Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Track, report, approve, and reimburse out-of-pocket expense claims.

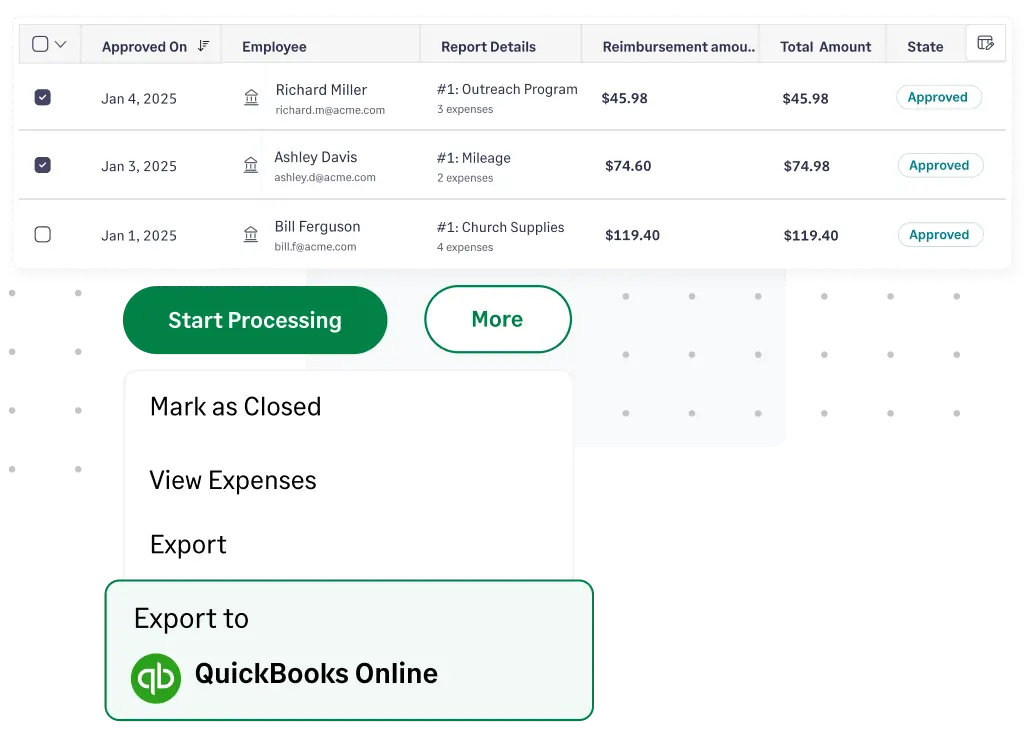

Auto-sync expense data to accounting software.

Save time and boost productivity.

1775+ reviews

1775+ reviews

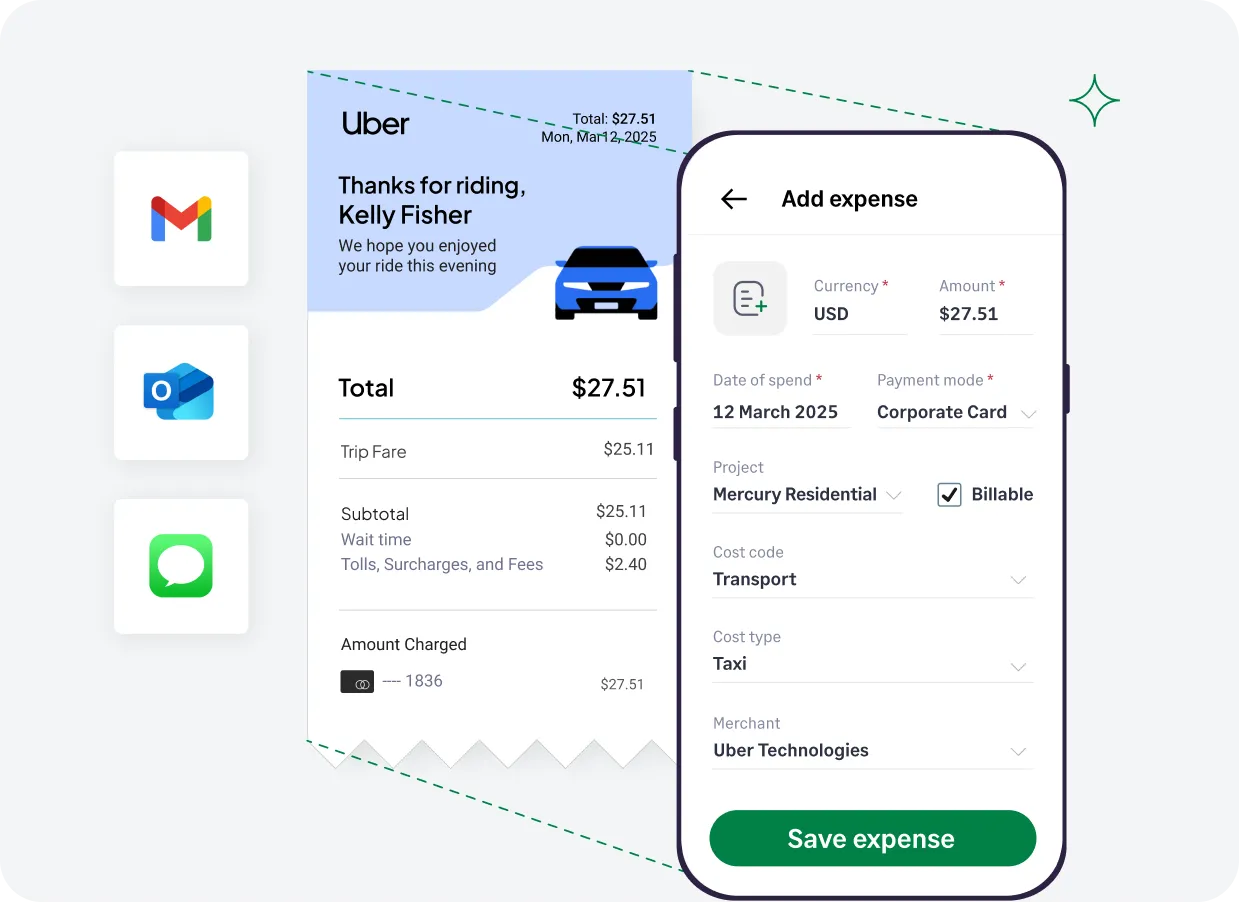

Track receipts and expenses from apps employees use everyday. Create and submit expense reports

right from Gmail, Outlook, Slack, or our mobile and web app.

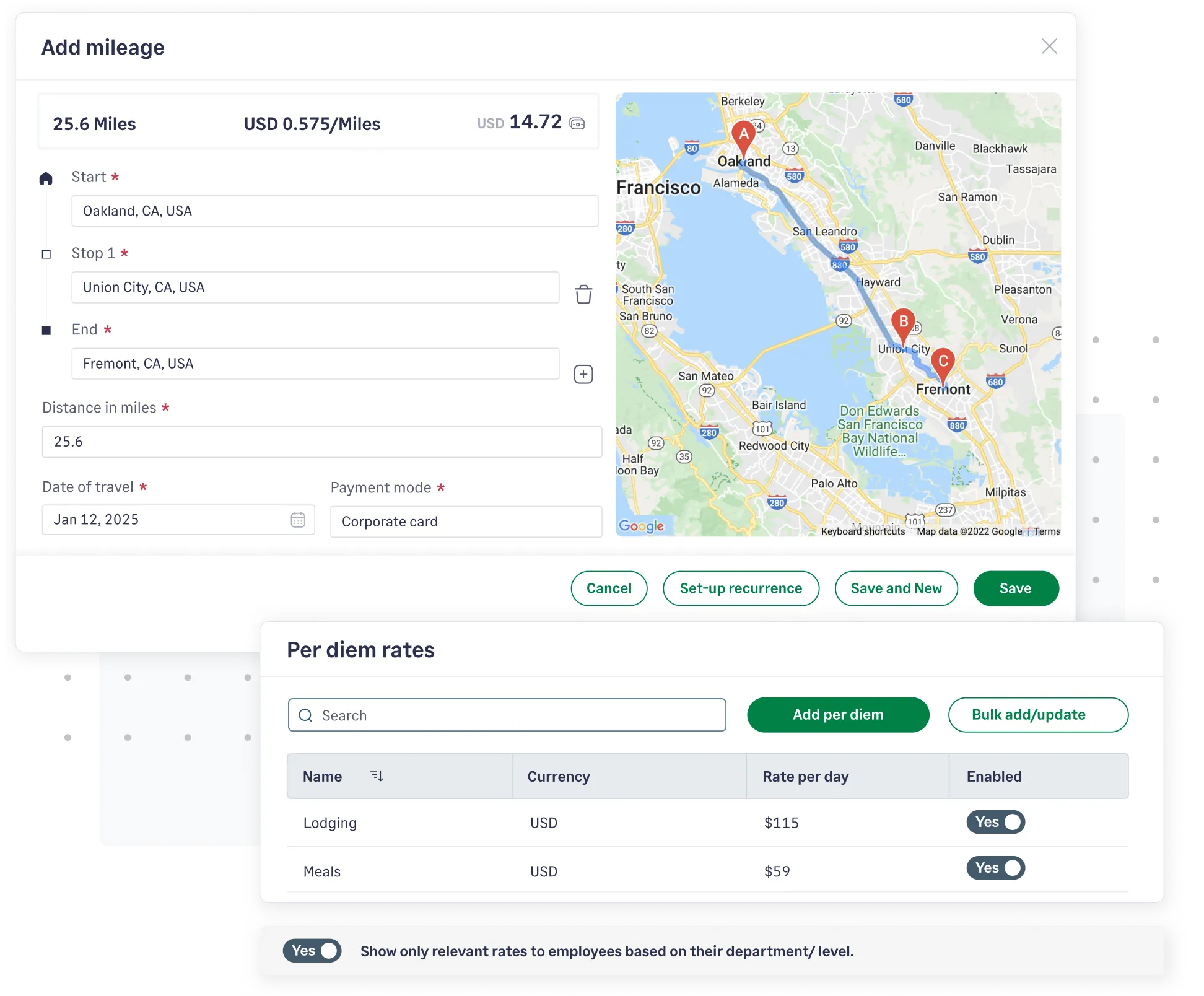

Simplify tracking business and commuting miles for your employees with our intuitive app, powered by Google Maps. Customize advanced Per Diem rates tailored to various currencies, employee levels, departments, and geographical locations for enhanced accuracy and flexibility.

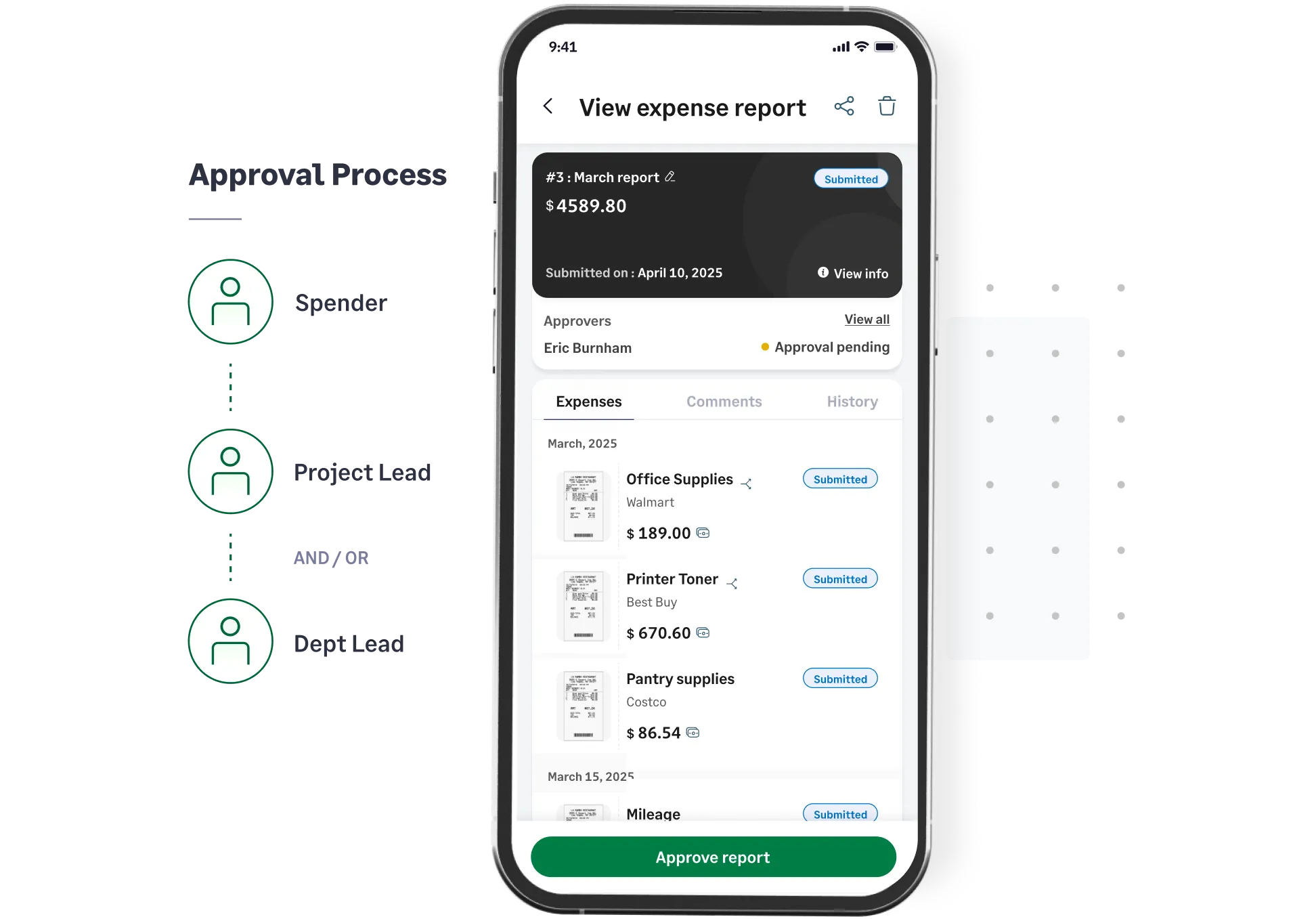

Explore mileage trackingAutomate sequential, parallel, project-led or any other approval workflow with Sage Expense Management. Approvers can view, edit, approve, or send back expense claims with a single click right from the the mobile app, email or Slack.

Explore expense approvals

Repay your employee reimbursements on time from Sage Expense Management directly to their account via ACH (US only). Payout multiple employees with just a single click and streamline your reimbursement process.

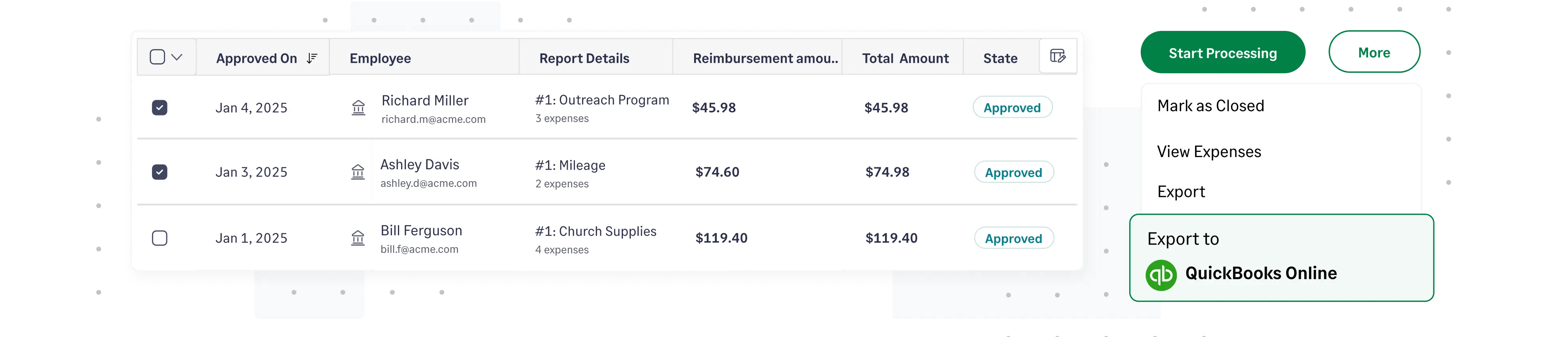

Explore reimbursements As soon as your employee reimbursements are settled, we will automatically sync them to your accounting

software. Connects with NetSuite, QuickBooks, Sage Intacct, Sage 50, Xero and Sage CRE.

Configure complex business rules based on categories, employees, projects, departments, locations, or more with our robust policy engine. Our AI automatically detects fraud or unusual expenses even before they are submitted.

Explore compliance and control

We ensure employees stay informed on their pending reimbursements. Receive notifications via email, or Slack, keeping everyone in the loop from reporting to payout.

Effortlessly track receipts from everyday apps, while Sage Expense Management automatically extracts and codes your expense data.

Explore receipt collection

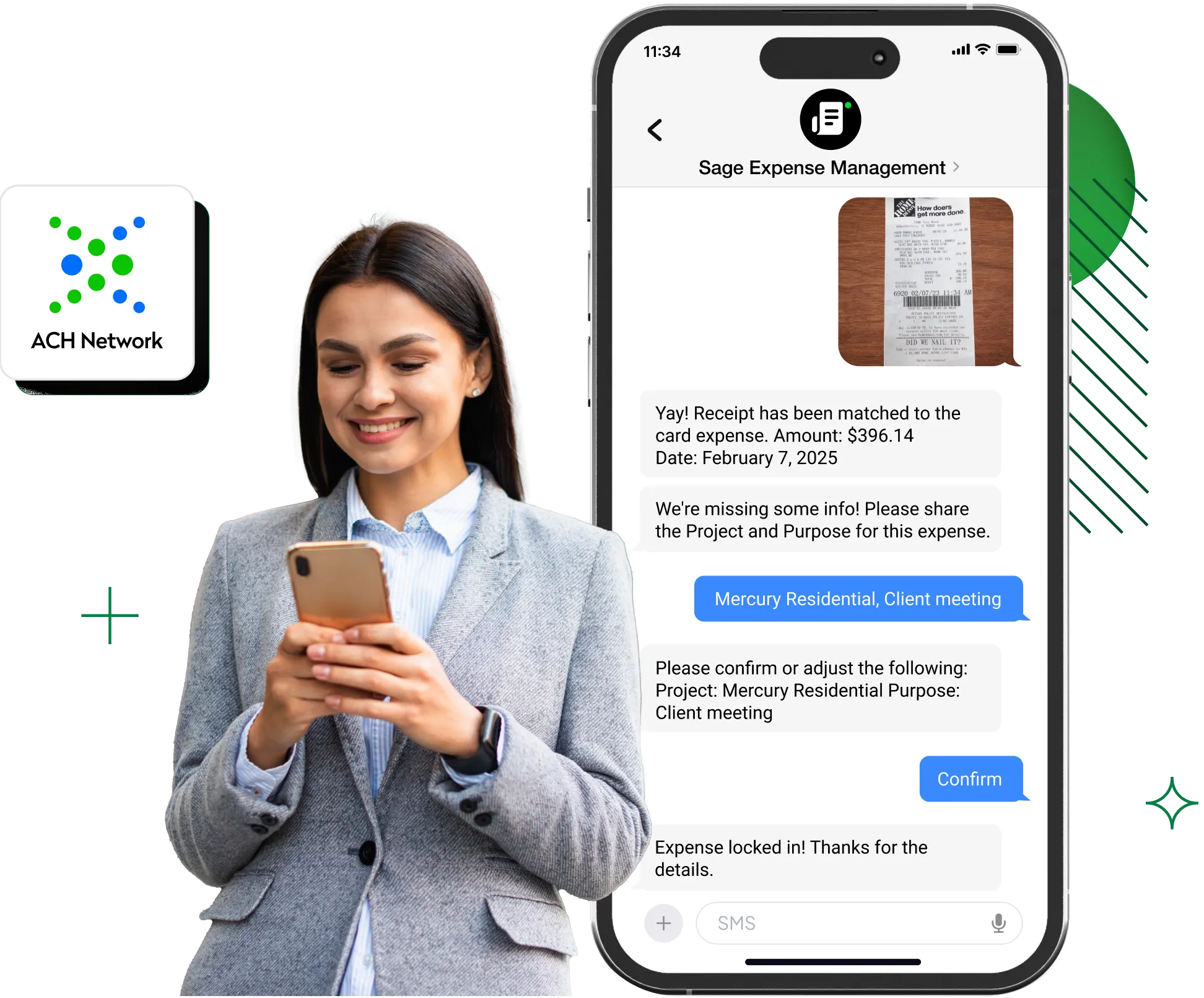

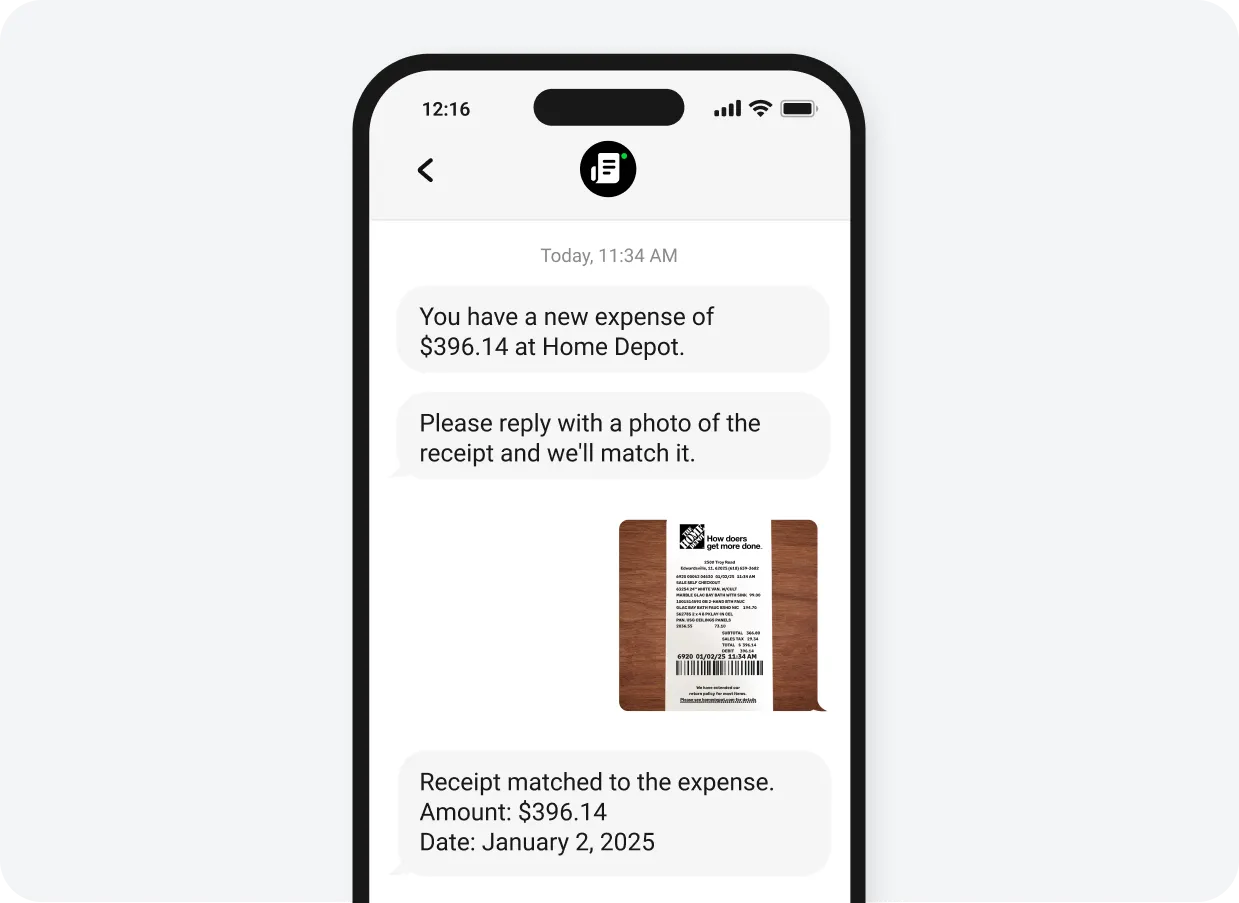

Get instant alerts for all credit card transactions, capture receipts via text, and simplify reconciliation with your existing cards.

Explore reconciliations

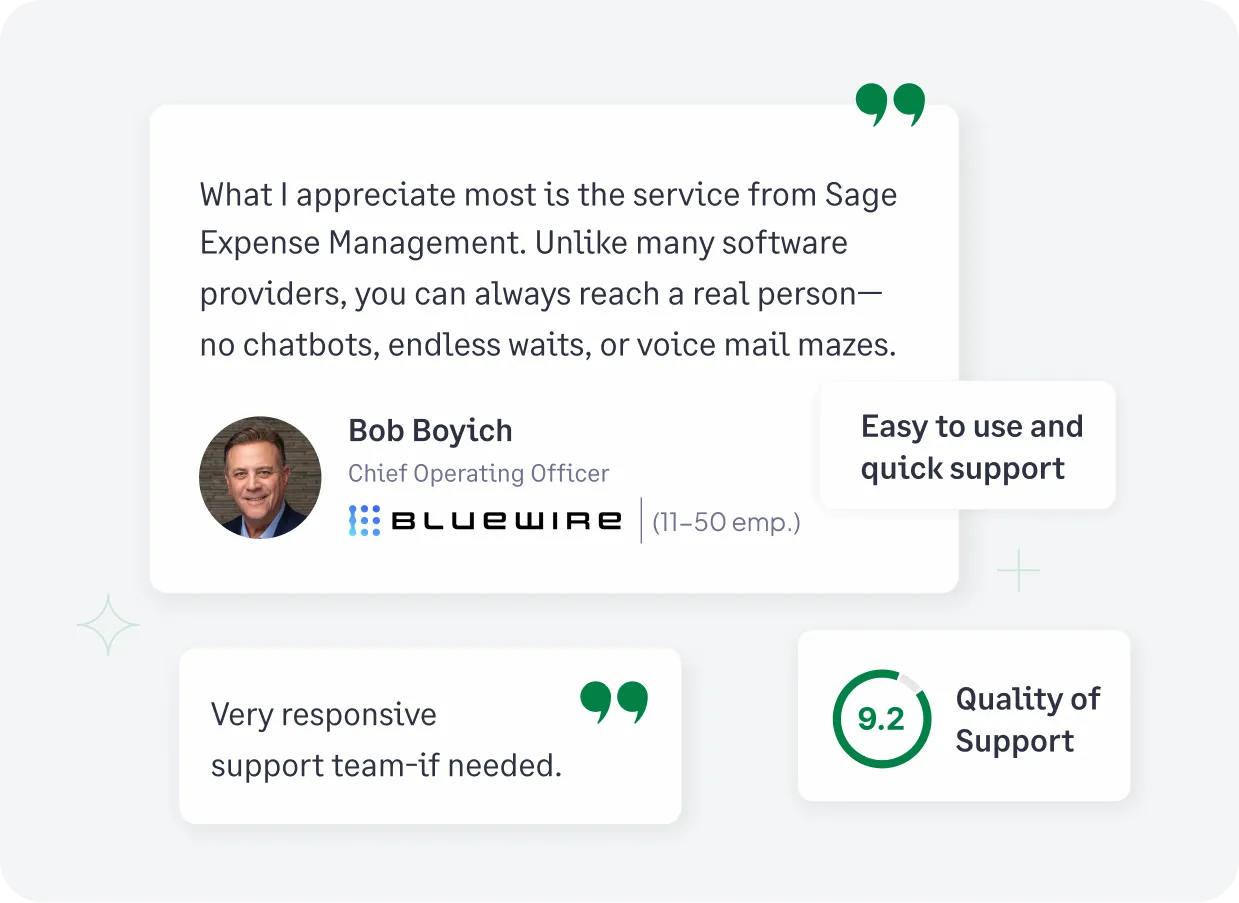

Get 24/7 support* over live chat and email with an industry best first response time of under 30 minutes. *For business plan users

Explore customer supportEmployee expense reimbursement refers to the process where a company reimburses employees for business-related expenses they've covered out-of-pocket. It serves as a means to fairly compensate employees for legitimate work-related costs they wouldn't typically bear themselves. Read more about employee expense reimbursements here.

An expense reimbursement software is a tool businesses use to streamline and automate reimbursement for employees who incur expenses while conducting company activities. The expenses include travel, meals, accommodation, and other costs.

Employees who incur expenses for company-related activities can follow the following process:

Alternatively, they can use an employee expense reimbursement software like Sage Expense Management to automate everything, making it quicker and reducing manual effort.

The benefits of using expense reimbursement software are twofold, benefiting employees and the businesses.

For employees, it saves time, reduces manual effort, minimizes human errors, and enhances visibility over expense claims. This means they can submit expenses more efficiently, with fewer mistakes, and track their reimbursement status easily.

For businesses, a software for expense reports contributes to cost savings by identifying areas where expenses can be reduced or optimized. Additionally, it enhances employee satisfaction by streamlining the expense reimbursement process, ultimately leading to a more efficient and productive workforce.

Expense reimbursements are typically non-taxable if they are legitimate company-related expenses with sufficient proof. These reimbursements are viewed as restoring employees to their financial state before incurring the expenses rather than additional income.