The world of finance is dynamic and intricate, requiring many roles meticulously crafted to safeguard and optimize a company's financial well-being. The fast-paced businesses today need someone who serves as the financial guiding light for a company, skillfully navigating it toward the path of triumph. This is exactly what a financial controller does.

Let us further explore the role of a financial controller responsible for overseeing and managing an organization's financial activities. The primary tasks of a financial controller include budgeting, financial reporting, etc.

What is a Financial Controller?

A financial controller is a personnel in the organization who works as a senior executive, responsible for managing the financial actions of a company. They are pivotal in budget management, financial planning, record-keeping, and financial reporting.

They oversee all aspects of the company's financial health, keeping their finger on the pulse of the company's financial status.

Controlling vs Accounting

While accounting focuses on recording financial transactions and ensuring compliance with financial regulations, controlling emphasizes managing and interpreting financial data to guide decision-making.

Financial controllers bridge the gap between the two, ensuring accurate financial records while providing actionable insights for business growth.

Financial Controller vs CFO

While both roles operate within the financial domain, a CFO focuses on strategic financial leadership, while a controller handles day-to-day operations.

The CFO sets the vision, and the controller ensures its execution through detailed financial management and compliance.

Finance Director vs Financial Controller

Finance directors take a broader approach, often managing external relationships like investors and stakeholders. In contrast, financial controllers handle internal financial processes, ensuring operational efficiency and robust financial controls.

When Does a Company Need a Financial Controller?

As businesses grow and operations become more intricate, financial processes often grow faster than existing systems and management capabilities. A financial controller becomes essential during such times to ensure financial stability, strategic growth, and compliance.

Here are some key indicators that signal your company needs a financial controller:

1. Rapid Growth & Increased Complexity

When businesses scale quickly, financial complexity grows. A financial controller becomes indispensable for managing increased transactions, diversified revenue streams, and broader operational scopes.

Indicators of Need

- Sudden spikes in sales and revenue.

- Challenges in reconciling accounts due to transaction volume.

- Difficulty managing payroll, vendor payments, and tax obligations.

2. Expanding to New Markets

Expansions into new geographical markets or industry sectors introduces regulatory, tax, and operational challenges that require specialized oversight.

Key Considerations

- Understanding and managing different tax laws, tariffs, and import/export duties.

- Handling multi-currency transactions.

- Ensuring compliance with international accounting standards (e.g., IFRS).

3. Enhanced Reporting Needs

As businesses mature, financial reporting requirements become more sophisticated, demanding granular insights for decision-making.

How Controllers Help

- Creating detailed financial dashboards segmented by departments, products, or regions.

- Preparing forecasts to guide resource allocation and growth strategies.

- Providing profitability analysis for new initiatives or product lines.

4. Regulatory Compliance

With increasing size and complexity, businesses face stricter regulatory and compliance obligations. Controllers ensure adherence to these requirements, minimizing the risk of penalties and reputational damage.

How Controllers Help

- Implementing financial policies aligned with regulations.

- Conducting regular internal audits to identify compliance gaps.

- Preparing accurate filings for tax authorities, regulatory bodies, or investors.

5. Better Cash Flow and Risk Management

Maintaining steady cash flow and mitigating financial risks are vital for business survival. Controllers help manage both aspects efficiently.

Cash Flow Management

- Optimizing payment schedules for vendors and clients.

- Predicting short-term and long-term cash needs through robust forecasting models.

Risk Mitigation

- Identifying and addressing currency fluctuation risks, supply chain disruptions, or customer defaults.

- Implementing internal controls to detect and prevent fraud.

6. Leadership Bottlenecks

Business owners or CFOs often find themselves overburdened with financial tasks, detracting from their strategic focus. A financial controller can take on operational financial management, freeing leadership to focus on growth and innovation.

Indicators of Need

- Leadership spending excessive time on financial reconciliations or audits.

- Missed opportunities for strategic initiatives due to financial distractions.

7. Demand for Strategic Financial Insights

As businesses evolve, executives demand actionable financial insights for strategic planning and decision-making. Financial controllers provide this guidance through:

- Identifying trends from historical financial data.

- Forecasting future scenarios using advanced models.

- Advising on investment opportunities, cost-cutting measures, or new revenue streams.

What Does a Financial Controller Do?

A financial controller is a key figure in ensuring a company’s financial health. Their responsibilities go beyond traditional accounting tasks, encompassing strategic decision-making and operational efficiency. Below is a detailed breakdown of their core functions:

1. Assisting In Financial Reports And Analysis

Financial controllers oversee the preparation, review, and interpretation of critical financial reports. These include:

- Income Statements: Reflecting the company’s profitability over a specific period.

- Cash Flow Statements: Providing insights into the company’s liquidity and cash management.

- Balance Sheets: Offering a snapshot of assets, liabilities, and equity.

How Controllers Add Value

- Analyze trends in financial data to guide strategic decisions.

- Identify discrepancies or anomalies in financial records, ensuring accuracy.

How Sage Expense Management (Formerly Fyle) Can Help

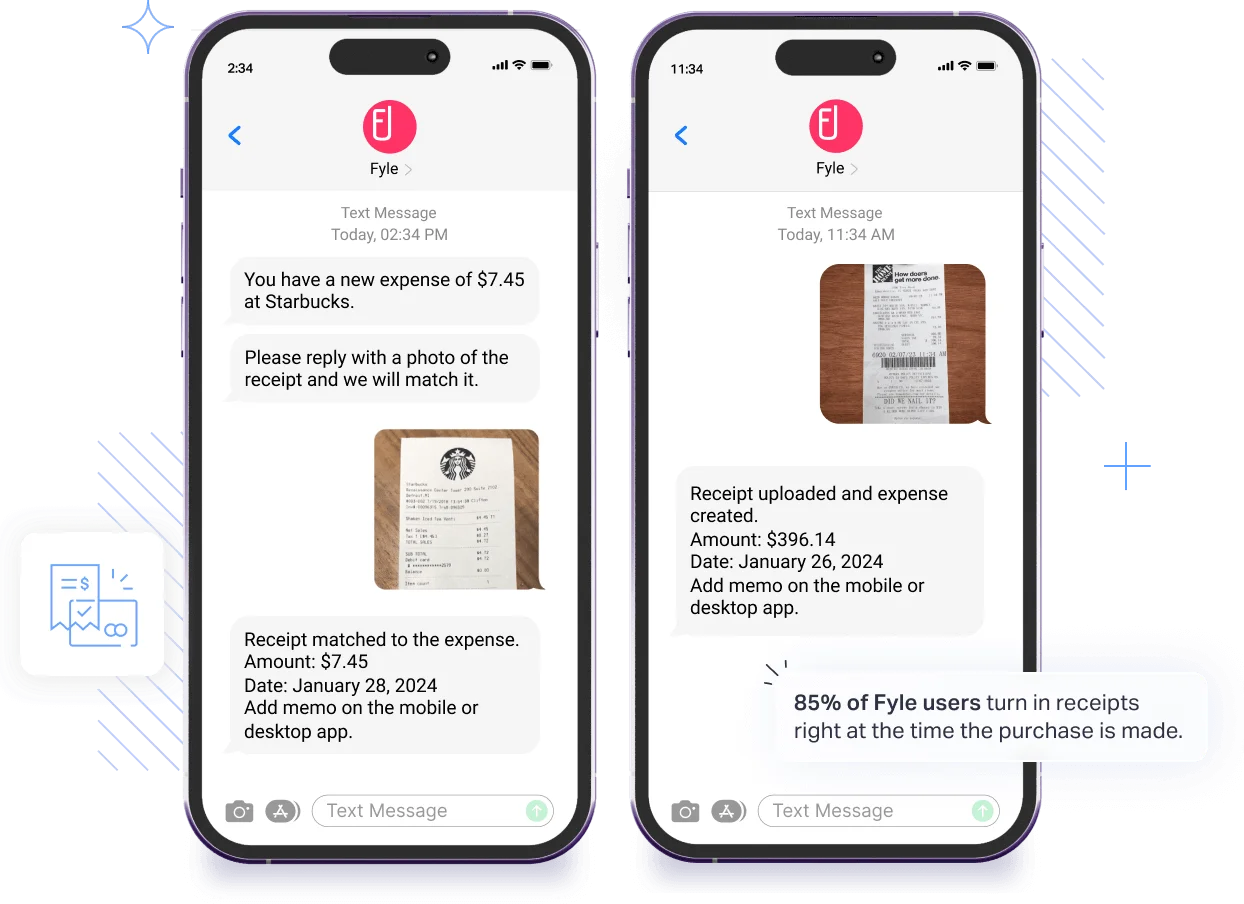

Sage Expense Management directly supports these efforts by providing real-time expense tracking and reconciliation. Its integration with credit card networks like Visa and Mastercard ensures immediate text notifications for every transaction.

Employees can reply with a receipt image, and Sage Expense Management automatically reconciles the data, allowing controllers to detect anomalies faster, maintain accurate records, and focus on strategic financial analysis.

Carry Out Budgeting And Forecasting Tasks

Budgeting and corecasting are essential to planning a company’s financial future. Controllers are responsible for:

- Creating Budgets: Collaborating with department heads to allocate resources effectively.

- Forecasting Revenue: Using historical data and market trends to predict future performance.

- Monitoring Variances: Comparing actual performance to budgets and identifying discrepancies.

How Controllers Add Value

- Provide actionable insights to optimize spending and allocate resources strategically.

- Set realistic financial goals that align with the company’s broader objectives.

Ensuring Regulatory Compliance

Compliance with financial regulations is a non-negotiable responsibility for controllers. This includes:

- Monitoring changes in financial laws and ensuring the company adheres to them.

- Preparing accurate tax filings and financial disclosures.

- Conducting internal audits to identify and address compliance gaps.

How Controllers Add Value

- Mitigate risks of fines, penalties, or reputational damage due to non-compliance.

- Ensure that financial operations are transparent and aligned with regulatory standards.

How Sage Expense Management Can Help

Its policy enforcement features detect policy violations in real-time, enabling controllers to correct issues before they escalate. Duplicate detection also ensures accurate expense reporting.

Managing Risks

Effective risk management is critical to safeguarding the company’s financial stability. Controllers play a key role in:

- Identifying Risks: Analyzing market conditions, operational inefficiencies, and internal processes.

- Mitigating Risks: Implementing strategies to address financial uncertainties like currency fluctuations or supply chain disruptions.

How Controllers Add Value

- Anticipate and respond to financial challenges proactively.

- Protect the company’s assets from fraud, inefficiencies, or market downturns.

How Sage Expense Management Can Help

Real-time visibility into expenses allows controllers to identify unauthorized transactions and overspending, addressing risks instantly.

Applying Internal Controls

The financial controller is also in charge of implementing internal financial controls. This contributes to ensuring the accuracy and reliability of financial reporting and prevents fraud and financial mismanagement.

They also overlook implementing and maintaining internal controls and procedures designed to optimize efficiency, safeguard assets, and prevent fraud. It usually involves setting up procedures for cash handling, approving expenses, and conducting regular internal audits. Implementing such data-backed controls help ensure the accuracy and reliability of financial reporting and compliance with laws and regulations.

Also Read

Skills the Financial Controller Should Have

The role of a financial controller is multifaceted, demanding a diverse set of skills to meet its complexities and responsibilities. Below is a breakdown of the essential skills every financial controller needs:

Let’s explore some of the critical skills of the financial controller:

1. Analytical Skills

Analyzing financial data is a core responsibility of financial controllers. Strong analytical skills enable them to:

- Draw meaningful conclusions from complex data.

- Use insights to inform and drive business strategies.

Controllers are adept at navigating through vast spreadsheets, ensuring the organization's financial health while steering it away from risks and toward growth opportunities.

Financial Acumen

Financial controllers must have a deep understanding of financial principles to:

- Interpret financial statements, such as income statements, balance sheets, and cash flow reports.

- Manage budgeting, forecasting, and financial analysis with precision.

Their expertise connects the company’s financial performance to the broader market landscape, allowing them to act as strategic guides. Controllers illuminate the path forward, ensuring informed decision-making in the often uncertain world of corporate finance.

Regulatory Knowledge

Navigating evolving financial regulations is a key challenge for controllers. Their responsibilities include:

- Staying updated on changes in laws and compliance requirements.

- Translating complex regulations into actionable steps for the company.

- Ensuring every aspect of the business meets legal standards to avoid penalties and reputational risks.

Due Diligence

Due diligence is vital to protecting a company from financial and legal risks. Controllers are responsible for:

- Scrutinizing all financial operations to ensure accuracy.

- Identifying and mitigating unforeseen risks.

- Maintaining adherence to regulatory standards at every step.

Attention to detail is paramount, ensuring every transaction and process is flawless and compliant.

Budgeting And Forecasting

Planning and monitoring the company’s financial future is another key area where controllers excel. They:

- Collaborate with departments to create realistic budget proposals.

- Monitor actual spending and compare it to the budget to identify variances.

- Predict future financial performance using market trends and internal data.

Key Outcome: Strategic thinking and a thorough understanding of the company's operations enable controllers to align budgets and forecasts with overall business goals.

IT Proficiency

With technology transforming financial operations, IT proficiency is no longer optional. Controllers need:

- Expertise in financial software and systems.

- Familiarity with fintech developments to streamline processes.

- The ability to integrate advanced tools for efficiency and better decision-making.

This technological competence ensures controllers can navigate digital transformations, keeping their organizations competitive and future-ready.

Financial Controller Salary Benchmarks

In the U.S., financial controllers earn between $184,337 and $343,287 annually, depending on experience, location, and industry. Companies like Apple, Amazon, and Tesla rank among the top-paying employers.

How to Become a Financial Controller? Qualifications and Skills

The journey to becoming a financial controller involves a mix of education, experience, and certifications.

1. Earn a Bachelor’s Degree

Most financial controllers start with a degree in finance, accounting, business administration, or a related field.

- Courses like financial analysis, accounting principles, and business law provide foundational knowledge.

- A strong academic base ensures eligibility for entry-level roles in finance or accounting.

2. Gain Work Experience

Practical experience is crucial for progressing to a financial controller role.

Typical Entry Level Roles

- Accountant

- Auditor

- Financial Analyst

Professionals often spend 5–10 years in such roles, gaining expertise in financial reporting, budgeting, and internal controls.

3. Obtain Certifications

Certifications showcase advanced expertise and improve career prospects. Common certifications include:

- CPA (Certified Public Accountant): Focuses on accounting and auditing.

- CMA (Certified Management Accountant): Emphasizes managerial accounting and financial strategy.

- MBA in Finance: Provides strategic and leadership skills.

Outcome: Enhanced credentials that make candidates competitive for senior roles.

When Does a Financial Controller Become a CFO?

The transition from a financial controller to a Chief Financial Officer (CFO) represents a shift in scope and responsibility.

Strategic Evolution

- As a CFO, responsibilities expand beyond operational financial management to encompass strategic vision and organizational leadership.

- CFOs oversee the company’s long-term financial planning, capital structure, and investor relations.

Some Key Competencies for the Transition

- Leadership: A CFO must inspire and lead cross-functional teams.

- Strategic Thinking: A broader understanding of market dynamics and competitive positioning.

- Advanced Financial Insight: Expertise in mergers, acquisitions, and capital allocation.

Outcome

The CFO role demands a balance between high-level strategic initiatives and the ability to drive financial performance, making it a significant step up from the financial controller position.

Expense Management for Financial Controllers

Managing organization-wide business expenses is one of the most important tasks a financial controller does. Manual expense management practices, though, can lead to a messy financial closing process.

There are two main reasons for this:

One, controllers have less visibility into company spend.

Two, available spending information is often poorly organized and formatted right from the start.

If you’re going to wait till the end of the month to find out where you’ve been spending, chances are, you will always run into some nasty and time-consuming surprises.

This is where Sage Expense Management comes in:

1. Real-Time Receipt Collection and Automated Credit Card Reconciliation

Users can text their receipts to Sage Expense Management, whether it’s for reimbursements or credit card transactions. Its AI will automatically create, code and submit the expense.

It also integrates with major credit card networks like Visa, Mastercard, and American Express. Employees get real-time text notifications as soon as a business credit card is swiped.

They just need to reply with a picture of the receipt, and the expense is automatically reconciled.

2. Automated Policy Compliance

Sage Expense Management’s real-time alerts flag policy violations, allowing controllers to address issues immediately. The duplicate detection module ensures expense accuracy and reduces the risk of fraudulent claims.

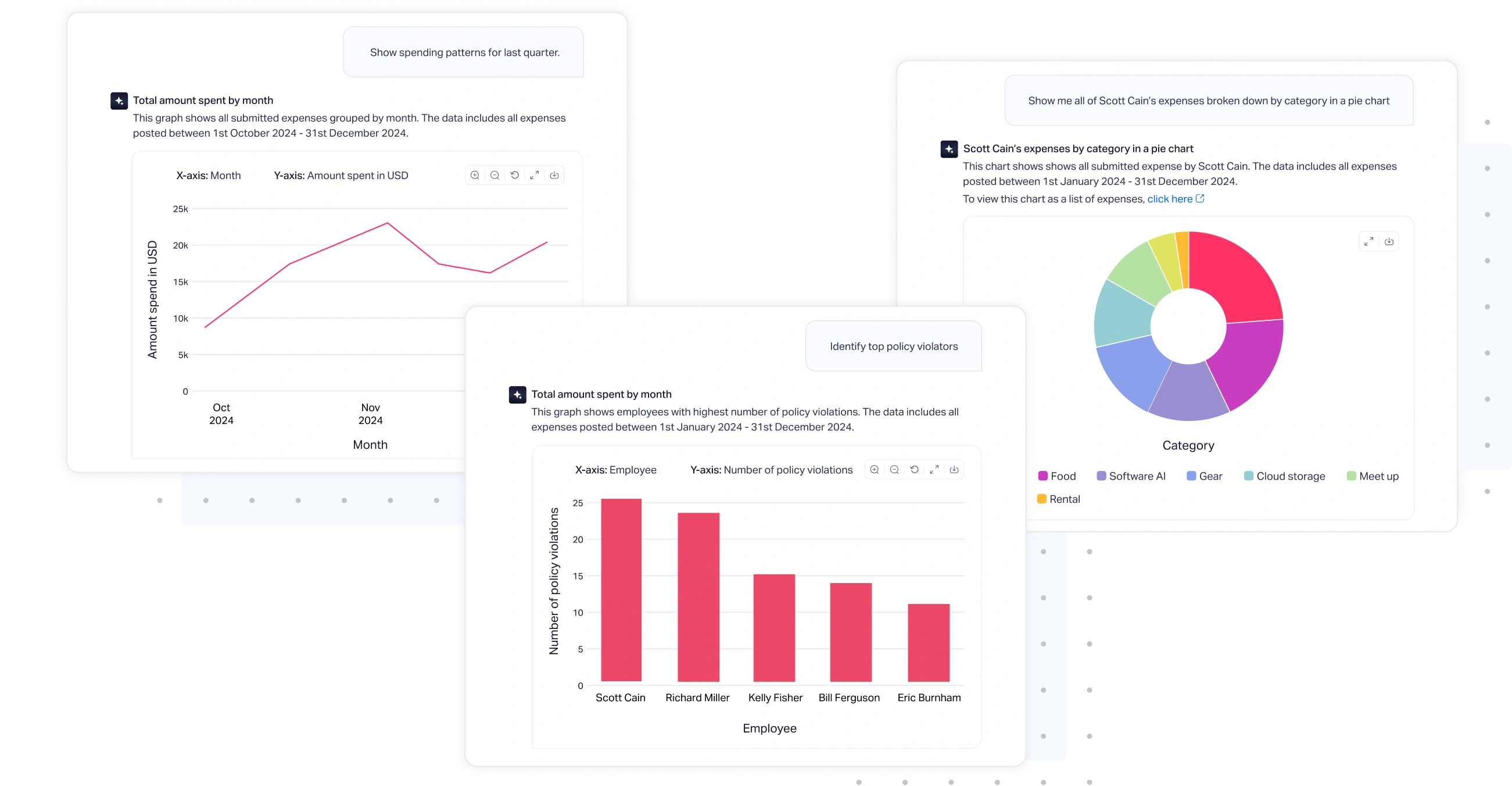

3. Instant AI Insights into Spend

AI-powered insights deliver comprehensive spend data segmented by category, department, merchant, or employee. Identify trends, risks, and inefficiencies instantly to drive actionable decisions with Sage Expense Management CoPilot.

It reduces your reliance on end-of-month reconciliations, enabling smoother financial closings and faster reporting. You also gain an AI-enhanced overview of expenses across teams, departments, or projects for better decision-making.

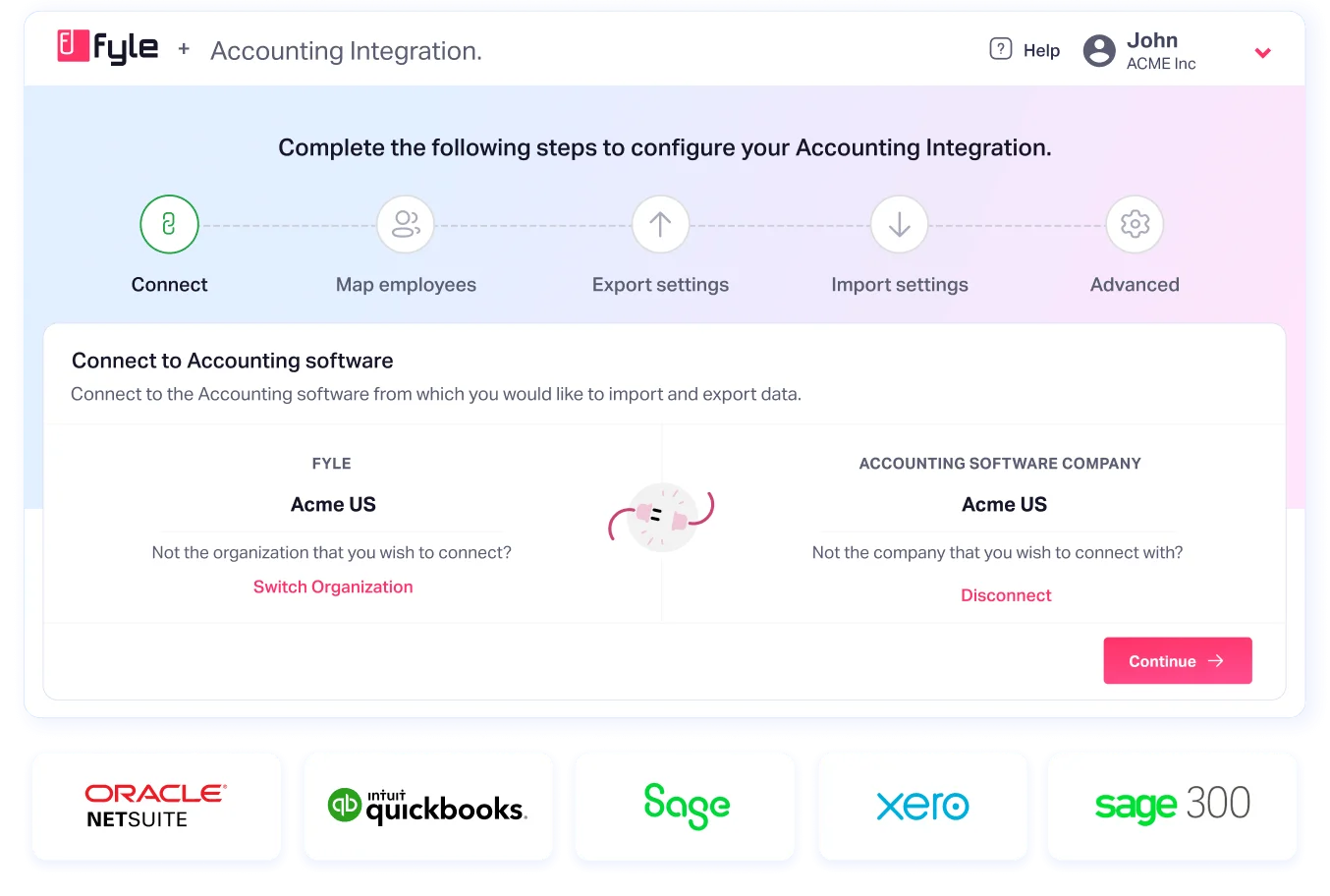

4. Seamless Accounting Integrations

Sage Expense Management integrates with popular accounting platforms like QuickBooks, Xero, Sage Intacct, and NetSuite to imports critical data such as GL codes, departments, and projects automatically.

You can also export expenses as bills, journal entries, or charges, streamlining workflows and saving time.

In Conclusion

Financial controllers play a vital role in steering organizations toward financial health and stability. By leveraging tools like Sage Expense Management, they can automate routine processes, maintain compliance, and focus on strategic initiatives that drive growth.