Sorry, something went wrong. Can you please try again? Or please send us a note at sales@fylehq.com, and we’ll get you started.

Sage Expense Management's AI automates expense tracking from receipt capture to reimbursement.

Ditch manual work and spreadsheets. Just text a receipt and you are done.

1775+ reviews

1775+ reviews

That shoebox of receipts. The scramble to match transactions in a spreadsheet. The endless emails for a $10 coffee. Your time is too valuable for this.

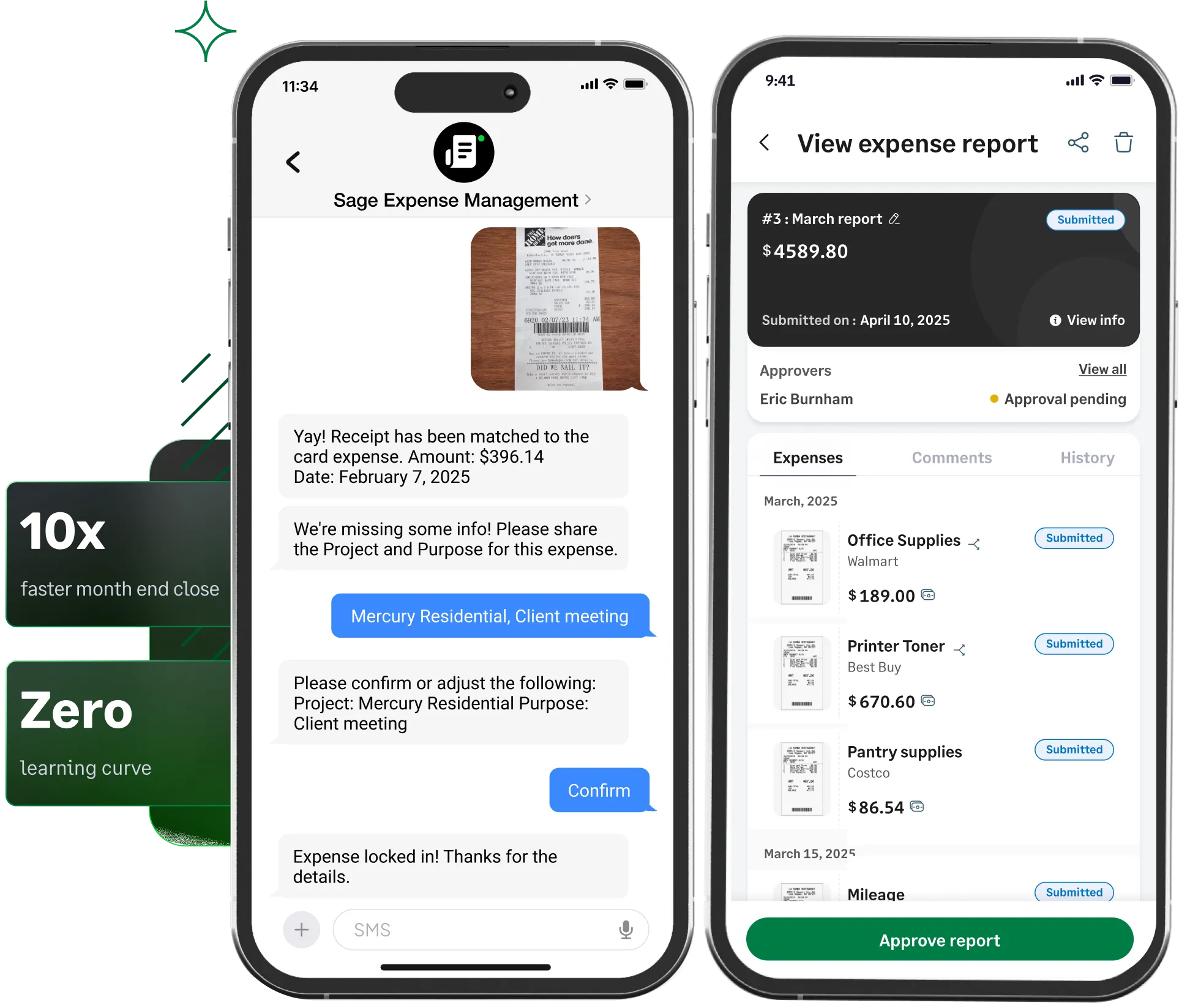

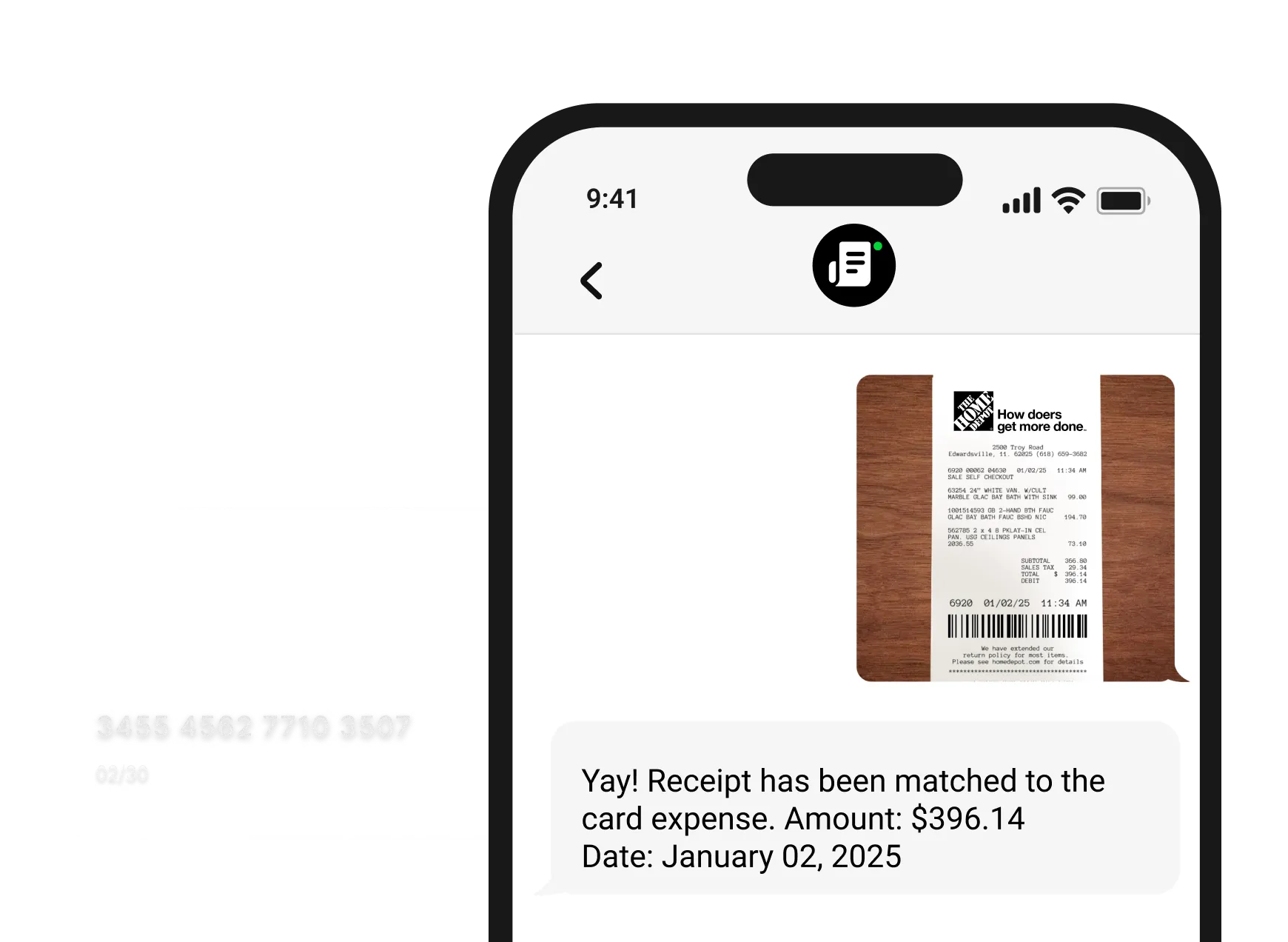

Snap or text a receipt. Our AI reads it instantly, so you don't have to.

Expenses are automatically coded and reports are created. Just review and submit with one click.

Data syncs to your accounting software in real time. Reimburse via ACH. (US only)

Take a self-guided tour to experience how easy it is to track and submit expenses

Experience the platform

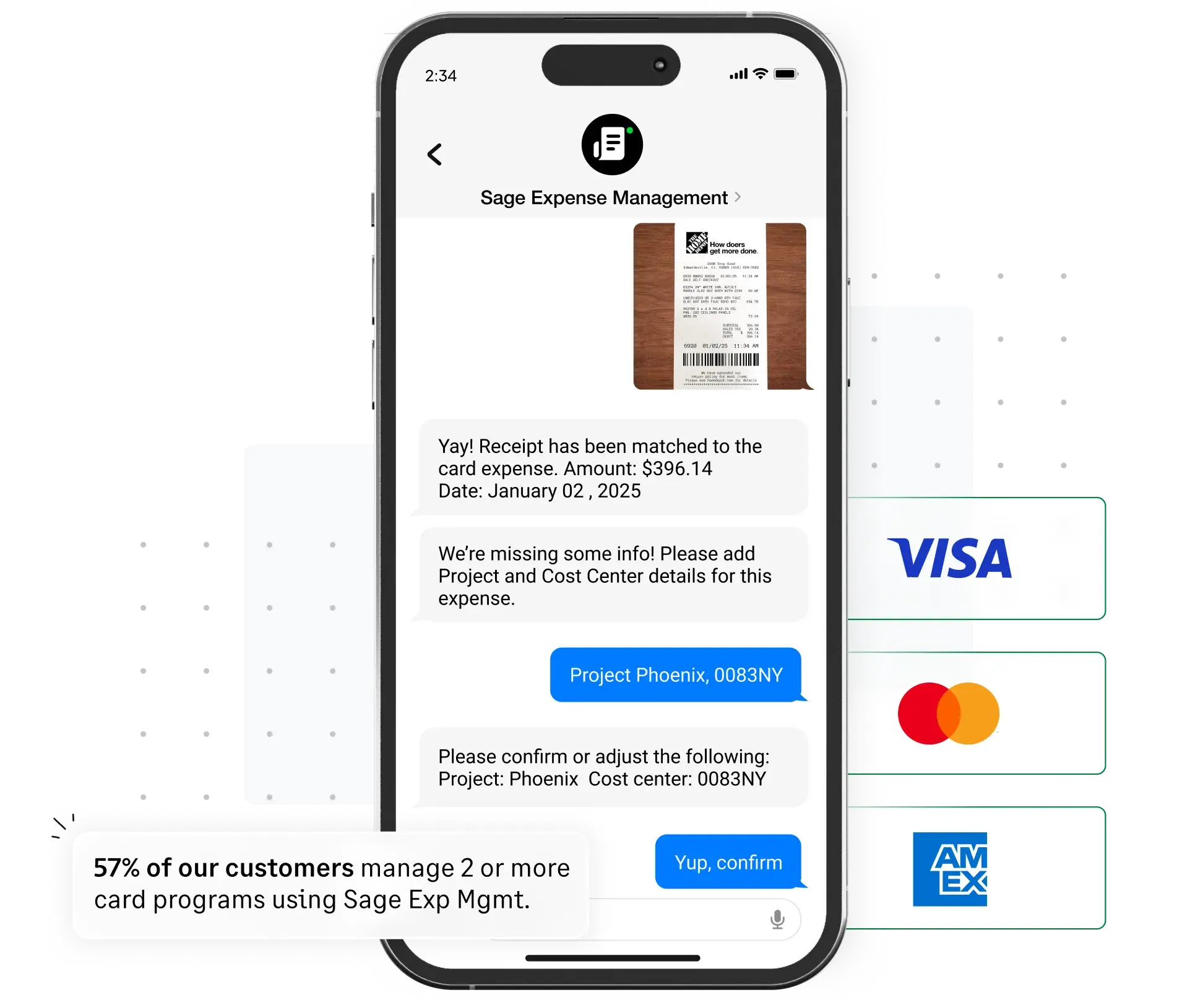

Sage Expense Management works with the Visa, Mastercard, and other business cards you already use. Get real-time reconciliation without changing your bank.

Never lose a receipt again.

Employees can submit expenses by texting a photo or directly from their Gmail and Outlook inboxes. Our AI extracts all the data with incredible accuracy.

Effortlessly track business travel.

Sage Expense Management provides accurate, automatic mileage tracking using Google Maps integration, ensuring fair and compliant reimbursements for every trip.

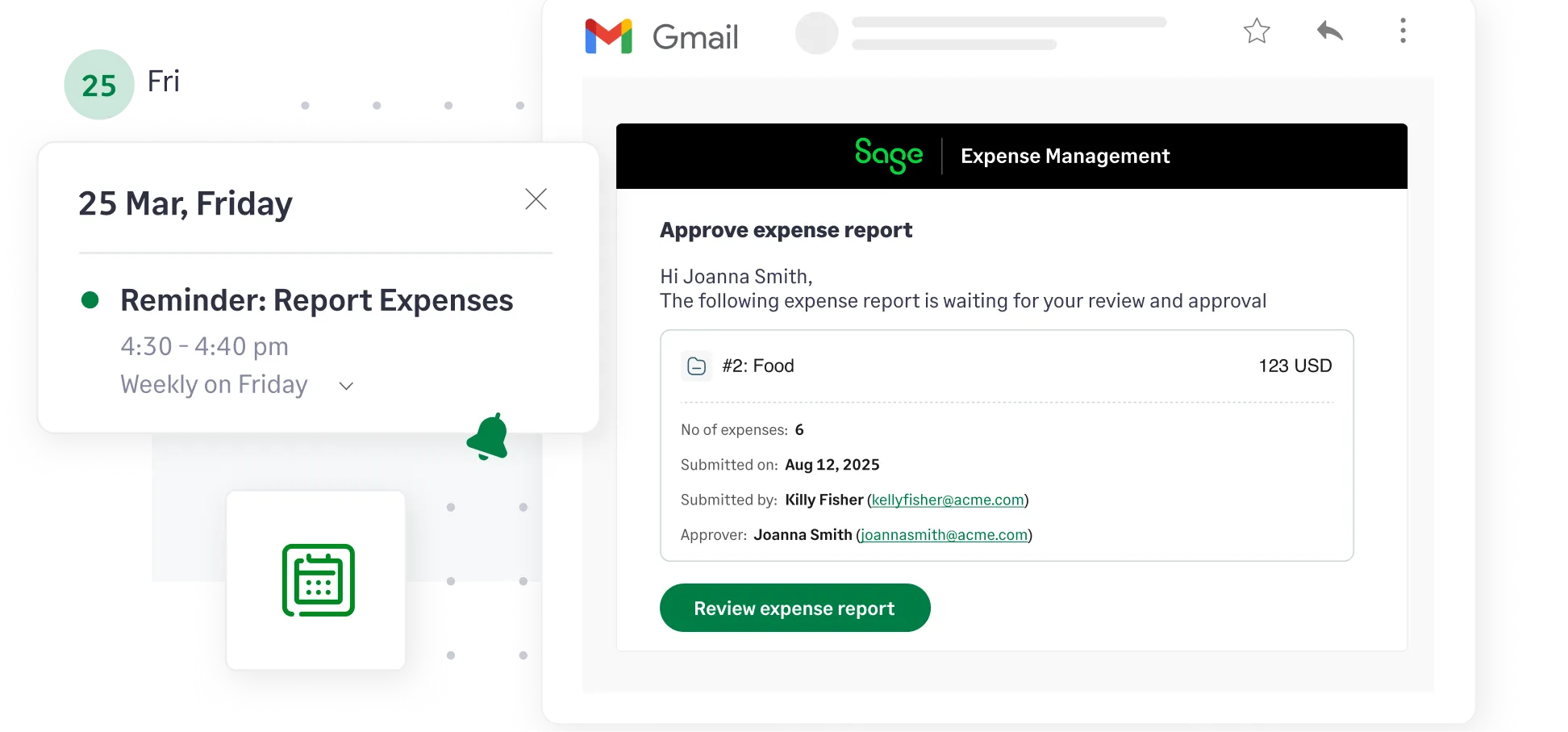

Approve expenses in seconds, not days.

Build custom, multi-stage approval workflows. Managers get instant notifications and can approve reports on-the-go from their phone or Gmail.

Close your books in record time.

We offer deep, two-way integrations with Sage, QuickBooks, Xero, NetSuite, and more. All expense data syncs automatically, eliminating manual entry.

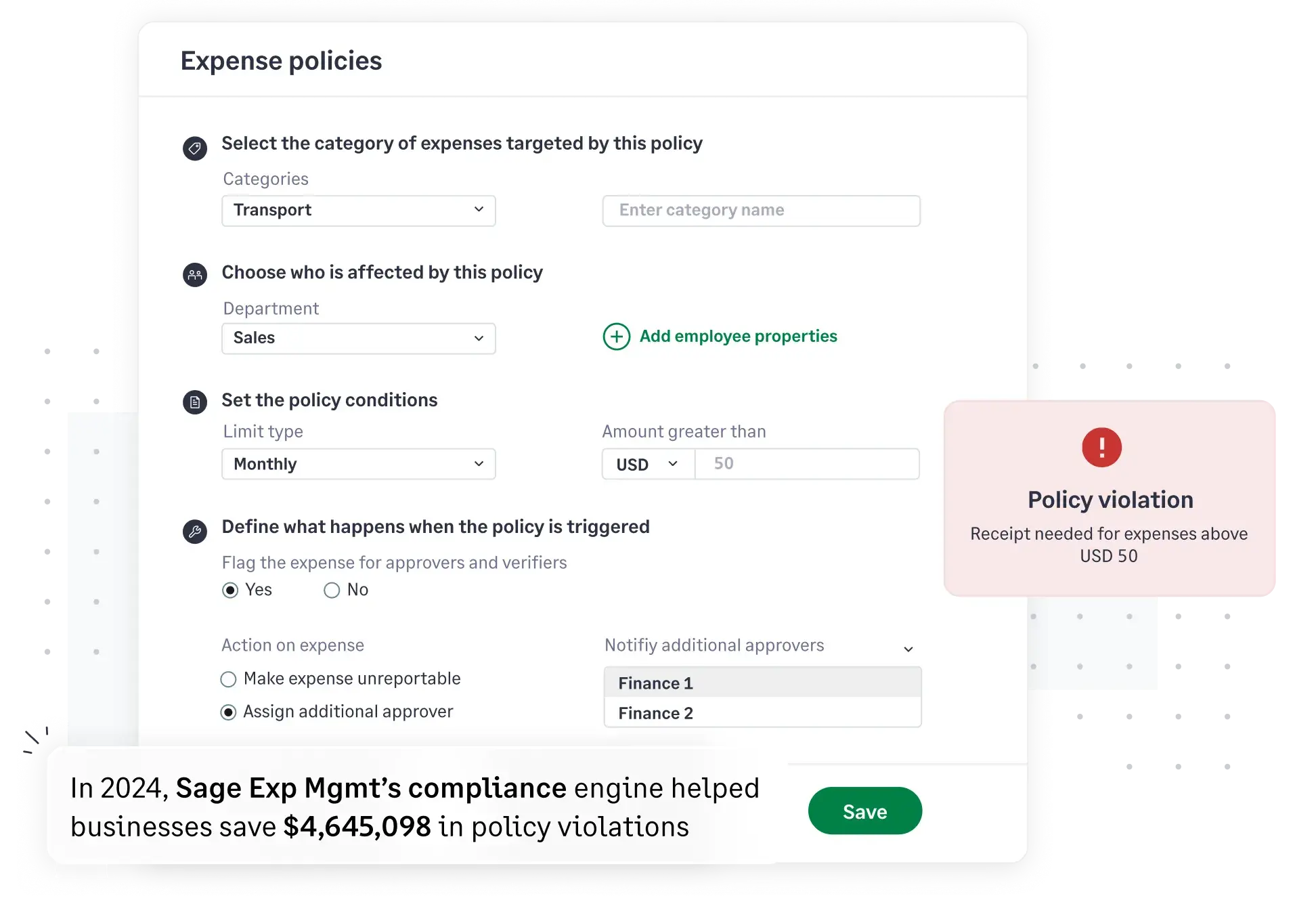

Ensure compliance before money is spent.

Our AI-powered engine checks every expense against your policies in real-time. Export detailed, IRS-compliant reports in seconds.

Tracking expenses is crucial for gaining control over your finances. It helps you stick to a budget, identify unnecessary spending, and find opportunities to save. For businesses, it's essential for monitoring profitability, managing cash flow, claiming tax deductions, and simplifying financial audits.

The best way to track expenses depends on your needs.

To effectively track business expenses, you can use several methods:

No, you do not have to switch your company credit cards. Sage Expense Management integrates directly with your existing Visa, Mastercard, or other business cards. We automatically pull transaction data and match it with receipts, eliminating the need for manual data entry.

We track mileage using our built-in Google Maps integration. Employees simply enter their start and end points in the mobile app, and we instantly calculate the distance. The reimbursement amount is then automatically computed based on the per-mile or per-kilometer rate set by your company.

As per IRS guidelines in the US, a digital or electronic copy of a receipt is as valid as the physical one, provided it is a complete and legible image. Using an expense management system to store digital receipts creates a compliant, organized, and easily accessible archive for tax audits, often eliminating the need to keep paper copies.