Taking out a loan is a common and often essential step for starting or growing a small business. Whether it's for purchasing equipment, securing a property, or managing cash flow, loans provide vital capital. However, a frequent and critical point of confusion for new business owners is how to treat these loans in their books.

A common mistake is to classify a loan or its repayments as a business expense. For tax purposes, the loan principal is never a deductible expense. The actual deductible expense is the interest you pay on the loan. This guide will clarify this crucial distinction and explain how to correctly handle loan-related expenses on your Schedule C.

The Expense of a Loan: Interest vs. Principal

When classifying costs related to a business loan, it is vital to separate the loan principal from the interest paid.

- Loan Principal: The money you borrow is a liability, not income. Consequently, the repayment of that principal is not a business expense; it is simply returning the money you borrowed. You cannot deduct loan principal repayments on your Schedule C.

- Interest Expense: The interest charged on the borrowed money is the cost of using that capital. If the loan is for a business purpose, this interest is a deductible business expense. The proper expense category for this is "Interest Expense."

Key IRS Rules for Deducting Loan Interest

To deduct interest on a loan, the loan must be a valid debt for which you are legally liable, and the proceeds must be used for your trade or business.

The Business Purpose Test

The primary rule for deducting interest on Schedule C is that the loan must be for your business. Interest paid on a loan used to fund personal activities, such as a family vacation or personal vehicle, is considered personal interest and is not deductible as a business expense.

Allocating Interest for Mixed-Use Loans

If you take out a loan and use the proceeds for both business and personal reasons, you must divide the interest expense accordingly. Only the portion of the interest that applies to the business use of the funds is deductible on Schedule C.

For example, if you get a loan to buy a vehicle and use it 70% for business and 30% for personal commuting, you can only deduct 70% of the interest paid on that loan as a business expense.

What Qualifies as Interest Expense?

Deductible interest expense includes the stated interest on loans and lines of credit. It can also include other specific costs, such as:

- Prepayment Penalties: If you pay off a business mortgage early and incur a penalty, that penalty is deductible as interest.

- Loan Origination Fees: Fees paid to obtain a loan, such as commissions or abstract fees, are generally not immediately deductible as interest. Instead, these costs are capitalized and amortized (deducted in equal parts) over the life of the loan.

Examples of Deductible Loan Interest on Schedule C

- Interest on a bank loan to purchase business machinery or equipment.

- Interest on a business line of credit used to manage cash flow and purchase inventory.

- The business-use portion of interest paid on a vehicle loan.

- Mortgage interest paid on a building or property used for your business.

Tax Implications of Loan Interest Expenses

Deductibility and Reporting

Interest paid on a qualifying business loan is fully deductible, subject to the allocation rules for mixed-use loans. On Schedule C (Form 1040), interest is reported on two separate lines:

- Line 16a, "Mortgage (paid to banks, etc.)": Deduct mortgage interest paid on real property used for your business here.

- Line 16b, "Other": Deduct interest on all other business loans here, such as equipment loans, business credit cards, and lines of credit.

Form 1098

If you paid $600 or more in mortgage interest to a single financial institution during the year, you will typically receive Form 1098, Mortgage Interest Statement, from the lender. This form shows the total amount of interest you paid for the year and serves as critical documentation.

Recordkeeping for Substantiation

To substantiate your interest deductions, you must keep clear records, including:

- Loan agreements and contracts.

- Bank and credit card statements showing interest payments.

- Copies of Form 1098 for mortgage interest.

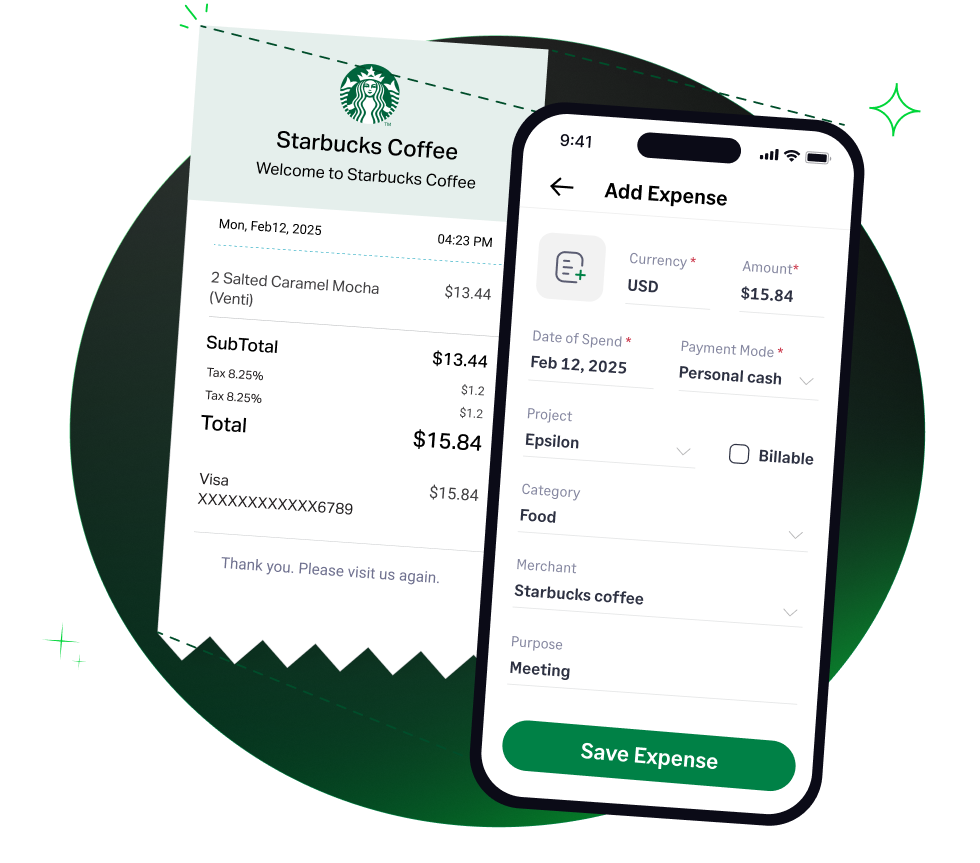

How Sage Expense Management (formerly Fyle) Automates Expense Categorization & More!

While Sage Expense Management is not a loan management platform, it is a powerful tool for maintaining the compliant, audit-ready records required to deduct your business interest expenses.

- Centralized Document Storage: Capture and store all your critical loan-related documents, including loan agreements, payment schedules, and monthly statements from lenders, ensuring they are always accessible.

- Track Credit Card Interest: Our real-time feeds from various major corporate card networks can automatically track and create expense entries for interest charges on business credit card balances, ensuring these costs are never missed.

- Create an Audit-Proof Trail: By linking payment records and statements to each transaction, Sage Expense Management helps you build the robust documentation required by the IRS to substantiate every interest deduction you claim.

- Seamless Accounting Sync: We sync all categorized expenses directly to your accounting software, including QuickBooks, NetSuite, Sage Intacct, and Xero, giving your accountant a clear and accurate record of your deductible interest payments.

Take the guesswork out of your financial records and manage your business with confidence.

4.6/51670+ reviews

4.6/51670+ reviews