Running a business is a whirlwind. Between juggling clients, projects, and deadlines, expense tracking can easily fall by the wayside. But come tax season, the scramble for receipts and reports creates chaos.

Manually entering data takes up valuable time for both employees and finance teams, and this administrative burden can even hurt your bottom line. This article is your one-stop guide to streamlining small business expense tracking. Let's ditch the stress and dive into a system that saves you time and money.

What are Business Expenses?

According to the IRS, business expenses are ordinary and necessary costs you need to keep your business going. Every business, from small shops to big corporations, records these expenses year-round for tax purposes.

Some expenses, like rent or insurance, typically stay the same each month, making them fixed costs.

On the other hand, expenses such as sales commissions, delivery gas, and shipping costs can vary depending on your business activities, making them variable costs. This means they're expected costs, but the amount can increase or decrease based on your business needs.

Why Should You Track Business Expenses?

Tracking expenses regularly gives you insight into the most up-to-date financial data. Using this, you can analyze your company’s success, identify weaknesses, and plan strategically.

What’s more?

- You don’t have to be buried in a pile of paper receipts.

- You don’t miss any tax deductibles.

- You don’t get into trouble with tax authorities.

- You can stay on top of spending and grow your business.

We won’t lie; small business expense tracking is as dull and time-consuming as it sounds. But we aim to simplify it for you by:

- Minimizing the time you spend on this task.

- Maximizing the value you derive from it.

What Business Expenses Should I Track?

When it comes to small business expense tracking, the key is to be comprehensive. Here’s a breakdown of essential business expenses you should monitor to maintain a healthy grip on your operations:

Fixed Costs

These are predictable expenses that stay relatively consistent each month. Tracking them helps with budgeting and forecasting. Examples include:

- Rent & Utilities: Lease payments for your office space, along with utility bills for electricity, water, and internet.

- Salaries & Benefits: Payroll for your employees, including wages, commissions, bonuses, and employer-provided benefits like health insurance.

- Loan Payments: Regular instalments towards any business loans you may have.

- Insurance Premiums: Costs associated with various insurance policies like property, liability, and worker's compensation.

Variable Costs

These expenses fluctuate based on your business activity. Monitoring them helps identify trends and optimize spending. Examples include:

- Inventory & Supplies: The cost of raw materials, finished goods, and office supplies you purchase.

- Marketing & Advertising: Expenses related to marketing campaigns, promotional materials, and online advertising.

- Travel & Entertainment: Costs incurred for business trips, meals with clients, or attending industry events.

- Professional Services: Fees paid to consultants, lawyers, accountants, or other professional service providers.

- Shipping & Delivery: Costs associated with shipping products to customers or delivering services.

Additional Expenses

- Technology & Software: Subscriptions to software programs, website maintenance costs, and any technology-related equipment purchases.

- Merchant Fees: Fees associated with credit card processing or other payment gateways.

- Taxes: Estimated or actual tax payments made throughout the year.

Remember: It's also essential to track any miscellaneous expenses that don't necessarily fit into the categories above.

What Not to Track (Non-Deductible Expenses)

The IRS draws a clear line between business and personal expenses. You cannot deduct personal expenses, fines for breaking the law, or entertainment costs. An expense that has both business and personal aspects can be split, but you can only deduct the "business portion."

Also Read:

How to Keep Track Of Your Business Expenses?

As a small business owner, you might not love the billable hours you and your employees spend on keeping accurate records of spends. You have bigger fish to fry, right?

Thus, we’ve curated a list of effective tips that might help make business finances easier to track:

1. Open A Business Bank Account

Using the same bank account for business and personal expenses might be working just fine for you, but it might not be the best move for your business.

What happens when you can’t remember if you spent that $36 on a business lunch or on a leisure brunch with your friend?

Having a business bank account helps separate your business expenses from personal expenses. It also ensures that you will not encounter trouble with the IRS for fraudulent or misrepresented expenses.

Here are some other benefits of opening a business bank account:

- Limited liability: Business accounts come with limited personal liability as your business and personal funds are kept separate.

- Security: Merchant services generally offer purchase protection to secure your customer’s details.

- Professionalism: Customers can pay with credit cards or make out cheques to your business instead of your personal account.

- Work delegation: You can safely have your employees handle day-to-day banking activities on your behalf.

- Line of credit: Business banking offers a line of credit that can be used in the event of an emergency or to make important business purchases.

- Increased purchasing power: Business accounts help establish a credible credit history, enabling you to make larger purchases for your business.

Once you’ve segregated your personal and business expenses, understanding spending v/s income is a no-brainer.

2. Track Your Receipts Regularly

Keeping track of receipts is of grave importance for several reasons: they are needed as evidence for business purchases if you ever get audited, they help you better manage cash flow, and they ensure business expenses don’t outstrip your income.

Whether you keep your receipts neatly organized in a file or dump them in your car’s dashboard, you must keep them safe. But an upgrade from the car dashboard would be migrating to a modern software solution.

Do I need Physical Copies of Receipts as Proof of Purchase for Taxes?

No, you don't necessarily need physical copies of receipts as proof of purchase for taxes. The IRS prioritizes having documented proof of your expenses, and there are several ways to achieve this:

- Digital Receipts: Many stores and service providers offer digital receipts via email or through their apps. These digital copies are perfectly acceptable for the IRS.

- Bank Statements & Credit Card Statements: Your bank and credit card statements can act as proof of purchase, showing the date, amount, and payee for your business expenses.

- Other Documentation: For some purchases, invoices, canceled checks, or confirmation emails can be proof of purchase.

Key Takeaway

The IRS is concerned with the details of the transaction, not necessarily the format of the receipt. As long as you have documented proof that includes the date, amount, payee, and a clear business purpose for the expense, you're good to go.

3. Maintain Records Of Business Travel Spend

.webp)

If your business requires your employees to stay on the road often, you must have a travel policy in place. The next step is to make sure your employees are aware of how they can keep track of their expenses on business trips. Without a streamlined process, inefficient travel request workflows and delayed reimbursements can seriously impact employee experience and hurt your bottom line.

Also Read:

4. Review Your Expenses Regularly

Keeping a close eye on your expenses allows you to avoid potential problems. This vigilance can help you identify areas of overspending, sniff out fraud attempts, and uncover inefficiencies in your operations.

Some accountants rely on double-entry bookkeeping, a method that helps catch errors and deter fraudulent activity.

5. Categorise Business Expenses

The easiest way to categorize business expenses is by using an accounting software or a chart of accounts. A chart of accounts is a list of all the financial accounts in a business’s general ledger, which helps you organize transactions and create financial statements. This ensures that your records are consistent and that all your financial reports are accurate.

Also Read

How Sage Expense Management (Formerly Fyle) Can Help with Business Expense Tracking

Forget the manual slog of expense tracking! Sage Expense Management automates the entire process for small businesses, freeing you to focus on what truly matters–growing your business. Here's how it works:

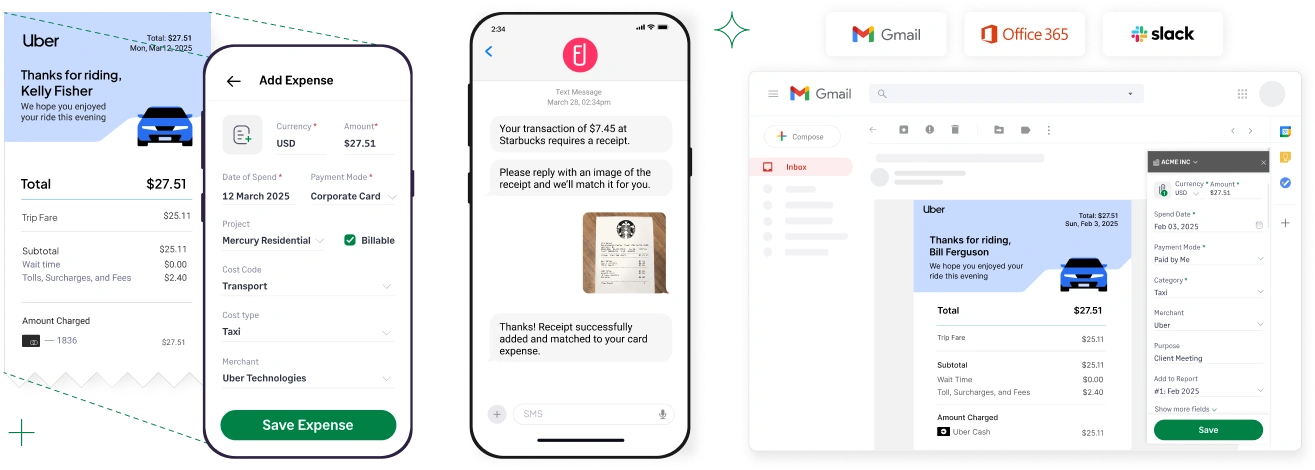

Text Message Receipt Submission and Automated Credit Card Reconciliation

Sage Expense Management seamlessly integrates with all major credit card networks. Get notified instantly whenever a company card is used. Simply snap a picture of the receipt and text it to us–Fyle will automatically match it to the corresponding transaction.

Or, simply text a receipt picture, and it will be auto-matched when the card data flows in. This means accountants no longer have to wait for bank statements to arrive or chase employees for receipts.

Receipt Collection Via Other Everyday Apps

No more hunting for receipts! With Sage Expense Management, submit receipts directly from your favourite apps - Slack, Gmail, Outlook, Teams, or even their mobile app. Plus, it does the legwork for you, automatically extracting key details and assigning expenses to the right categories.

FAQs on Business Expense Tracking

What is the Difference Between Fixed and Variable Expenses?

- Fixed expenses: These are expenses that typically stay the same each month, such as rent, insurance, and payroll.

- Variable expenses: These are expenses that can fluctuate depending on your business activity, such as commissions, shipping, and marketing.

What are the IRS Rules For Keeping Digital Receipts?

The IRS has accepted digital receipts as valid records since 1997. The key is that the digital record must be clear, legible, and contain all the information from the original receipt, including the vendor, date, amount, and business purpose.

How Long Should I Keep My Business Records?

The IRS states that you should keep records that support your deductions for at least 3 years from the date you filed the return. However, in some cases, you may need to keep them for up to 7 years if you've filed a claim for a loss from worthless securities or bad debt deduction.

Can a Credit Card Statement Serve as a Receipt?

A credit card statement can act as proof of payment, but it may not contain all the details required by the IRS, such as a detailed description of the purchase or the business purpose. The IRS may ask for additional proof if the credit card statement lacks sufficient detail.

Can I Use My Personal Credit Card For Business Expenses?

While you can, it's not recommended. It's best to maintain a separate business bank account and credit cards for business use. This helps to keep your business and personal finances separate, which simplifies bookkeeping and tax preparation.

What Is an "Ordinary And Necessary" Business Expense?

An expense is ordinary if it is common and accepted in your industry. An expense is necessary if it is appropriate and helpful for your business operations, even if it is not absolutely essential.

.webp)