Repairing equipment is a common expense for businesses that rely on machinery, tools, and other equipment to operate. It is important to understand how to categorize and account for repairing equipment expenses properly.

Repairing Equipment Expense Category

Repairing equipment expenses typically fall under the category of repair and maintenance expenses.

- These are considered operating expenses, which are the costs a business incurs to keep its assets in working condition.

- This category is distinct from capital expenses, which are costs that add to the value of an asset or prolong its useful life.

Here's a more detailed breakdown:

What's Included?

- Parts and labor costs for fixing broken equipment.

- Costs of cleaning and inspecting equipment.

- Expenses for preventive maintenance to avoid breakdowns.

What's NOT Included?

- Costs of improvements that increase the equipment's productivity or efficiency.

- Expenses for replacing a major component of the equipment.

Some Important Considerations While Classifying Repairing Equipment Expenses

- Repair vs. Improvement: Is the work performed considered a repair, or is it an improvement that extends the equipment's useful life?

- Type of Equipment: Is it a minor repair to office equipment or a major overhaul of industrial machinery?

- Frequency of Repair: Is it a one-time repair, or is it part of a regular maintenance schedule?

Tax Implications of Repairing Equipment Expenses

Repair expenses are generally deductible business expenses.

- This means you can deduct these costs from your business income to reduce your taxable profit.

- The IRS allows deductions for repairs that keep your property in ordinary operating condition.

Expenses for improvements are generally capitalized.

- Capitalizing means adding the cost to the asset's basis and recovering it over time through depreciation.

- Improvements are expenses that increase the asset's value, prolong its useful life, or adapt it to a new use.

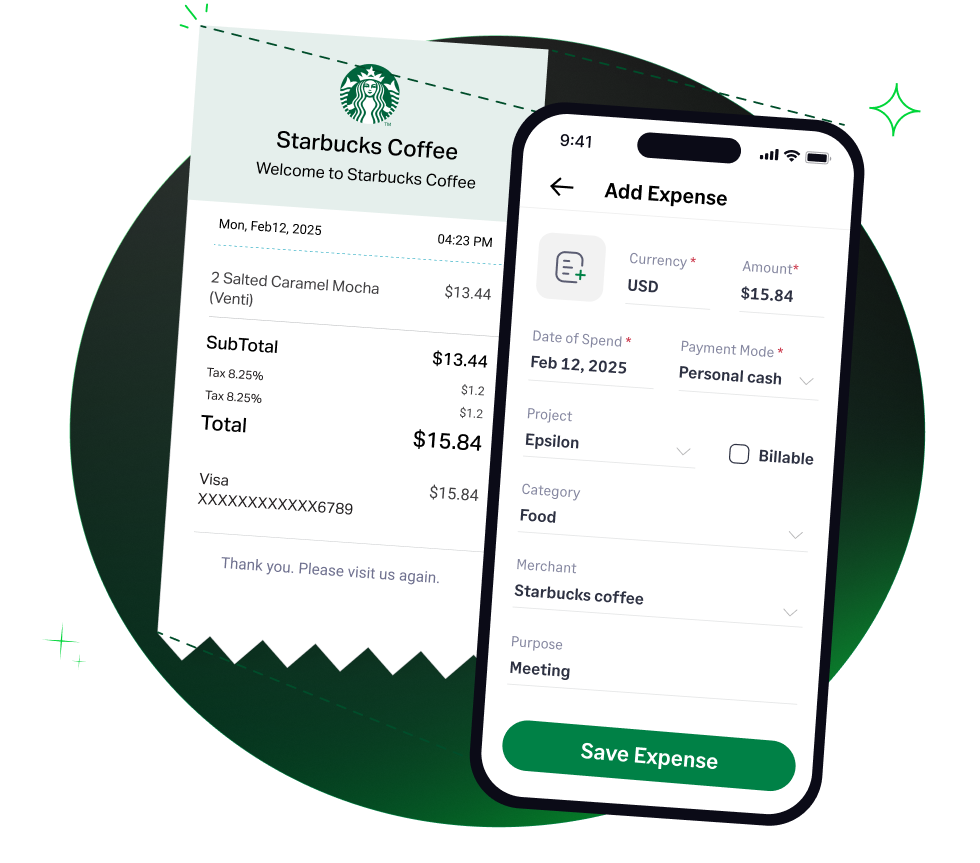

How Sage Expense Management (formerly Fyle) Can Automate Expense Tracking

Sage Expense Management streamlines expense tracking, automating the entire process from capture to reconciliation. This automation reduces manual effort, minimizes errors, and accelerates expense reporting, freeing up your team to focus on more strategic initiatives.

4.6/51670+ reviews

4.6/51670+ reviews