Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Eliminate the mind-numbing effort involved in managing company expenses. Give employees an expense tracking platform that works from everyday apps like Text Messages, Gmail, Outlook, and Slack, so they can submit expenses in a single click.

1775+ reviews

1775+ reviews

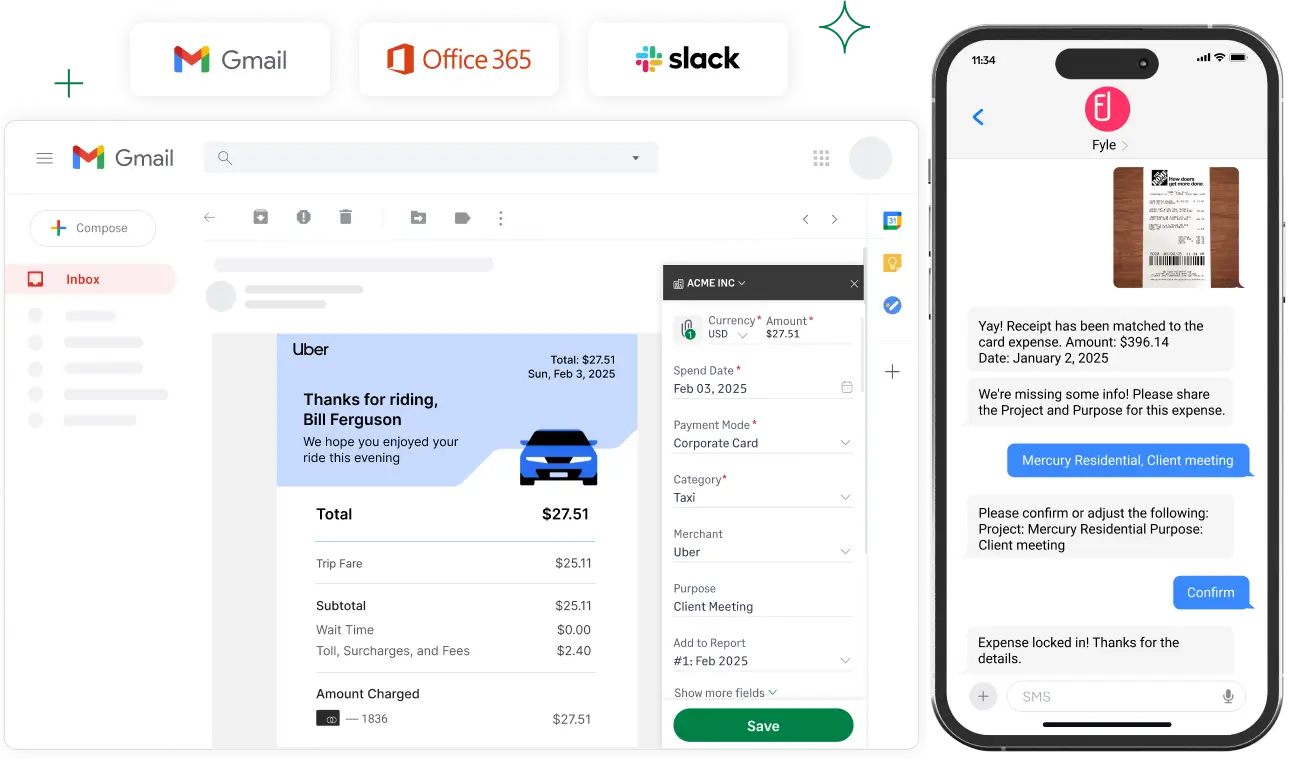

Users can submit receipts through text, Gmail, Outlook, Slack, email forwarding, or directly on Sage Expense Management’s mobile or web app. All expense data is automatically extracted, coded, and tracked in one place.

After making a purchase, users can snap a photo of the receipt, and text it to us. Our OCR will automatically extract and fill in data like date, amount, merchant, and category - no manual entry needed.

Track e-receipts right from your inbox with Sage Expense Management's Gmail and Outlook plugin. You can also forward receipts by email, upload them on Slack, or use our mobile and web app.

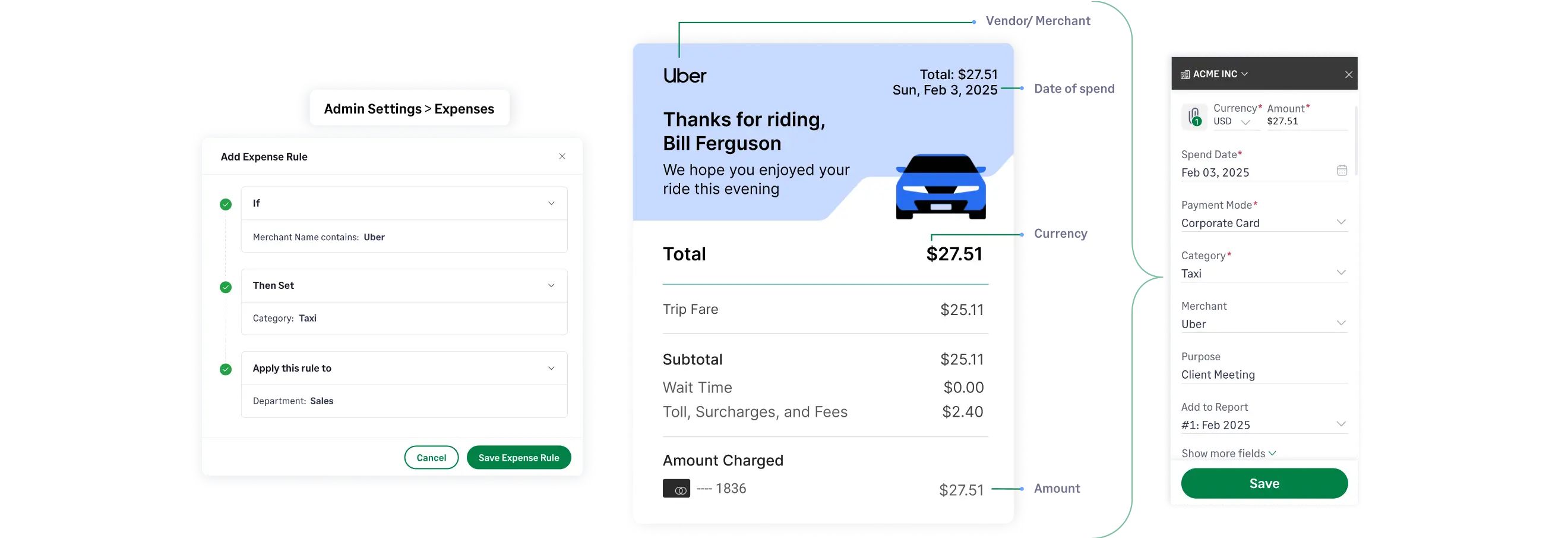

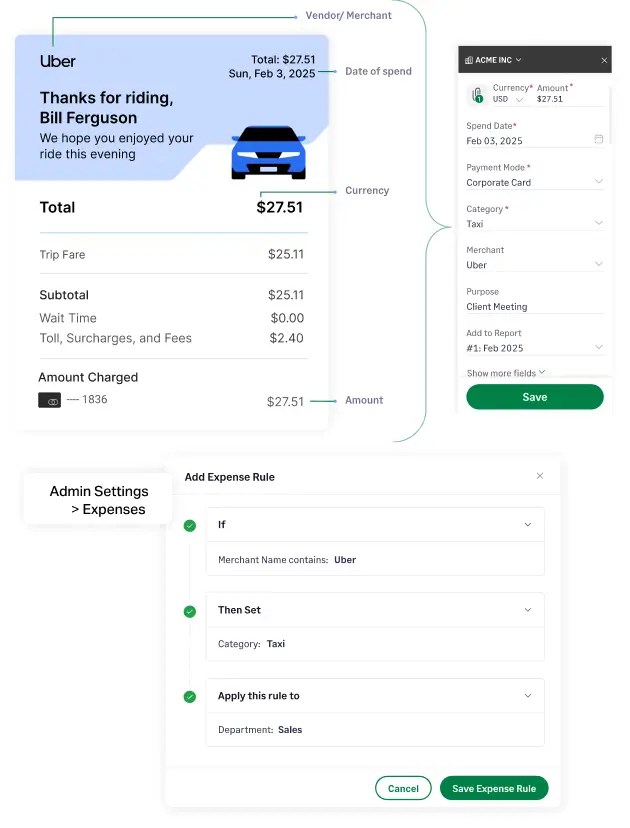

Ensure you capture all important expense data. Sage Expense Management automatically imports data from your accounting software and codes expenses according to your General Ledger.

Default fields like Category, Amount, Merchant, Date etc, are auto-populated with OCR. Users can also add data like Projects (Cost Codes, Cost Types), Cost Centers, Locations and more.

Set different rules on how expense fields like Categories and Projects should be populated based on the auto-extracted Merchant name. For example, if Merchant is Uber, the Category must be Taxi. Eliminate the need to enter data every time.

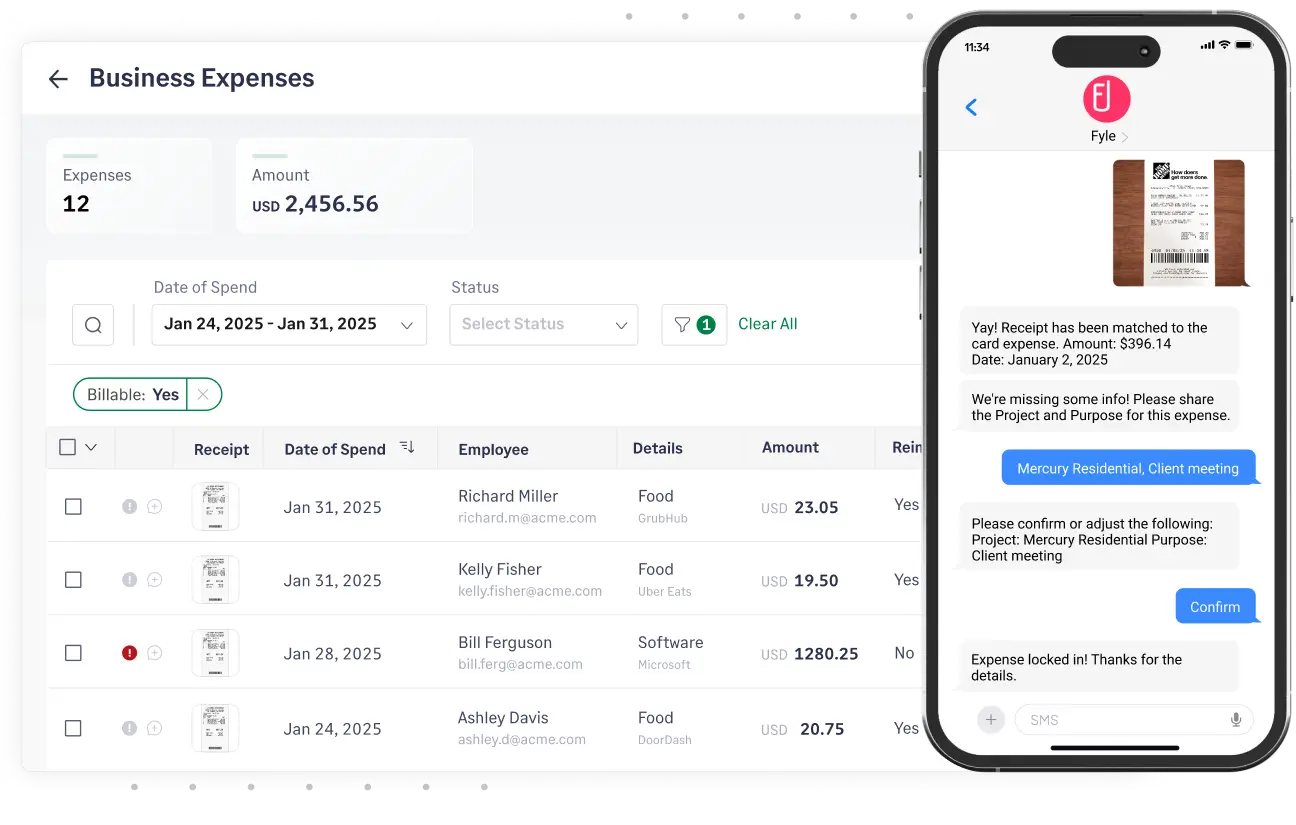

Users get instant notifications for every business card transaction and can simply text a photo of the receipt. Sage Expense Management automatically extracts the data and matches it to the right transaction, saving you hours of manual reconciliation.

Learn more about credit card reconciliation

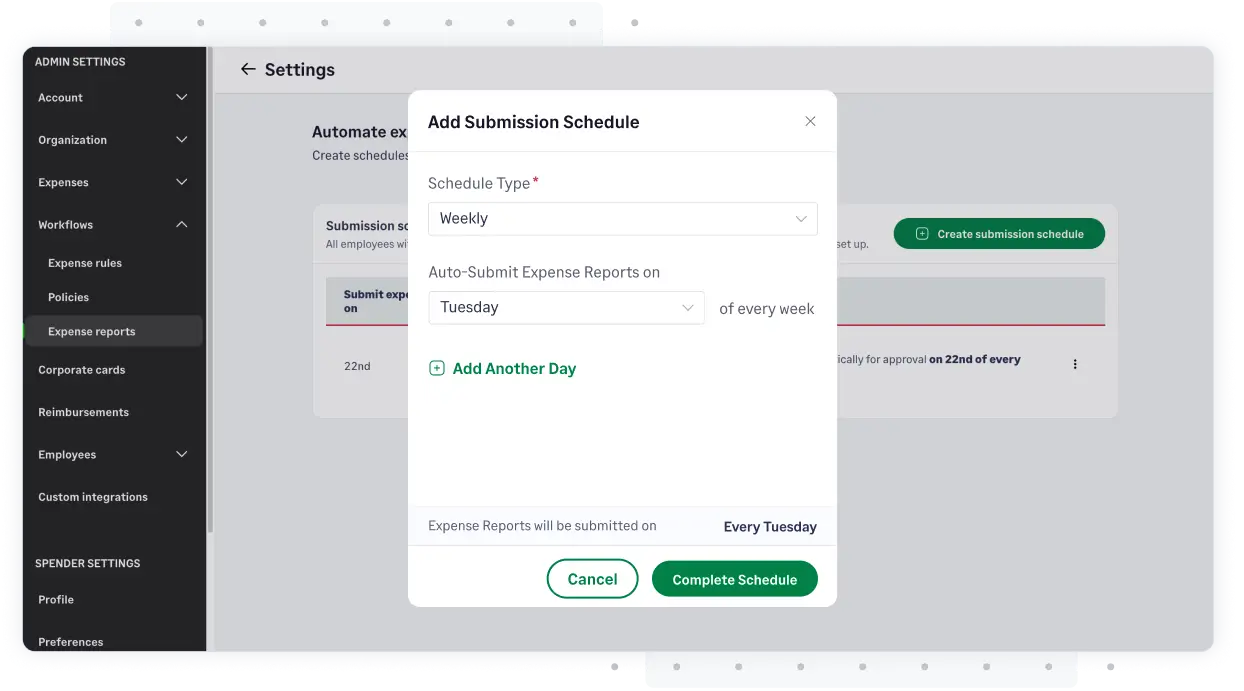

When employees add expenses in Sage Expense Management, reports are automatically created and submitted for approval according to your chosen schedule. No more chasing employees for submissions.

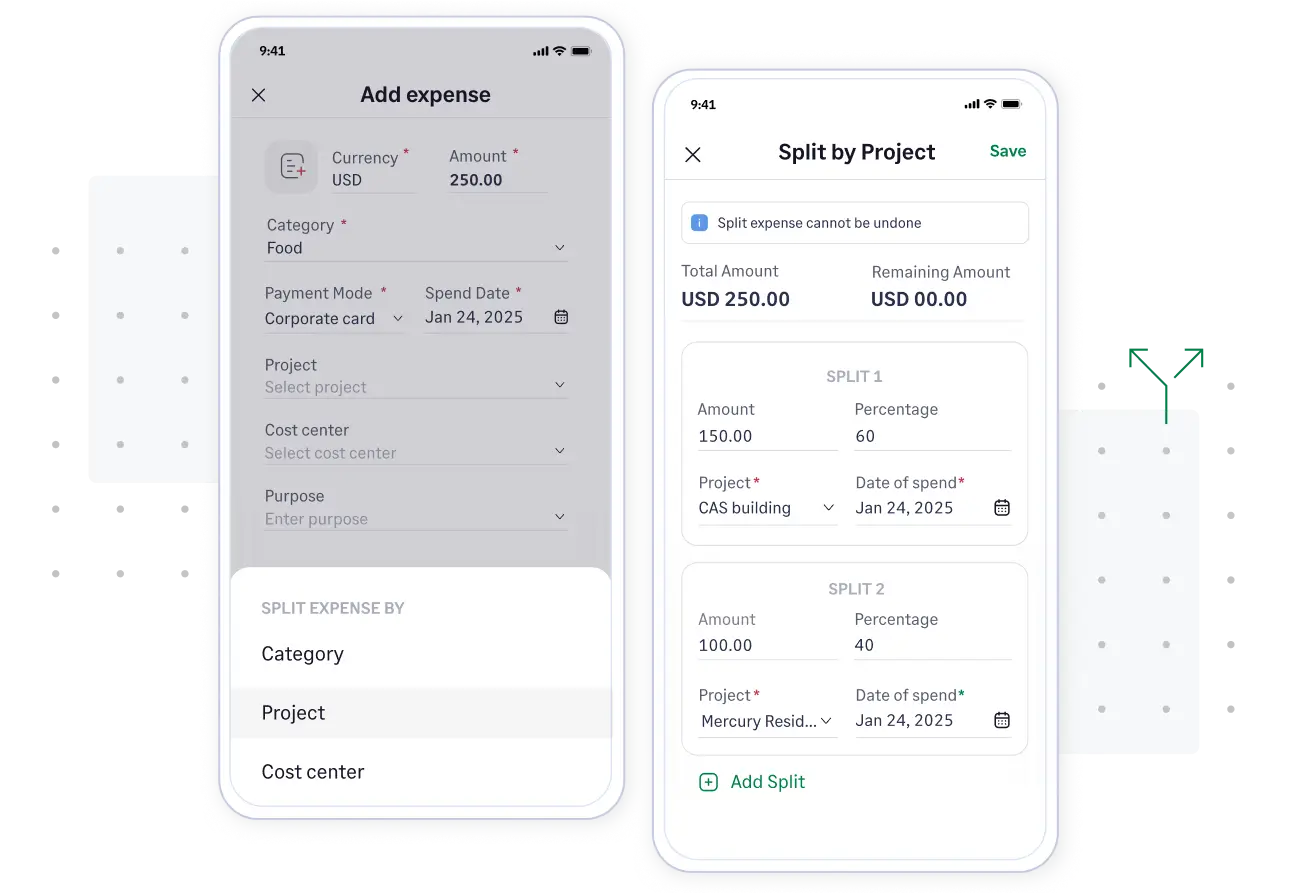

Enable employees to split expenses between multiple Expense Categories, Projects, or Cost Centers with ease.

Easily automate and manage out-of-pocket expenses like mileage and per diems. Ensure employees are paid on time via ACH (US only).

Sage Expense Management’s mileage tracker, powered by Google Maps, only needs the start and end location. Employees can add stops, duplicate trips, or set up recurring mileage expenses. Admins can easily configure mileage rates in line with IRS guidelines.

Configure advanced Per Diem rates for different currencies based on employee levels, departments and locations. Users can just select the right rates to create expenses.

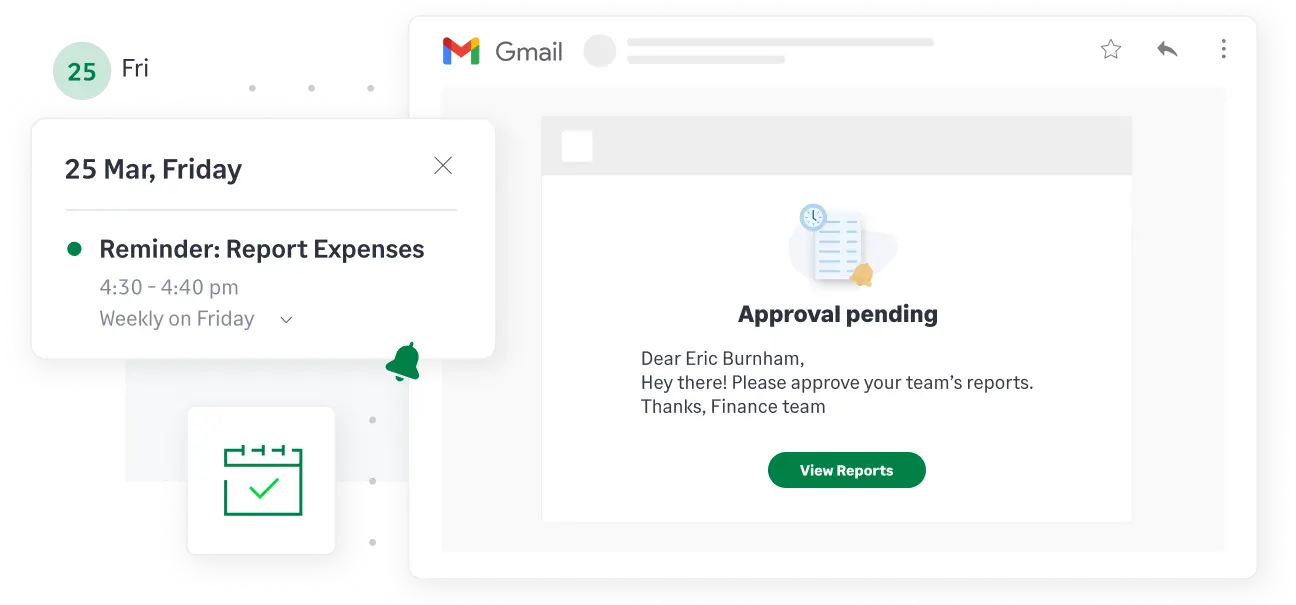

Schedule weekly, monthly, or custom automated email reminders for employees to submit their expenses on time.

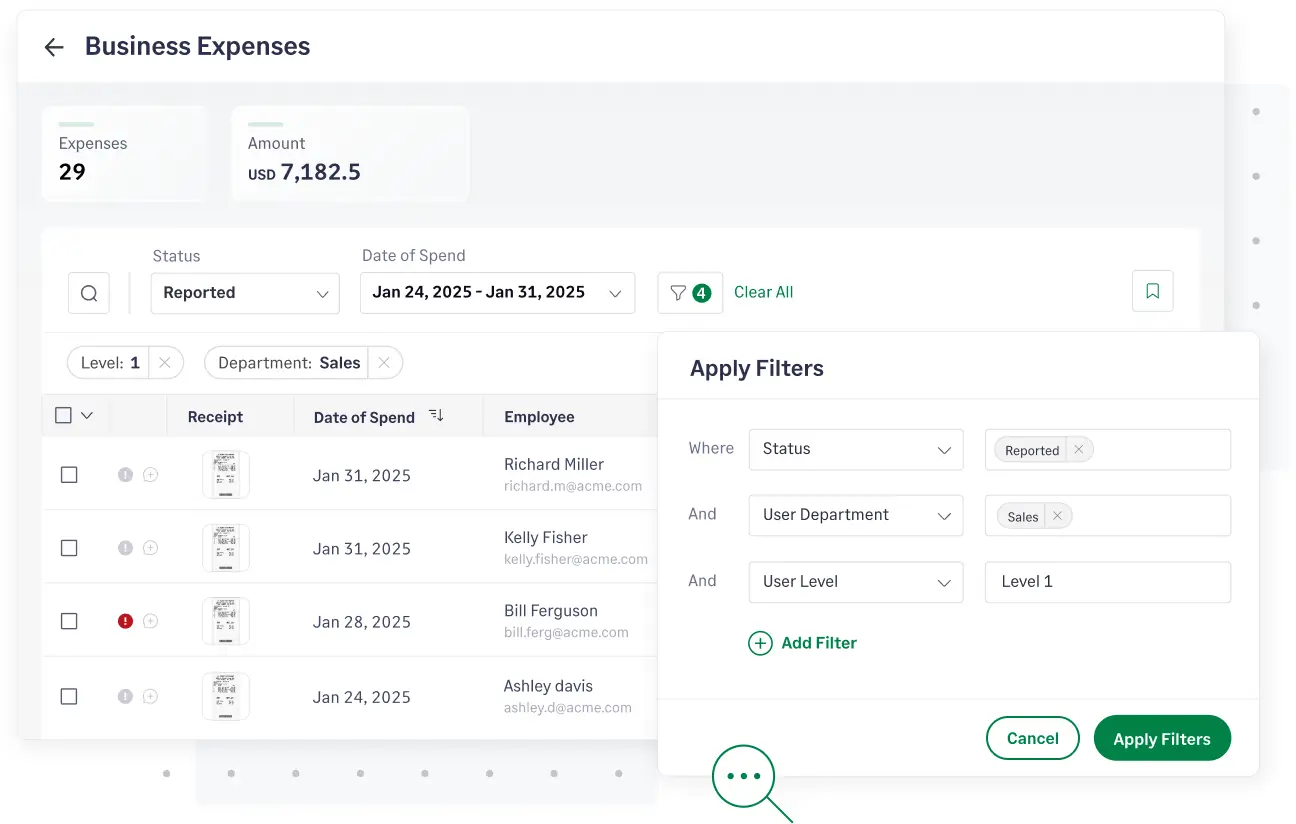

All receipts and expenses are centralized and securely stored with Sage Expense Management. Access any expense based on employee parameters like amount, date of spend, department, and more.

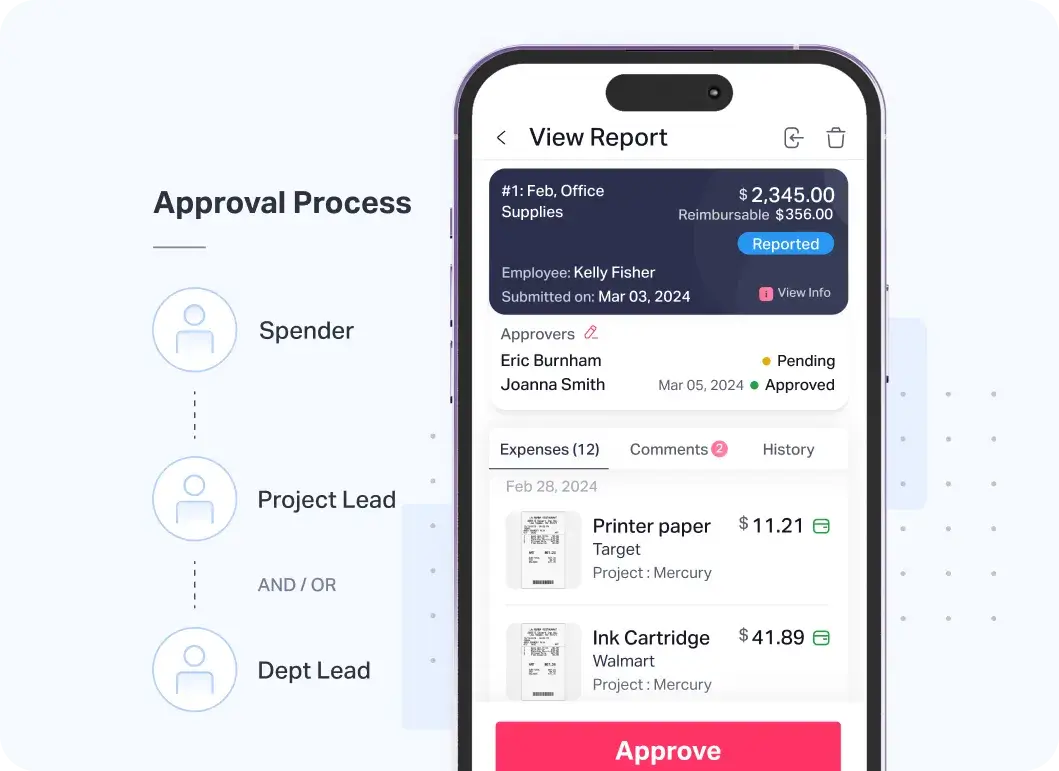

Configure automated approval workflows and enable managers to approve expenses right from their Emails, Slack or our Mobile App.

Learn more

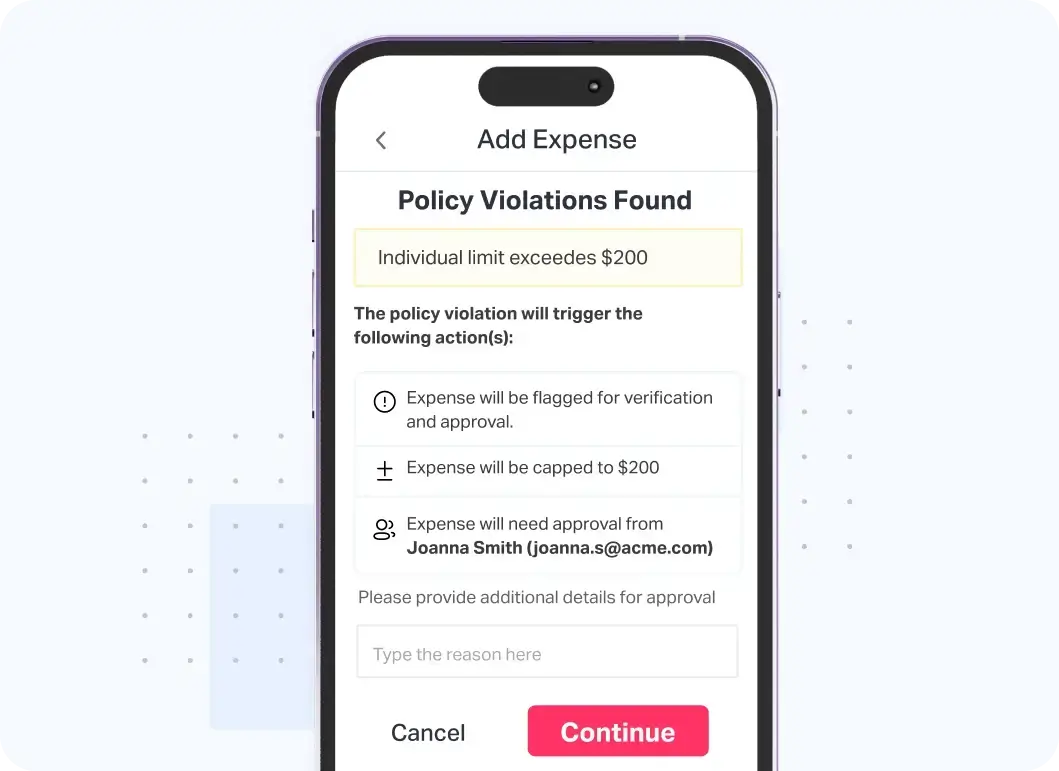

Our platform automatically checks if every expense complies with your business rules before it’s submitted for approval. Detect duplicate or out-of-policy expenses instantly.

Learn more

We sync your fully-coded expense and receipt data to accounting software like QuickBooks Online, Sage Intacct, Xero, Sage 300 CRE and NetSuite automatically.

Learn moreTracking expenses is vital for managing budgets, controlling costs, and improving profitability. It ensures you can claim all eligible tax deductions and provides a clear audit trail, which is crucial for compliance with financial regulations. Accurate records make you audit-ready, facilitate strategic decisions, help secure investments, and ensure long-term financial stability.

The easiest way to track expenses is by using an expense tracking software like Sage Expense Management to automate the process. While manual methods like collecting receipts and logging them in spreadsheets exist, they are time-consuming and prone to errors.

An automated solution eliminates manual work by allowing you to instantly capture receipts, automatically categorize spending, and get an accurate, real-time view of your expenses with minimal effort.

You should track any cost incurred for running your business. This includes major categories like office expenses (rent, utilities), salaries, professional services, software subscriptions, and marketing costs. Also track all travel, meal, and vehicle expenses to ensure accurate financial reporting and maximize your available tax deductions.

A tax-deductible business expense is any cost that is both "ordinary and necessary" for your business, such as office rent, employee salaries, supplies, and travel. Tracking these deductions directly lowers your taxable income.

Disclaimer: Always consult a tax professional to understand all deductions applicable to your specific business.

An expense tracker simplifies tax season by automating data collection all year. It creates a centralized, audit-ready record of all transactions with receipts attached. With expenses already categorized and checked for errors, you eliminate the last-minute scramble and provide your accountant with accurate, organized data for a much faster tax filing process.

Sage Expense Management automates the entire expense tracking process. Employees can submit expenses via text, Gmail, or Outlook, and Fyle’s AI instantly extracts the data. It also offers a Google Maps integration for mileage tracking and automatic policy checks. This ensures compliance, eliminates manual work, and provides real-time visibility into company spending.