This article aims to clarify the IRS guidelines for adding receipts to your business expenses and if you need to generate e-receipts from your expense management platform.

What is a receipt?

For a business transaction to be considered valid, the Internal Revenue Service (IRS) requires organizations to retain the following

- cash register tapes

- deposit information (cash and credit sales)

- receipt books

- Invoices

- Forms 1099-MISC

A receipt can be defined as a written acknowledgment that something of value has been transferred from one party to another. Typically, vendors and suppliers will provide either a written or digital proof of transaction to an individual as either a receipt or an invoice.

IRS guidelines for submitting receipts

When it comes to T&E, the IRS mandates that you document the following:

- The date the expense was incurred

- The amount spent

- The place/vendor details

- The business purpose of the expense

Most of this information is readily available in most receipts. The IRS states that if the receipt contains this basic information, there is no need to provide further proof.

There are, however, some exceptions to the above rule. To make things simpler for businesses and help them deal with fewer expense receipts, the IRS allows for a few relaxations. No receipts are required for

- transactions less than $75

- transportation expenses where you can't get a receipt (an auto ride in Mumbai, maybe)

- Meals and lodging expenses that are at least 100 miles from home

But, these exceptions don’t apply to lodging and travel expenses more than 100 miles, even if the expense is less than $75. For any sort of business spend on lodging, employees have to provide a proof of transaction.

The transition to digital receipts

The IRS has been accepting digital receipts since 1997. And now, most vendors send emails with the transaction receipt and invoice to your registered email or mobile number. Invoices are also usually available on the vendor's website.

Expense management software, like Sage Expense Management (formerly Fyle), allows you to upload these receipts right from your email, cloud storage, or phone gallery. What's more, it also automatically extracts data from digital receipts to make submitting expenses easier.

Expensify's e-receipt generator

Now, any expense management system worth your money should enable you to submit and manage digital receipts. But, this applies to proof of spending directly issued by the vendor. We've already established the rules under which a receipt is necessary.

But, what about software like Expensify that provides an option to generate your e-receipts. Is this necessary?

Here's how their e-receipt generation works. Firstly, this feature is only available for

- personal credit card users

- company card users

- Expensify card users

They claim that their e-receipts are full digital replacements for paper receipts. So instead of scanning paper receipts for corresponding card transactions, the tool automatically generates an e-receipt.

If you submit reimbursable expenses only and do not use any kind of credit cards, the e-receipt generator is not available for you. You still would need to manually attach your receipts for all your expenses.

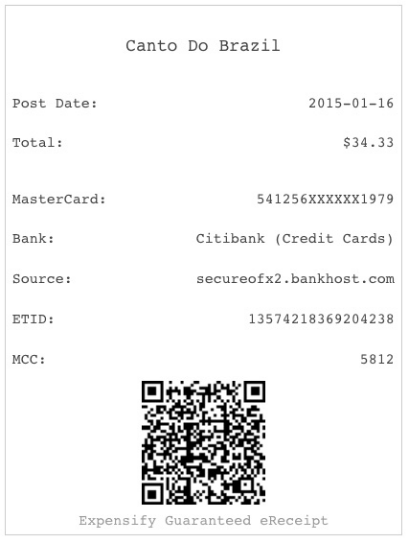

A sample of their e-receipt:

Here are some limitations of this mechanism in their own words (taken from https://community.expensify.com/discussion/5542/deep-dive-what-are-ereceipts on 16 June, 2021):

- e-receipts only for transactions in USD

- Can only be imported directly from the bank account and not from CSV/OFX files of bank transactions

- No e-receipts for lodgings

- Chances of misidentifying merchants and generating invalid e-receipts.

Do you really need an e-receipt generator?

The answer is a resounding no. Here is why

- The IRS does not need receipts below $75. Why generate an e-receipt for the same?

- The IRS mandates actual electronic or paper receipts for spend above $75. In this case, “e-receipts” generated by Expensify are not legally valid.

Expensify also captures the date of spend, the amount spent, and card details in their e-receipts. We already know that it needs a date, amount, vendor, and business purpose for a receipt to be valid.

The downside of the Expensify e-receipt generator

When Expensify launched the feature, they only generated e-receipts for transactions below $75. But, now they do so for expenses greater than $75. The reasoning is that “they want Expensify Card expenses to flow in an automated fashion to keep their holistic expense report process as second nature as possible.”

What they mean by second-nature is however ambiguous. They auto generate e-receipts for every card expense and the IRS does not accept receipts that the actual vendor does not provide for expenses greater than $75. Which means, the user at some point has to manually upload the actual receipts.

Most Expensify users like the e-receipt generator for more minor expenses because they do not need to attach them manually. Since this is promoted as a way to make expense reporting seamless, they should allow users to set limits for when an e-receipt should be auto-generated.

However, currently Expensify users cannot set an amount limit for the generation of e-receipts. Either you enable e-receipts, manually remove them, attach actual receipts for over $75 expenses, or disable the feature altogether.

What is the alternative, then?

To reiterate, you are not legally obligated to submit receipts for expenses under $75, and you need to submit actual proof of transactions for expenses over $75. Simply put, your chosen expense management platform does not need to generate e-receipts.

What you should look for instead is a tool that gives you complete control over your expense management process, while not compromising on the user experience. Sage Expense Management allows you to set limits, so that users need not submit any kind of receipts for expenses under $75.

And for expenses requiring an actual receipt, with our platform, you can attach, scan, or upload both paper and digital receipts in a single click. With the mobile app, users can quickly scan paper receipts individually or in bulk. Fyle's intelligent OCR technology automatically scans and creates an expense. All of this in a few seconds!

If you are on the lookout for a solution that automates and simplifies your expense management process, then do not look for minor enhancements like an e-receipt generator. What you need is a tool like Sage Expense Management that is built for future-facing organizations that delivers on the promise of making your expense management process faster, more automated and much less complicated.