Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

The receipt chase ends here, with Sage Expense Management (formerly Fyle).

1775+ reviews

1775+ reviews

Receipt tracking software digitizes and manages receipts for bookkeeping. Using OCR, it scans receipt photos to automatically pull key data like vendor, date, and amount. This eliminates manual entry and syncs with accounting software, saving time and ensuring accuracy.

Choosing the best receipt tracking software depends on your specific needs. Consider these key factors:

Track and submit receipts right from your email or text messages. No training or onboarding required.

Be ready for any IRS audit. Enjoy unlimited, secure and searchable receipt storage with detailed audit logs for better transparency.

Instant receipt submission means finance teams get real-time data. This eliminates the end-of-month scramble and enables you to close your books on time, every time.

Employees get instant reminders to text their receipts right after a credit card transaction. Reply with a photo, and our AI instantly extracts all data using OCR.

The system then prompts for any necessary extra information, categorizes the expense with your GL codes, and automatically matches the transaction. It's the fastest way to get accurate data, minimizing manual work for everyone.

Explore receipt tracking via textUsing our mobile app, employees can easily scan, extract, and manage expense receipts. Just point at a receipt, snap a picture, and let us do all the expense coding automatically.

Explore Sage Expense Management's mobile appWith our plugin, you can submit e-receipts without leaving your inbox. An expense will be created, the information will be extracted, and the receipt will be attached automatically.

Your employees can also forward the receipts they receive in their emails to our receipt forwarding email address, and we will read and create expenses automatically.

Instant notifications about employee credit card spending, receipt collection via text and Slack, and automatic reconciliations without waiting on delayed bank feeds.

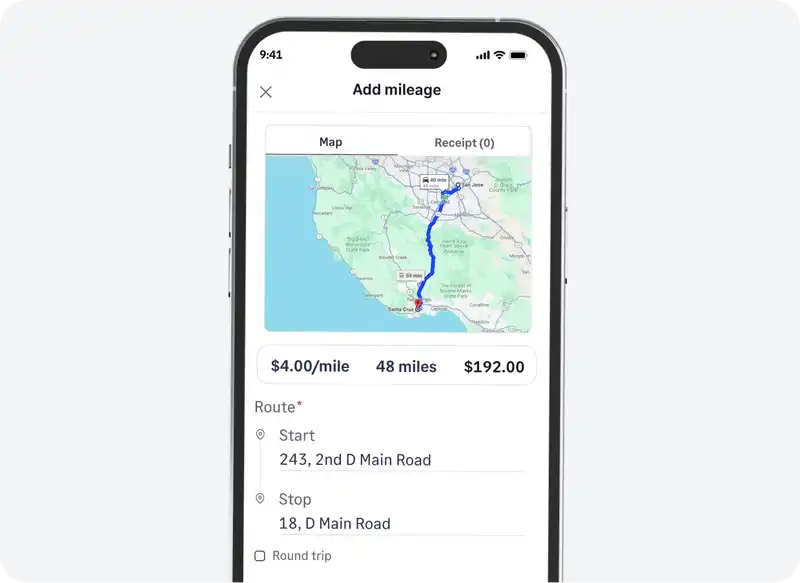

Learn morePowered by Google Maps, we ensure accurate mileage tracking for your employees. Add the starting point, stops, and destination to calculate the distance and mileage automatically.

Learn moreWe support two-way integrations with accounting software like NetSuite, QuickBooks, Sage Intacct, Xero, Sage 50, and Sage CRE to automatically sync all your expense data, GL codes, and more.

Learn moreKey benefits include saving time by automating data entry, improving expense accuracy, and reducing lost receipts. It aids tax compliance, offers real-time spending insight, streamlines reimbursements, and simplifies financial audits for better financial health.

The best receipt tracking software is the one that fits your business's needs. Evaluate options based on how they integrate with your accounting software, ease of use for your team, and their ability to scale with your company's growth to ensure a seamless and valuable solution.

Yes, it's ideal for small businesses. It helps maintain organization, manage cash flow, and saves time on administrative work. It also ensures accurate records for tax deductions and provides a scalable system for managing employee expenses as the business grows.

Yes, digital receipts from tracking software are typically compliant with tax authorities like the IRS. The software helps categorize expenses accurately, making it easier to claim all eligible deductions and providing a clear, accessible audit trail for tax season.

Sage Expense Management simplifies receipt tracking with zero manual effort. Just text a picture of your receipt or forward an email receipt. Our AI automatically extracts all the data, categorizes the expense, and matches it to the correct transaction seamlessly.

Sage Expense Management offers an effortless experience your team will love. Submit receipts via text, email, or other everyday apps. Sage Expense Management integrates directly with card networks to provide real-time reconciliation and offers deep accounting integrations, eliminating manual work and ensuring high adoption rates.

Yes, Sage Expense Management prioritizes your data's security. We employ industry-standard encryption to protect your financial information, both in transit and at rest. Our platform features robust security measures to ensure your sensitive data remains confidential and secure.

Sage Expense Management offers seamless, two-way integrations with major accounting software, including NetSuite, QuickBooks Online, QuickBooks Desktop, Sage 50, Sage Intacct, Sage 300 CRE and Xero. This ensures your expense data is always synchronized, eliminating manual reconciliation and data transfer.