Ensuring worker safety is a top priority for any responsible business, particularly in industries such as construction, manufacturing, and healthcare. The costs of providing Personal Protective Equipment (PPE) such as hard hats, safety glasses, gloves, and high-visibility vests, are a fundamental and necessary cost of doing business.

For tax purposes, these expenses are fully deductible. However, their specific tax treatment depends on the cost and useful life of the equipment. This guide will clarify how to categorize PPE according to IRS rules, ensuring your business remains compliant and maximizes its deductions.

Personal Protective Equipment (PPE) Category

There is no single expense category that applies to all PPE. The costs must be categorized based on whether the item is a consumable supply or a durable piece of equipment.

- Supplies (Currently Deductible): Most common PPE items that are consumed, have a short useful life, or are low-cost are treated as Supplies. IRS Publication 535 allows you to deduct the cost of materials and supplies in the year they are purchased.

- Depreciable Assets (Capitalized): More expensive, durable safety equipment that is expected to last more than one year is a capital expenditure. As explained in IRS Publication 946, these items must be capitalized and recovered over time through depreciation.

Important Considerations While Classifying Personal Protective Equipment (PPE)

The most critical factor is distinguishing between a currently deductible supply and a capital asset that must be depreciated over time.

Durable Equipment vs. Consumable Supplies

- Supplies (Deduct Now): This includes items that are used up quickly or have a low cost. Examples include disposable gloves, safety glasses, hard hats, and high-visibility vests.

- Equipment (Capitalize and Depreciate): This includes more substantial, long-lasting safety gear. An example might be a specialized, reusable respirator system or a fall arrest harness.

The De Minimis Safe Harbor Election

To simplify recordkeeping, IRS Publication 535 provides a de minimis safe harbor election. This allows you to deduct the cost of tangible property in the current year if it falls below a certain threshold (generally $2,500 per item or invoice for businesses without an applicable financial statement). This election is a powerful tool for expensing many types of durable PPE instead of depreciating them.

Distinction from Uniforms

PPE is different from a uniform. While both are provided to employees, uniforms are subject to a strict three-part test to be deductible (e.g., they must not be suitable for everyday wear). Protective clothing, such as steel-toed boots or safety glasses, is deductible because it is required for safety, not because it meets the uniform test.

Tax Implications and Recordkeeping

The reporting for PPE costs depends entirely on their classification.

How to Report the Costs

For a sole proprietor filing a Schedule C (Form 1040):

- Supplies: The cost of consumable PPE is deducted on Line 22, Supplies.

- Depreciation: The annual depreciation deduction for capitalized safety equipment is calculated on Form 4562 and carried to Line 13 of Schedule C. You can also use Form 4562 to make the Section 179 election to expense the full cost of qualifying equipment in the year of purchase.

What Records to Keep

You must have documentary evidence to substantiate all PPE costs. Your records should include:

- Invoices from safety supply vendors.

- Receipts for all PPE purchases.

- Proof of payment, such as canceled checks or credit card statements.

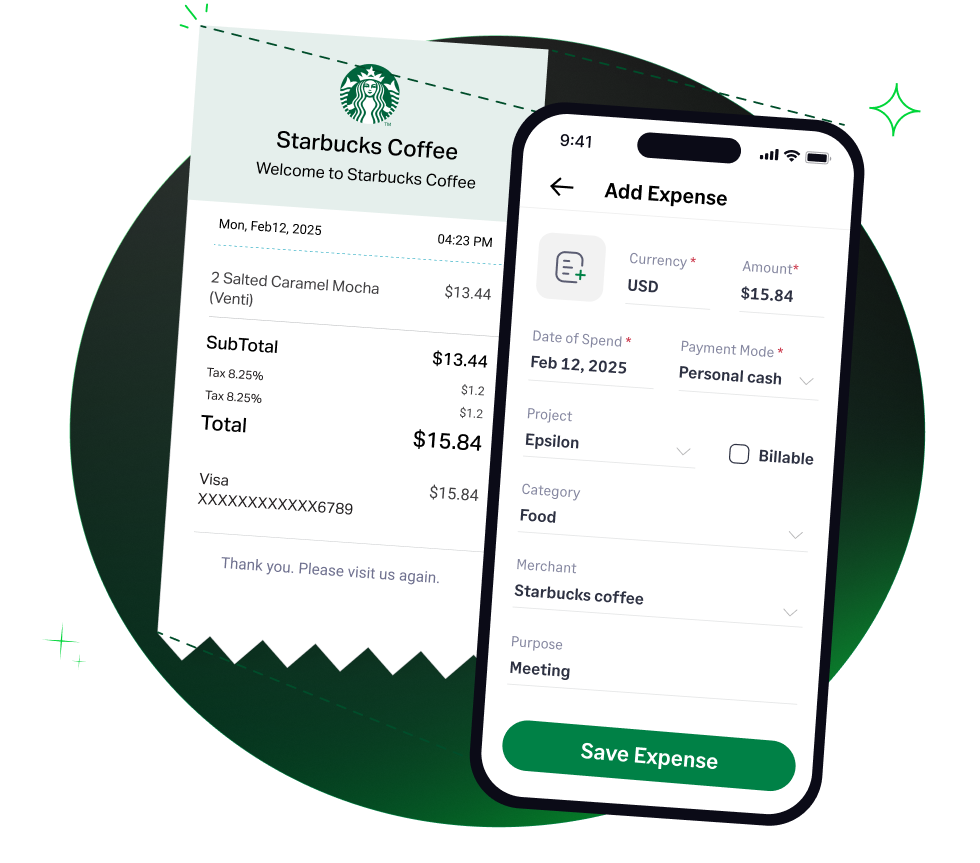

How Sage Expense Management (formerly Fyle) Can Automate Expense Tracking

Sage Expense Management helps you capture and categorize all your safety-related expenses accurately, from recurring supply orders to one-time equipment purchases.

- Capture All Purchases: Instantly capture receipts for PPE from any vendor using the mobile app or email forwarding.

- Track by Job Site or Employee: Code safety gear costs to a specific project or employee for better inventory and cost control.

- Enforce Capitalization Policies: Our policy engine can flag high-cost equipment purchases for review to ensure proper capitalization.

- Automate Your Accounting: Sync all categorized safety expenses to the correct GL account in QuickBooks, Xero, NetSuite, or Sage Intacct.

4.6/51670+ reviews

4.6/51670+ reviews