Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

1775+ reviews

1775+ reviews

Expense management is the process of tracking, controlling, and reimbursing employee expenses. It involves everything from capturing receipts and submitting expense reports to approving expenses, reconciling transactions, and generating reports for analysis.

But let's face it, manual expense management is a pain.

It's time-consuming, inefficient, and prone to errors. When you're already juggling a million things, chasing down receipts and reconciling expenses manually shouldn't be one of them.

Sage Expense Management's AI-powered expense management software automates the entire process, giving you back valuable time and control over your company's spending.

Think about this: the average expense report costs $58 and takes 20 minutes to process. But nearly 20% have errors, costing another $52 and 18 minutes to fix. That's over $100 and nearly 40 minutes for a single report!

Now, let's do some math. A company with just 10 employees, each submitting one expense report a month, could be wasting over $1,000 and 6 hours on this inefficient process. With 50 employees, that jumps to over $5,000 and 30 hours wasted.

And for a company with 100 employees? You're looking at over $10,000 and 60 hours down the drain.

Now imagine if you could automate all those tedious tasks:

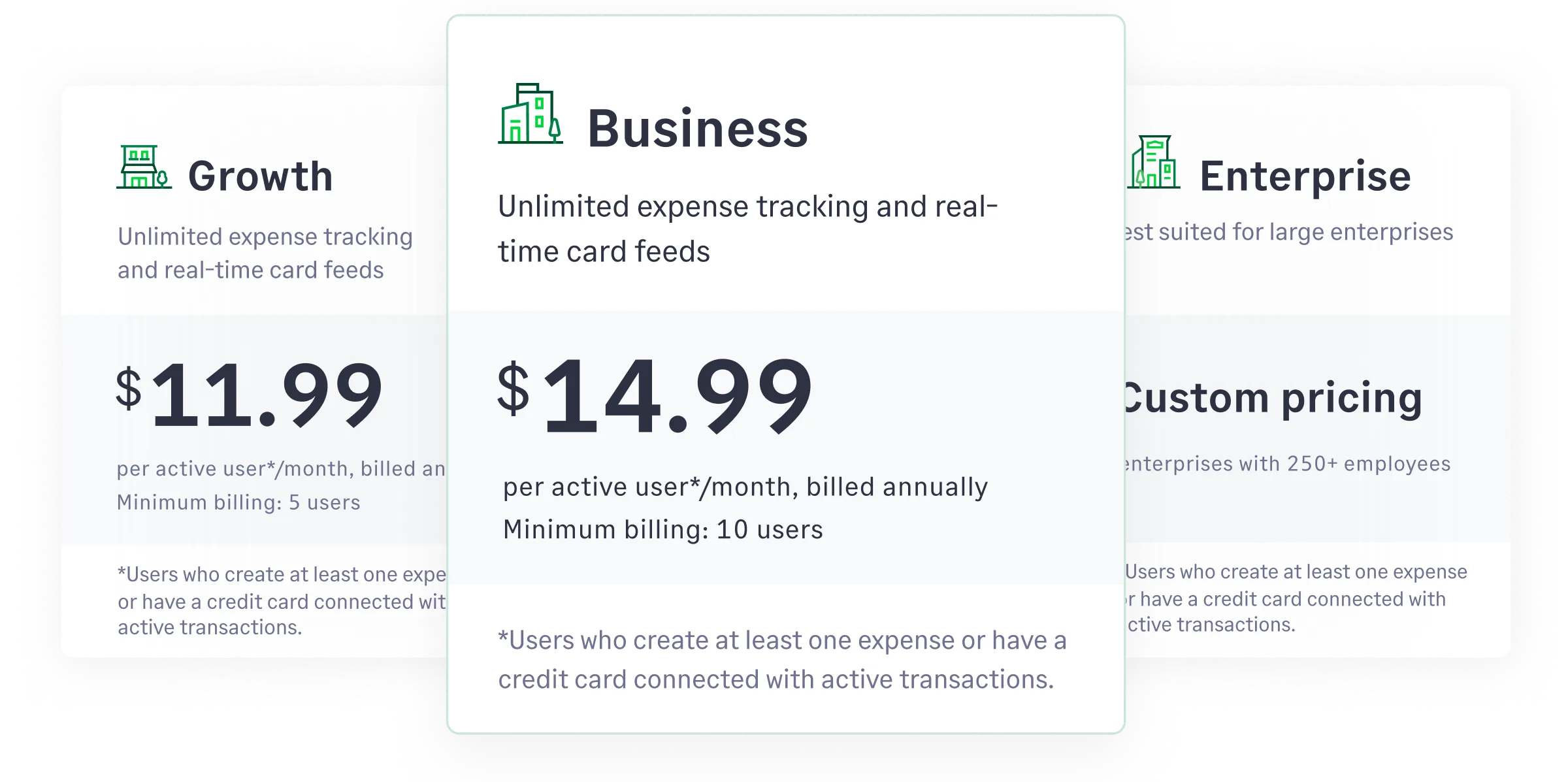

Instead of wasting $10,000 and 60 hours every month on manual expense management, what if you could automate everything for just $11.99 per user per month?

You don't need to hunt receipts every minute of the day.

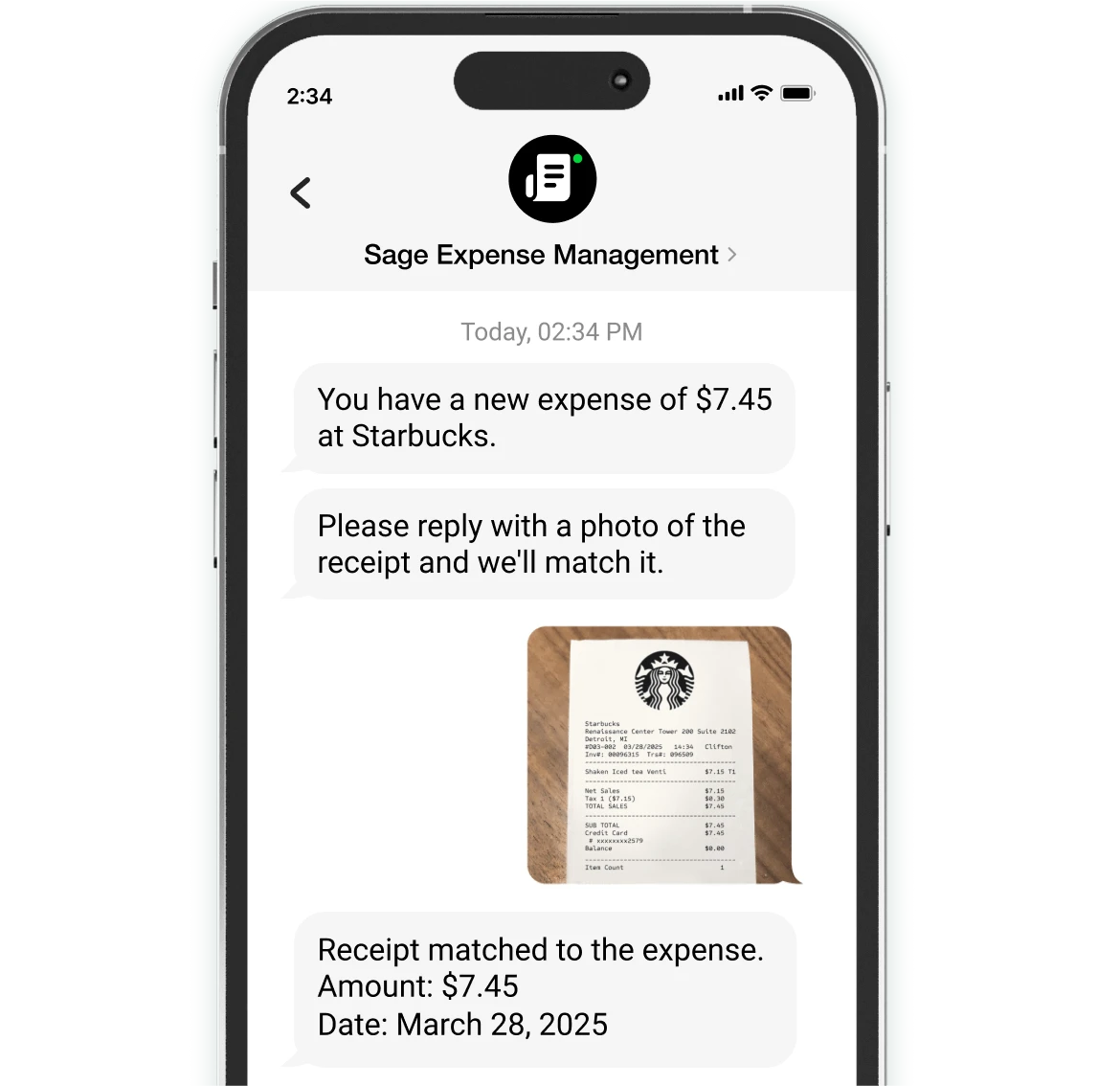

With Sage Expense Management, employees simply text receipts for reimbursable and credit card expenses on the fly. We instantly match them to the right card transaction.

Plus, employees can submit expense receipts from the apps they already use every day, like Gmail, Outlook, and Slack. Or, they can use our easy-to-use mobile app. It's all about making expense reports less of a chore.

Stop waiting for statements. See spending as it happens.

Sage Expense Management integrates directly with all major credit card networks, so you get real-time alerts for every business card transaction.

Employees get instant text notifications to submit receipts with a single click. Collect receipts and reconcile expenses in < 2 minutes all on your existing credit cards!

Standardize approvals, stop expenses from slipping through the cracks.

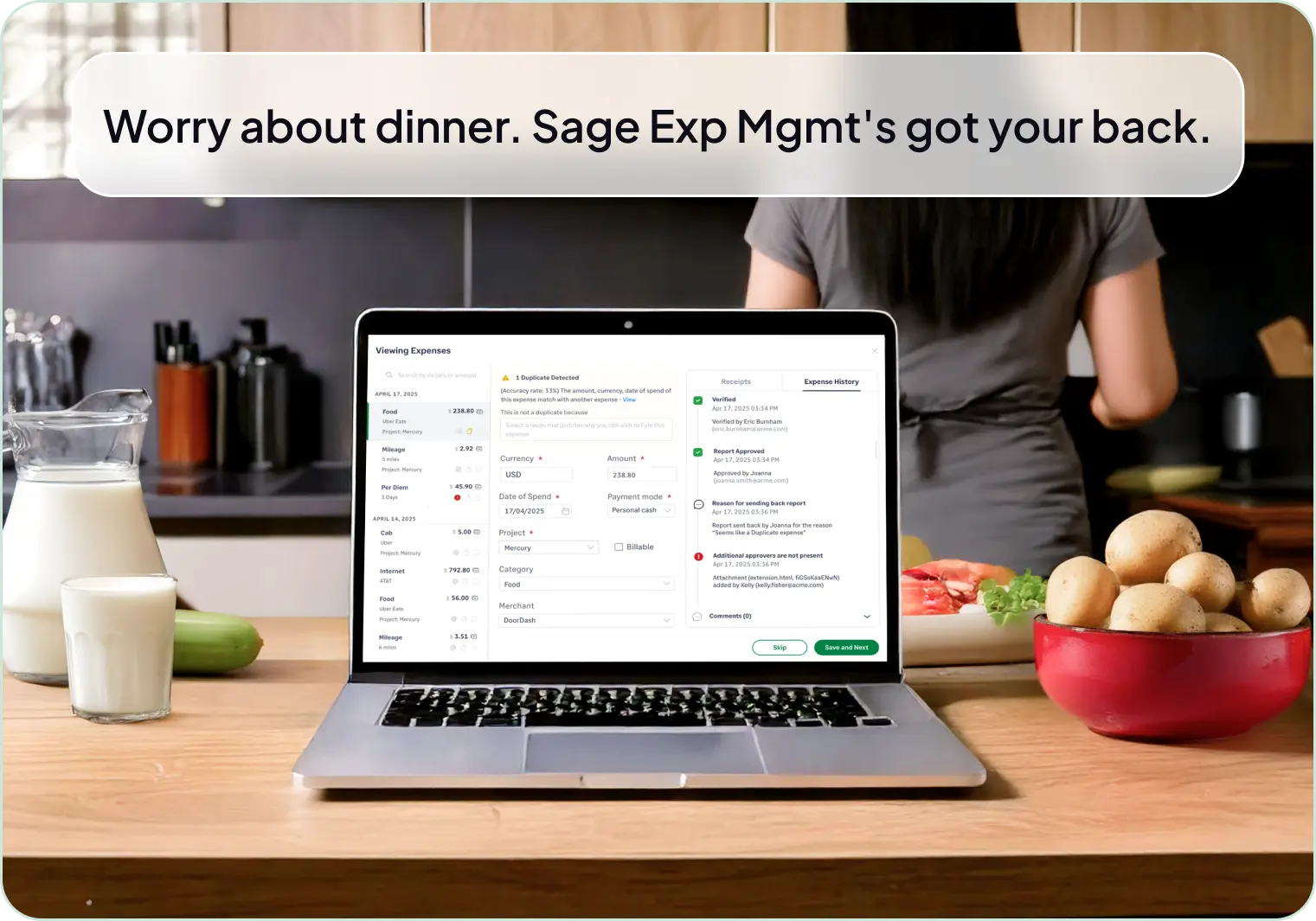

With Sage Expense Management, approvers can review and approve expenses from anywhere, anytime. Set up multi-stage approvals and customize workflows to fit your company's structure. We ensure timely reimbursements and keep everyone on track.

Sage Expense Management's AI-powered policy engine automatically checks every expense against your company's policies. It flags potential violations, so you don't have to.

Stay compliant without lifting a finger.

Eliminate manual data entry. Seamlessly integrate expenses with your accounting software.

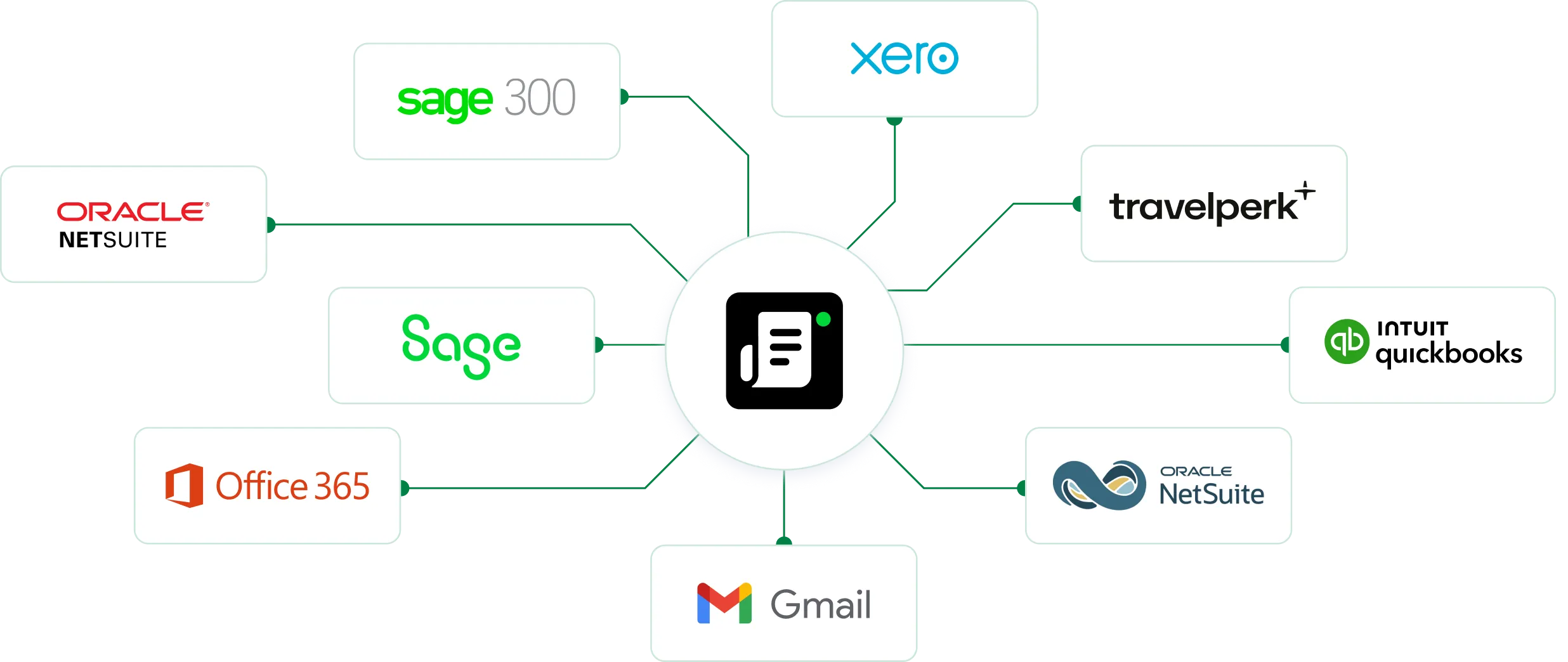

Sage Expense Management has two-way integrations with all major accounting tools to eliminate manual data entry, ensuring that all your expense data is automatically synced.

No more data silos, just a smooth, integrated expense management experience.

"We're operating in the dark most of the time—there's no transparency." This no longer needs to be a reality.

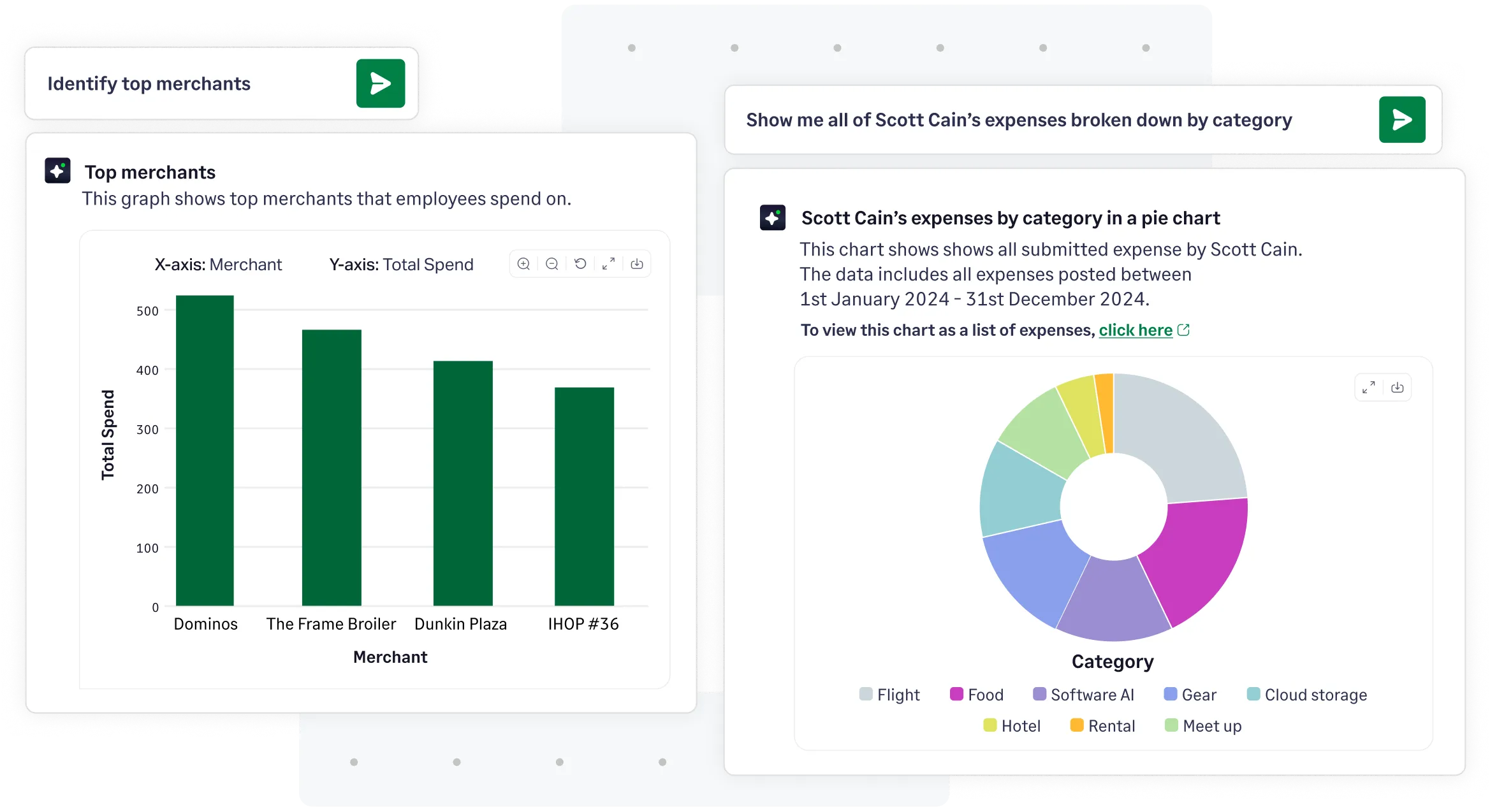

Sage Expense Management's AI-powered Copilot gives you instant insights into your company's expenses. Identify spending trends, track budgets, and monitor policy violations with ease.

It helps you understand where every dollar is going, so you can make informed decisions and stay in control of your company's finances.

"We need predictable pricing without hidden fees." We hear you.

Sage Expense Management's pricing is simple and transparent. No lock-in contracts, pay only for active users, making it easy to budget and scale.

faster receipt collection

learning curve

card spend visibility

faster month end close

minutes reconciliation

Expense management helps organizations control costs, ensure compliance, improve visibility into employee spending, and streamline the reimbursement process. By tracking and managing employee expenses, businesses can optimize spend, identify and prevent fraud, and make better financial decisions.

Follow these tried and tested methods to efficiently track your business expenses:

Choosing the right expense management software? Here's your checklist:

We might be a little biased, but we genuinely believe Sage Expense Management is the best expense management software out there. Here's why:

But don't just take our word for it. See what our customers are saying, and try Sage Expense Management for yourself. We're confident you'll love it.