4.6/51670+ reviews

4.6/51670+ reviewsFor any small business or enterprise, bank fees are an unavoidable cost of doing business. From monthly maintenance charges to fees for wire transfers, these small costs can add up significantly over the course of a tax year. Correctly identifying, categorizing, and deducting these expenses is crucial for maintaining accurate financial records and maximizing tax savings.

This guide explains which bank fees are considered deductible business expenses by the IRS, the records you need to keep, and how you can utilize automation to streamline the manual work of tracking these costs.

According to the IRS, fees that are ordinary and necessary for the operation of your business are deductible. Bank fees charged on your business accounts fit this description. These expenses are typically reported on Schedule C (Form 1040) under Part II, Line 27a for "Other expenses."

Accountants often create a specific account in the company's chart of accounts, such as "Bank Service Charges" or "Bank Fees," to accurately track these costs.

While most business bank fees are straightforward deductions, there are a few important distinctions for accountants and business owners to keep in mind.

The most critical rule is that only fees associated with your business accounts are deductible. The IRS is clear that you cannot deduct personal, living, or family expenses. This is why maintaining a separate business checking account is a fundamental practice in maintaining accurate records. It provides a clear separation between business and personal finances, simplifying the substantiation of deductions.

Bank service fees should be categorized separately from interest expenses. Interest paid on a business loan is deducted under "Interest", not as a general bank fee. Keeping these categories distinct is crucial for accurate tax reporting and compliance.

Fees paid to obtain a business mortgage or loan are treated differently. According to IRS Publication 946, charges like mortgage commissions, abstract fees, and recording fees are not deductible as current expenses. Instead, these costs must be capitalized, added to the property's basis, and amortized over the life of the loan.

Fees associated with business credit cards, such as annual membership fees, are generally deductible. Furthermore, the convenience fees that credit card companies charge your business to accept customer payments (merchant fees) are also a deductible business expense.

The following are common examples of bank fees that can be deducted as ordinary and necessary business expenses:

To deduct bank fees, you must be able to substantiate the expenses with adequate records if your return is ever examined.

As a sole proprietor, you deduct bank service charges and other miscellaneous bank fees on Schedule C (Form 1040) as an "Other Expense." It is best practice to list "Bank Fees" as a separate line item.

Your recordkeeping system must clearly show your income and expenses. The primary supporting documents for bank fees are your monthly bank and credit card statements. These documents are crucial because they support the entries in your books and on your tax return.

Your records should be kept in an orderly manner and stored in a secure location. They must contain sufficient information to prove the following:

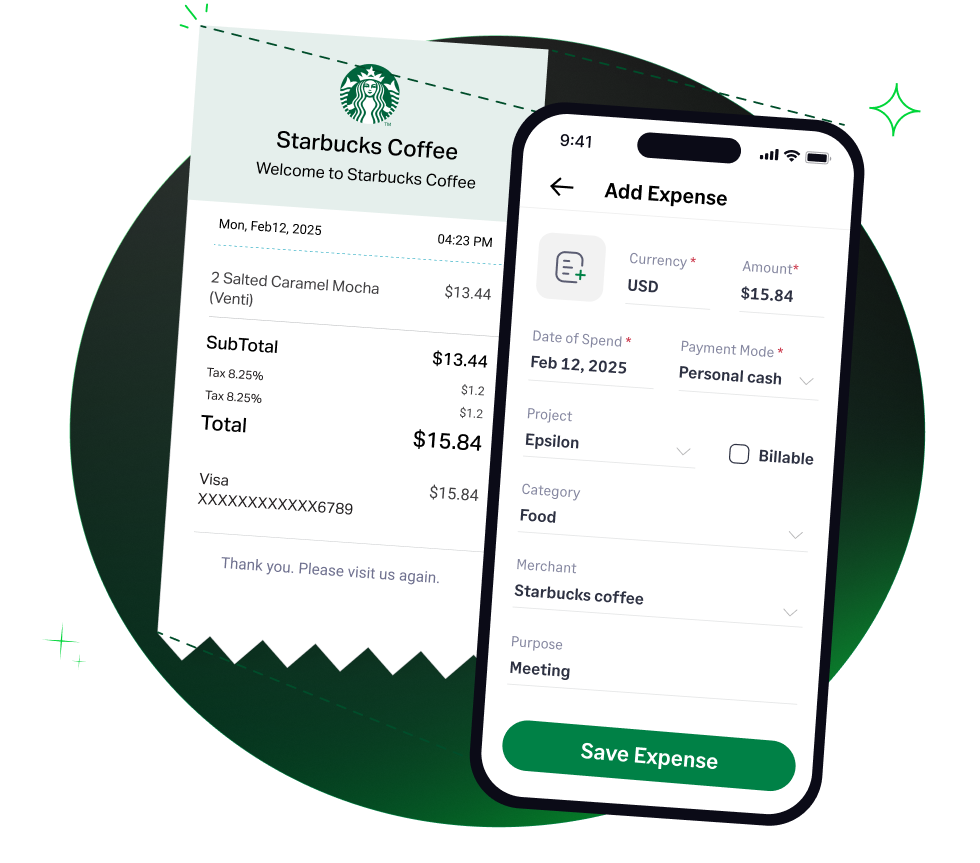

Manually reviewing bank statements to find and categorize every small fee is time-consuming and prone to error. our expense management platform helps businesses automate the tracking of all business expenses, including bank fees, ensuring nothing is missed.

By connecting directly with your existing business credit cards from networks like Visa and Mastercard, you can capture transaction data, such as annual fees, in real-time.

For recurring charges like monthly service fees, you can set up rules to automatically categorize them to the correct "Bank Fees" account in your general ledger. This automation eliminates the need for manual line-by-line review, ensuring that no deductible fee is missed.

Beyond categorization, Sage Expense Management serves as a central repository for all related documentation, allowing you to attach service agreements or other communications to expenses for a complete audit trail.

The most significant time-saver is our direct, two-way integration with major accounting software, including NetSuite, Sage Intacct, QuickBooks, and Xero. This seamless sync ensures that all categorized bank fees and credit card charges are automatically posted to your general ledger, saving hours of manual data entry and maintaining accurate and compliant books year-round.