4.6/51670+ reviews

4.6/51670+ reviewsIn the course of business, you may give gifts to clients, customers, or employees. It's important to understand how to categorize and account for these expenses properly.

Gift expenses are typically classified as general and administrative expenses or selling expenses. These are the ongoing costs a business incurs to run its daily operations and promote its products or services.

The tax treatment of gift expenses depends on whether they meet the requirements to be classified as a gift. If the expense is considered entertainment, then it’s not deductible. If the expense meets the requirements to be classified as a gift, then it’s deductible, but only up to $25 per person per year.

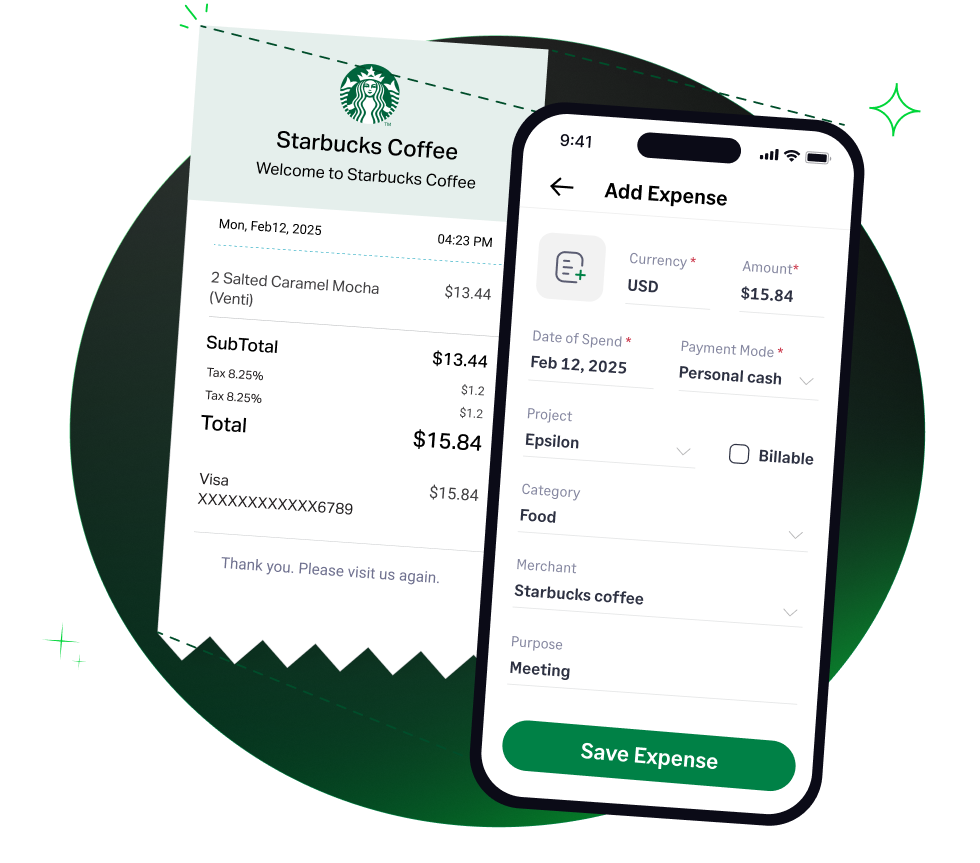

Our AI-powered expense management platform can help businesses accurately categorize and track their gift expenses. Our AI can automatically extract data from receipts and invoices, ensuring accurate record-keeping and compliance with IRS regulations, including the $25 limit per person. This saves businesses time and reduces the risk of errors, making tax preparation easier and more efficient.