✨ Exciting news: Fyle is now part of the Sage family! Learn more in our press announcement >

4.6/51670+ reviews

4.6/51670+ reviewsIn the grand scheme of business expenditures, the cost of paper clips might seem minuscule. However, for meticulous accountants and Small to Medium-sized Business (SMB) owners, every expense, no matter how small, contributes to the overall financial picture and must be accounted for correctly. Understanding how to categorize even these minor items ensures accurate bookkeeping and that all eligible deductions are claimed.

This guide will address how paper clip expenses are categorized, important considerations for their classification, examples, their straightforward tax implications, and how Fyle can help ensure even the smallest office expenses are tracked efficiently.

Paper clips, along with similar items like binder clips or staples, are quintessential office supplies. Unsurprisingly, for accounting and tax purposes, their costs fall squarely into the Office Supplies or General Office Expenses category.

These are considered ordinary and necessary business expenses, vital for day-to-day administrative tasks and organization within any business environment.

Paper clips are a classic example of de minimis (minor) expenses. They are consumed in the course of business and are not tracked individually as assets due to their low cost and high volume. They are expensed immediately upon purchase or as they are consumed (though most businesses expense them on purchase for simplicity).

Method of Purchase

Whether paper clips are bought in a single small box or in larger quantities for stocking the office supply closet, their accounting treatment as an expense generally remains the same.

For incidental materials and supplies that a business keeps on hand, IRS Publication 535, Chapter 11, states that you can deduct their cost in the year of purchase if:

Due to their consumable nature and low cost, paper clips are never capitalized as assets.

While individual paper clips aren't tracked, the purchase of boxes of paper clips should be documented. This is typically done through receipts from office supply stores or invoices for larger orders, which support the total "Office Supplies" expense claimed.

This category is quite specific but can include:

The "expense" is the purchase cost of these items.

The cost of paper clips and similar small office supplies used in your trade or business is fully deductible as an ordinary and necessary business expense, typically as part of the "Office Supplies" category.

Unlike some other expense categories (e.g., meals or certain travel costs), there are no percentage limitations or complex qualifying rules for deducting the cost of basic office supplies like paper clips.

Keep receipts and invoices for office supply purchases. The IRS recordkeeping guide states that documents for expenses should show the payee, amount paid, proof of payment, date incurred, and a description of the item purchased. While an auditor isn't likely to scrutinize individual paper clip purchases, they will look at the overall "Office Supplies" category, so proper documentation for all such purchases is important.

Even though paper clips are a minor expense, ensuring all office supply purchases are tracked is important for good financial management. Fyle helps capture these, often as part of larger purchases:

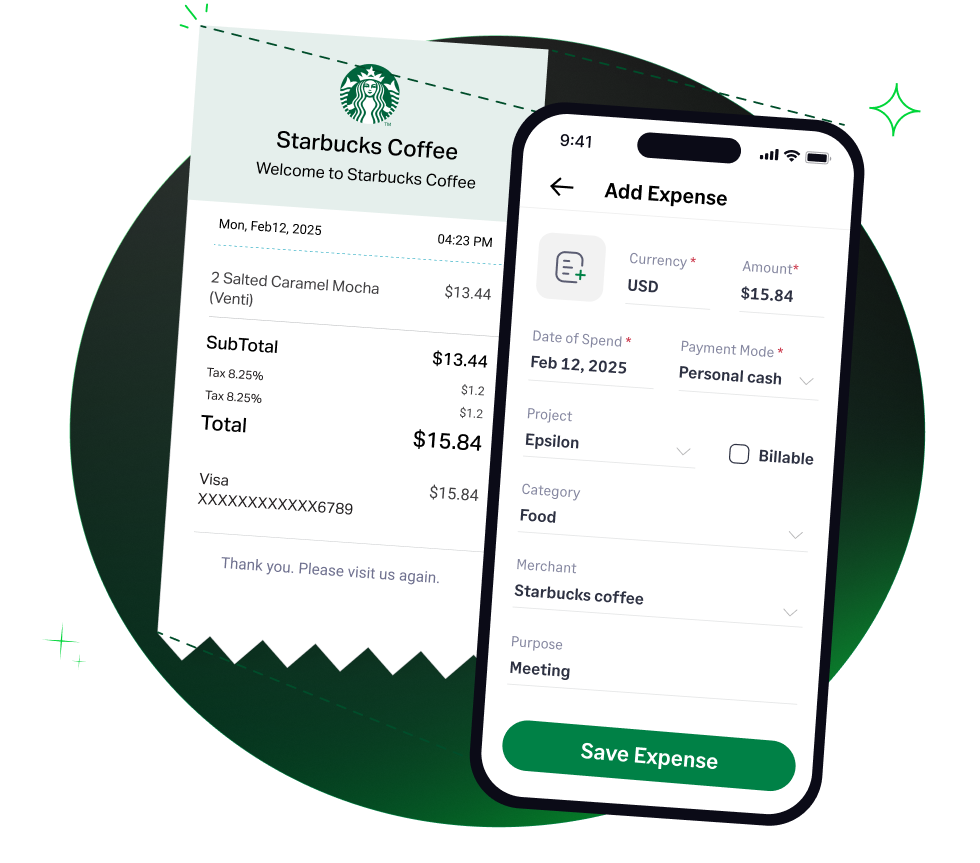

When paper clips are bought, whether as a standalone purchase or as part of a larger office supply order, the receipt or e-invoice can be quickly captured. Employees can submit receipts via SMS, the Fyle mobile app (by snapping a photo), or by forwarding emails from online vendors (like Amazon or Staples) directly to Fyle.

If office supplies, including paper clips, are purchased using a corporate credit card, Fyle’s real-time feeds will automatically import the transaction details. The corresponding receipt can then be easily matched to it.

Fyle can be set up to automatically categorize these types of purchases under "Office Supplies" or a similar designated category, saving manual data entry and ensuring consistency.

Paper clips are often purchased along with other office supplies like pens, paper, and toner. Fyle captures the entire receipt or transaction, ensuring that these small but necessary items are accounted for within the total office supply expenditure.

All office supply expenses, including those for paper clips, are reconciled within Fyle and can be seamlessly exported to your integrated accounting software (such as QuickBooks Online/Desktop, Xero, NetSuite, or Sage Intacct). This ensures your financial records are accurate and complete.

Tracking all office supply expenses, including the minor ones, gives businesses better visibility into operational spending, aiding in budgeting and cost control efforts.

With Fyle, businesses can ensure that even the smallest office supply expenses like paper clips are efficiently documented and accounted for, contributing to a comprehensive and accurate financial overview.