4.6/51670+ reviews

4.6/51670+ reviewsFor many businesses, trade shows and conventions are essential for marketing, networking, and generating sales. The costs of participating from renting the booth space to setting it up and traveling to the event, are a significant investment and are generally deductible business expenses.

However, these are not a single, all-in-one expense. The IRS requires you to break down the total cost of a trade show into its individual components, as each part has a specific tax treatment. This guide will clarify how to categorize these costs to ensure compliance and maximize your deductions.

There is no single expense category for all trade show costs. The various expenses must be unbundled and reported according to their nature.

To deduct these expenses correctly, you must separate them into the proper categories, as each is subject to different rules.

IRS Publication 463 confirms that you can deduct travel expenses for attending a convention or trade show if your attendance benefits your business. This includes:

If you give away branded items at your booth, their tax treatment depends on their value, as outlined in IRS Publication 535:

It is essential to note that expenses for entertainment are generally not tax-deductible. If you host a party for clients at the trade show with performers or other activities considered entertainment, those specific costs cannot be deducted as a business expense.

You must report the various costs of your trade show in their proper categories on your tax return.

For a sole proprietor filing a Schedule C (Form 1040):

You must have documentary evidence to substantiate all trade show expenses. Your records should include:

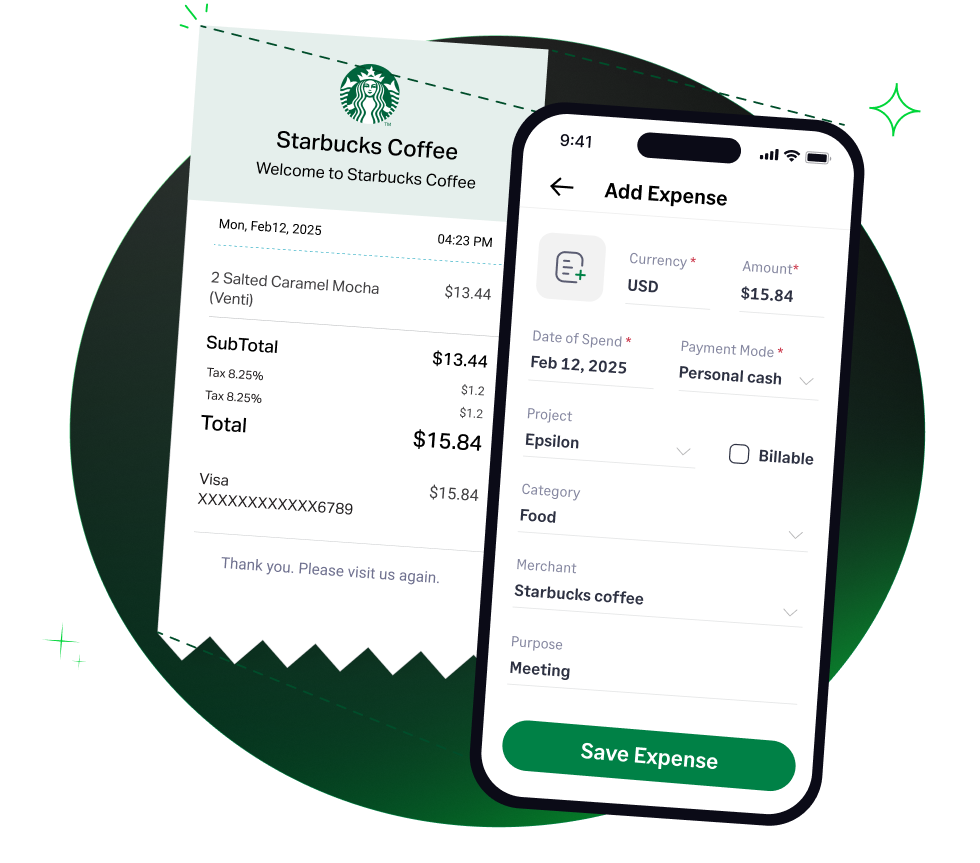

Sage Expense Management simplifies the complex task of managing trade show expenses, ensuring every cost is captured, categorized, and ready for tax time.