Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Streamline expense reporting with Sage Expense Management (Formerly Fyle). Effortlessly track receipts, reconcile credit card spend, process reimbursements, and sync data to your accounting software.

1775+ reviews

1775+ reviews

Automate expense tracking to employee reimbursement with Sage Expense Management

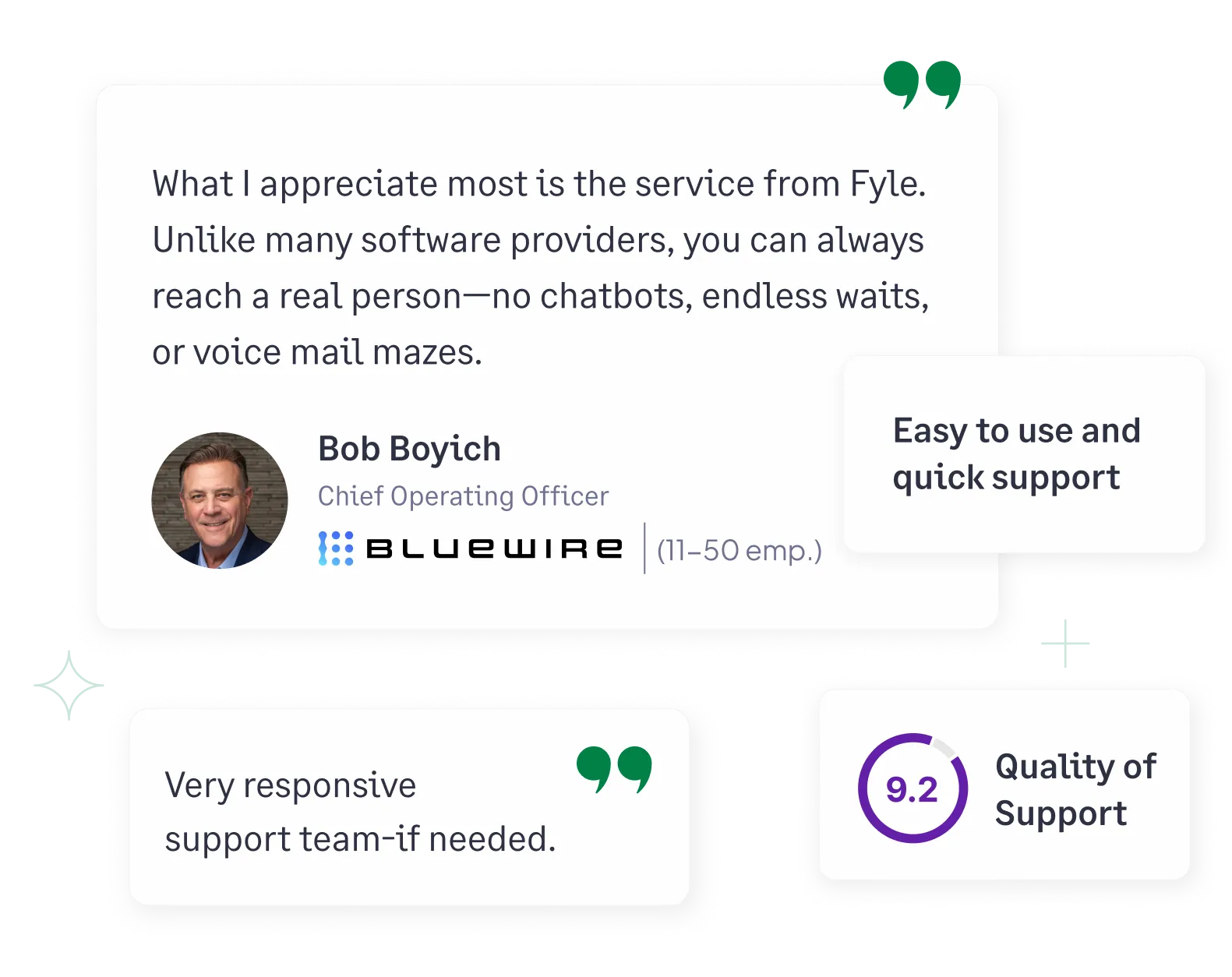

Get 24/7 support* over live chat and email with an industry best first response time of under 30 minutes. *For business plan users.

Learn more

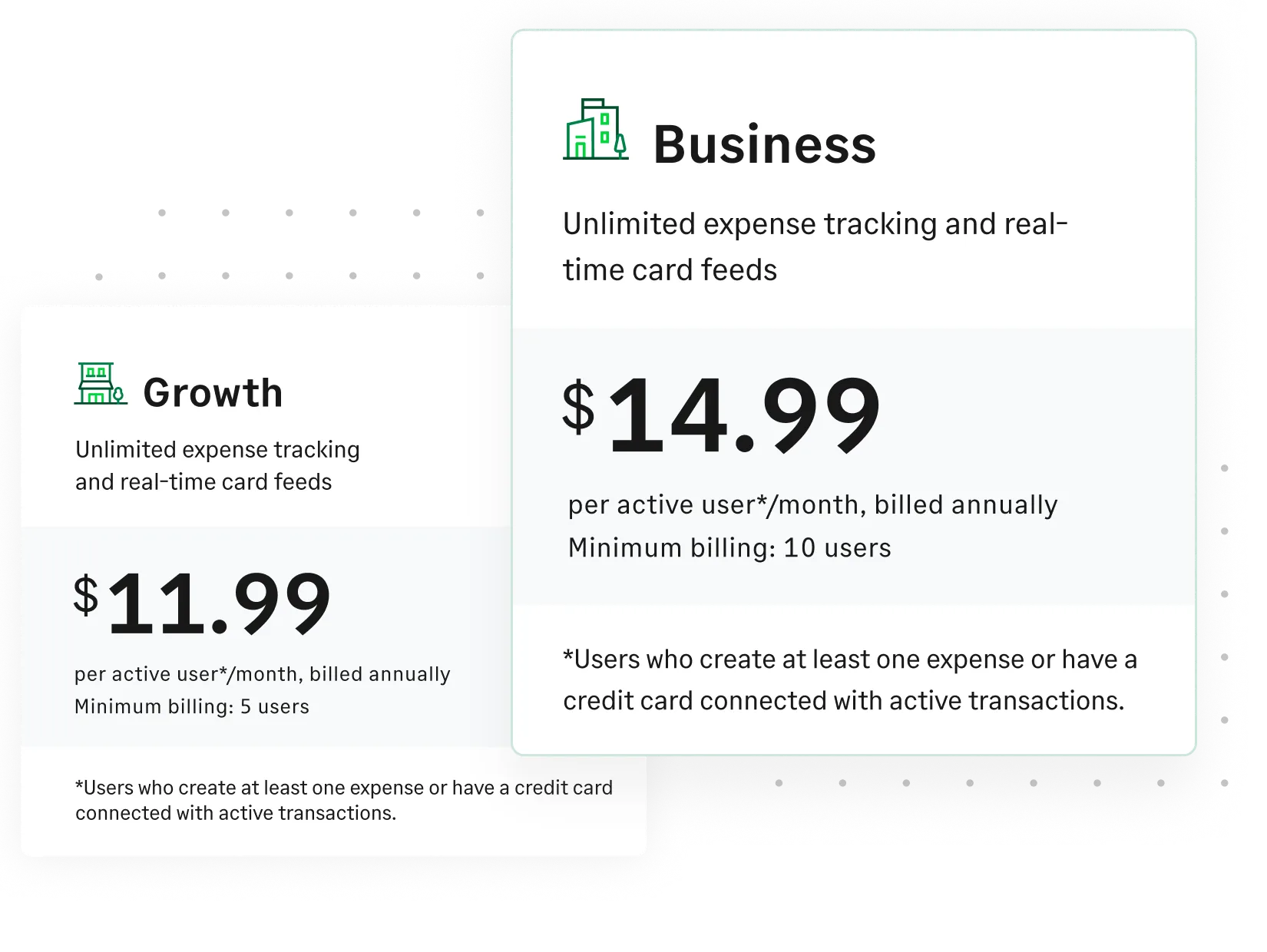

No hidden costs or lock-in contracts. Our pricing is simple and usage-based. Perfect for SMB, mid-market businesses and accounting firms.

Learn more

This data is gathered from a crowd and customer-sourced review and product comparison site that provides unbiased, verified, and trustworthy reviews on the top software for expense reports in the market. Their scores are calculated based on real-time user reviews.

Here's why our business expense report software is better for your employees and your business.

Star Rating

General Ratings

Ease of Use

Ease of Setup

Quality of Support

Expense reporting

Ease of Creating Expense Reports

Bank / Credit Card Integration

Smart Categorization

Digital Receipt Management

Employee Reimbursement

Client Invoicing

Electronic Payments

Project Accounting / Revenue Recognition

Mobile

Receipt Capture

Mileage Tracking

Travel Itinerary and Flight Status Updates

Platform

Embedded AI / Machine Learning

Complex Approval Workflow

Reporting

APIs / Integration

Internationalization

Performance and Reliability

Mobile User Support

Administration

Business Tool Integration

Workflow

Automated Reminders

Policy Compliance Management

User, Role, and Access Management

Source: a customer review and product comparison site

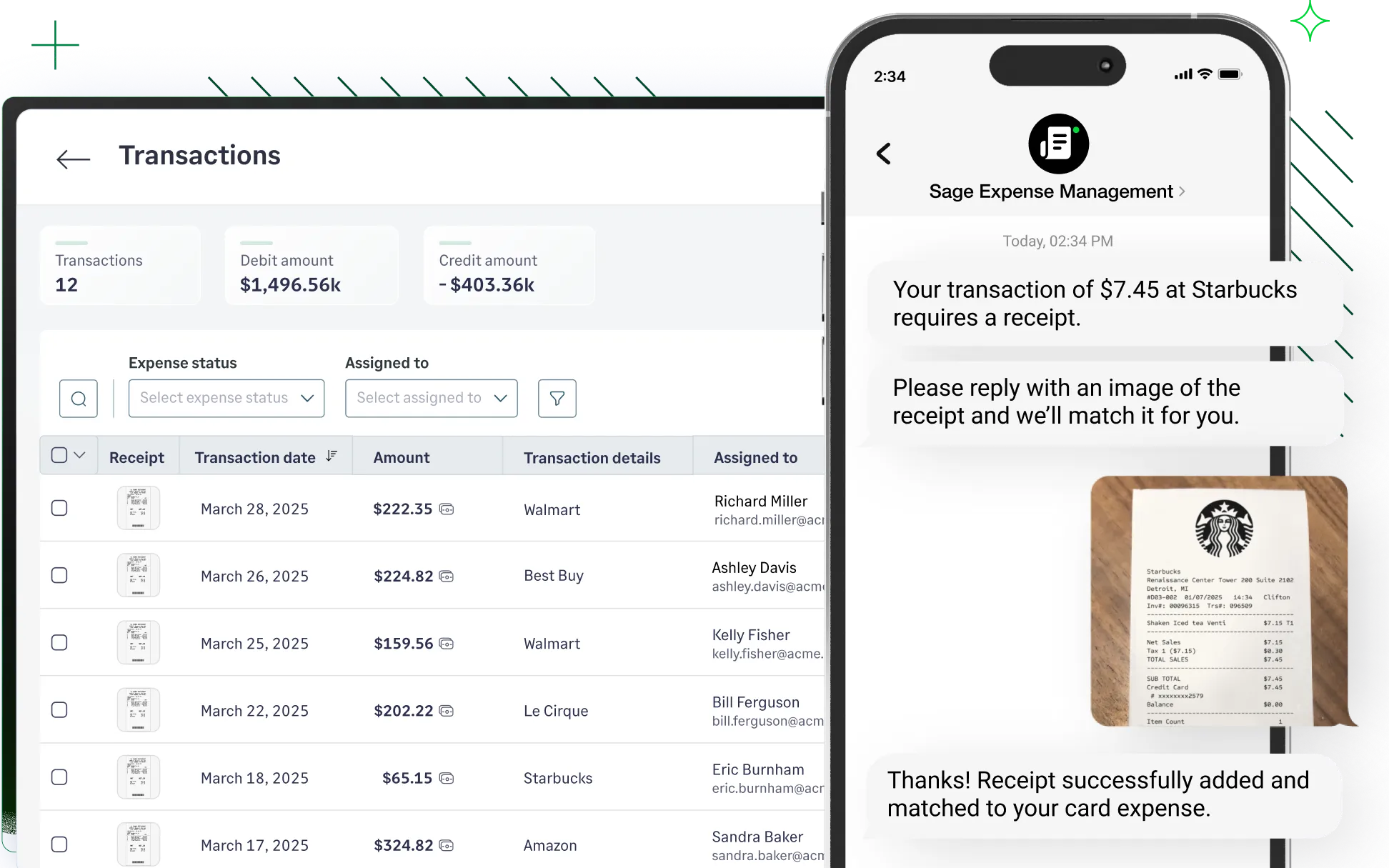

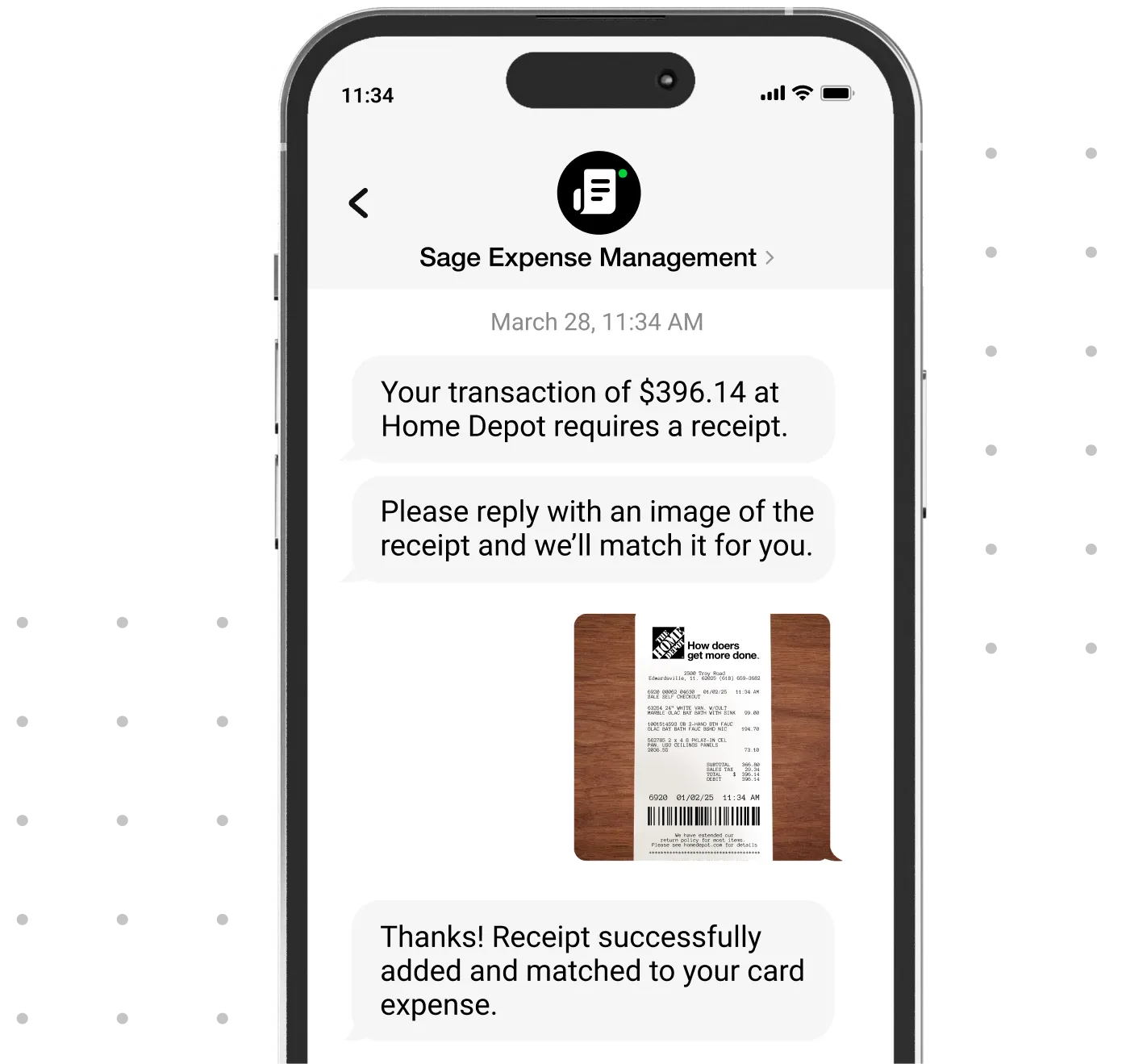

Sage Expense Management offers powerful expense features - all on your existing cards.

Sage Expense Management gives better support and transparent pricing-no card switch needed.

Sage Expense Management is more modern and intuitive than Certify’s legacy tools.

Sage Expense Management is simpler, faster, and more agile than Concur’s suite.

Expense reports are detailed records of business-related expenses that employees incur on behalf of the organization. They typically include information such as the date, amount, and purpose of each expense, along with supporting receipts or invoices.

For example, an expense report after an employee business trip can include expenses like transportation, hotel stay, rental car cost, and more.

Creating an expense report can be based on the type of expense, the payee, the specific project or client associated with it, or the employee responsible for the cost.

7 steps to create an expense report for employee expense reimbursements:

Step 1: Use a template or an employee expense reporting software to create expense reports

Step 2: Determine the reimbursable business expenses to include in your expense report

Step 3: Report each business expense as different in-line items in your expense report

Step 4: Ensure you fill in all necessary expense fields like date, purpose of expense, merchant, and other payment details

Step 5: Calculate the total amount of reimbursable expenses included in your report

Step 6: Add relevant notes about the expenses incurred or the overall expense report

Step 7: Print and attach expense receipts as proof of spend and then submit them to your reporting manager

Alternatively, you can also use Sage Expense Management, to automate and streamline your expense reporting!

Outdated expense reporting methods like manually creating expense reports hinder efficiency and accuracy. A business expense reporting software streamlines the process by extracting all necessary expense report fields, auto-populating it, checking for policy violations or expense fraud, and ensuring all expense claims are compliant.

An expense reporting software is a tool businesses use to simplify managing employee expense reimbursements and reconciliations. The software enables employees to submit digital expense reports on time, ensures policy compliance, streamlines approval workflows, integrates with accounting systems, and provides insightful data to make better financial decisions.

An expense report software is designed to automate and simplify your entire expense reporting process. The key features to look for are:

Sage Expense Management simplifies every step, from receipt tracking to automated credit card reconciliations, and integrates seamlessly with your accounting software. At Sage Expense Management we ensure your teams only focus on what truly matters.