4.6/51670+ reviews

4.6/51670+ reviewsIn the quest for efficiency and productivity, businesses are increasingly turning to automation tools to connect their various web applications and streamline workflows. Zapier is a prominent online automation platform that enables users to create Zaps – automated tasks between different apps – without needing extensive coding knowledge. For accountants and Small to Medium-sized Business (SMB) owners, the subscription fees for services like Zapier are common operational costs that require proper classification for accurate financial reporting and tax purposes.

This guide will explain how Zapier expenses are typically categorized, key considerations for their classification, examples of these costs, their tax implications under IRS guidelines, and how Sage Expense Management can assist in streamlining the tracking of these essential software expenditures.

Zapier is a Software as a Service (SaaS) platform that businesses subscribe to for automating repetitive tasks and creating integrations between the various cloud-based tools they use (e.g., CRMs, email marketing platforms, project management software, spreadsheets). Expenses related to using Zapier are generally considered ordinary and necessary operating costs aimed at improving productivity and operational efficiency.

For accounting and tax purposes, Zapier subscription fees usually fall into categories such as:

The key is that these costs are incurred to enhance operational efficiency and integrate disparate software systems for business benefit.

Zapier operates on a subscription basis, with various plans (e.g., Free, Starter, Professional, Team, Company) typically priced based on the number of tasks automated per month, the frequency of Zaps running, access to premium apps, and the number of multi-step Zaps. These recurring fees are generally treated as operating expenses.

The cost of Zapier will vary depending on the selected plan and the volume of tasks processed. Understanding your usage is key to managing these costs, but the classification as a subscription expense generally remains consistent across tiers.

It's essential that the Zaps created and the apps connected via Zapier are for legitimate business process automation. Examples include automating lead data entry, syncing customer information between systems, automating social media posting, or creating task reminders.

Maintaining proper documentation for Zapier expenses is crucial. This includes:

Expenses related to using the Zapier platform typically include:

The primary expense is usually the recurring subscription fee, which grants access to the platform to build and run automated workflows (Zaps).

Subscription fees paid for workflow automation platforms like Zapier, when used for legitimate business purposes to improve efficiency and connect applications, are typically deductible as ordinary and necessary business expenses under IRC Section 162. These can be considered software costs or general operating expenses.

Standard SaaS subscription fees for platforms like Zapier are expensed as incurred. They are not capitalized as a long-term intangible asset by the subscribing company.

If applicable, any sales tax charged by Zapier on its subscription fees would be considered part of the total deductible expense.

Managing and accounting for recurring cloud service costs like Zapier subscriptions can be significantly simplified with Sage Expense Management's capabilities:

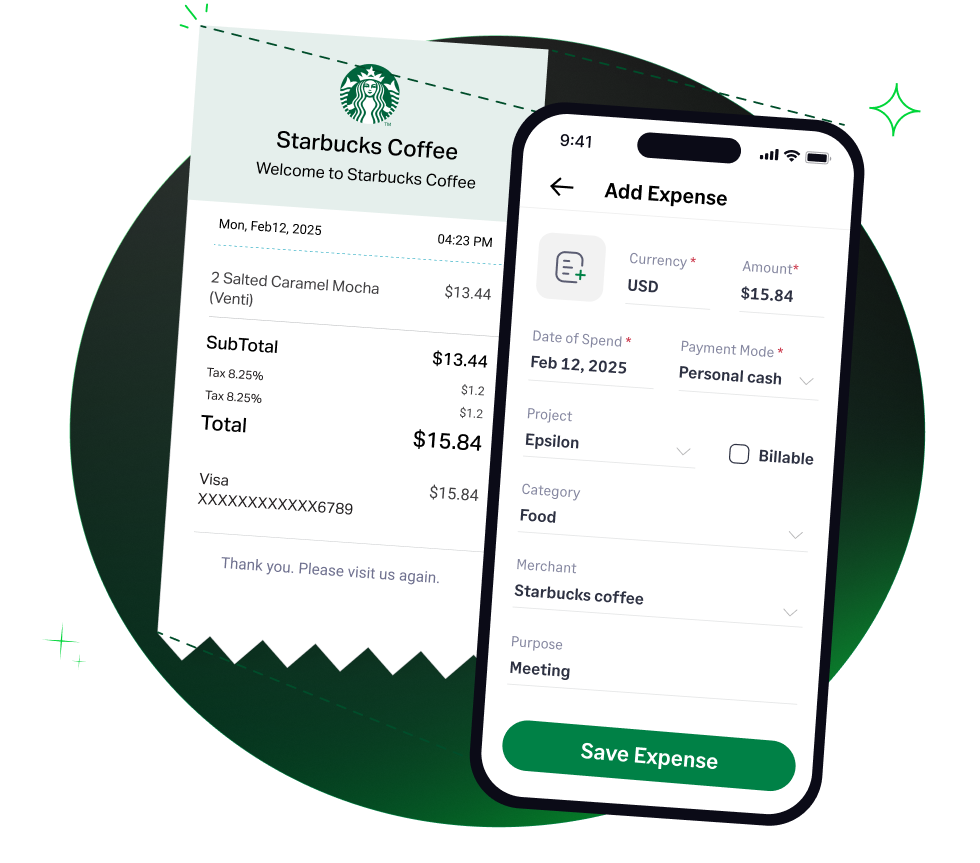

Zapier typically distributes invoices and payment confirmations via email. Sage Expense Management enables users to forward these e-receipts directly from their email client (e.g., Gmail, Outlook) into the Fyle system. Our technology can then automatically extract crucial data points, create a detailed expense record, and digitally attach the original receipt.

Within Sage Expense Management, you can establish automated rules to ensure that Zapier expenses are consistently categorized under the correct expense account (for example, "Software Subscriptions" or "Automation Tools") and are assigned the appropriate General Ledger (GL) codes as per your chart of accounts. This process is aided by our ability to import your company's financial dimensions from your primary accounting software.

If Zapier subscriptions are settled using a corporate credit card that is integrated with Sage Expense Management, payment transactions are captured in real-time via direct feeds from major card issuers like Visa, Mastercard, and American Express. This allows our platform to automatically match these card transactions with the relevant Zapier invoices, significantly reducing the time and effort involved in monthly reconciliation.

Sage Expense Management provides robust, two-way integrations with leading accounting platforms such as QuickBooks Online, QuickBooks Desktop, NetSuite, Xero, and Sage Intacct. This ensures that once Zapier expenses are reviewed and approved, they are automatically and accurately transferred to your company's main accounting ledger, eliminating manual data entry and keeping financial data current and reliable.

Sage Expense Management's dashboards and reporting features offer real-time visibility into all business expenditures, including amounts spent on crucial automation tools like Zapier. This empowers finance teams and department heads to monitor these costs effectively, track them against allocated budgets, and gain insights into the overall investment in technology and process automation.

By utilizing Sage Expense Management, businesses can ensure that their Zapier expenses are accurately documented, correctly classified, promptly reconciled, and seamlessly integrated into their financial management ecosystem, contributing to enhanced operational efficiency and sound financial governance.