4.6/51670+ reviews

4.6/51670+ reviewsFor businesses in the publishing industry, growing and maintaining a reader base is the key to success. The costs associated with this effort—from marketing campaigns to subscriber management—are collectively referred to as circulation costs. While these expenses are fundamental to the business model, they have unique tax implications that distinguish them from other operating expenses.

The IRS offers publishers of newspapers, magazines, and other periodicals special options for treating these costs. This guide explains what qualifies as a circulation cost, the different tax treatments available, and how your business can effectively track these expenditures to maximize compliance and tax benefits.

As defined in IRS Publication 535, circulation costs are the expenses paid or incurred to establish, maintain, or increase the circulation of a newspaper, magazine, or other periodical.

Even though these costs might otherwise be considered capital expenditures because they build a long-term asset (your subscriber base), a special IRS rule allows publishers to deduct them as a current business expense.

It is crucial for accountants and business owners to distinguish between deductible business expenses and other costs that must be capitalized.

According to IRS Publication 535, the special deduction for circulation costs does not apply to the following types of expenditures, which must be capitalized:

Circulation costs are specifically related to building your audience. Other general business expenses, such as office rent or utilities, should be deducted under their own respective categories. The key is that circulation expenses are directly tied to the effort of getting and keeping subscribers and readers.

IRS Publication 535 provides clear examples of what constitutes a circulation cost. A primary example is the expense of hiring extra employees for a limited time, specifically to solicit new subscriptions through telephone calls or other direct marketing efforts.

Other common examples include:

One of the most unique aspects of circulation costs is the flexibility the IRS provides for its tax treatment. Publishers are not locked into one method.

As outlined in IRS Publication 535, a publisher can choose one of three ways to handle their circulation costs:

If you do not want to deduct circulation costs as a current expense and choose to capitalize them instead, you must attach a statement to your tax return for the first year the election applies.

According to the IRS, this election is binding for that year and all future years unless you receive IRS approval to revoke it. This same process applies if you elect the 3-year amortization option. The election is made on Form 4562, Depreciation and Amortization.

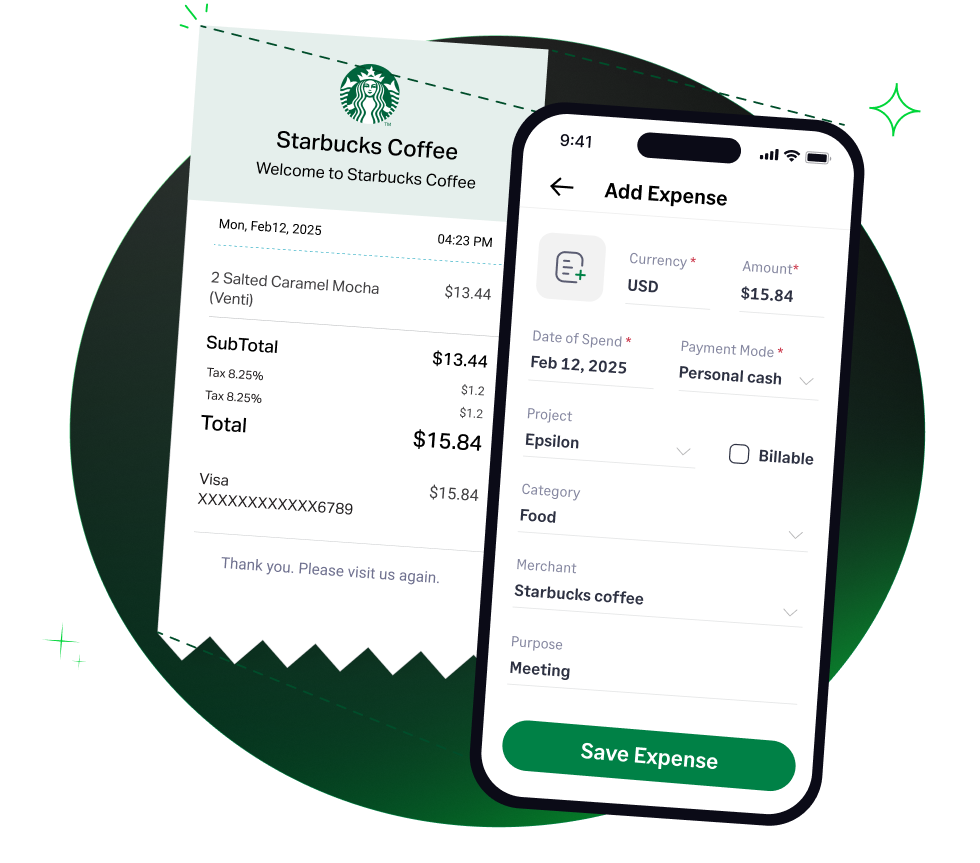

Managing the various costs of a subscription campaign—from marketing agency invoices to freelancer payments—can be complex. Sage Expense Management helps you capture and organize every expenditure, providing a clear financial picture and simplifying tax-time decisions.

Track expenses by "Project," so you can create a project for each subscription drive or marketing campaign. Every related cost, from digital ad spend on a corporate card to an invoice from a print-and-mail house, can be coded to a specific project, providing precise visibility into the ROI of your circulation efforts.

All supporting documents can be centralized within Sage Expense Management. A marketing agency can email an invoice directly, where it is automatically captured and attached to an expense record. This ensures you have the necessary "documentary evidence" required by the IRS for every cost incurred.

Our integration with accounting software, such as QuickBooks, Sage Intacct, NetSuite, and Xero, provides accountants with clean, categorized data, making it easy for them to apply the chosen tax treatment—whether deducting currently, capitalizing, or setting up a 3-year amortization schedule—all without manual data entry.