4.6/51670+ reviews

4.6/51670+ reviewsFor startups and growing companies, managing equity, stock options, valuations, and cap tables is a critical and often complex task. Platforms like Carta offer specialized software and services to simplify these processes. For accountants and Small to Medium-sized Business (SMB) owners, understanding how to categorize expenses related to Carta is important for accurate financial reporting and tax compliance.

This guide will explore how Carta expenses are typically categorized, key considerations for their classification, examples of these costs, their tax implications under IRS guidelines, and how Sage Expense Management (formerly Fyle) can assist in streamlining the tracking of these specialized business expenditures.

Carta provides a platform and services primarily for cap table management, equity plan administration, and valuation services (like 409A valuations). Expenses incurred for using Carta are generally considered ordinary and necessary operating expenses, especially for companies that issue equity to employees or are preparing for fundraising or an exit.

In an accounting system, these expenses can be classified under several categories depending on the specific service:

For new companies, costs incurred to set up the initial cap table, establish the first equity plan, or conduct an initial 409A valuation before or as part of the company's formation and before active business operations commence might be considered start-up costs (under Section 195) or organizational costs (under Section 248 for corporations or Section 709 for partnerships). These rules allow for a potential immediate deduction of up to $5,000 for each type of cost, with the remainder amortized over 180 months (15 years).

Carta may offer packages that bundle platform access with services like 409A valuations. Businesses should understand the components. If a significant portion is for a distinct professional service (like a valuation), it may be appropriate to allocate or classify based on the dominant feature or separate itemization if available.

Maintain detailed records for all Carta expenses, including:

Common expenses a business might incur with Carta include:

Fees paid for Carta's platform subscription and related professional services (like 409A valuations), when used for managing the company's equity and maintaining compliance, are typically deductible as ordinary and necessary business expenses.

As mentioned, if specific Carta services are integral to the formation or launch of a new business, they might be treated under the rules for start-up or organizational costs (potential $5,000 immediate deduction, with the balance amortized over 180 months).

Standard SaaS subscription fees for platforms like Carta are generally expensed as incurred and not capitalized as a long-term intangible asset by the subscribing company. This is different from the cost of purchasing or developing custom software.

Any applicable sales tax on Carta's services or software subscription would be part of the total deductible expense.

Businesses must keep clear records, including service agreements, invoices, and proof of payment, to support the deductions claimed for Carta expenses.

Effectively managing payments for SaaS subscriptions and professional services like those from Carta is crucial for financial control. Sage Expense Management can assist in several ways:

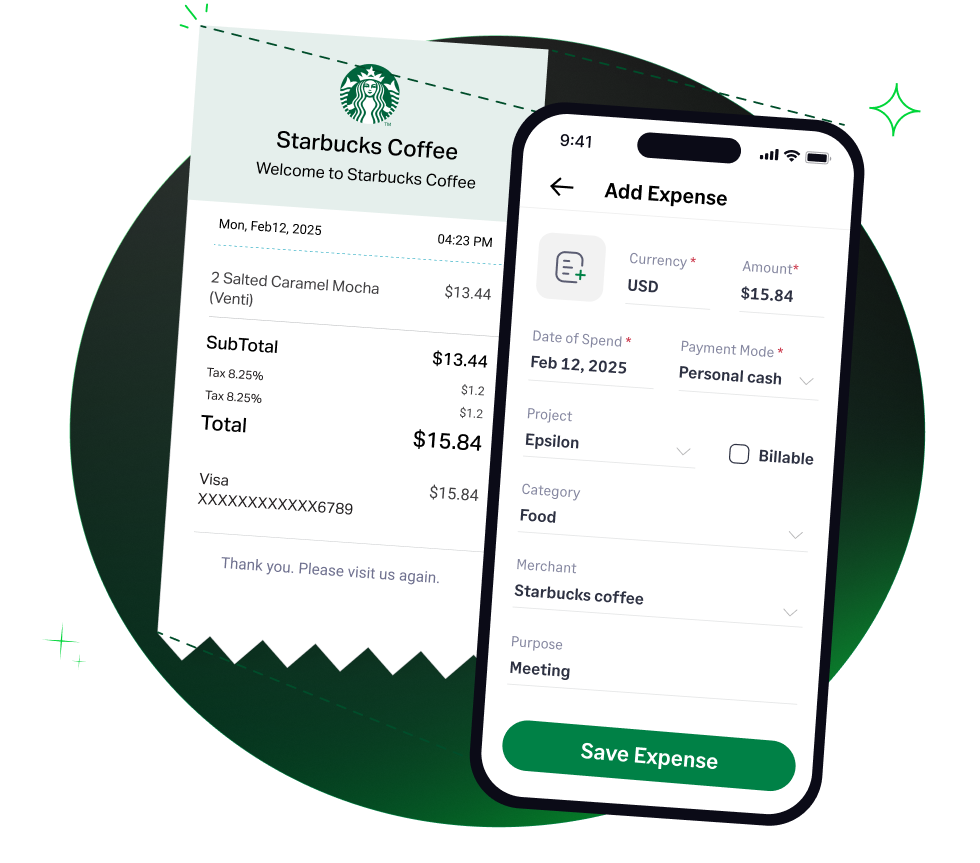

Sage Expense Management can help track and manage the recurring subscription fees for the Carta platform, ensuring payments are accounted for.

For significant expenditures like annual subscription renewals or engagement for valuation services, Our customizable approval workflows can ensure proper internal authorization is obtained and documented before payment.

Our dashboards and reporting tools provide clear visibility into spending on financial technology, professional services, and compliance tools. This helps businesses manage budgets, track vendor expenses, and understand their overall administrative and compliance costs.

All contracts, invoices, and payment confirmations related to Carta services can be stored centrally within Sage Expense Management, creating an easily accessible and audit-ready record.

By utilizing Sage Expense Management to manage expenses for services like Carta, businesses can ensure meticulous recordkeeping, improve the accuracy of their financial data, streamline internal controls, and simplify the process of accounting for these specialized operational costs.