What are Operating Expenses?

Operating expenses, often called OpEx, are the ongoing costs that a business faces to keep things running. In essence, they constitute the essential payments required to facilitate the functioning of your business. Operating expenses are usually repetitive in nature and represent the resources needed to make sure the business keeps running smoothly.

This means they're costs that aren't directly tied to making or selling products. So, unlike some costs that change when you sell more or less, operating expenses are not tied to revenue and mostly stay the same.

Understanding Operating Expenses

Operational Activities

Costs a company incurs in its day-to-day functioning are called operating expenses. For its day-to-day functioning, an organization undertakes several operational activities that generate revenue.

The kind of operating expenses incurred can differ based on what a company does. In fact, operational expenses in one industry may not be considered so in another. It becomes important to understand the distinction between these expenses due to the variations in tax deductions.

What Is Included in Operating Expenses?

Some of the most common operating expenses include:

- Property rent

- Accounting fees

- Bank fees

- Marketing charges

- Office supplies

- Payroll

- Utilities

- COGS (Cost of Goods Sold)

Managing Operating Expenses

A major responsibility that the management of any organization needs to deal with is figuring out how to reduce operating expenses without affecting the company’s ability to compete with its competitors.

While operating expenses are inevitable, some organizations use proven methods to reduce them and boost profits. Here are some things you can do:

- Data-Driven Decision-Making: Use data to make smart choices about your spending. Analyze the numbers to see patterns, trends, and things that stand out. This helps you make good decisions and fix any problems quickly.

- Flexibility in Spending: Even though planning your budget is important, being able to change it is also crucial. Things like the economy, how your industry is doing, and unexpected events can all affect your expenses. Being able to adjust your budget when needed is helpful.

- Employee Engagement: When your employees are enthusiastic about their jobs, they usually perform better. Motivate your team to share their thoughts on spending less. This helps them feel involved in making the business financially robust.

- Continuous Improvement: Keep finding ways to do things better. Encourage everyone in your team to come up with ideas to save money. Regularly check how you do things and see where you can work more efficiently.

- Benchmarking: It's good to see how your spending compares to others in your field. This can give you some good ideas on how to make things more efficient. It's like learning from the best to do better yourself.

Fixed and Variable Costs

An operating expense can be fixed or variable.

A fixed cost is the cost that incurs no change when there’s an increase or decrease in the quantity of goods or services sold. Typical fixed costs are recurring payments like interest, loan payments, insurance, rent, and bank charges.

A variable cost is a cost that shows variations depending on the levels of production and sales.

How to Calculate Operating Expenses

Here’s the most common formula used to calculate operating expenses:

Operating Expenses = Payroll/Wages + Sales Commissions + Marketing/Advertising Costs + Rent + Utilities + Insurance + Taxes

Source: Netsuite

Examples of Operating Expenses

Let’s go into more detail and unpick each type of operating expense to help you better understand how to manage yours.

Personnel Costs

Personnel costs encompass all the expenses linked to the people you hire. Depending on your team size, this can become a significant chunk of your operating expenses. They involve things like salaries, benefits, and any training or travel expenses for your employees. These costs have various components:

- Employee Salaries: The regular payments made to employees for their work.

- Employer Benefit Contributions: In addition to salaries, companies often contribute to employee benefits like health insurance and dental plans.

- Commissions and Bonuses: Incentives such as sales commissions and performance-based bonuses motivate and reward employees.

- Retirement Plan Contributions: Companies contribute to employees' retirement plans, securing their financial future.

- Payroll Processing Costs and Payroll Taxes: Administering salaries involves expenses such as payroll software and services, alongside considerations for payroll taxes to ensure legal compliance.

To manage these costs effectively, you should ensure your staff levels are optimized, regularly evaluate any compensation structures and reward schemes, and create a productive work environment that maximizes the potential of your workforce.

Occupancy Expenses

Occupancy costs refer to the expense of occupying and maintaining a business's physical space and are typically one of the largest operational expenses to a business. If you run your business from an office or warehouse facility, you'll need to account for any rent you pay, utility bills, property taxes, and the cost of maintaining the buildings you use.

Here’s an example from Harvard Business Review on how you can uncover your hidden occupancy costs:

To cut down on occupancy costs, businesses can consider strategies like downsizing, using less storage or warehouse space, implementing remote working, or utilizing shared office spaces.

Administrative Expenses

These encompass various ‘behind the scenes’ administrative tasks that keep a business running smoothly. This can include everything, from an .io or .org domain registration and software subscriptions to legal fees, communication expenses, and office supplies."

For example - Apple reported $12.08 billion of operating expenses in Q3 2022. Out of this, $6.79 billion was attributed to R&D, while $6.012 billion was attributed to selling, general, and administrative expenses.

To reduce these expenses, consider efficient procurement and technology to improve operations. For instance, using digital tools to track expenses rather than paper forms can help to reduce stationery costs. Businesses can also "shop smarter," making sure they look around to get the best deals and prices for products and services they regularly use.

Marketing and Advertising Costs

These are the expenses a business pays for creating ads, running campaigns, and conducting market research.

When businesses look at areas to cut costs, marketing can sometimes seem like an expensive luxury, but investing in marketing your business is essential in securing ongoing growth. Instead, you can optimize what you spend by finding the right balance between the types of advertising and media that you use, making sure you maximize your return on investment.

For example, high-impact campaigns and traditional marketing methods like putting ads on billboards or running TV ads are often costly, while digital marketing and email campaigns can provide a more cost-effective way to reach your target audience.

When businesses use their money smartly, they can make their marketing work harder, making the most of the budget available.

Research and Development (R&D) Expenses

Research and Development (R&D) Expenses are often crucial, especially for businesses that focus on technology. This refers to the funds you use for coming up with fresh concepts, exploring new products, and enhancing the ones you already have.

Businesses often face the challenge of needing to trim expenses while safeguarding technological advancements. However, engaging consistently in R&D activities shows both customers and investors that your business is committed to producing market-leading and quality products.

For example - In the 2023 fiscal year, Nvidia spent $7.34 billion on R&D, an increase from its $5.27 billion spend in 2022. This comes from Nvidia CEO Jensen Huang, now pushing for the company’s move beyond gaming and into AI.

To make the most of your R&D spend, make sure you carefully evaluate which new ideas are worth investing in and which might not work out.

Interest and Finance Charges

When a business borrows money, it comes with the cost of paying interest and finance charges. These expenses become part of the overall operating expenses. Businesses that have taken loans need to make regular payments to cover the interest on the borrowed money and any additional finance charges.

To make these costs more manageable, businesses can negotiate favorable terms when they borrow money. This might involve getting a lower interest rate or more flexible repayment options. Additionally, managing debt efficiently is essential. This means keeping a close watch on how much debt is taken on and creating a plan to pay it back on time.

Another strategy that businesses often use to optimize their financial situation is inventory financing, which involves using their inventory as collateral to secure a loan. This can provide working capital to manage operational expenses and growth opportunities.

Depreciation and Amortization

These are terms used to describe how the value of assets decreases over time. Even though they don't involve actual cash going out, they are considered expenses on paper.

Think of it like this: when a business buys things like equipment or buildings, as time goes on, these things become less valuable because they get old or newer things come out. Depreciation is used for physical assets like machinery or vehicles, while amortization is used for intangible things like patents or copyrights.

These non-cash expenses are important because they help businesses report their financial health accurately. They also play a role in determining how much tax a business pays. By factoring in depreciation and amortization, businesses can present a more realistic view of their finances and ensure they are compliant with tax regulations.

Operating vs. Non-Operating Expenses

Operating expenses are the costs a business incurs in its normal day-to-day operations.

Non-operating expenses are the costs a business incurs that are unrelated to its everyday functioning. Some of the most common types of non-operating expenses include: borrowing costs, costs incurred in loss of assets, interest charges, etc.

The IRS allows an organization to deduct operating expenses if the business functions to earn profits.

Operating Expenses Example

Here’s a sample income statement for an example company that shows its operating expenses.

Operating Expenses vs. COGS

While operating expenses are the direct expenses a business incurs to manufacture or sell its products, COGS can be difficult to calculate based on what the business sells and where it sells.

However, here’s the most commonly used formula to calculate COGS:

COGS = Beginning inventory + Purchases in the current period - Ending inventory

What Are Capital Expenses?

The costs a company incurs in acquiring or upgrading its existing tangible assets are called capital expenses.

Common tangible assets include pieces of factory equipment, company-operated plants, real estate, property, office furniture, and computers. These expenses, unlike operating expenses that are deducted from revenue in the year they are incurred, can be deducted from taxes over a period of years.

Capital Expenses vs Operating Expenses

The IRS sees capital expenses differently from operating expenses.

According to the IRS, an operating expense must be necessary and accepted in business trade. Generally, businesses can deduct operating expenses in the year they were incurred. This can significantly reduce a business's taxable income and save them money on taxes.

On the other hand, organizations must capitalize on capital expenses/costs.

Here’s an example to explain how a business can do this:

A coffee shop owner buys a new espresso machine for $10,000. They can expense the cost immediately, reducing their taxable income in the current year by $10,000. However, they choose to capitalize the cost and depreciate it over its five-year useful life, deducting $2,000 in depreciation expense per year. Capitalizing the expense spreads it out over five years, reducing their taxable income in each of those years and saving them money on taxes.

Pro-Tip: The IRS has strict and clear guidelines on how businesses should capitalize assets based on asset class and type. Remember to go through this thoroughly before making any decision.

How Does the IRS Treat Operating Expenses?

The IRS allows businesses to deduct their operating expenses from their taxable income, but only if the business is operating for profit.

As mentioned earlier, operating expenses but be necessary and accepted in the business trade. In general, an organization can write off the operating expenses for the year in which they were made.

Is Interest Expense an Operating Expense?

No, an interest expense is not an operating expense. An interest expense is a cost incurred by someone for borrowing funds. It is a non-operating expense that’s shown on the income statement.

Is Depreciation an Operating Expense?

Yes, depreciation is considered an operating expense. Depreciation allocates the loss of value in fixed assets over a period of time. Fixed assets are critical for the everyday functioning of businesses. Hence, depreciation is considered an operating expense on a company’s income statement.

Elevate Your Operating Expense Management With Sage Expense Management (Formerly Fyle)

Our Sage Expense Management platform will help your organization reduce operating expenses and manage your business expenses more effectively. Here’s how:

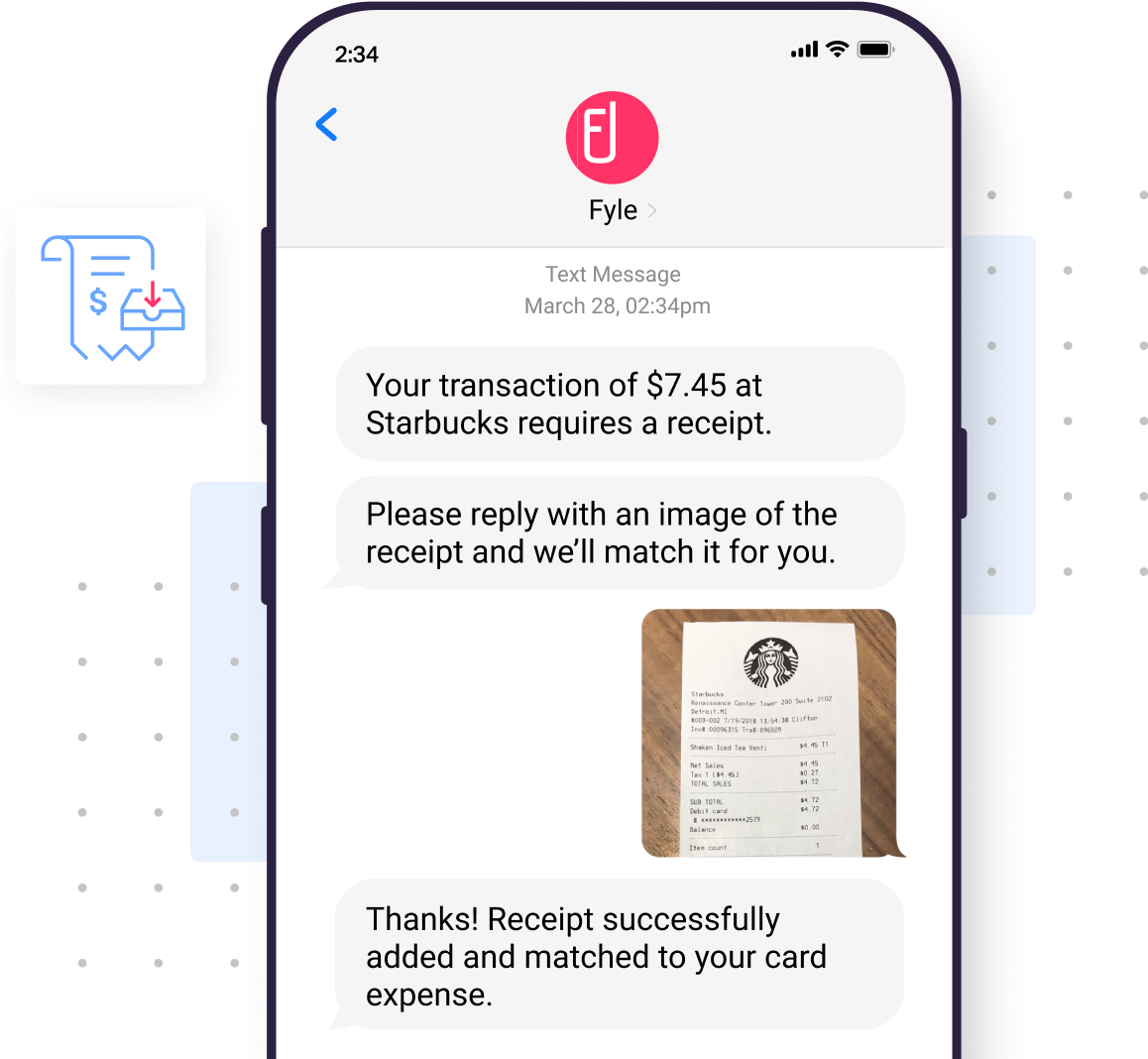

Instant Receipt Submission via Text Messages

Our real-time feeds through direct integrations with Visa and Mastercard enable employees to submit receipts for card transactions via text messages. This ensures the timely submission of receipts with no manual reminders.

Automated Compliance

The Sage Expense Management (formerly Fyle) checks for policy violations as employees create expenses, preventing them from submitting expenses that violate company policies. Its duplicate detection module checks for duplicates if two submitted expenses are found to be the same and instantly notifies the user

With automated fraud and duplicate detection controls in place, our platform ensures continuous compliance for your organization.

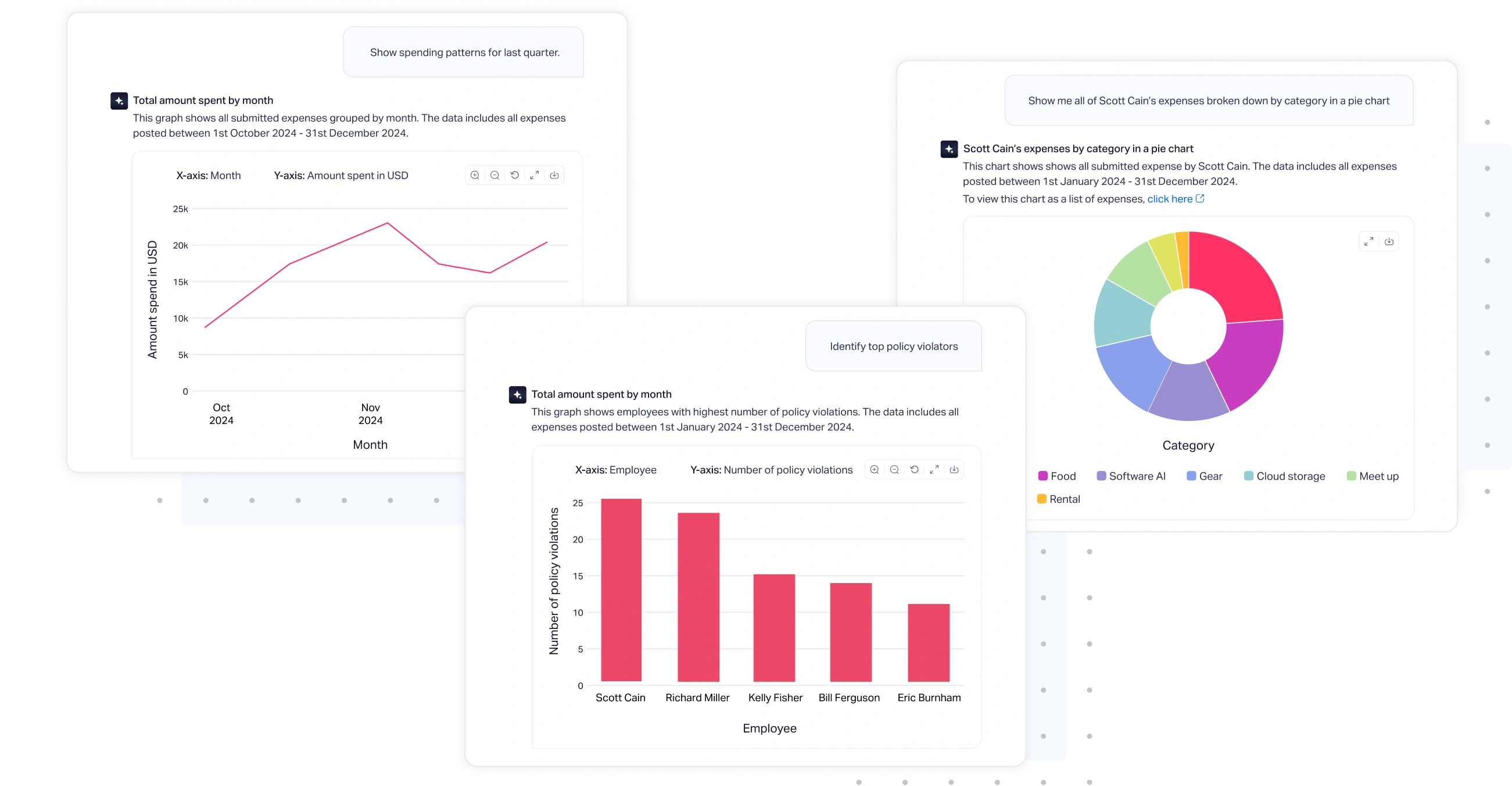

Instant AI Insights into Spend

Our CoPilot delivers an immediate, AI-driven overview of all employee credit card expenses. Finance teams can effortlessly dissect transactions by category, merchant, project, employee, or department. This empowers you to pinpoint potential risks, operational inefficiencies, and overspending with rapid, intelligent analysis.

In Conclusion

Operating expenses are an unavoidable part of a company’s day-to-day functioning. They can fixed or varied and are typically tax-deductible as long as your organization is operating for profit.

An efficient expense management software can bring together your business’s corporate card spend, expenses, receipts, and budgets under one roof–everything that accountants would need to keep operating expenses under control.

Schedule a demo today to see how Sage Expense Management can help you manage your operational expenses!

.webp)