Business trips are an exciting part of the professional world. They offer opportunities to connect with clients, explore new markets, and learn from industry experts. But let’s be honest, the whole act of filing an "expense report" can leave a bad taste in your mouth after an exciting journey.

Fear not.

This guide will equip you with the knowledge you need to navigate your T&E expenses like a pro. We'll break down the crucial IRS rules, provide clear examples of what you can and can't deduct, and give you actionable tips for a seamless expense management process that saves you money and headaches.

What Does T&E Mean?

T&E stands for "travel and entertainment" and is a category of business expenses that an employee incurs while conducting business, either locally or away from their tax home. T&E expenses include everything that fuels a business's professional adventures, such as flights, hotels, meals, local transportation, and conference fees.

What comes under T&E Expenses?

While first-class flights might be reserved for bigwigs (for now), most companies reimburse reasonable expenses that keep you focused on work and not your wallet. Here’s a breakdown of the usual suspects:

- Transportation: This includes airfare, train tickets, taxis, rideshares, and rental cars. The IRS also allows deductions for business-related tolls, parking fees, and the use of a personal vehicle at the standard mileage rate.

- Lodging: This covers the cost of hotels, Airbnbs, or other accommodations to ensure adequate rest while away from home on a business trip. The IRS permits deductions for reasonable lodging costs, typically aligned with federal per diem rates.

- Meals: Expenses for business lunches, dinners with clients, or even grab-and-go meals at the airport are all considered meals and are generally 50% deductible by businesses under IRS guidelines.

- Miscellaneous: This includes other small, business-related costs like conference fees, laundry and dry cleaning, business phone calls, and tips.

What to Include in a T&E Policy?

A clear T&E policy is like a compass, guiding both employees and employers through the world of business travel expenses. Here’s what it should cover:

- Define What Expenses Are Reimbursable: Your policy should clearly specify which types of expenses are covered and any limitations. For instance, a policy might specify that a company will only reimburse for economy-class flights or a standard hotel room.

- Set Clear Spending Limits: A policy should set clear daily spending limits for meals or per diem rates for specific locations. This helps to manage costs and prevent overspending.

- Approval Process: A well-defined policy should outline when pre-approval is mandatory (e.g., for international travel) and who has the authority to approve expense reports. Sage Expense Management's automated approvals can be a great tool to help here.

- Expense Reporting: A policy should set clear deadlines for submitting expense reports and specify what documentation is required.

- Reimbursement Process: The policy should specify the timeframe for employees to expect reimbursement. This transparency builds trust and helps employees manage their personal finances.

What Are The Benefits Of A Well-Defined T&E Policy?

- Everyone's on the same page: A clear policy removes all confusion about what's covered and what's not, setting clear expectations for everyone.

- Reduced frustration: Clear guidelines mean less back-and-forth communication and a faster, smoother process for both employees and the finance team.

- Tax compliance: A well-defined policy is a key part of an IRS-compliant accountable plan, which is necessary to avoid treating reimbursements as taxable income.

IRS T&E Expense Rules

Understanding IRS rules for Travel & Entertainment (T&E) expenses is essential for businesses and employees to ensure compliance and maximize deductions. Here’s everything you need to know:

Deductible T&E Expenses

You can deduct specific business expenses incurred while traveling or entertaining clients. These fall into four main categories:

- Local Transportation: Includes travel between workplaces, client visits, or temporary work locations (lasting less than a year).

- Out-of-Town Travel: Covers flights, lodging, meals, and other business-related travel costs.

- Meals: These expenses are limited to business-related meals that meet IRS requirements.

- Gifts: Deductions are limited to $25 per person annually for business-related gifts.

Local Transportation and Commuting

What Type Of Local Business Transportation Can I Deduct?

- Traveling between workplaces or to client locations.

- Trips from home to a temporary worksite are provided if it’s expected to last a year or less.

What Is Commuting, And Can I Deduct The Costs?

- Commuting (traveling between home and your regular workplace) is not deductible. However, transportation to a temporary worksite is deductible under specific conditions.

Also Read

Vehicle Expenses

What Methods Can I Use To Compute Vehicle Expense Deductions?

- Standard Mileage Rate: Deduct a set rate per mile driven for business.

- Actual Costs: Deduct actual operating expenses (e.g., gas, maintenance) based on business use percentage.

Also Read

What Is The Standard Mileage Rate, And When Can I Use It?

The IRS sets a standard mileage rate that covers all operating costs. You can use this if:

- You own or lease the vehicle.

- You use it solely for business purposes.

- You haven’t claimed actual expenses previously.

The standard mileage rate for 2026 is 72.5 cents per mile.

Can I Deduct Other Car-Related Costs Using The Standard Mileage Rate?

Yes, you can deduct:

- Business-related parking fees and tolls.

- A percentage of loan interest and personal property tax proportional to business use (self-employed individuals only).

What Can I Deduct Using Actual Costs?

Expenses such as gas, insurance, repairs, and depreciation. If your vehicle is used for both personal and business purposes, you must calculate the deductible portion based on business use percentage.

Out-of-Town Travel

Can I Always Deduct Out-Of-Town Travel Costs?

You can deduct travel expenses if your "tax home" (primary workplace) differs from your travel location.

Temporary work assignments (lasting a year or less) typically qualify. However, long-term assignments may disqualify deductions.

What Are Typical Deductible Travel Expenses?

- Transportation: Flights, trains, or car rentals.

- Lodging: Hotel or other accommodations.

- Meals: Business-related meals (50% deductible).

- Other Costs: Tips, laundry, baggage fees, and business calls.

Also Read

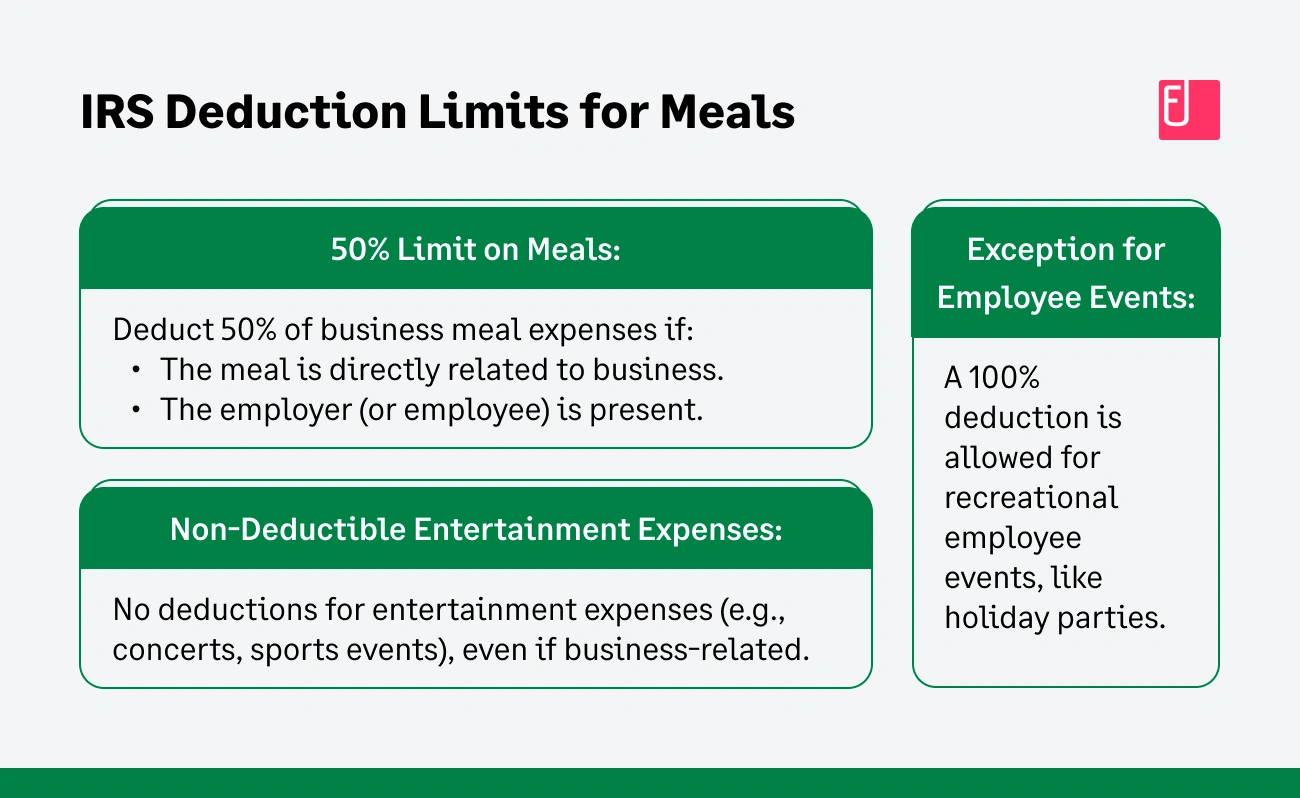

Meals and Entertainment

What Meal And Entertainment Expenses Are Deductible?

- Business-related meals with clients or team members (50% deductible).

- Entertainment expenses that meet the "directly related" or "associated" test.

What Are The Requirements For Entertainment Deductions?

- Expenses must be directly related to conducting business or immediately precede/follow a substantial business discussion.

Can I Deduct 100% Of Meal And Entertainment Costs?

No, only 50% of these expenses are deductible.

Gifts

Can I Deduct Business Gifts?

Yes, up to $25 per recipient annually. Small promotional items costing $4 or less (e.g., branded pens) are excluded from this limit.

Record-Keeping for IRS Compliance

What Records Should I Keep For T&E Expenses?

A detailed log of expenses, including:

- Date, amount, and purpose of each expense.

- Names of attendees and their business relationship.

- Receipts for expenses over $75.

- For vehicle use, maintain a mileage log with odometer readings.

For more information, please refer to IRS Travel & Entertainment Expenses Frequently Asked Questions

Common Challenges of Managing T&E

Let’s be real; managing T&E expenses can feel like an episode of your least favorite paper-work-filled reality show. Here are some common struggles that can turn your business trip into a bit of a nightmare:

- Vanishing receipts: Those tiny bits of paper seem to have a life of their own, disappearing when you need them the most.

- Manual data entry: Spending hours categorizing expenses can feel like an eternity.

- Policy confusion: Unclear guidelines can leave people wondering what exactly you can and can’t claim, leading to frustration and even potential misuse of funds.

- Slow reimbursements: Waiting weeks (or even months) for reimbursements can seriously dampen your employees' travel enthusiasm.

Also Read:

Managing Your T&E Expenses with Sage Expense Management (Formerly Fyle)

Cutting costs is a priority for any business owner, but business travel expenses always seem like a drop in the bucket. Here’s how our platform can help you:

Focus on Growth, Not Paperwork

Imagine a world where business travel isn’t bogged down by paperwork and receipt collection. A world where you can focus on building relationships, exploring new markets, and achieving strategic goals. This is the power of efficient T&E management with Sage Expense Management.

How does it achieve this? Through direct integrations with your business credit cards.

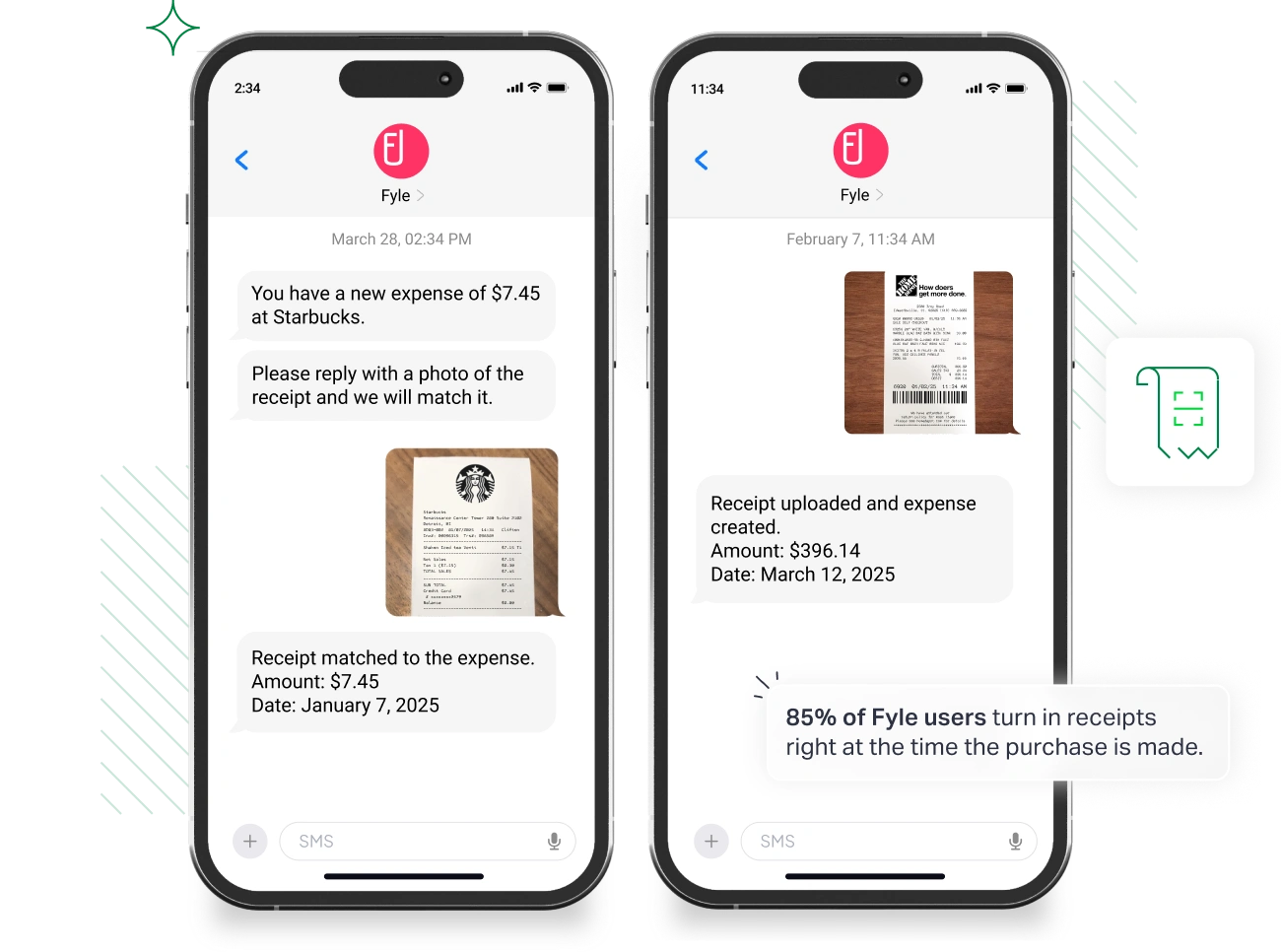

Real Time Credit Card Purchase Alerts

Employees receive real-time transaction notifications via text message, each time they swipe their business credit card. They can then simply reply with a receipt picture for instant reconciliation and expense categorization.

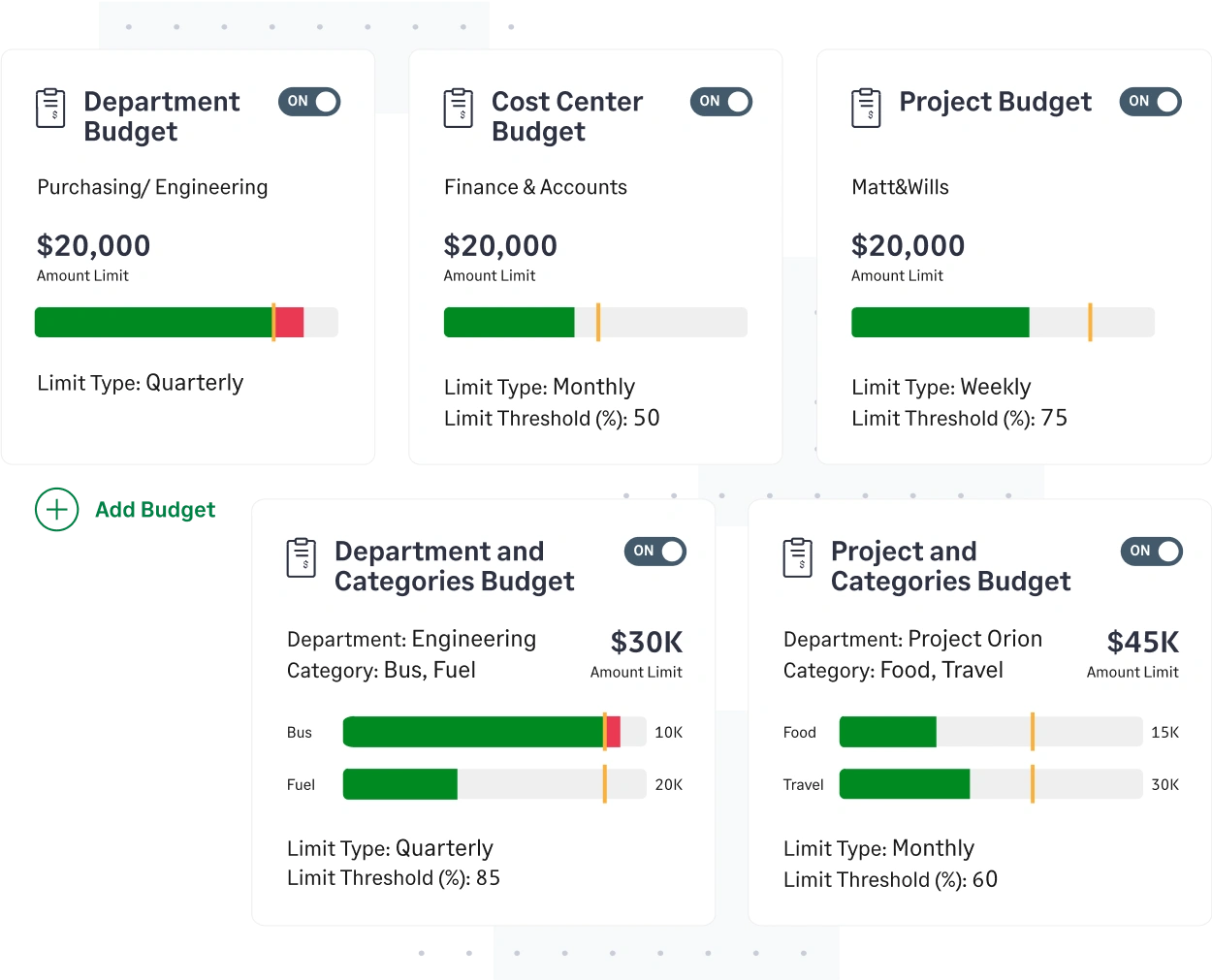

No More Blind Spots in your Budget

Most companies still rely on manual expense reporting, leaving room for errors and missed spending. Sage Expense Management can offer complete visibility into your T&E spending, ensuring you capture every expense.

Find Hidden Cost-Saving Opportunities

Transparency is key. With CoPilot, you can identify areas for significant savings, like repeat vendors with high prices or out-of-policy employee spending (which is almost 20% of all T&E expenses!). Use this leverage to negotiate better rates and eliminate wasteful spending.

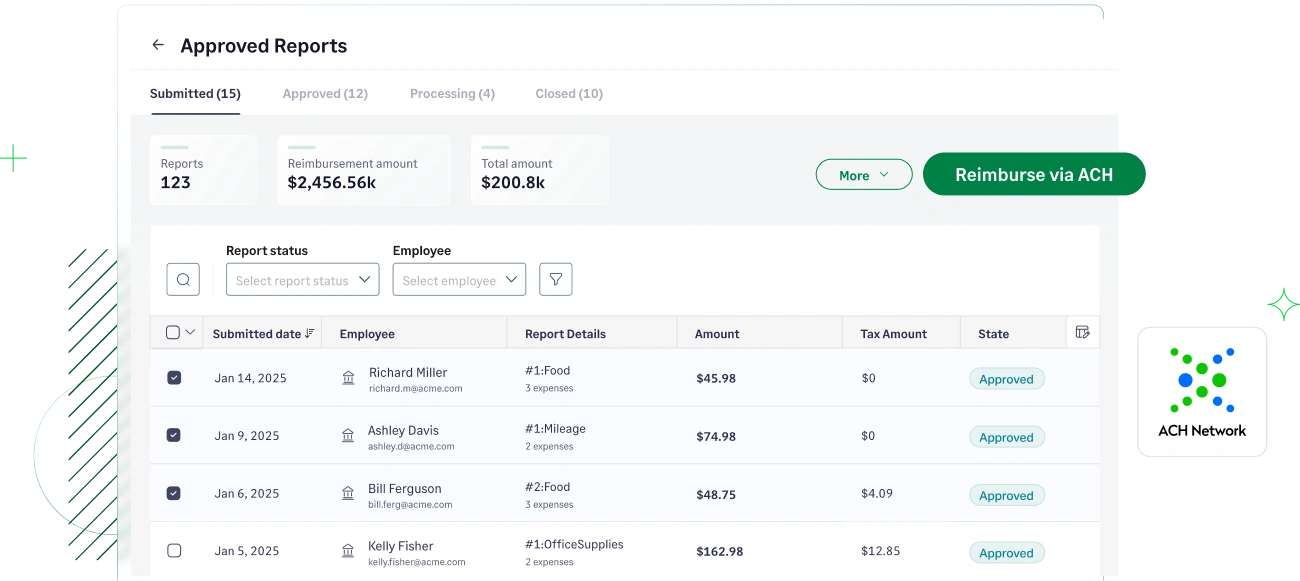

Faster Reimbursements, Happier Employees

Even infrequent business travelers must be reimbursed promptly. Sage Expense Management streamlines the process, ensuring employees get their money back quickly.

It streamlines the entire T&E process, freeing you and your team to focus on what truly matters. Sign up for a demo today!

%20-%20Main.webp)