Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Automate expense receipt tracking, and credit card reconciliations with the best expense tracking software.

* Sage Expense Management (formerly Fyle) integrates directly with your existing business credit cards 1775+ reviews

1775+ reviews

With Sage Expense Management, submit expense receipts and additional details like projects, cost centers and memos--all via text. Sage Expense Management's AI will automatically create, code, and submit the expense.

Our platform notifies you by text every time your business credit card is swiped. Employees can reply with a receipt photo for instant expense reconciliation. Or, simply text the receipt, and we will automatically reconcile it when the card data flows in.

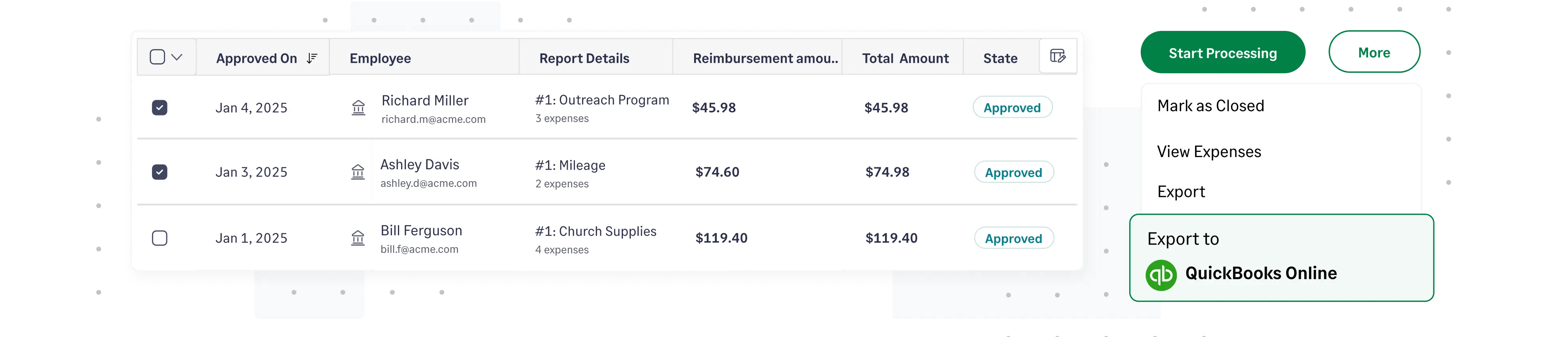

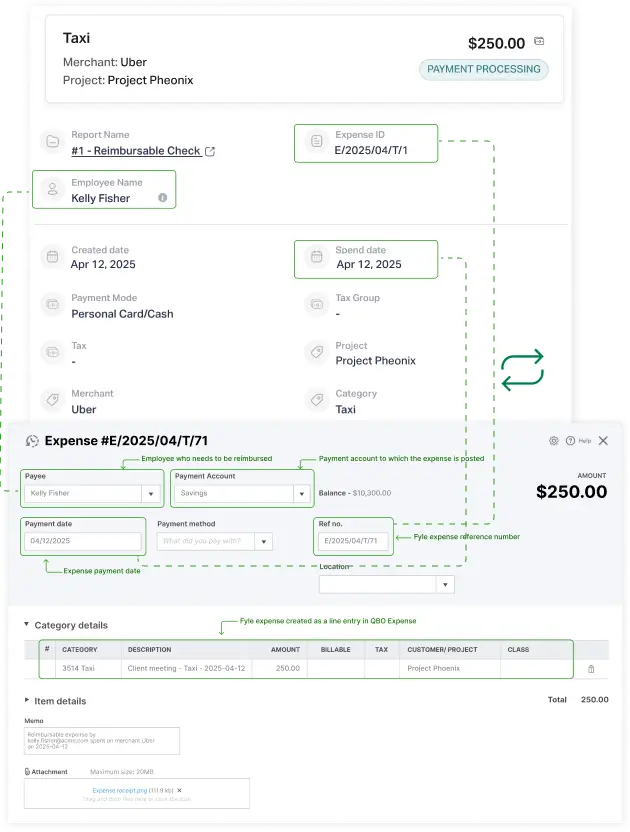

See how we automate credit card reconciliations Sage Expense Management automatically categorizes and codes your expenses. Two-way accounting and ERP software sync eliminates manual accounting tasks.

eliminates manual accounting tasks.

As soon as your employee reimbursements are settled, Sage Expense Management will automatically sync them to your accounting software. Connects with NetSuite, QuickBooks, Sage Intacct, Sage 50, Xero and Sage CRE.

Explore our integrations

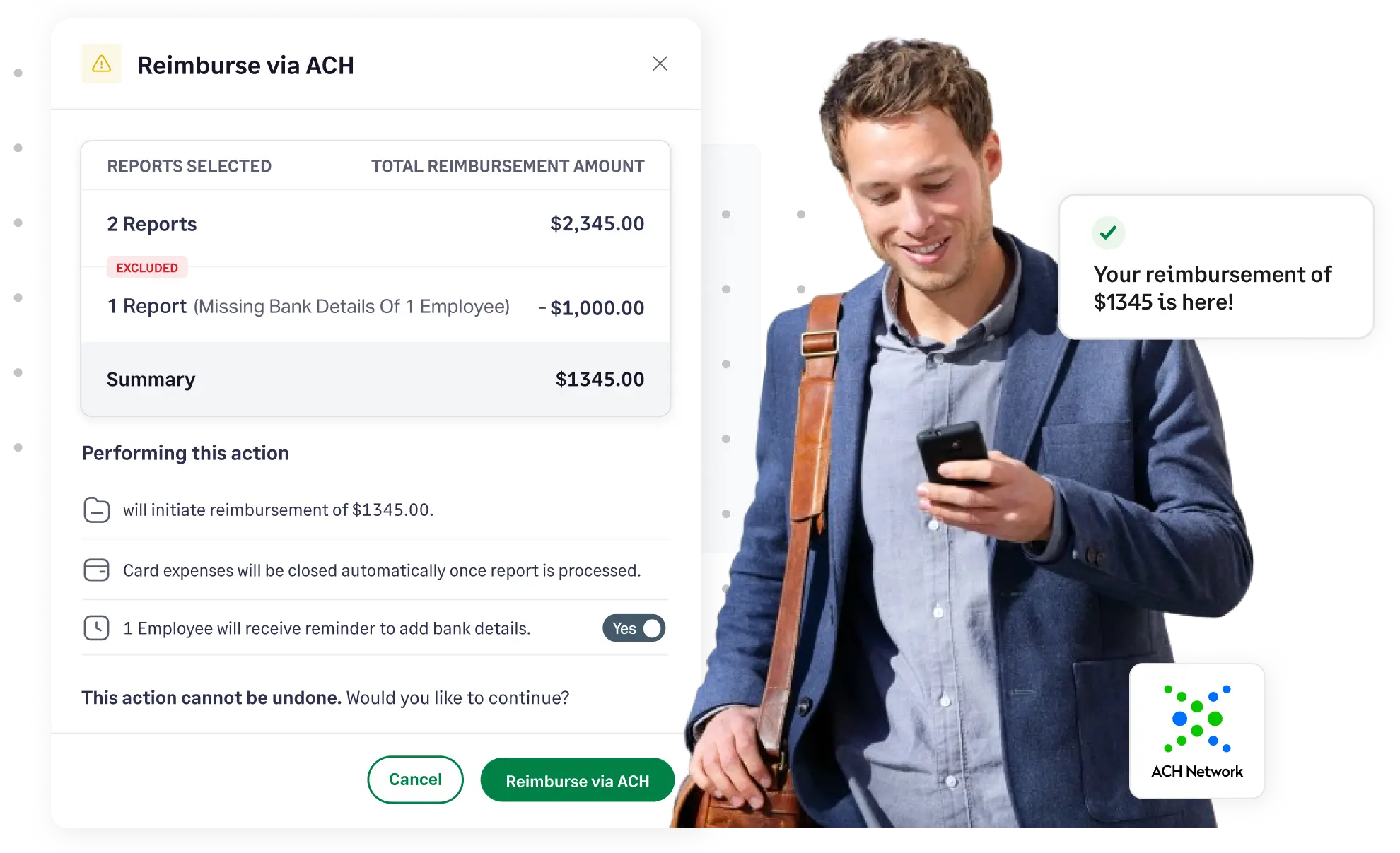

Track and reimburse mileage and out-of-pocket expenses with Sage Expense Management using ACH payments (US only). We automatically sync payment data with your accounting software.

See how ACH makes reimbursements faster See how ACH makes reimbursementsOur policy engine lets you set complex rules for categories, employees, projects, and more. The AI auto-detects fraud before submissions, saving you time and money.

See how we automate complianceAsk Sage Expense Management Copilot for real-time insights into card and out-of-pocket expenses. Get a quick breakdown by category, project, department and more.

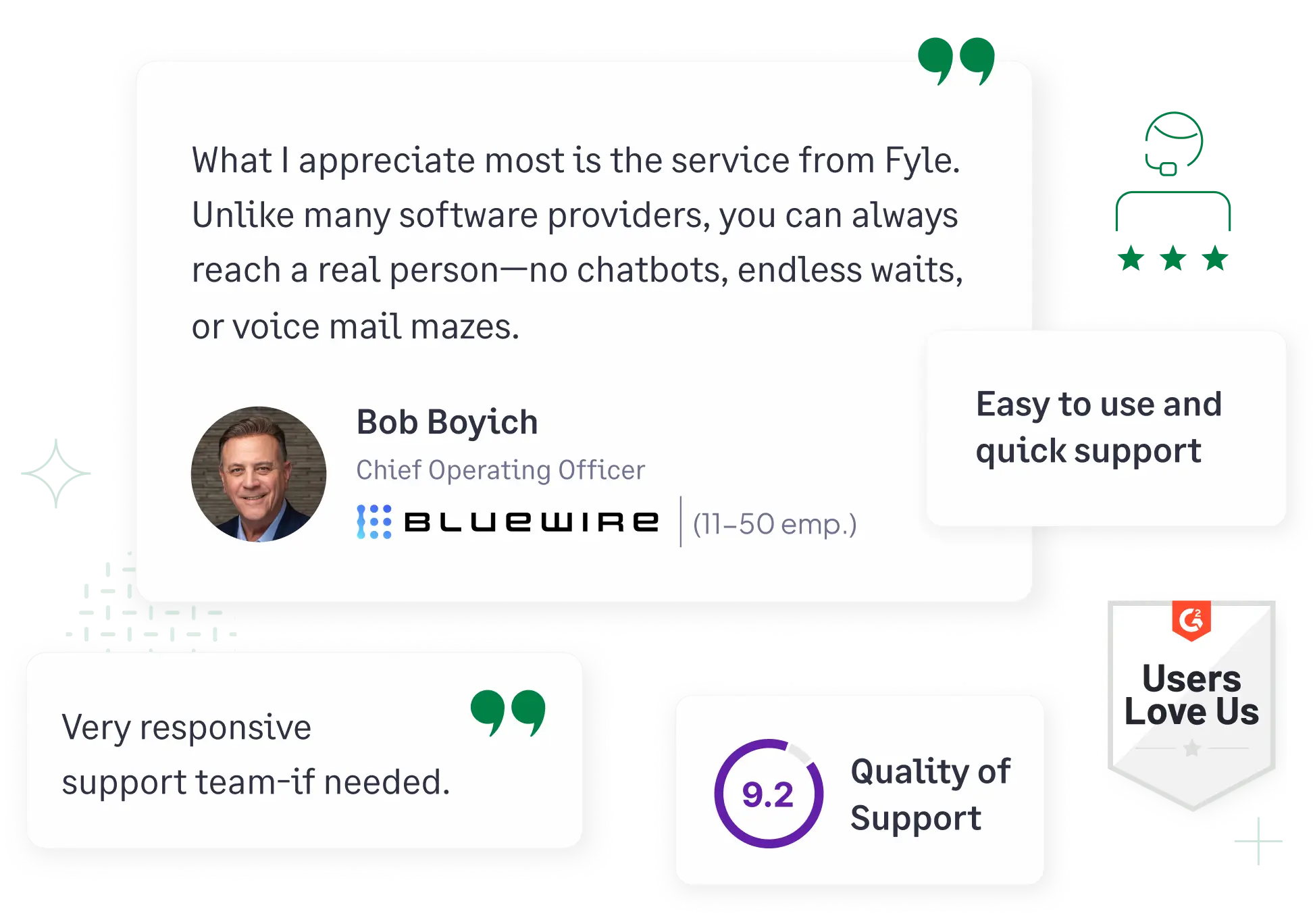

See how Sage Expense Management Copilot helps businessesGet started fast with our easy setup & 24/7 support, with a dedicated account manager*, and an industry leading first response time of < 30 min!

See why customers love Sage Expense Management

Step 1: Open a separate business bank account

Step 2: Choose a user-friendly accounting system

Step 3: Connect your financial accounts for automation

Step 4: Implement a digital receipt management system

Step 5: Leverage expense tracking apps for efficiency

Here are steps to implement effective expense tracking in your organization:

Step 1: Define clear expense policies

Step 2: Choose the right tools

Step 3: Implement a user-friendly system

Step 4: Automate where possible

Step 5: Educate and train employees

Step 6: Enforce policies consistently

Step 7: Review and analyze data