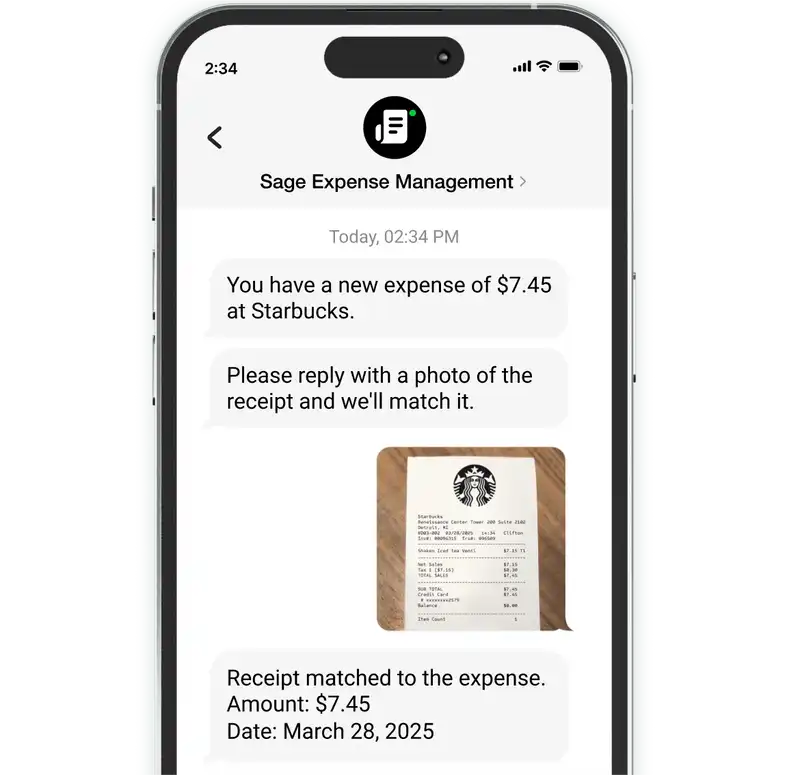

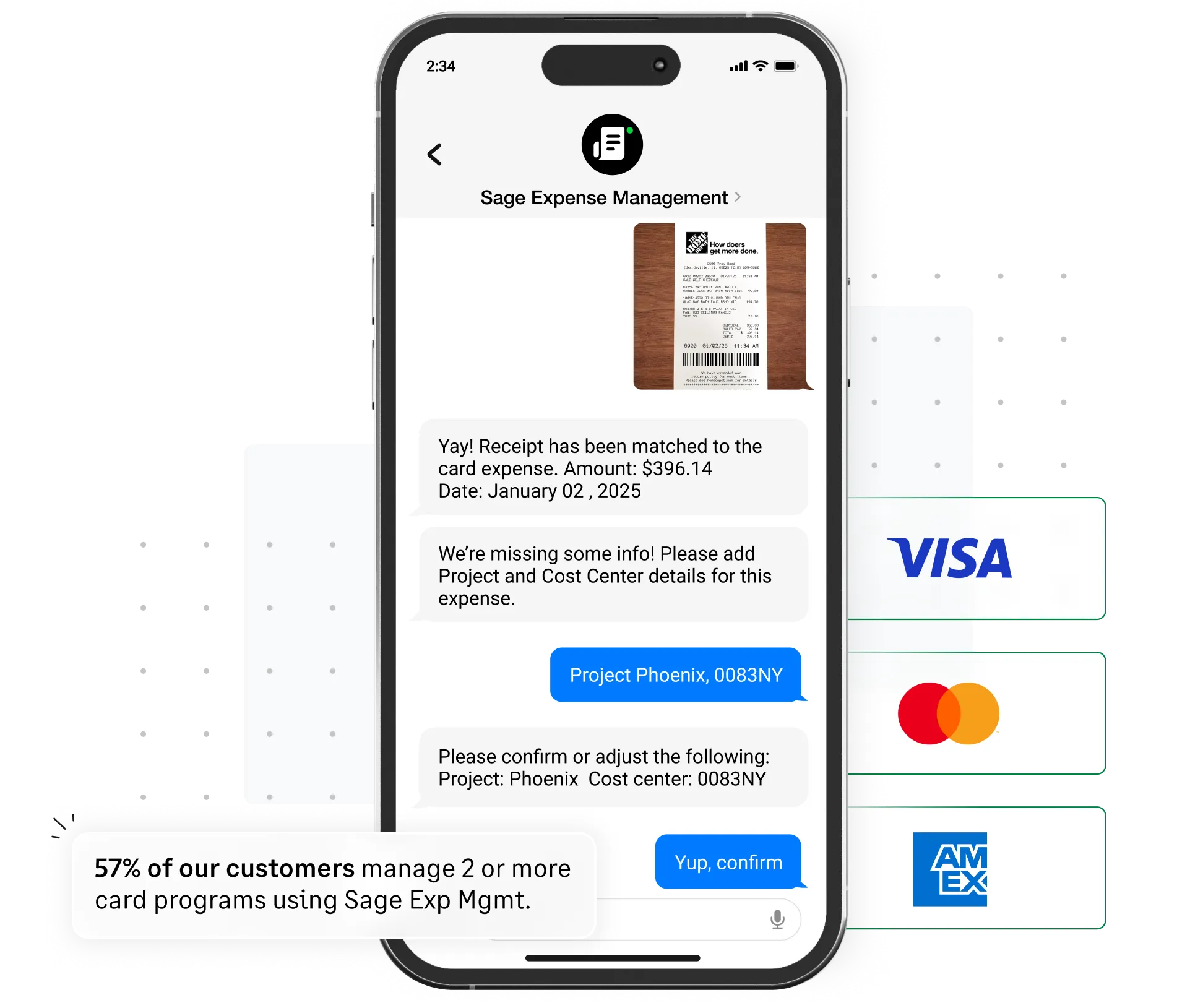

When an employee uses a company card, they receive an instant text alert. They can simply reply to the text with a photo of the receipt, and our system automatically matches it to the correct transaction. This process guarantees accurate reconciliation and eliminates duplicate entries.

Learn more about credit card reconciliations

Automate expense reporting and reclaim your time with Sage Expense Management.

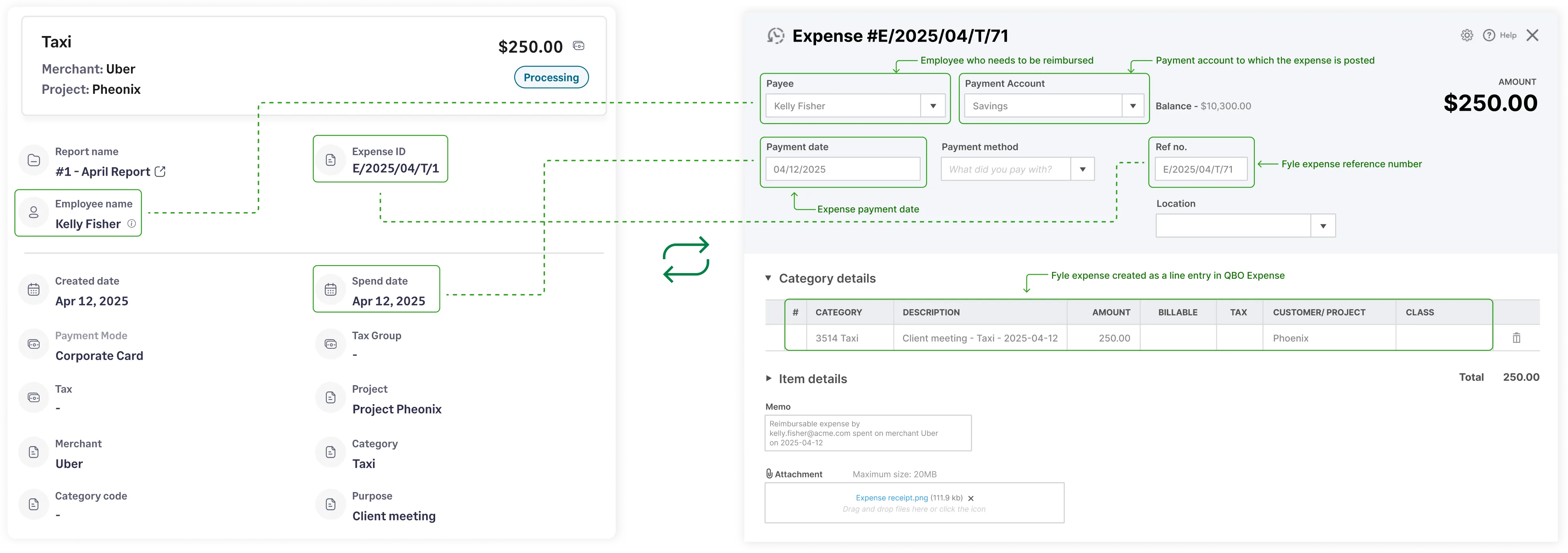

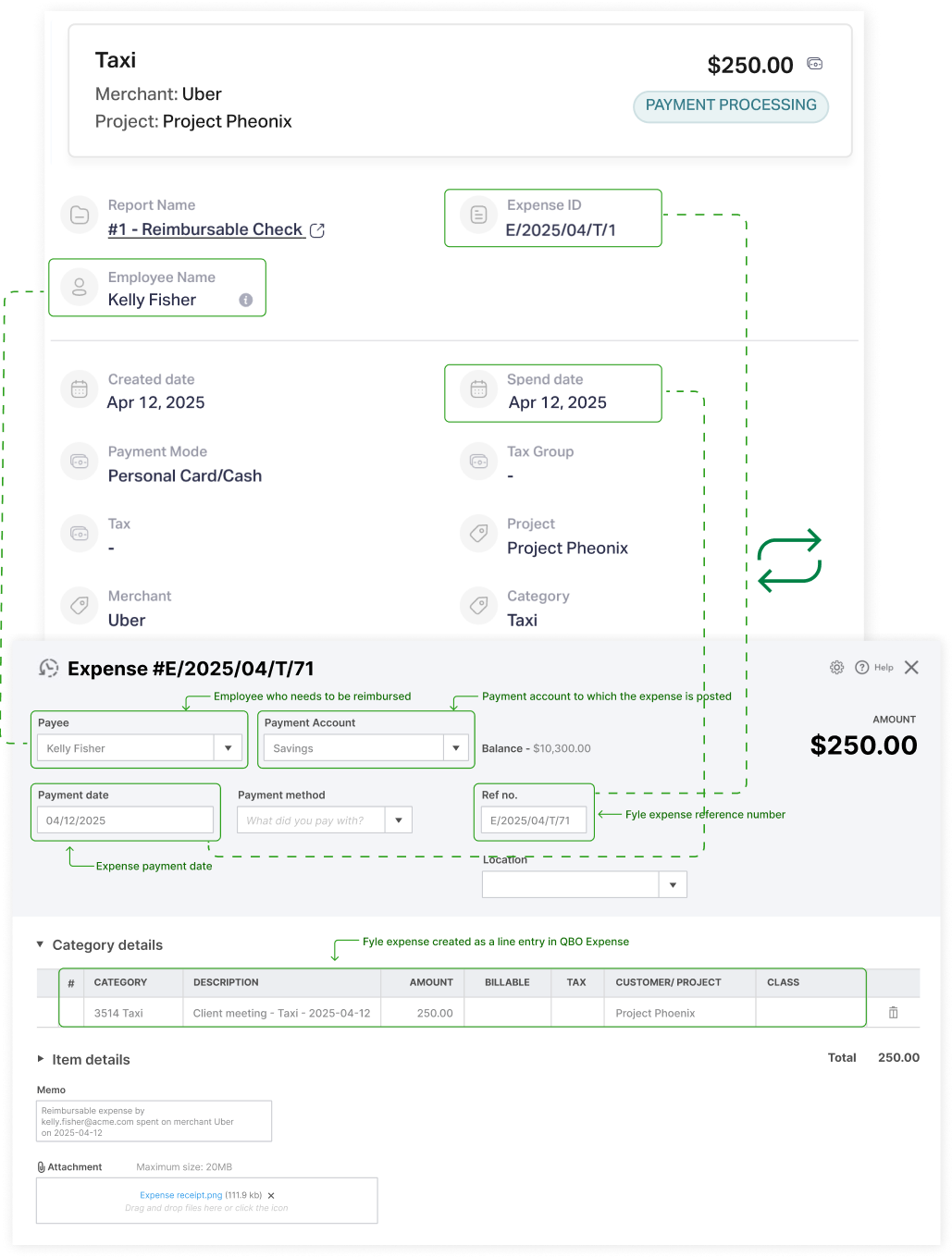

Sage Expense Management integrates with QuickBooks, Xero, Sage and NetSuite, ensuring all transactions and receipts flow directly into your accounting system for seamless reconciliation.

Managers can view, edit, approve, or send back expense reports directly from Gmail, Slack, or the mobile app, ensuring that reimbursements are never held up - even when they are on the move.

Explore approval workflows

Our powerful policy engine ensures employee expenses are verified against company policies automatically, even before they are submitted for approval. Reduce fraud, identify duplicates, and ensure every expense is compliant.

Learn how to stay compliant

Empower your finance teams to concentrate on what truly matters by automating expense reporting.

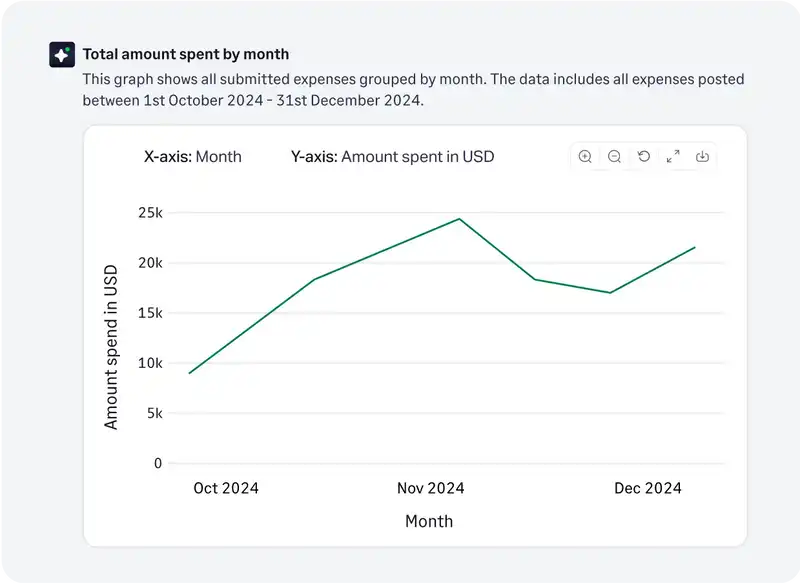

Ask our AI powered Copilot for spend insights to track budgets and uncover trends to improve cash flow management.

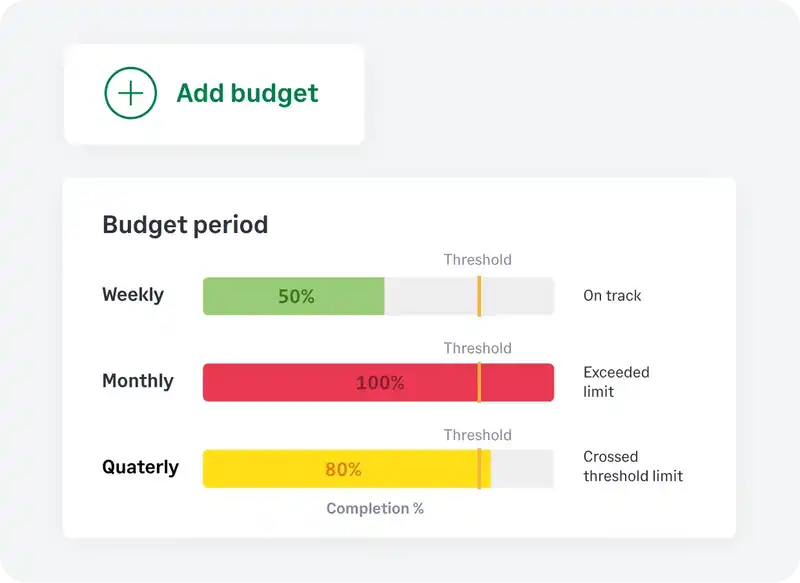

Learn more about CopilotSet limits by category, department, project, or cost center (weekly to annual). Get real-time email alerts when thresholds are near or exceeded.

Explore budgeting featuresGet 24/7 support* over live chat and email with an industry best first response time of under 30 minutes.

*For business plan users.

Learn more about supportExpense reporting is the process where employees submit business-related costs to their employer to be reimbursed. It involves tracking expenses, collecting receipts, submitting them for approval, and receiving payment. Modern software automates this process to reduce manual work and increase accuracy.

Automating an expense report involves using software that handles the entire process digitally. The key steps are:

Expense reports are typically categorized by the purpose of the spending. Common types include:

Getting started with Sage Expense Management is incredibly fast. Its user-friendly design allows businesses to get up and running in minutes. Administrators can easily set up company policies on an intuitive dashboard, while employees can start submitting expenses immediately via the simple mobile or web app.

Sage Expense Management provides enterprise-grade security. The platform is SOC 2 Type II and ISO 27001:2013 certified, uses end-to-end encryption, and is hosted on secure AWS servers. We ensure your financial data is always protected.