4.6/51670+ reviews

4.6/51670+ reviewsSubscription-based e-commerce has become a powerful business model, and for merchants on the Shopify platform, the Recharge app is a leading tool for managing recurring billing and customer relationships. For accountants and SMB owners running subscription businesses, understanding how to properly categorize the fees associated with Recharge is vital for accurately calculating profitability, managing cash flow, and maintaining tax compliance.

This guide will explain the common expense categories for Recharge, key factors to consider when classifying its costs, typical examples of these expenses, their tax implications, and how Sage Expense Management can automate the tracking of this essential e-commerce expense.

The Recharge app is a Software as a Service (SaaS) tool that enables subscription functionality. Its fees are an operating cost necessary for running a subscription-based e-commerce store. In your accounting system, Recharge expenses are typically classified as follows:

This is the most direct and accurate category. Recharge provides software that integrates with your Shopify store, and you pay a recurring fee for its use. Many businesses group all their SaaS tools under this account.

Some businesses create a specific parent category for all costs related to their online store, including platform fees, transaction fees, and app subscriptions. Recharge would be a sub-account here.

Recharge’s pricing model often includes a per-transaction fee in addition to a monthly platform fee. This variable cost, which is directly tied to a sale, can be categorized as a transaction or merchant fee, similar to credit card processing fees.

This is a more nuanced classification. While the monthly platform fee for Recharge is almost always an operating expense, some businesses choose to include the per-transaction fees within COGS. These fees are a direct cost of making a sale, similar to payment processing fees. While IRS publications do not explicitly list these fees under COGS, they are directly related to the sale of a product. Classifying them as an operating expense (like Transaction Fees) is more common and conservative, but including them in COGS can provide a clearer picture of gross profit.

While less common, if the primary benefit of your subscription program is seen as a customer retention and marketing tool, some of the platform costs could be allocated here.

The best practice for most businesses is to categorize the fixed monthly fee as Software Subscriptions and the variable fee as Transaction Fees.

It is critical to distinguish between Recharge's fixed platform fee and its variable per-transaction fees. The fixed fee is an overhead cost for having the technology, while the transaction fee is a direct cost of each sale. Separating these in your books can lead to better financial analysis.

The expense must be "ordinary and necessary" for your business. For an e-commerce store offering subscriptions, using an app like Recharge is a common and necessary operational cost, making it fully deductible.

Your accounting method (cash or accrual) determines when you recognize the expense. Under the cash method, you deduct it when paid. Under the accrual method, you deduct it over the period the service is provided.

If you prepay for an annual Recharge plan, you create a prepaid expense. Per IRS Publication 334, you generally deduct the expense in the year to which it applies. For cash-basis taxpayers, the "12-month rule" may allow for a full deduction in the year of payment if the benefit does not extend more than 12 months or beyond the end of the next tax year.

Your expenses from using the Recharge app might include:

Fees paid to use the Recharge app for your business are fully tax-deductible as an ordinary and necessary business expense.

For a sole proprietor filing Schedule C (Form 1040), Recharge expenses are typically reported under Part II, Expenses. They can be included under other expenses (line 27a) with a clear description like software subscriptions or merchant fees.

If you choose to include the transaction fees in your Cost of Goods Sold, they would be factored into the calculation in Part III of Schedule C.

You must keep all supporting documents to substantiate your deductions. For Recharge, this includes the detailed billing statements provided by Recharge or Shopify and proof of payment from your bank or credit card statements.

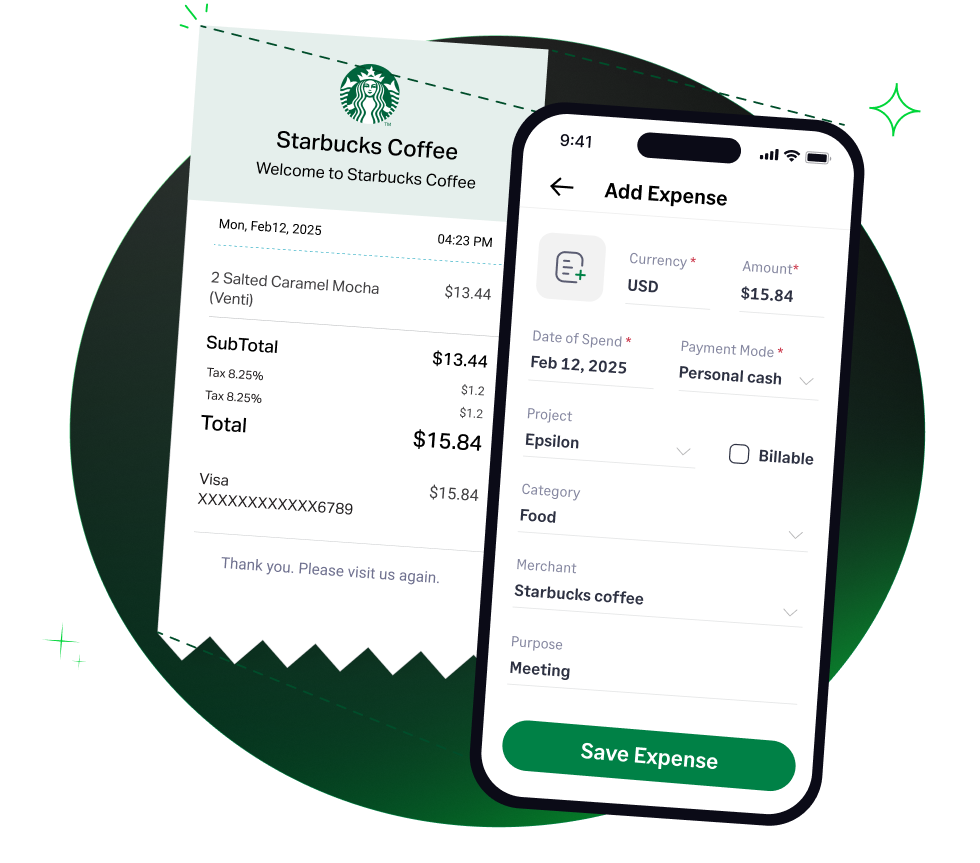

Manually tracking recurring app fees and variable transaction costs can be a challenge. Sage Expense Management automates this process to ensure accuracy and save significant time.

By using Sage Expense Management, you can ensure that all the fees associated with your Recharge subscription app are efficiently captured, documented, and accurately reported, giving you a clearer view of your subscription model's financial health.