Like any other industry, accurate and efficient accounting is also vital for success in construction. However, despite being built on standard accounting principles, construction accounting is a specialized discipline owing to the number of difficult choices construction companies have to make–choosing which project to bid on, selecting the right financing for materials, or determining a project’s profit margin.

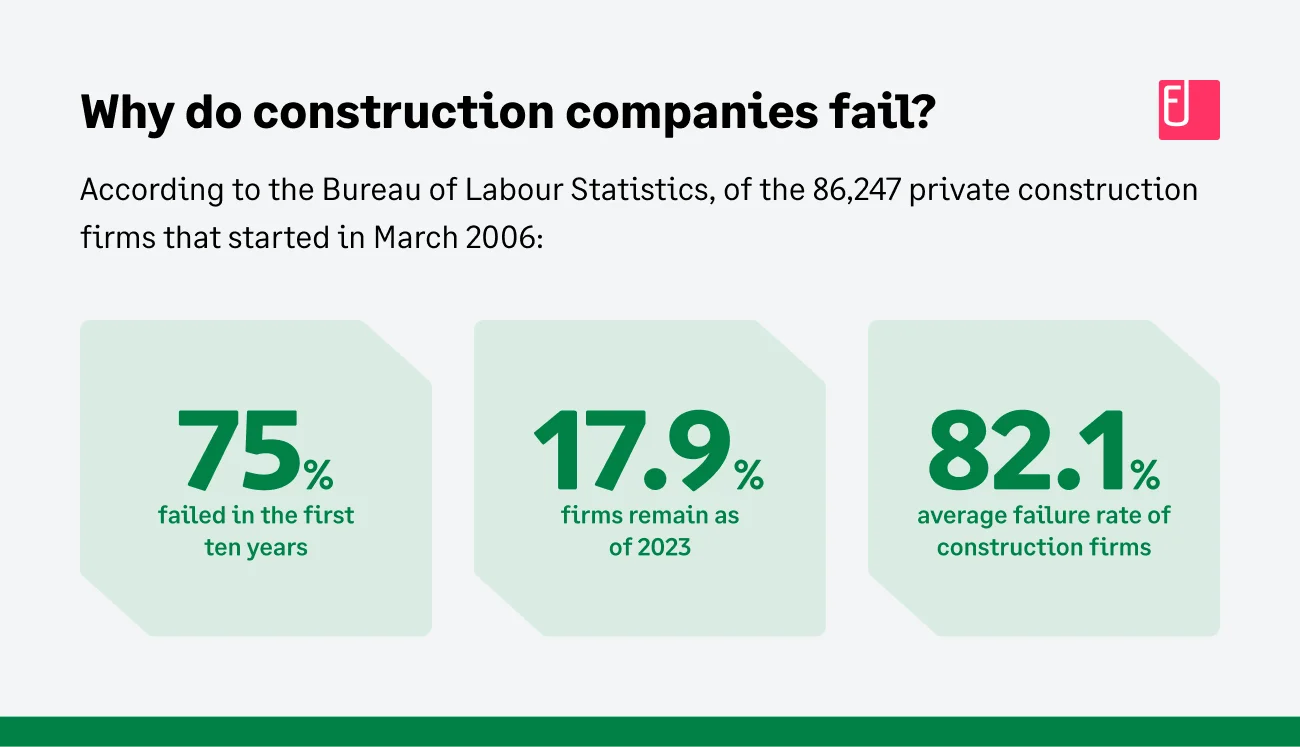

But that’s not all; the construction industry is also a dangerously volatile industry with an extremely high failure rate. According to the Bureau of Labour Statistics, of the 86,247 private construction firms that started in March 2006, 75% of them failed within the first ten years. As of 2023, only 17.9% of firms remain, which puts the failure rate at a massive 82.1%!

Construction accounting isn’t just about accurately tracking costs, revenue, and other financial data but also involves helping firms manage industry best practices like retainage, specialized billing, and other revenue recognition methods.

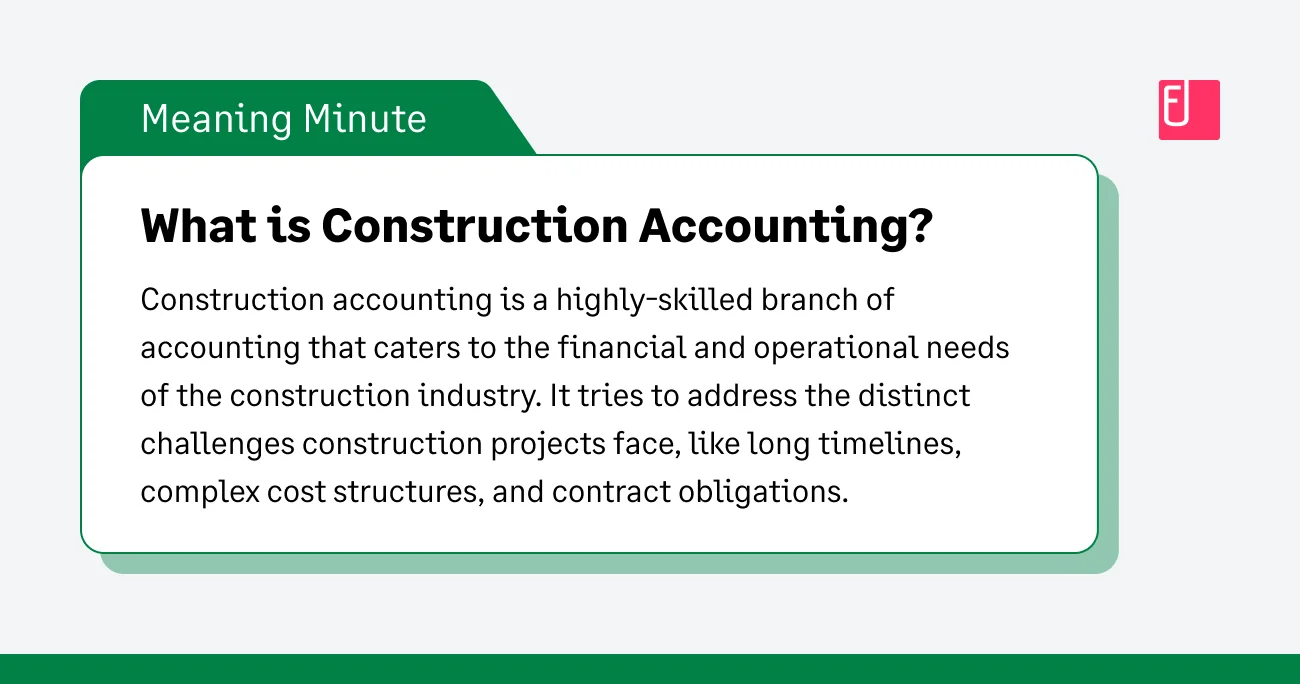

What is Construction Accounting?

Construction accounting is a specialized field of accounting that addresses the unique financial and operational needs of the construction industry. It tackles the specific challenges of construction projects, such as long timelines, complex costing structures, and contractual obligations.

Unlike traditional accounting, which focuses on general business transactions, construction accounting focuses on individual projects, ensuring their financial viability and monitoring them closely from start to finish.

How Is Construction Accounting Different From Regular Accounting?

Even though construction shares the same basic principles as accounting in other industries, it contains many industry-specific challenges that arise from the fact that construction is project-based.

For instance, every construction firm aims to ensure each project is profitable, making accurate job costing critical. Additionally, since projects are often large and one-off, project leaders must get the numbers right from the start. This is often challenging as a company’s projects are split across multiple sites and often employ a mobile workforce.

This is why construction companies find it difficult to match the efficiency of organizations that make the same products repeatedly in a single location.

Regular Accounting vs. Construction Accounting: A Summary

Let’s look at some of these differences in detail.

Project-based Accounting

The main difference between construction accounting and general accounting is that construction accounting is project-based. Project-based accounting focuses on transactions that are specific to that project. It allows construction firms to assess the financial implications of completing certain projects and plan their completion while meeting contractual parameters.

Production

Due to the nature of construction, production is inherently decentralized, meaning it happens on various project sites instead of a single location. This means construction accountants must account for travel and equipment reinstallation costs as workers and equipment constantly shift between projects.

Furthermore, construction firms must comply with local wage scales and regulations at each site. This might involve sourcing materials and machinery from nearby vendors to optimize efficiency and meet local requirements.

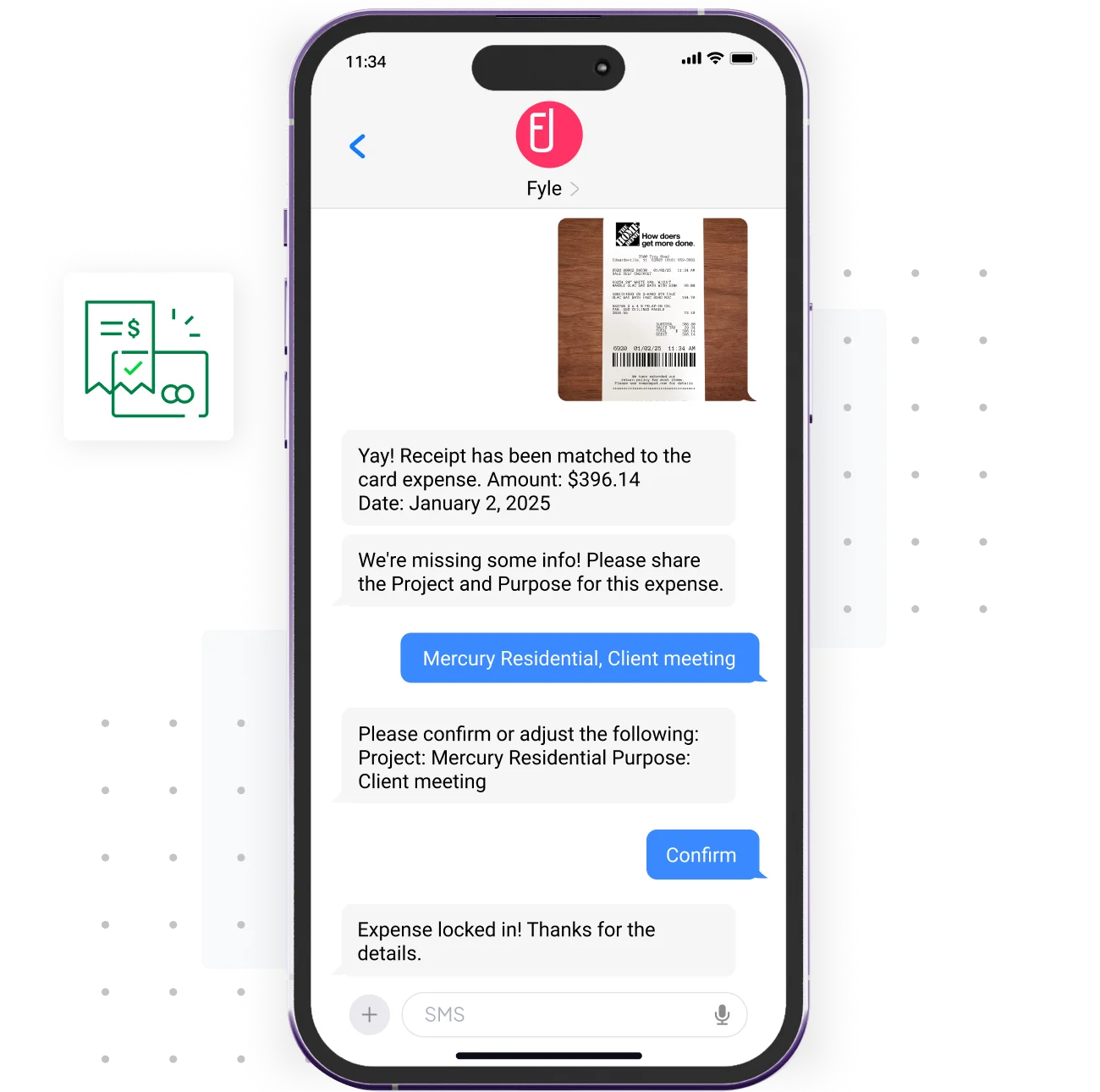

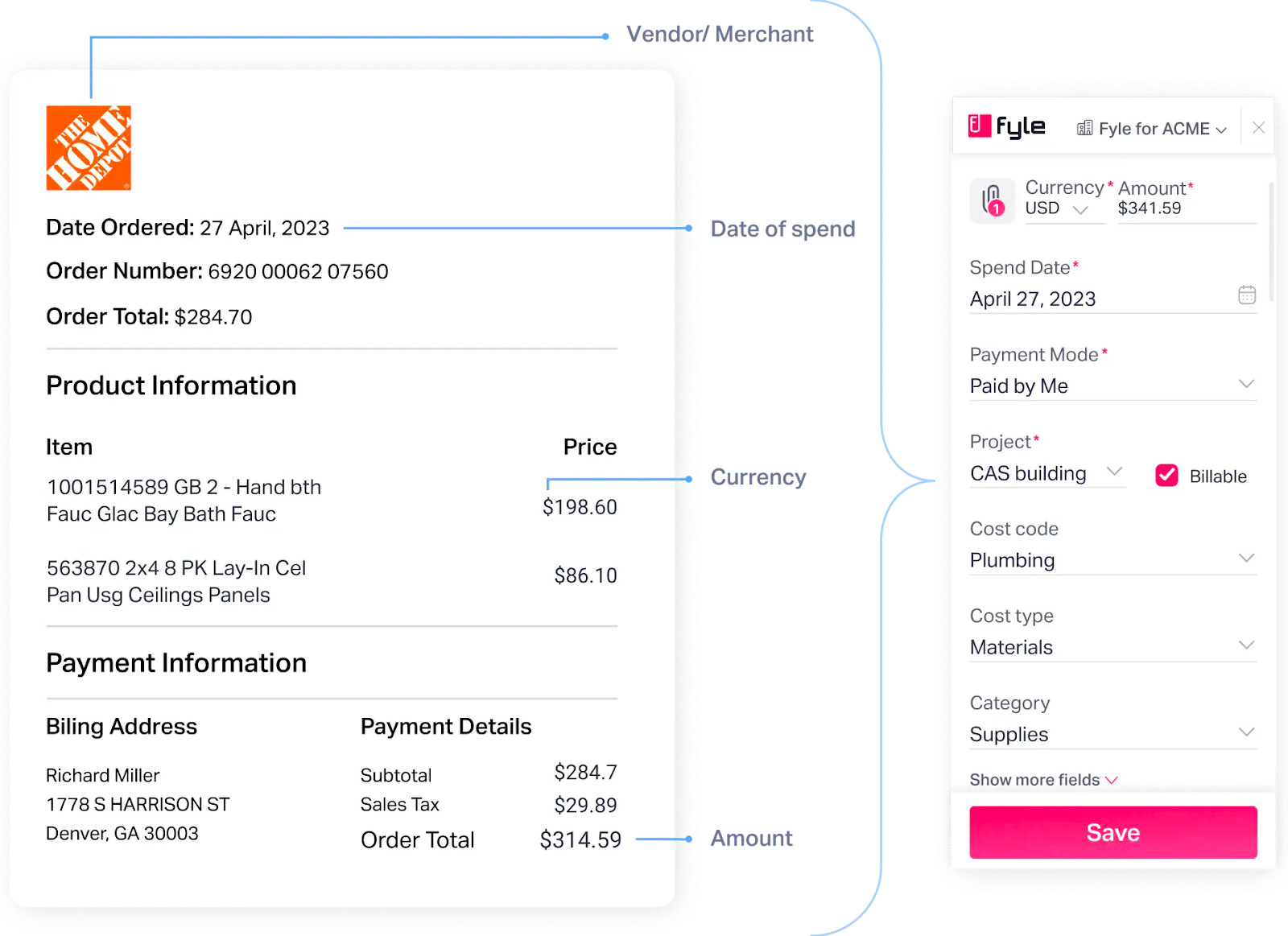

By leveraging mobile technology, workers can easily submit receipts and record expense information directly from the field, which helps organizations maintain real-time visibility into project costs, progress, and budgets.

For instance, Sage Expense Management allows field workers to submit receipts through text messages that are automatically coded and categorized.

This ensures that field workers don’t have to go to the back office with a shoebox full of receipts. It also reduces the time accountants spend sending out reminders for submissions and manually organizing receipts once they arrive.

Construction Accounting Contracts

Construction projects are usually lengthy, spanning multiple accounting periods. Even smaller projects can often stretch out due to problems like bad weather, labor shortages, or raw materials. To ensure adequate income and cash flow, contractors usually manage a schedule of multiple payments that are based on work completed to date.

There are four key types of construction contracts, these are namely:

Lump Sum Contract

Also called fixed-price contracts, where the parties agree on a fixed price for all the materials and labor for an entire project or phase.

Time and Materials Contract

Also known as a T&M contract, contractors are reimbursed for material costs, and labor costs are paid at a fixed hourly or daily rate.

Unit Price Contracts

Each distinct repeatable aspect of a project is assigned a fixed price (a fixed cost unit), and contractors bill each unit separately.

For example, a construction company agrees with a client to build a wall for $15 per square foot. The estimated wall size is 100 square feet, so the initial projected cost is $1500. However, the final price will depend on the actual size of the wall measured upon completion. The unit price remains fixed, but the total cost adapts to the final quantity.

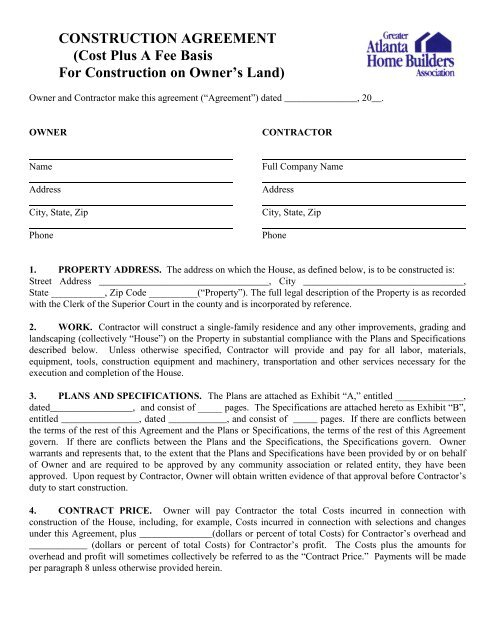

Cost-plus Contracts

Contractors are reimbursed for project costs–labor, materials, and equipment along with a pre-determined profit margin.

Remember that most construction contracts include retainage–a portion of the payment that is usually withheld till the entire project is complete. This means that a contractor’s profit margin can be held back long after their portion of the work has been completed.

Fluctuating Costs

Construction projects are characterized by inconsistent cash flow cycles due to continuously fluctuating costs, making expense forecasting extremely challenging. This is primarily driven by the volatile prices of labor and raw materials, which can significantly change throughout the project's extended duration. Additionally, the difficulty in stockpiling building materials in advance further intensifies this vulnerability for contractors.

To address this problem, some construction contracts include fluctuation provisions.

What Are Fluctuating Provisions?

“Fluctuation Provisions" adjust the total project cost based on changing prices for labor, materials, and other expenses throughout the project.

For example, if the contractor initially bases its price on current market rates, but inflation drives up material costs during construction (with no fluctuation provision), the contractor absorbs that additional cost. This shifts the risk of price fluctuations entirely to the contractor.

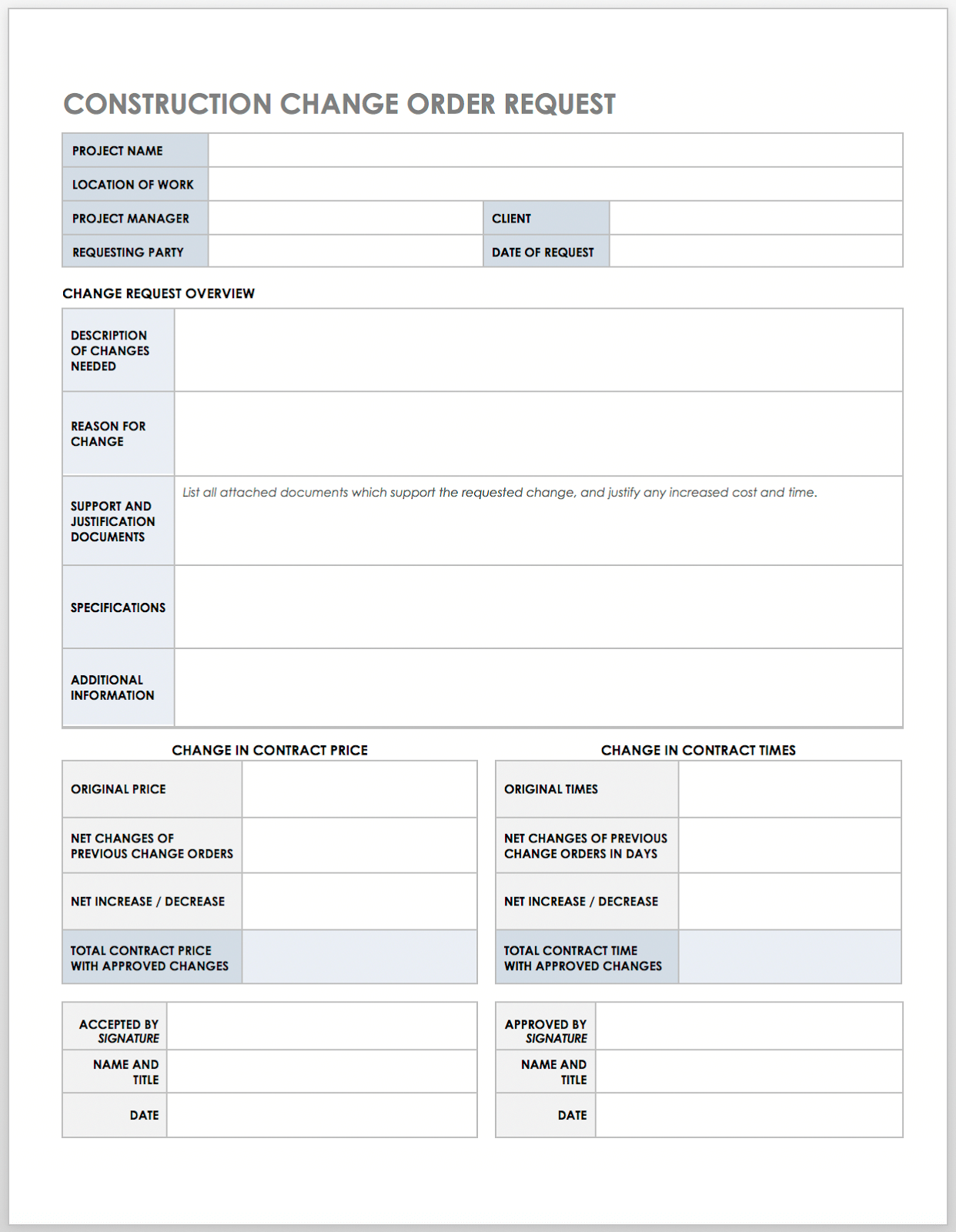

Change Orders

A change order simply refers to a formal modification to the original contract. This alternation can involve any of the following:

- Adjusting the scope of work (often leading to a higher overall project cost)

- Extending the project timeline

- Or both

For a change order to be valid, the owner and contractor must mutually agree on all the revised terms.

Common scenarios for change orders include the owner requesting adjustments like moving a wall, adding a window, or changing the flooring material. These are called ‘additive change orders’ and typically increase the contract price.

Conversely, ‘deductive change orders’ involve removing elements from the original scope, lowering overall cost.

How Do Contractors View Change Orders?

For contractors, change orders are the norm, especially when it comes to larger projects. If not handled with care, they can cut into project profits. It’s important to accurately document the financial impact of each change on the overall project.

As a best practice, most contractors also include a change order process in the original project contract.

Profitability

All the factors above make predicting profitability extremely difficult in construction projects. Each project brings about its own set of challenges, while change orders, and fluctuating expenses can further complicate this picture.

This reaffirms how important it is to account for all costs in a project regardless of whether the project makes or even loses money.

Construction Accounting Concepts

Job Costing

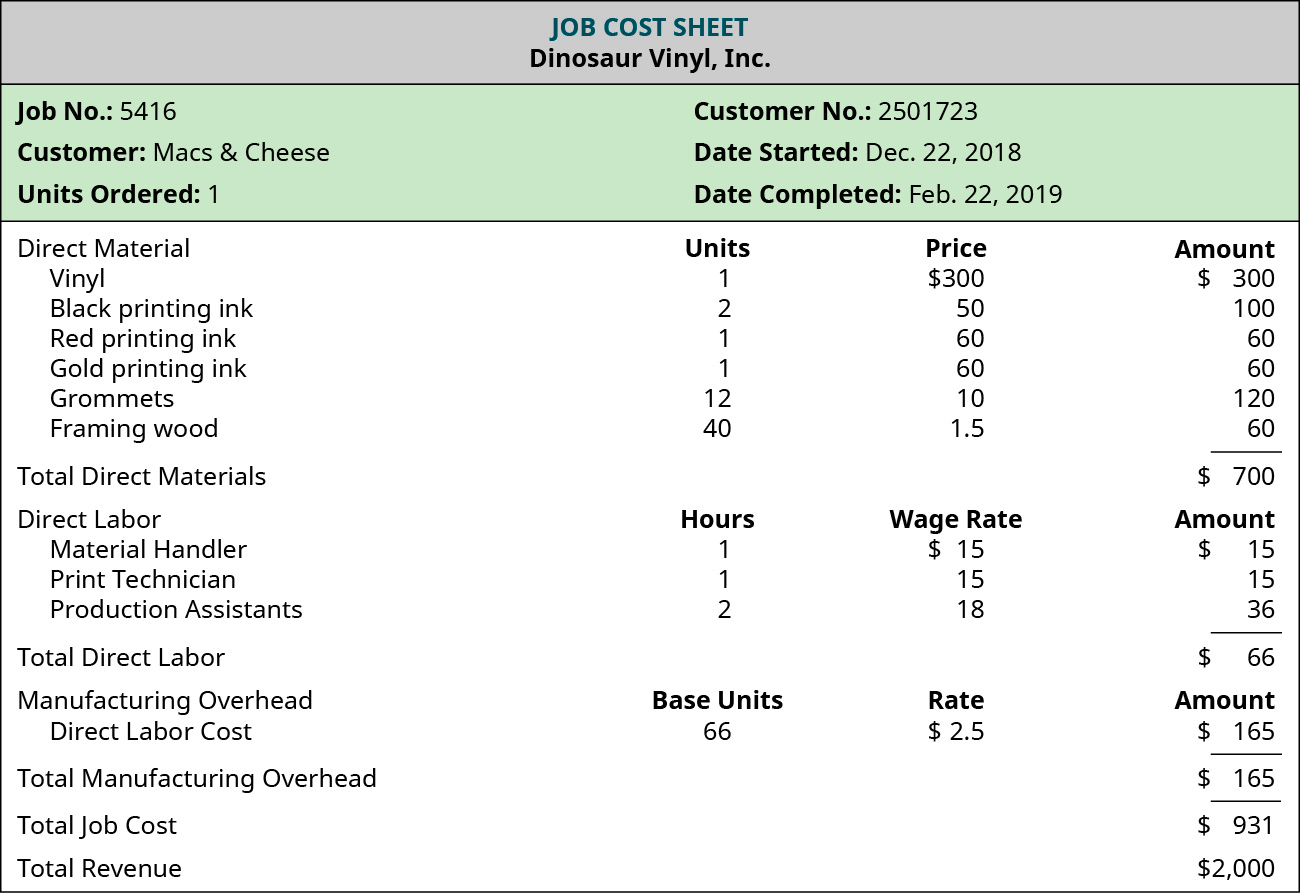

Job costing, a crucial aspect of construction accounting, is a project-based accounting method that meticulously tracks all expenses associated with a specific construction project. Since each project acts as its own profit center, accurately estimating and tracking all project costs is a crucial aspect of construction accounting.

The job cost sheet is a ledger that plays a central role: each project has a dedicated ledger where expenses, revenue, and the project budget are meticulously recorded. This information empowers contractors to generate accurate bill estimates and assess if the project is progressing according to contractual deadlines.

Below is a Job Cost Sheet for Job MAC001, an example from Pressbooks:

Construction project costs are typically classified into three main categories: materials, labor, and overhead expenses. However, job costing should encompass all project stages, including anticipated costs for change orders and estimates, to paint a complete financial picture.

Here’s what job costing looks like in practice for construction:

- Project Initiation: A construction company wins a bid to build a new school. The initial project budget is established, and a job cost ledger is created for the project.

- Project Execution: Throughout the construction phase, the company meticulously records all expenses incurred, including materials purchased (lumber, bricks, etc.), labor costs (wages, salaries, benefits), and overhead expenses (rent, utilities, equipment rentals).

- Monitoring and Adjustments: The job cost ledger is constantly updated, allowing the contractor to monitor how the project's actual costs compare to the initial budget. If unforeseen circumstances arise, such as the need for additional materials due to a design change, a change order is issued, and the associated cost is incorporated into the job cost ledger.

- Project Completion: Upon project completion, the final costs are compared to the initial budget and project revenue to determine the project's profitability. This information can be used to refine future bid estimates and improve overall project management efficiency.

Also Read

Contract Revenue Recognition

In traditional accounting, revenue recognition is a straightforward concept: it defines when a company has earned and can record income from a sale or service. However, construction projects are unique. Spanning weeks, months, or even years, they often involve multiple payments and require a nuanced approach to recognizing revenue.

A construction company's chosen revenue recognition method hinges on company size and project duration. This choice impacts various aspects such as:

- Billing frequency: How often invoices are sent.

- Payment collection: The ability to receive payments throughout the project.

- Financial reporting accuracy: The impact on a project's income statements.

- Tax implications: Potential tax changes based on the chosen method.

- Cash flow management: The potential for complications in managing cash flow.

Let’s take a look at the most commonly used types of revenue recognition in the construction industry:

Cash-basis method

The simplest and easiest approach to recognizing revenue, cash-basis accounting records revenue when a payment is received, and an expense when a payment is made. For instance, if you receive a down payment for a project, you can record revenue even if work hasn’t started.

Remember that construction companies can only use the cash basis method if they have an average gross receipts for the three preceding tax years of $25 million or less (adjusted for inflation) as per the IRS’s Tax Cuts and Jobs Act ("TCJA") 2018.

Larger businesses and those who maintain inventory must use an accrual basis of accounting to comply with U.S GAAP (Generally Accepted Accounting Principles).

In accrual accounting, you record revenue when it's earned and expenses when they’re incurred, regardless of when the money changes hands. It matches revenue with expenses when they’re incurred.

Percentage of Completion Method

An accounting method where revenue is recognized as a percentage of work completed over the life of a contract.

Contractors should use the percentage of completion method (PCM) when they have a long-term contract. A long-term contract is:

- A contract for the manufacture, building, installation, or construction of property.

- Not completed within the year it's entered into.

- In the case of manufacturing contracts, it involves unique items or takes over 12 months to complete.

However, there are some exceptions where contractors don't need to use the PCM:

- Certain construction contracts: These must meet specific criteria like being completed within 2 years and the taxpayer meeting a gross receipts test.

For more information, read 26 U.S. Code § 460 - Special rules for long-term contracts, Cornell Law School.

Potential Pitfalls of the Percentage of Completion Method

While the percentage of completion method offers flexibility, it can be misused by companies seeking to manipulate their financial statements. This practice, known as creative accounting, allows for shifting income and expenses between reporting periods, potentially leading to misleading financial performance.

The dangers of such manipulation are evident in the tale of Toshiba Corp. in 2015. The company's infrastructure unit artificially lowered operating costs by a staggering 152 billion yen ($1.2 billion) over a seven-year period.

This accounting scandal resulted in significant consequences, with the CEO's resignation and the departure of half the Board of Directors.

Source: Reuters

Completed Contract Method

As the name suggests, revenue and expenses aren’t recognized till the project is completed and all other obligations are met.

This method is often used for short-term projects, that is, those that are completed within one to two years. Plus, an advantage of this method is that contractors can defer taxable revenue to the following year if the project won’t be completed in the current tax year.

However, the IRS states that taxpayers can elect CCM over PCM (percentage completion method) for long-term contracts if they are:

- Home construction contracts.

- Other construction contracts where the taxpayer, at the time the contract is signed, believes:

- The project will be completed within two years.

- The taxpayer's average annual gross receipts for the past three years are under $25 million (or under $10 million for contracts signed before January 1st, 2018).

A contract qualifies as a home construction contract if, at the end of the year the contract is signed, at least 80% of the estimated total costs are expected to be used for:

- Building a dwelling unit.

- Making improvements to the real property directly linked to that dwelling unit.

For more information, please refer to IRS Knowledge Base – Corporate/Business Issues & Credits.

In addition to these, contractors must also pay attention to the standard of revenue recognition.

ASC 606

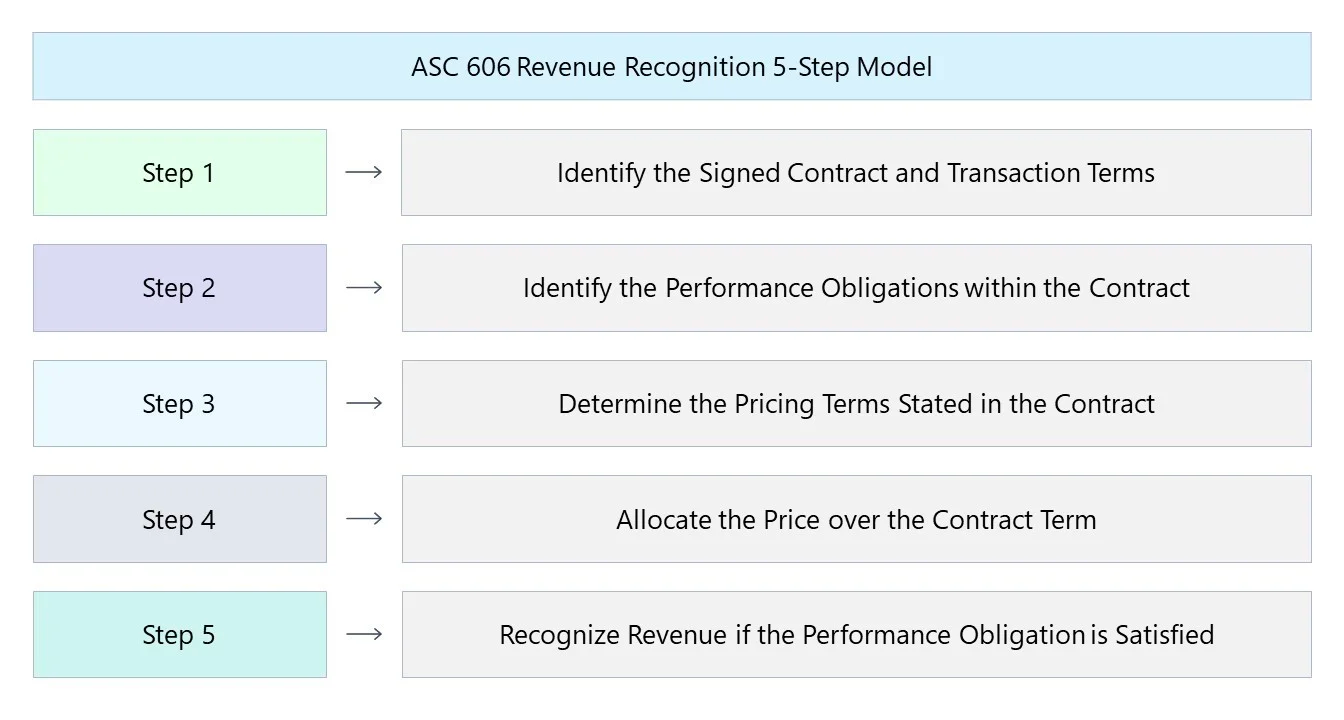

ASC 606 is a revenue recognition model established by the Financial Accounting Standards Board. It outlines a five-step model organizations must follow when recognizing revenue from customer contracts. It is based on the delivery of goods and services to a client, labeled as performance obligations.

A contract may include a single obligation or several. Contractors must identify such obligations in the contract and assign a price for each.

How does the ASC 606 affect revenue recognition in the construction industry?

The ASC 606 impacts revenue recognition in the construction industry by requiring contractors to reconsider how and when they recognize revenue.

Traditionally, the construction industry used the percentage of completion method, which recognized revenue based on the project's completion percentage.

However, ASC 606 focuses on identifying performance obligations, and whether control has been transferred to the customer for each obligation, that is, whether they can enjoy the benefits of the asset or service at that point in time. This can lead to different timing of revenue recognition compared to the traditional method.

Retainage

Retainage is the agreed-on percentage of the project price that is withheld from a contractor for a defined period until the job is completed. The amount that’s held back is typically defined in the contract, usually amounting to 5%-10% of the contract value.

Why Is Retainage Used?

- Incentivizes completion: Withholding a portion of the payment motivates the contractor to complete the project according to the agreed-upon terms and quality standards.

- Protects the owner: It serves as a financial safeguard for the owner if the contractor:

- abandons the project before completion

- delivers work with defects requiring additional work or repairs

- Ensures completion of subcontracts: When the general contractor withholds retainage from subcontractors, it helps guarantee payment for the subcontractor's work, encouraging them to complete their tasks within the project.

Construction Payroll

Construction payroll deals with complexities that other industries don’t normally have to worry about, like prevailing wage, union payroll, and multi-state-multi-city payroll requirements.

Prevailing Wage

The government requires contractors working on public projects to pay their employees no less than the defined minimum wage–which are known as the prevailing wages as they’re based on what similarly employed workers in the region are paid.

The main challenge for construction companies here is that ensuring a uniform wage isn't possible. This is because there’s a diverse workforce present on a site, with individuals from various localities filling various job roles.

For each federal project in excess of $2,000 the Davis-Bacon Act applies and defines the prevailing wage through a Davis-Bacon determination. Here’s a breakdown of how it works:

- Wage determinations: The government publishes wage determinations for different regions and project types on the System for Award Management (SAM) website. These determinations list the prevailing wage and fringe benefit rates for various worker classifications like electricians, carpenters, and laborers.

- Contractor obligation: Contractors are required to use these wage determinations to classify their workers and pay them at least the listed rates. This ensures workers receive fair compensation based on the local market rates for their skills and experience.

Therefore, the allowable wages for workers on federal projects are dynamic and location-specific, based on the prevailing wage determinations published by the government.

For more information, please refer to Department of Labor USA: Fact Sheet #66: The Davis-Bacon and Related Acts (DBRA).

Union Payroll

The construction industry remains heavily unionized, setting it apart from other industries. This means wages and working conditions are often determined through collective bargaining agreements, which require companies to report wages and other details to each union for verification. These agreements, negotiated between unions and employers, establish specific terms for pay, benefits, and work environment.

Multi-state Payroll

Multi-state payroll adds a layer of complexity for contractors with projects across several cities and states. This is because they must navigate:

- Varying regulations and local taxes: Over 5,000 cities in 17 states have their own unique rules and local taxes.

- State and city tax deductions: They need to accurately withhold taxes for each employee based on their specific location and state residency.

- Tax reciprocity in some states: This requires employers to handle calculating taxes, withholdings and reports for employees working in neighboring jurisdictions.

Failing to comply with these intricacies can result in underpaid employees and legal consequences for the employer.

Financial Statements Specific to Construction Accounting

Due to the industry’s distinct nature, certain financial statements exist just for construction accounting. These statements try to address the complexities that are prevalant in construction operations and give stakeholders access to accurate, and actionable financial information.

Work-in-Progress (WIP) Schedule

WIP, or Work in Progress, represents all ongoing construction activities not yet finished within a specific accounting period. It functions as a detailed snapshot of ongoing projects' financial health, encompassing:

- Labor, material, and overhead costs incurred to date.

- Projected total cost for the project.

- Costs already billed and revenue recognized.

By analyzing WIP data accurately, contractors can gain valuable insights into project profitability and identify potential discrepancies in billing or revenue recognition. This information allows for proactive management and adjustments, ensuring financial health and project success.

Construction-in-Progress (CIP) Report

The construction-in-progress report is used to track financial data for projects that have begun and are not complete. It’s useful in giving an overview of ongoing costs and revenue.

A CIP report includes an account of:

- Ongoing costs

- Ongoing labor

- Materials in use

- Overhead expenses

- Revenue based on percentage of completion

An accurate CIP report can enable construction firms to evaluate the financial performance of individual projects, mitigate challenges early on and ensure profit margins are met.

Job Cost Sheets

Job cost sheets are a major part of construction accounting, as accountants use them as a financial guide. These sheets offer a microscopic view of expenses for specific tasks or project stages.

Each sheet has a comprehensive breakdown detailing job costs–materials and subcontractor fees. It also compares actual spending against the initial budget. By consistently updating and reviewing these sheets, organizations can track budgets in real time, adjust resource allocation as needed, and forecast final project costs with improved accuracy.

Other Relevant Financial Statements

Balance Sheet

The construction industry balance sheet reflects–assets, liabilities, advances, equipment charges, project financing, and retentions. If properly maintained, it can give you an overview of the organization’s financial position.

Assets = Liabilities + Owners or Shareholders’ Equity

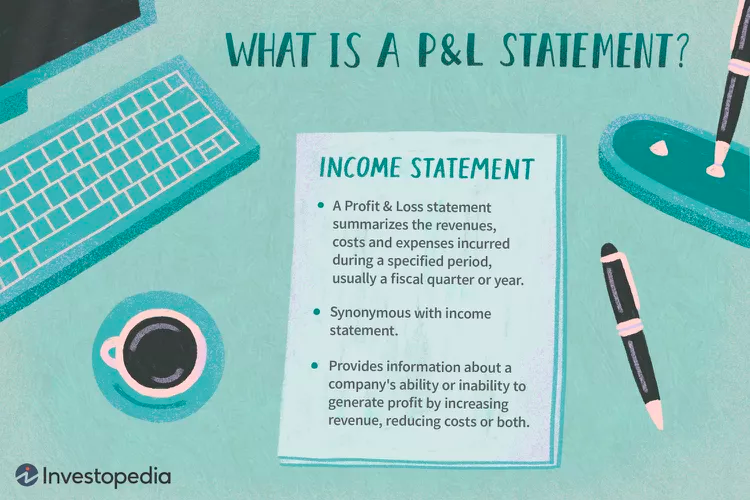

Profit and Loss Statement

Profits are calculated in different ways on an income statement:

- Gross profit considers only the direct costs associated with generating sales, and is simply revenue minus cost of goods sold.

- Net profit takes further deductions by subtracting operating expenses (indirect costs) from gross profit.

- Profit after taxes arrives at the final figure by subtracting income tax expense from net profit.

Construction Accounting Ratios

Construction accounting ratios act as financial health checkups for a firm. These calculations offer insights into the different facets of a company’s financial well-being. Some of the most commonly used ratios are:

Current Ratio

Current Ratios evaluates how a company can use its current assets to cover its current liabilities.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio

Quick Ratio measures if a company can pay its current liabilities with cash or other assets that can be converted to cash.

Quick Ratio = Current Assets - Inventory / Current Liabilities

Debt To Equity Ratio

Debt To Equity Ratio evaluates the risk of an organization’s creditors and owners.

Debt to Equity Ratio = Total liabilities / Total Equity

Working Capital Turnover

Working Capital Turnover measures how much revenue each dollar of working capital is producing.

Working Capital Turnover = Net Sales / Working Capital

4 Construction Accounting Best Practices

Focus On Accurate Job Costing

- Track and record every expense associated with a project, including labor, materials, and overhead costs.

- Utilize detailed job costing reports to compare actual costs against estimated costs and identify areas for improvement.

- Encourage all employees to understand the importance of accurate job costing and its contribution to overall profitability.

- Consider using construction accounting software with clear and intuitive coding structures for each job and cost category.

Choose the Right Accounting Method

- Cash basis accounting is a popular option for smaller businesses due to its simplicity and clear picture of the company's cash flow.

- Accrual basis accounting provides a more comprehensive view of a company's financial health but requires more complex bookkeeping.

- Contractors with large projects often use the percentage of completion method to recognize revenue and expenses throughout the project lifecycle, smoothing out income fluctuations.

- Home construction companies may benefit from the completed contract method, deferring revenue and tax liability until project completion.

Determine the Best Tax Strategy

Several factors impact your tax liability, including your revenue recognition method, project type, and business structure.

- Large contracts: Most contractors use the percentage of completion method, recognizing revenue and expenses throughout the project's life.

- Home construction projects: You might use the completed contract method, recognizing revenue and expenses only at project completion, potentially deferring taxes.

- Business structure: Consider the tax implications of your structure. Pass-through entities like sole proprietorships or some LLCs allow deducting business losses from personal income tax.

Invest In Construction Accounting Software

Modern construction accounting softwares automates all tedious job costing tasks, simplifies financial management, and aids in tax compliance. Look for features like:

- Project tracking and reporting: Gain real-time insights into project performance and overall business finances.

- Accounts receivable and payable management: Ensure timely collections and maintain positive supplier relationships.

- Revenue recognition flexibility: Support various methods commonly used in the construction industry.

Consider popular options like Sage 300, QuickBooks Online/Desktop, or Xero.

For a more detailed breakdown, review our Best Construction Accounting Software.

Choose Sage Expense Management, Regardless of Your Accounting Tool to Streamline Construction Expense Management

Sage Expense Management integrates seamlessly with Sage 300 CRE, Sage Intacct, Quickbooks Online, and Quickbooks Desktop to streamline construction expense management. Here’s how:

Instant Transaction Alerts and Automated Credit Card Reconciliation

Sage Expense Management integrates directly with credit card networks like Visa, Mastercard, and American Express. Your employees receive instant text notifications whenever your company card is used. Simply reply with a picture of the receipt for instant reconciliation.

Alternatively, just text the receipt itself to Sage Expense Management and we will automatically match the data with the corresponding card transaction when it arrives. This eliminates manual data entry and streamlines the reconciliation process for everyone.

Automate Expense Categorization

Sage Expense Management automatically categorizes expenses based on your accounting software's chart of accounts, reducing errors and streamlining the approval process.

Centralized Visibility

Gain real-time insights into all project expenses within your accounting system, enabling better financial control.

In Conclusion

By combining your chosen accounting tool with Sage Expense Management, you can stay on top of your organization’s spend in real-time, and automate your receipt collection and expense categorization, allowing you to focus on what truly matters–building your business.

.webp)