4.6/51670+ reviews

4.6/51670+ reviewsIn an increasingly digital world, tools that streamline document workflows and enable secure electronic signatures are essential for businesses of all sizes. DocuSign is a leading platform in this space, helping companies accelerate agreements and simplify processes. For accountants and SMB owners, correctly categorizing DocuSign expenses is vital for accurate financial statements, effective cost management, and compliant tax reporting.

This article will explore how DocuSign expenses are typically categorized, important factors to consider during classification, common examples of these expenses, their tax implications, and how a modern expense management system like Sage Expense Management (Formerly Fyle) can help automate their tracking.

DocuSign is a Software as a Service (SaaS) offering, and its costs are generally subscription-based. When categorizing DocuSign expenses in your accounting system, the following categories are commonly used:

This is often the most precise category for DocuSign. It represents a recurring payment for the use of a software platform that provides a specific business service. Many businesses maintain this category for all SaaS tools. The Ramp example pages also show "Software Subscription" as a common category.

This is a broader category that can include various recurring charges for business services, including software like DocuSign. If your chart of accounts is simpler, DocuSign might fit here.

Some businesses might include DocuSign under general office expenses, especially if its use is widespread across administrative functions and not tied to a specific department like sales or marketing. IRS Publication 334 refers to this as a general category for Schedule C filers.

While DocuSign itself isn't a legal service, if its primary use is by the legal department or for executing legal documents, some businesses might track it as part of their legal tech stack, though it's typically still booked as software. The service facilitates professional workflows.

If no other category seems fitting, DocuSign can be classified under a general "Other Business Expenses" or "General and Administrative Expenses." IRS Publication 334, Chapter 8, allows for various expenses necessary for business operations.

Choosing the right category depends on your company's internal accounting structure and the primary use of DocuSign. Consistency in applying the chosen category is paramount for accurate financial analysis.

DocuSign costs are typically recurring subscription fees (monthly or annual) for accessing its e-signature and document management platform. This differs from a one-time capital purchase.

DocuSign is used for executing contracts, client agreements, internal approvals, HR documents, and more. These are "ordinary and necessary" business activities for most companies, supporting the expense's legitimacy.

If you pay for a DocuSign subscription annually, it's a prepaid expense. IRS Publication 535, Chapter 1, explains that expenses creating a benefit that extends substantially beyond the current tax year may need to be capitalized and amortized.

However, a key exception (the "12-month rule") often allows for current deduction if the benefit does not extend more than 12 months beyond the first date the benefit is realized or beyond the end of the tax year following the year of payment.

For cash-basis taxpayers, an annual DocuSign subscription would likely fall under this rule and be deductible in the year paid. Accrual-basis taxpayers would typically amortize the expense over the subscription term.

If DocuSign is used by multiple departments (e.g., Sales, Legal, HR, Operations), your business might choose to allocate its cost across these departments for internal budgeting and reporting, even if it's booked under a single expense category like "Software Subscriptions" in the general ledger.

Maintain all DocuSign invoices and proof of payment. This is crucial for substantiating the expense for both accounting and tax purposes, as emphasized in the IRS "What kind of records should I keep?" document.

Your business might incur several types of expenses related to using DocuSign:

Correctly handling DocuSign expenses on your tax returns is important for compliance and ensuring you claim all allowable deductions.

As an ordinary and necessary business expense used in the operation of a trade or business, DocuSign subscription fees are generally tax-deductible. This deduction reduces your overall taxable income.

For sole proprietors and single-member LLCs filing Schedule C (Form 1040), DocuSign expenses can typically be reported under "Office expenses" (Part II, line 18) or "Other expenses" (Part II, line 27a), specifying "Software Subscriptions" or a similar description. IRS Publication 334 provides guidance for Schedule C filers.

For corporations and partnerships, these expenses would be reported on the respective business tax returns (e.g., Form 1120, Form 1065) under similar categories like software, subscriptions, or general operating expenses.

The IRS requires businesses to maintain adequate records for all deductions. For DocuSign, ensure you keep:

As noted earlier, annual subscriptions paid upfront by cash-basis taxpayers may be deductible in the year of payment under the 12-month rule. Accrual-basis taxpayers generally deduct the expense over the service period.

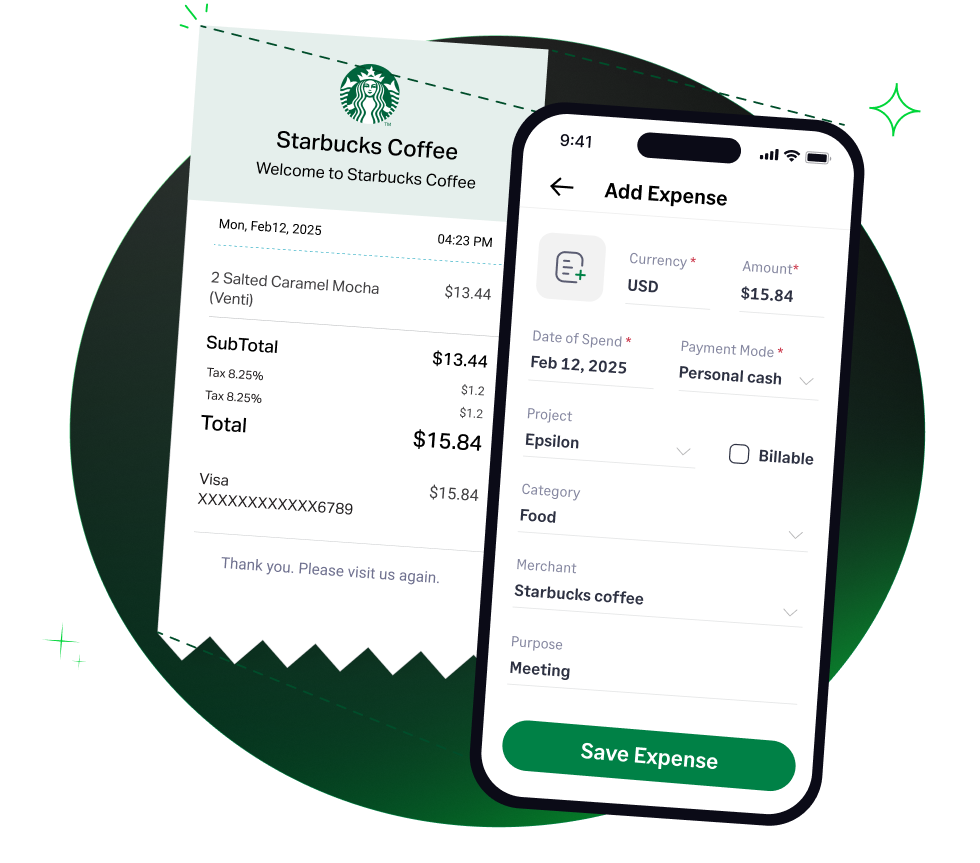

Managing recurring software subscriptions like DocuSign can become a hassle with manual processes. Sage Expense Management offers powerful automation to streamline the tracking of these expenses:

If your DocuSign subscription is paid with a company Visa, Mastercard, or American Express card, our real-time feeds will capture the transaction data almost immediately after the charge occurs. This provides instant visibility into subscription payments.

We can automatically identify and import DocuSign e-receipts and invoices from your connected Gmail or Outlook inboxes. This ensures that proof of purchase is always matched with the transaction without manual effort.

You can configure Sage Expense Management to automatically categorize DocuSign expenses to your preferred GL account (e.g., "Software Subscriptions," "Office Expenses") based on the vendor name or other transaction details. This eliminates manual coding and ensures consistency.

We provide robust, two-way integrations with leading accounting software like QuickBooks Online, QuickBooks Desktop, Xero, NetSuite, and Sage Intacct. This means DocuSign expense data, along with its categorization and receipts, flows directly into your general ledger, reducing manual data entry and reconciliation efforts.

If you have budgets allocated for software or specific departmental tools, we can help you monitor spending on DocuSign against these budgets in real-time.

Our dashboards and reporting features provide a clear overview of all expenses, including software subscriptions, allowing for better cost management and identification of all SaaS spend across the organization.

By automating these aspects, Sage Expense Management helps accountants and SMB owners efficiently manage DocuSign expenses, maintain accurate records, and ensure compliance with ease.