Understanding your target market is fundamental to business success. The costs associated with market research—whether for surveys, focus groups, or data analysis—are a necessary investment to guide your strategy, develop new products, and stay ahead of the competition.

However, the tax treatment of these costs is not always straightforward, resulting in a current-year deduction. The IRS has definite rules that depend on when you incur these expenses: before your business begins or during its ongoing operations. This guide will clarify how to categorize market research costs to ensure your business remains compliant with relevant regulations.

Market Research Costs Category

There is no single expense category for market research. The correct classification depends entirely on the timing of the study.

- Startup Cost (Capital Expenditure): If the market research is conducted before your business begins operations, it is considered a startup cost. IRS Publication 535 explicitly lists "An analysis or survey of potential markets, products, labor supply, transportation facilities, etc." as a startup cost that must be capitalized.

- Advertising or Other Expense (Deductible Now): If the market research is for your existing, active business—for example, to test a new product line or understand current customer preferences—it is generally considered an ordinary and necessary business expense. It can be deducted as an Advertising expense or under Other Expenses.

Important Considerations While Classifying Market Research Costs

The most critical factor for accountants and business owners is determining whether the research is for creating a new business or for improving an existing one.

Before Business Begins vs. During Operations

- Before Business Begins (Capitalize): Any market research conducted as part of investigating the creation or acquisition of a new business must be treated as a startup cost. You cannot deduct these costs in the year they are paid. They must be capitalized and amortized.

- During Operations (Deduct Now): Research conducted for an active, ongoing business is a currently deductible expense. This is because the research is helping you operate and grow your current business, not create a new one.

Consumer Surveys

IRS Publication 535 notes that consumer surveys are generally not considered research and experimental expenditures. This reinforces their classification as either a startup cost or a general business/advertising expense, depending on the timing.

Tax Implications and Recordkeeping

The reporting for market research costs depends entirely on their classification.

How to Report the Costs

- Startup Costs: These are capitalized and have a special tax treatment. You can elect to deduct up to $5,000 in the first year of business, with the remainder amortized over 15 years (180 months). This is calculated and reported on Form 4562.

- Deductible Research for an Existing Business: For a sole proprietor, these costs are reported on Schedule C (Form 1040), either on Line 8, Advertising, or Line 27a, Other expenses.

What Records to Keep

You must have documentary evidence to substantiate all market research costs. Your records should include:

- The contract or service agreement with the market research firm.

- Invoices detailing the scope of the research performed.

- Proof of payment for the services.

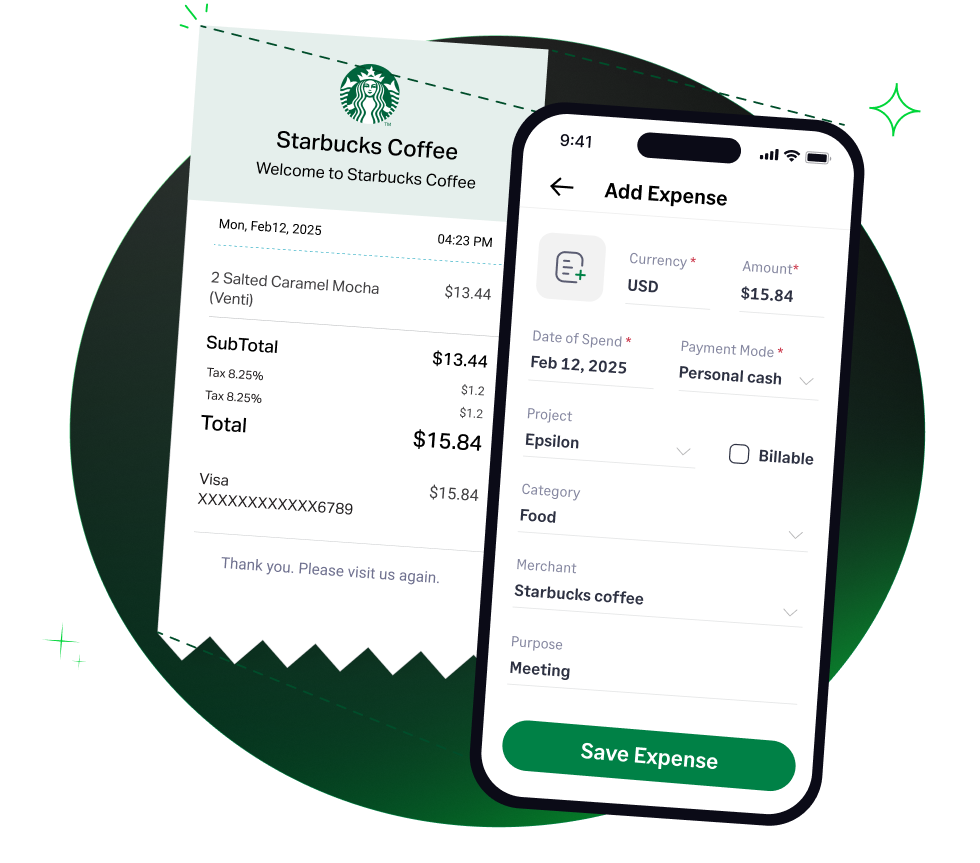

How Sage Expense Management (formerly Fyle) Automates Tracking of Market Research Costs

Sage Expense Management helps you manage and document payments to market research firms, ensuring every invoice is captured and correctly categorized for tax time.

4.6/51670+ reviews

4.6/51670+ reviews