4.6/51670+ reviews

4.6/51670+ reviewsModern businesses run on the cloud. From hosting websites and managing customer data to everyday software applications, companies increasingly rely on cloud computing services. These services are typically delivered in one of three models: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), or Software as a Service (SaaS).

For accountants and business owners, this shift raises a critical question: how do you treat these costs for tax purposes? Are they a utility, a software purchase, or a rental? The answer determines how and when you can deduct them. This guide will break down the IRS rules for cloud computing expenses and explain how to categorize them for maximum tax compliance.

The IRS does not have a single, dedicated category for "cloud computing." Instead, these costs are treated as ordinary and necessary business expenses and are generally classified based on the nature of the service being provided. Most cloud computing costs are not capital expenditures; they are operating expenses that can be deducted in the year they are paid or incurred.

The most appropriate way to think about cloud computing costs, based on IRS principles, is to consider them as a rental or subscription expense. As detailed in IRS Publication 535, you can deduct rent for property you use in your business but do not own. This principle also applies to cloud services, where you effectively rent computing resources or lease access to software.

Therefore, cloud computing expenses typically fall into these categories on a company's books:

The key to correctly handling these costs is understanding the difference between subscribing to a service versus purchasing or developing an asset.

If you prepay for a cloud service subscription that extends substantially beyond the end of the current tax year, you cannot deduct the entire amount at once. IRS Publication 535 requires you to deduct the expense only for the period to which it applies.

For example, if you pay for a 3-year SaaS subscription upfront in 2024, you can only deduct the portion of the cost that covers the 2024 period. The rest must be deducted in 2025 and 2026.

The rules change significantly if you use cloud services (like IaaS or PaaS) to develop your own software. Per IRS Publication 535, costs related to developing software must be capitalized and amortized over a 5-year period (or 15 years for foreign research).

This means that the fees you pay to a provider like AWS or Azure during the development phase of your own software product are not immediately deductible and must be amortized over time.

These are ready-to-use software applications that can be accessed over the internet. The monthly or annual fees are deductible as operating expenses.

Example: Salesforce, QuickBooks Online, Sage Expense Management, Microsoft 365, Slack, Dropbox.

This is where you rent IT infrastructure—servers, storage, and networking—from a cloud provider. Your pay-as-you-go fees are deductible operating expenses.

Example: Amazon Web Services (AWS), Microsoft Azure, Google Compute Engine.

This provides a platform that allows customers to develop, run, and manage applications without the complexity of building and maintaining their own infrastructure. The subscription fees are deductible as operating expenses.

Example: Heroku, AWS Elastic Beanstalk, Google App Engine.

For a sole proprietor filing a Schedule C (Form 1040), cloud computing expenses can be deducted under Line 20a Rent or lease - Vehicles, machinery, and equipment, or as a separate line item under Line 27a Other expenses, such as Software Subscriptions.

The IRS requires that you keep supporting documents for all your business expenses. For cloud computing services, this includes:

These documents must clearly display the payee, the amount paid, the date, and a description of the service to demonstrate that the expense was incurred for business purposes.

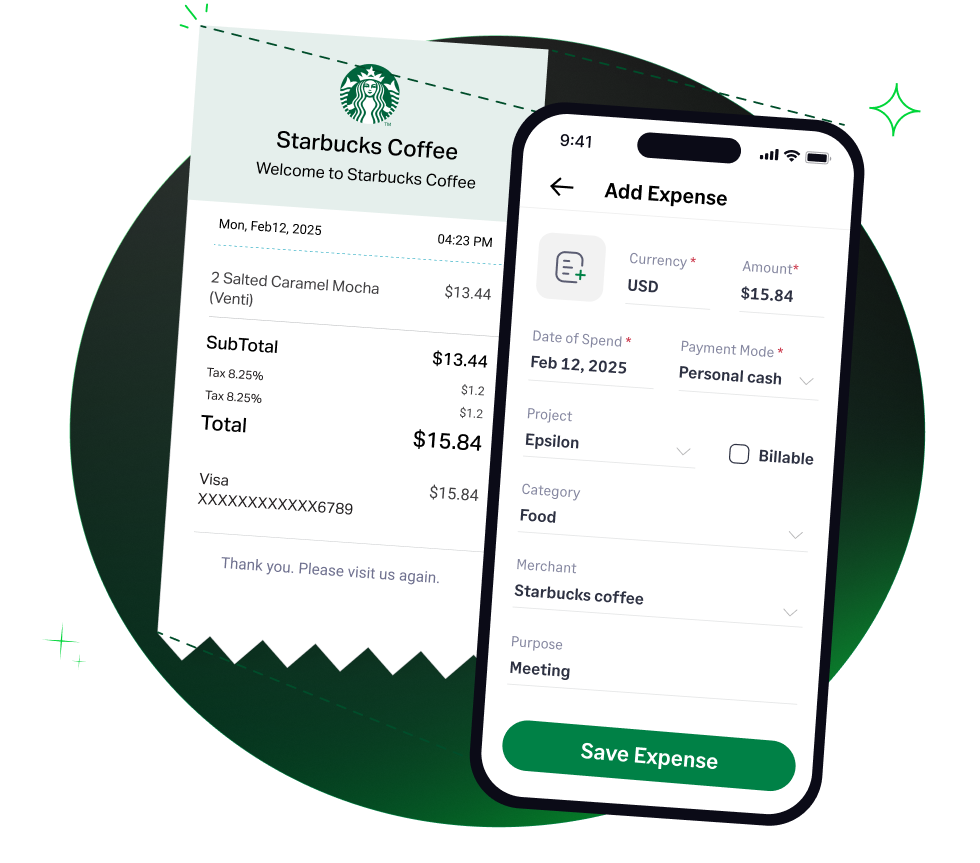

With dozens of recurring SaaS subscriptions and variable IaaS bills, manually tracking cloud spend is a major challenge for finance teams. Sage Expense Management automates this entire workflow, from payment to accounting.

When a recurring subscription fee is charged to a business credit card, our real-time feeds capture the transaction instantly. This gives an immediate view of all your cloud spending across the organization.

You can create specific expense categories, such as "SaaS Subscriptions" or "Cloud Hosting," in Sage Expense Management. Then, set up rules to automatically categorize every recurring charge from vendors without manual intervention.

Email invoices can be forwarded directly to a dedicated email address, where our AI engine will extract the data and automatically attach the invoice to the corresponding transaction. This creates a complete, audit-ready record while eliminating the need to hunt through inboxes.

Our direct, two-way integrations with accounting software, including NetSuite, Sage Intacct, QuickBooks, and Xero, ensure that all your fully coded and documented cloud expenses are synced directly to your general ledger in real-time.