Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Monitor corporate card expenses effortlessly. Link your existing business cards to Fyle for instant spend notifications via text, automated reconciliations, and streamlined expense tracking. All without needing to switch cards.

1775+ reviews

1775+ reviews

Get instant text notifications the moment an employee uses their business card. Fyle keeps you informed about every transaction, ensuring you always have maximum visibility into your spending.

Receive real-time alerts for specific spending categories. Fyle helps you stay within your set budgets, preventing overspending and maintaining tight control over your finances.

Don't wait for statements. Fyle alerts you immediately about any unauthorized or dubious spend, enabling you to take timely action against potential fraud.

You no longer need to switch card providers to bypass delayed bank feeds or tiresome manual reconciliations.

With Fyle, you can seamlessly integrate any business credit card from any bank, getting the best software experience without disrupting your cash management or losing valuable rewards.

Monitor corporate card expenses effortlessly. Link your business credit card to Fyle in minutes to receive immediate spend notifications via text, enhancing fraud detection and simplifying expense tracking.

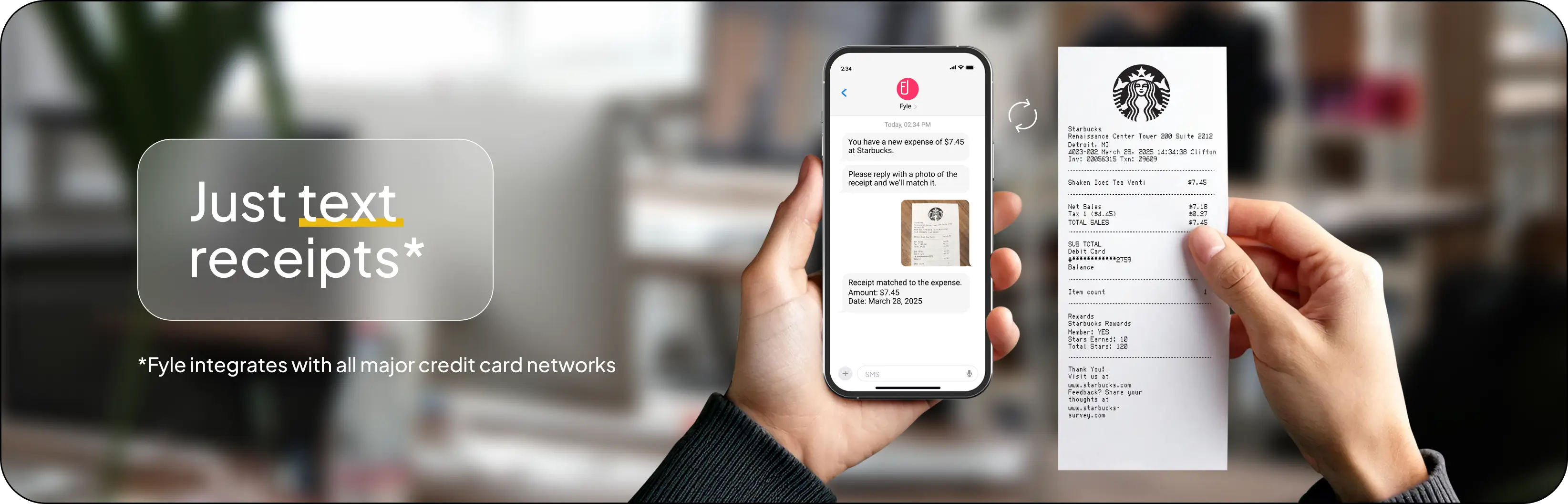

Fyle notifies employees via text when a card spend is made. Reply with a receipt photo, and Fyle will auto-match it to the right transaction. No more manual effort or delayed month-end close.

Learn more about receipt tracking via text

Your employees can track expenses from everyday apps like Gmail, Outlook, our mobile app, email, or text messages. Fyle's AI automatically extracts and codes receipt data, categorizing them precisely based on merchant.

Learn more about easy expense trackingCreate and track granular budgets for projects, categories, and departments. Fyle notifies you when thresholds are crossed, providing instant insights into where your money is spent.

Learn more about smart budgets

Set up custom expense policies, spend limits, and multi-level approvals. Enforce them in real-time, ensuring compliance and maintaining complete control over business card spending.

Learn more about compliance and control

Analyze your business credit card spend with Fyle Copilot to identify exactly how your budget is being used. Break down spending by category, merchant, project, or department to improve operational cash flow and make smarter decisions.

Learn more about Fyle CoPilot

Real-time credit card transaction alerts are instant notifications sent to you or your employees the moment a purchase is made on a business credit card. Unlike traditional bank statements or delayed feeds, these alerts provide immediate visibility into spending activity, allowing for quick action on receipt capture, fraud detection, and budget monitoring.

Fyle provides real-time credit card purchase alerts through direct partnerships with major card networks like Visa and Mastercard. When an employee swipes a corporate card, Fyle receives instant transaction data directly from the card network, bypassing traditional bank delays. This allows Fyle to immediately send a text notification to the employee's phone, prompting them to submit their receipt for that specific transaction.

Fyle streamlines business credit card management by offering real-time transaction alerts, automated receipt capture via text or other apps, and AI-powered expense coding. It connects directly with your existing business credit cards, eliminating the need to switch providers.

Fyle also automates reconciliation, enforces spending policies in real-time, provides granular budget tracking, and integrates seamlessly with your accounting software. This comprehensive approach helps you maintain control, prevent fraud, and accelerate your financial close.

Business credit cards offer revolving credit lines and typically allow balances to be carried over, providing crucial cash flow flexibility that many SMBs rely on. They also often come with robust rewards programs and benefits through established bank partnerships, which businesses strategically leverage for cost savings.

In contrast, corporate charge cards (often marketed by fintech solutions as "credit cards") usually require businesses to maintain significant cash balances as collateral (e.g., $75,000 to $250,000). They act more like a debit or pre-paid card, requiring payment in full each month and lacking the flexibility of revolving credit.

Their credit limits can fluctuate with your cash balance, potentially leading to unexpected transaction declines, and they might offer fewer rewards compared to traditional bank-issued credit cards. Sticking with your existing business credit cards allows you to retain valuable benefits and financial flexibility without disrupting your banking relationships.