Nearly every business relies on printed materials to operate and grow. From internal business forms and contracts to external marketing materials like brochures and flyers, the costs for printing and reproduction are a constant and necessary part of doing business.

For accountants and business owners, it's important to know that these costs are a fully deductible business expense. This guide will clarify how to categorize printing costs according to IRS rules, the important distinctions to be made, and how to track these expenses for accurate tax compliance.

Printing and Reproduction Costs Category

The costs you pay for printing and reproduction are an ordinary and necessary business expense. While the IRS does not provide a single, dedicated line item for all printing, these costs are generally categorized based on their purpose:

- Advertising: If the printed materials are used for promotional purposes, such as brochures, flyers, or catalogs, their cost is a deductible Advertising Expense.

- Office Expenses / Supplies: If the printed materials are for internal use, such as business forms, letterhead, or internal reports, their cost is best categorized as Office Expenses or Supplies.

Important Considerations While Classifying Printing and Reproduction Costs

The key to handling these costs correctly is to distinguish between materials used for promotion and those used for administrative or operational purposes.

Advertising vs. Office Supplies

- Advertising Materials: As noted in IRS Publication 535 you can deduct reasonable advertising expenses that are directly related to your business activities. This includes the cost of printing promotional materials designed to attract customers and generate business.

- Office Supplies: The cost of materials and supplies used in the business are also deductible. This covers a wide range of printed items needed for the day-to-day operation of the business.

Circulation Costs for Publishers

For businesses in the publishing industry, there's a special category. IRS Publication 535 explains that costs to establish, maintain, or increase the circulation of a newspaper or periodical are known as Circulation Costs. These have their own unique tax treatment options and are not treated as standard printing expenses.

Tax Implications and Recordkeeping

To deduct your printing and reproduction costs, you must report them correctly and maintain the required documentation.

How to Report the Deduction

For a sole proprietor filing a Schedule C (Form 1040):

- Costs for promotional materials are deducted on Part II, Line 8, Advertising.

- Costs for internal forms and other office-related printing are deducted on Line 18, Office expense.

What Records to Keep

You must have documentary evidence to substantiate your printing expenses. Your records should include:

- Invoices from the print shop or service provider that detail the items printed.

- A copy or sample of the printed material to prove its business purpose.

- Proof of payment, such as a canceled check or credit card statement.

How Fyle Can Automate Tracking for Printing and Reproduction Costs

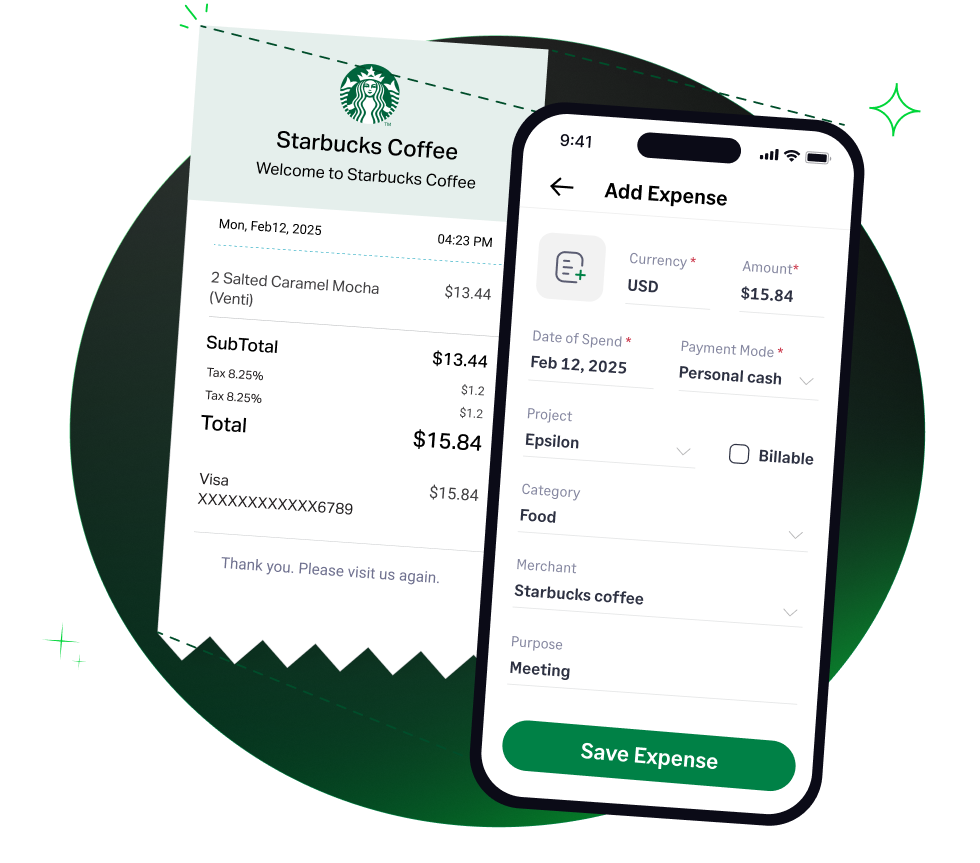

Fyle helps you manage and document all your printing expenses, ensuring every invoice is captured and correctly coded for tax time.

- Centralize Invoices: Have your print vendors email invoices to be forwarded directly to Fyle for automatic and accurate data capture.

- Track by Project or Campaign: Code printing costs to a specific marketing campaign or internal project for precise cost allocation.

- Create a Clear Audit Trail: Fyle keeps the invoice, a sample of the work (if attached), and proof of payment together in one digital record.

- Automate Your Accounting: Sync the categorized printing expense to the correct GL account in QuickBooks, Xero, NetSuite, or Sage Intacct.

4.6/51670+ reviews

4.6/51670+ reviews