4.6/51670+ reviews

4.6/51670+ reviewsBusiness travel is an investment, but it also comes with risks, such as flight cancellations, medical emergencies, or lost baggage. Business travel insurance is a common way to protect that investment. For accountants and small business owners, understanding how to account for the cost of this insurance is crucial for accurate bookkeeping and tax filing.

While the IRS does not list "travel insurance" as a specific line item, its cost is deductible if it meets the criteria for an ordinary and necessary business expense. This guide will clarify how to categorize travel insurance premiums, the rules that apply, and how automation can help you track these expenses accurately.

The premiums you pay for business travel insurance are generally deductible as an ordinary and necessary business expense. According to IRS Publication 535, an ordinary expense is one that is common and accepted in your trade or business, and a necessary expense is one that is helpful and appropriate. Insurance that protects your business from financial loss during travel clearly meets this standard.

You can categorize this expense in one of two primary ways:

Regardless of the category you choose, consistency is crucial for maintaining accurate financial records.

When deducting travel insurance premiums, several key IRS rules should be considered.

The most critical rule is that the insurance must be for business-related travel. If a trip combines business and personal travel, you can only deduct the portion of the insurance premium that covers the business part of your trip.

According to IRS Publication 463, if a trip within the U.S. is primarily for business but you extend your stay for a vacation, you can only deduct business-related expenses. The same principle applies to the insurance coverage for that trip. You must allocate the cost and cannot deduct the portion that covers your personal vacation days.

IRS Publication 535 states that you generally cannot deduct expenses paid in advance. For insurance, this means you can only deduct the premium for the year to which it applies.

For example, if you buy an annual, multi-trip travel insurance policy on July 1, 2024, you can only deduct the portion of the premium that covers the remaining six months of 2024. The rest is deducted in 2025.

It is important to note that you cannot deduct amounts you credit to a self-insurance reserve fund. The IRS only allows deductions for premiums paid to a third-party insurance provider.

You purchase a single-trip insurance policy for a 10-day trip to London. You spend 7 days in business meetings and 3 days sightseeing. You can only deduct the portion of the premium that covers the 7 business days.

An insurance policy purchased for a purely personal vacation, even if you answer a few work emails while you are away.

To claim a deduction for business travel insurance, you must follow IRS rules for substantiation.

For a sole proprietor filing a Schedule C (Form 1040), travel insurance premiums can be included with other travel costs on Line 24a, "Travel." Alternatively, they can be listed as a separate line item under Line 27a, "Other expenses."

As with all business expenses, you must have adequate records to prove the deduction. You cannot deduct estimated costs. Your records should include:

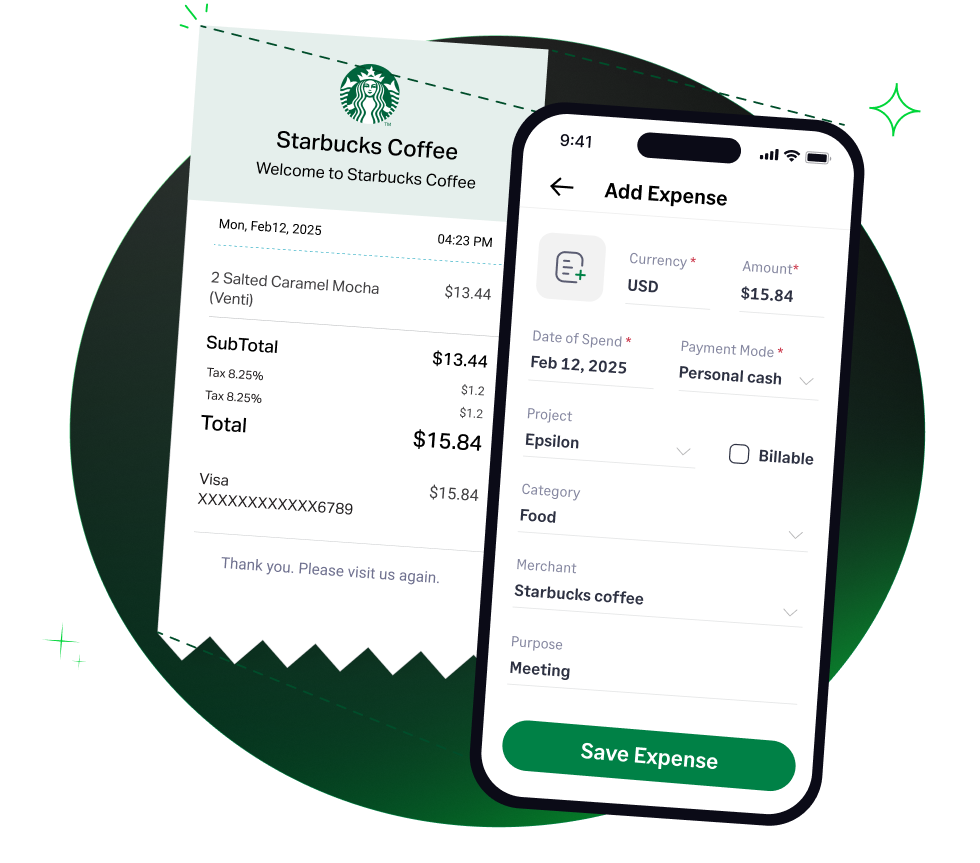

Tracking insurance policies and allocating costs for each business trip can be a complex process. Sage Expense Management simplifies this by allowing employees to instantly submit policy documents and receipts via email or by texting a picture of the document.

Our AI-powered engine automatically captures the expense data and attaches the policy document, creating a complete record for audit purposes. The travel insurance expense can then be coded to a specific "Project" or trip name, allowing accountants to easily group all costs related to a single business trip for a clear view of the total travel cost.

This automation is especially valuable for accounting accuracy. We integrate directly with major accounting software like NetSuite, Sage Intacct, and QuickBooks. For annual policies that need to be prorated across tax years, accountants have a clear, dated record of the purchase, simplifying the process of making the correct journal entries.

Once an expense is approved, the deductible portion of the premium is synced seamlessly to the correct GL account, saving time on manual data entry and ensuring your financial records are always accurate.