Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Double the spend volume on your business credit cards by giving customers a powerful, real-time expense management platform. No tech integration needed.

See how Fyle helps you get higher revenue from current customers by giving them

the software they need to support their existing credit cards.

Average increase in transaction volume on cards connected to Fyle via real-time feeds

Average increase in number of transactions incurred on cards connected to Fyle via real-time feeds

Average increase in transaction volume on cards connected to Fyle via real-time feeds

Average increase in number of transactions incurred on cards connected to Fyle via real-time feeds

You needn't worry about training your customers to implement Fyle. We'll manage onboarding, implementation, training, and support on your behalf.

Our implementation team helps onboard customers quickly, based on their requirements. Fyle requires no learning curve, and is easy-to-use for both employees and finance teams.

Fyle will manage ongoing support for you and your customers. Our support team is available 24x7 on chat and call. We guarantee an industry-best first response time of under 30 minutes.

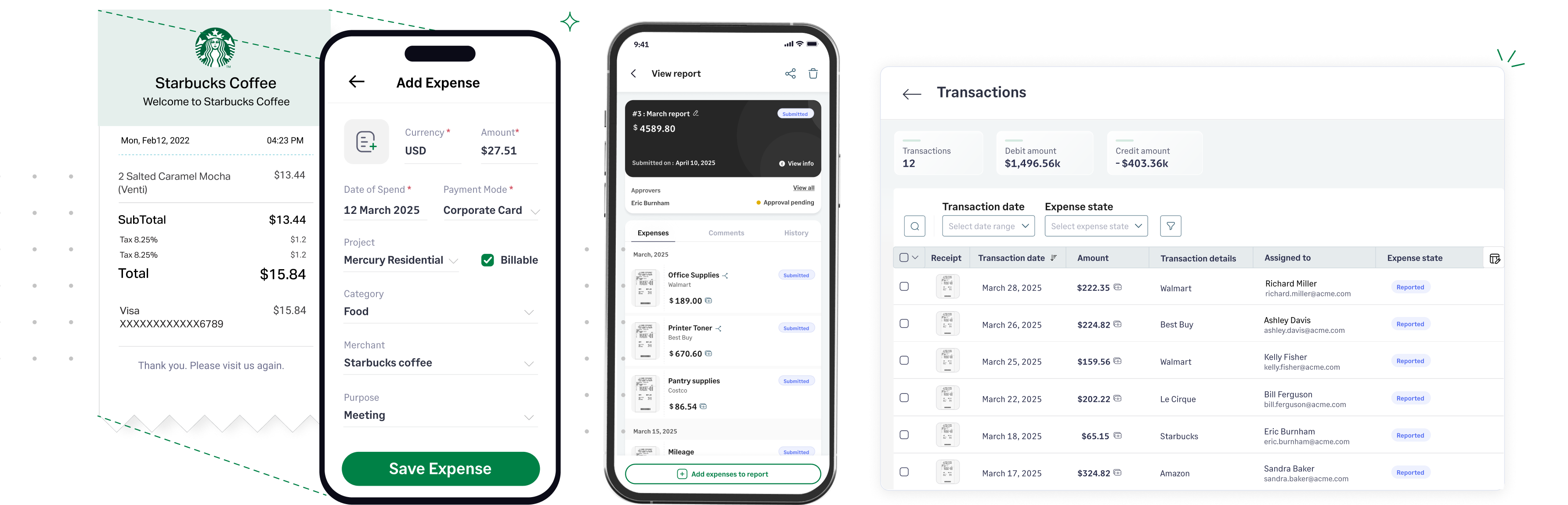

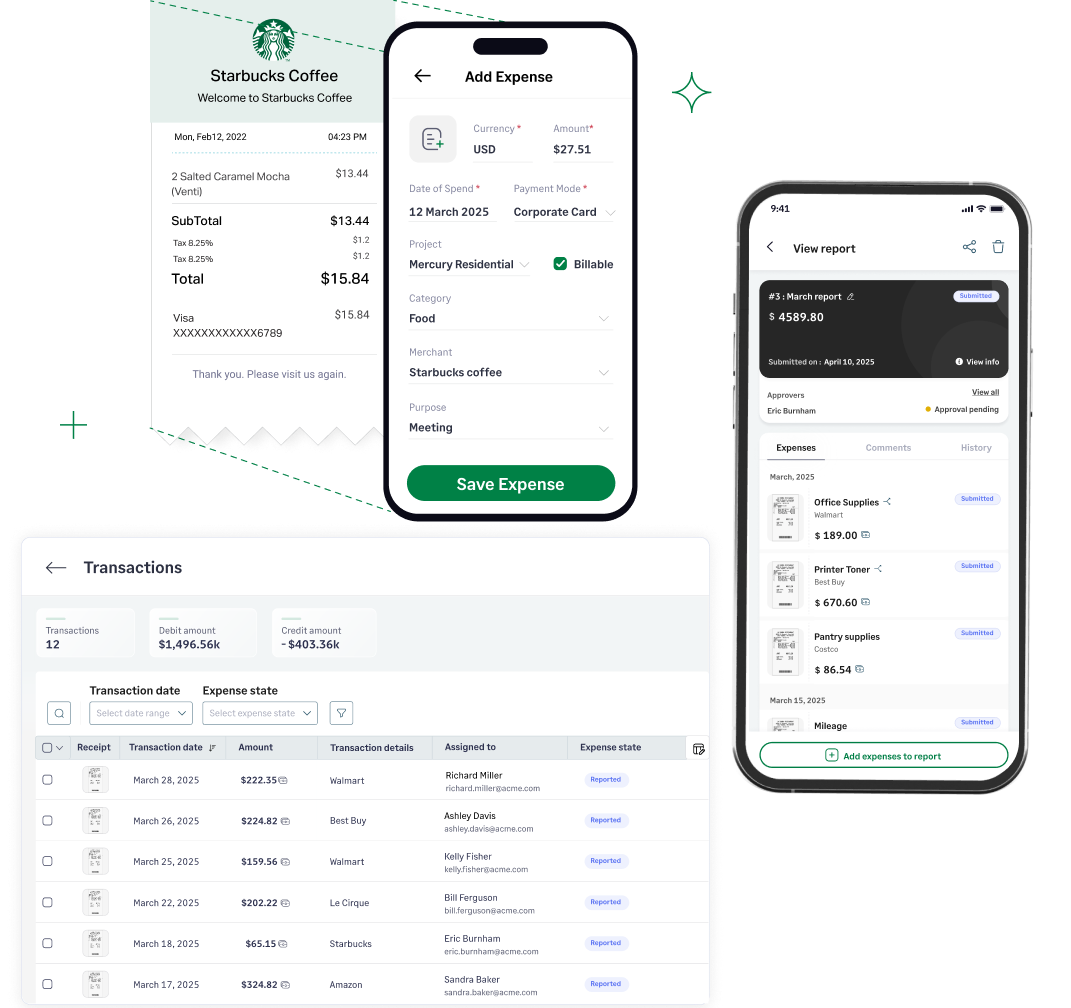

Fyle helps issuing banks offer their customers a way to eliminate the manual effort involved in expense management, and make their bookkeeping easier.

Accountants can see card transaction data in real-time, as soon as cardholders swipe your credit cards.

Set up automated approval flows and business rules that get enforced in real-time, ensuring compliance.

Fyle has direct, bi-directional integrations with accounting software like NetSuite, QuickBooks Online, Sage Intacct and Xero.

Users are instantly notified of credit card spend, and accountants can collect receipts via SMS, Slack Gmail, Outlook, our mobile app, and more.

Fyle automatically extracts, categorizes and codes expense data from receipts according to the user's accounting practices.

Accountants can break down their expenses to find out where budget is consumed, and take steps to make operational cash flow more efficient.