For employees, it’s the frustrating wait for reimbursement. For the finance team, it’s a critical bottleneck holding up the month-end close. Slow expense approvals are a common symptom of a broken, manual process, creating a ripple effect of inefficiency and frustration throughout the organization. Reports get lost in email inboxes, managers are too busy to review spreadsheets, and your team is left in the dark, unable to close the books.

This cycle of delays isn't just an inconvenience; it's a sign that your expense management system is failing to keep pace with your business. If you’re constantly chasing managers for approvals and explaining late reimbursements to employees, it's time for a solution that automates and accelerates your entire workflow.

How a Manual Expense Approval Process Holds You Back

A manual approval workflow, precariously built on spreadsheets and email chains, is destined to fail as your business grows. It creates friction, lacks oversight, and actively works against efficiency.

Inefficient, Multi-Step, and Invisible Workflows

The journey of a manual expense report is a masterclass in inefficiency. It begins with an employee attaching a spreadsheet to an email, hoping it gets to the right manager. That manager, often busy or traveling, must find time to open, review, and then manually forward the email to the finance team. There is no central system of record, which leads to a cascade of problems:

- The Email Black Hole: Reports are frequently lost in cluttered inboxes or accidentally deleted.

- Lack of an Audit Trail: Approvals are buried in disparate email threads, making it nearly impossible to track who approved what and when.

- Version Control Issues: Employees may send updated reports, leading to confusion over which spreadsheet is the correct and final version.

The Month-End Close Bottleneck

Your finance team's ability to close the books is entirely dependent on receiving approved expense reports. When approvals are delayed, the entire reconciliation process is held hostage. This forces the finance team into a compressed and frantic work period at the end of every month, which not only increases stress but also elevates the risk of errors.

The ultimate consequence is that leadership cannot get a timely and accurate picture of the company's financial health, forcing them to make strategic decisions based on outdated information.

Delayed Reimbursements

Nothing demotivates employees faster or erodes trust more effectively than making them wait weeks to be reimbursed for business expenses they paid for out of pocket. For an employee who put a significant hotel or flight charge on their personal credit card, this delay can cause genuine financial stress.

This is especially acute for employees in SMBs, where personal cash flow is often a greater concern. The message it sends is that the company’s internal process is more important than its employees' financial well-being.

Zero Visibility

A manual process creates a complete information vacuum. The employee who submitted the report has no idea when they will be reimbursed. The manager who needs to approve it doesn't have a single, consolidated view of their team's pending expenses. And the finance team has no way to forecast upcoming cash outflows because they have no idea what reports are stuck in the approval pipeline. This results in frustration and inefficiency across the entire organization.

Why Slow Approvals Hurt Industries Differently

While all businesses suffer from approval bottlenecks, the consequences are uniquely damaging in specific sectors.

Construction

Project managers and superintendents live on active job sites, not behind desks. Expecting them to review a 50-line Excel spreadsheet on their phone between managing subcontractors and materials is unrealistic.

As a result, approvals lag for days, preventing the finance team from tracking real-time project costs. This delay in cost recognition directly impacts the accuracy of client billing and can disrupt the company's cash flow.

- Also Read:

How to Set Up Multi-Level Expense Approvals for Construction Teams

IT & Tech

Fast-moving tech companies often have complex, multi-level approval hierarchies and globally distributed teams. A manual email chain to get approval from a team lead in Bengaluru, a department head in London, and a finance controller in New York is a recipe for week-long delays.

For a tech-savvy workforce that builds and uses cutting-edge software, being forced to use an archaic, inefficient internal process is a major source of frustration and disengagement.

Mid-Market

As companies scale into the mid-market, their organizational charts become more complex. The simple, single-level approval process that worked for a startup is no longer sufficient. A manual system cannot adapt to this complexity.

Who approves expenses for the new R&D department? What happens if a manager is on vacation? Without built-in logic, reports are sent to the wrong people, creating confusion, security risks, and a complete breakdown of internal financial controls.

SMBs

In many small and medium-sized businesses, the owners and top executives are the final approvers for all significant expenses. These leaders are focused on sales, strategy, and business growth; reviewing expense reports is the last thing on their priority list.

As a result, reports can pile up in their inboxes for weeks, creating a major bottleneck that slows reimbursements for their tight-knit team and distracts leadership from high-value activities.

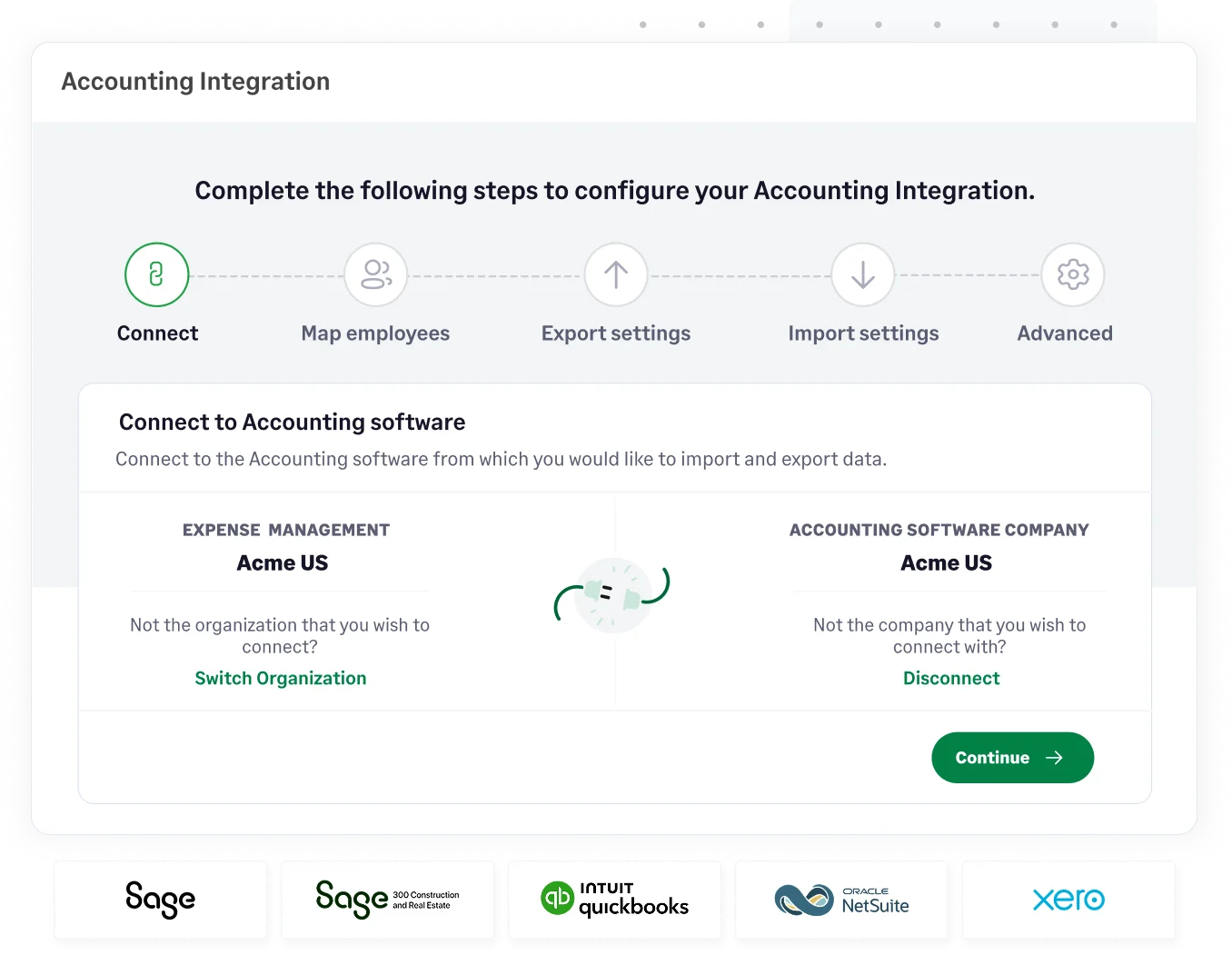

How Sage Expense Management (Formerly Fyle) Automates and Accelerates Approvals

The platform is designed to eliminate the bottlenecks in your approval process by automating the entire workflow, making it fast, efficient, and painless for everyone involved.

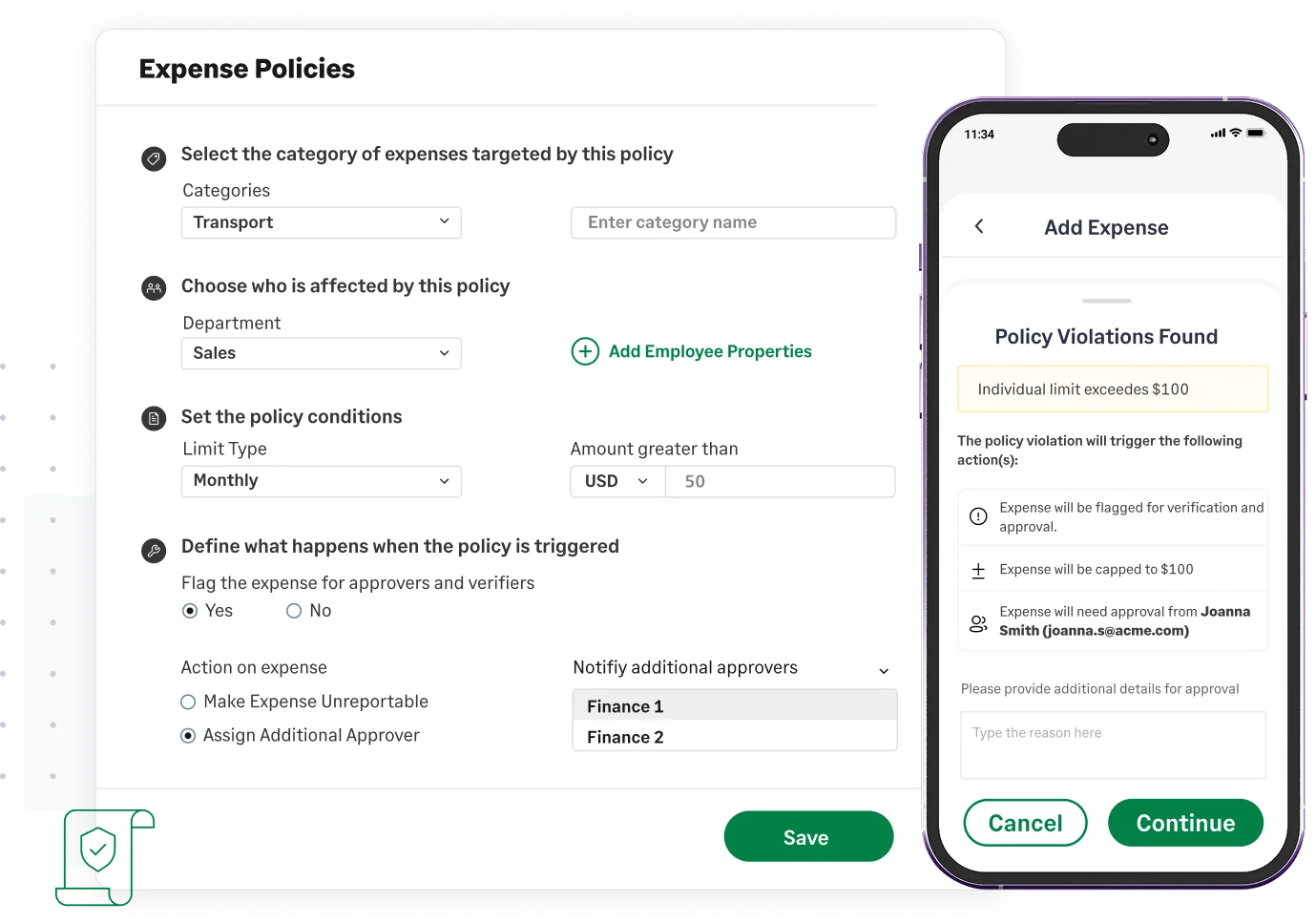

Smart, Customizable, and Automated Workflows

It allows you to build an intelligent approval matrix that mirrors your company’s structure. You can create rules like, If an expense is from the Marketing department and is under $500, route it to the Marketing Manager. If it's over $500, route it to the Marketing Manager and then to the VP of Marketing.

This eliminates manual forwarding and ensures reports go to the right person, every time.

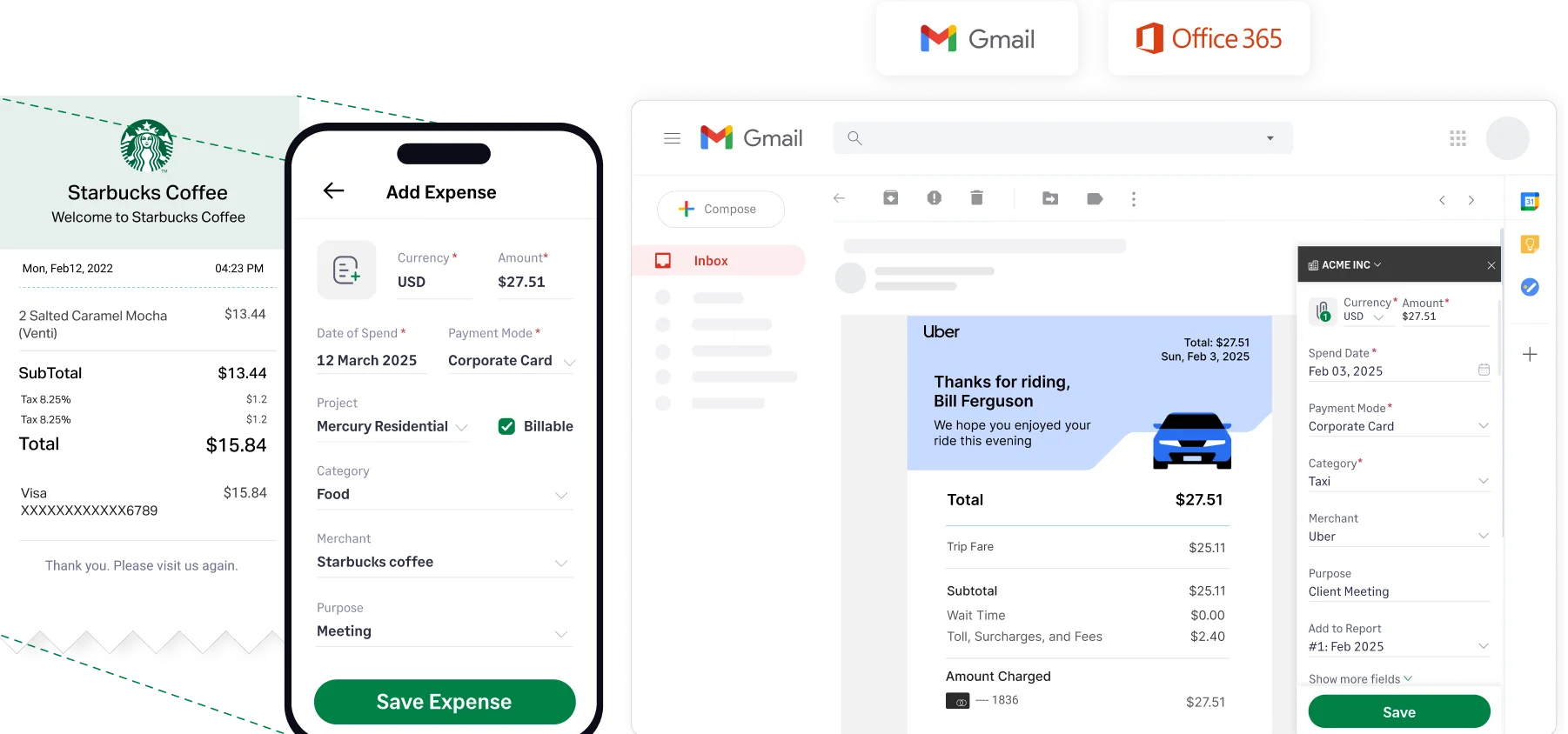

On-the-Go Approvals

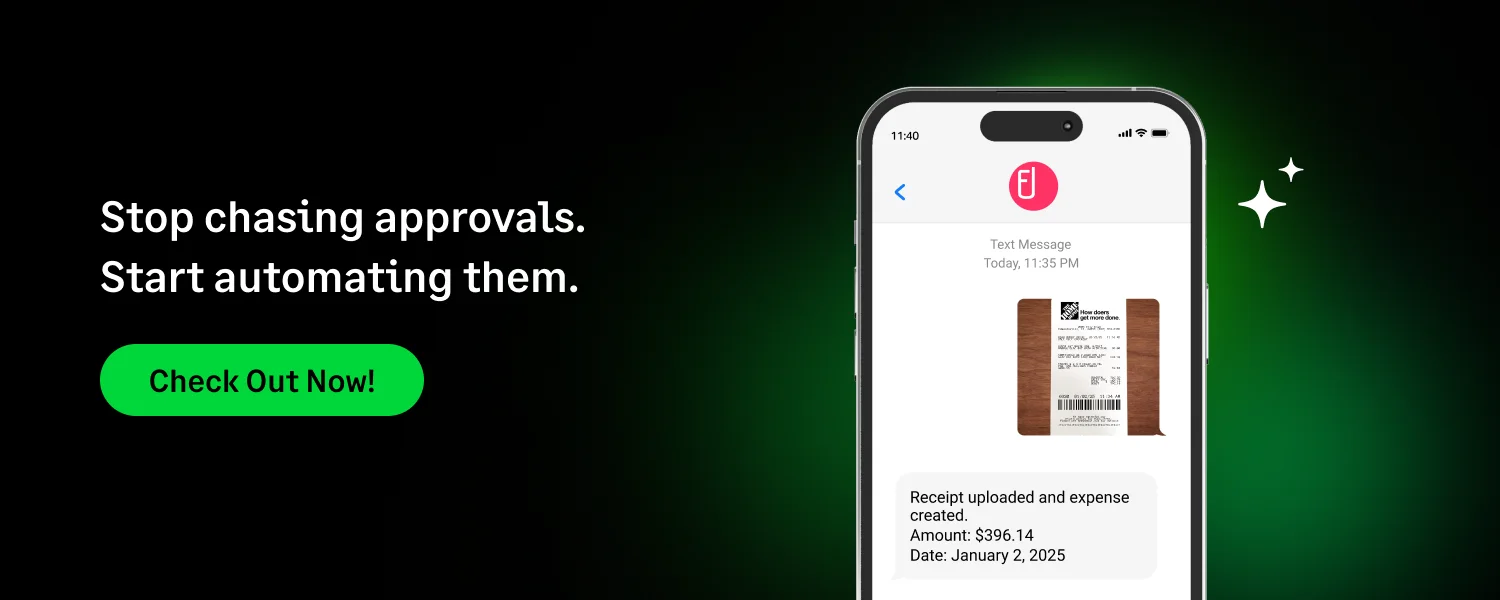

The platform is designed for the modern, mobile workforce. Managers receive instant notifications and can securely review and approve expenses with a single click from their Gmail or Outlook inbox, or from our mobile app.

This is perfect for traveling executives or managers in the field, allowing them to approve reports in seconds, from anywhere.

Automated Reminders and Smart Escalations

Our system ensures that an expense report never gets stalled. You can configure to send automatic nudges to approvers after a set period. More importantly, you can set up escalation rules, so if a primary approver is unresponsive, the report is automatically forwarded to their manager or another designated approver, guaranteeing the process continues to move forward.

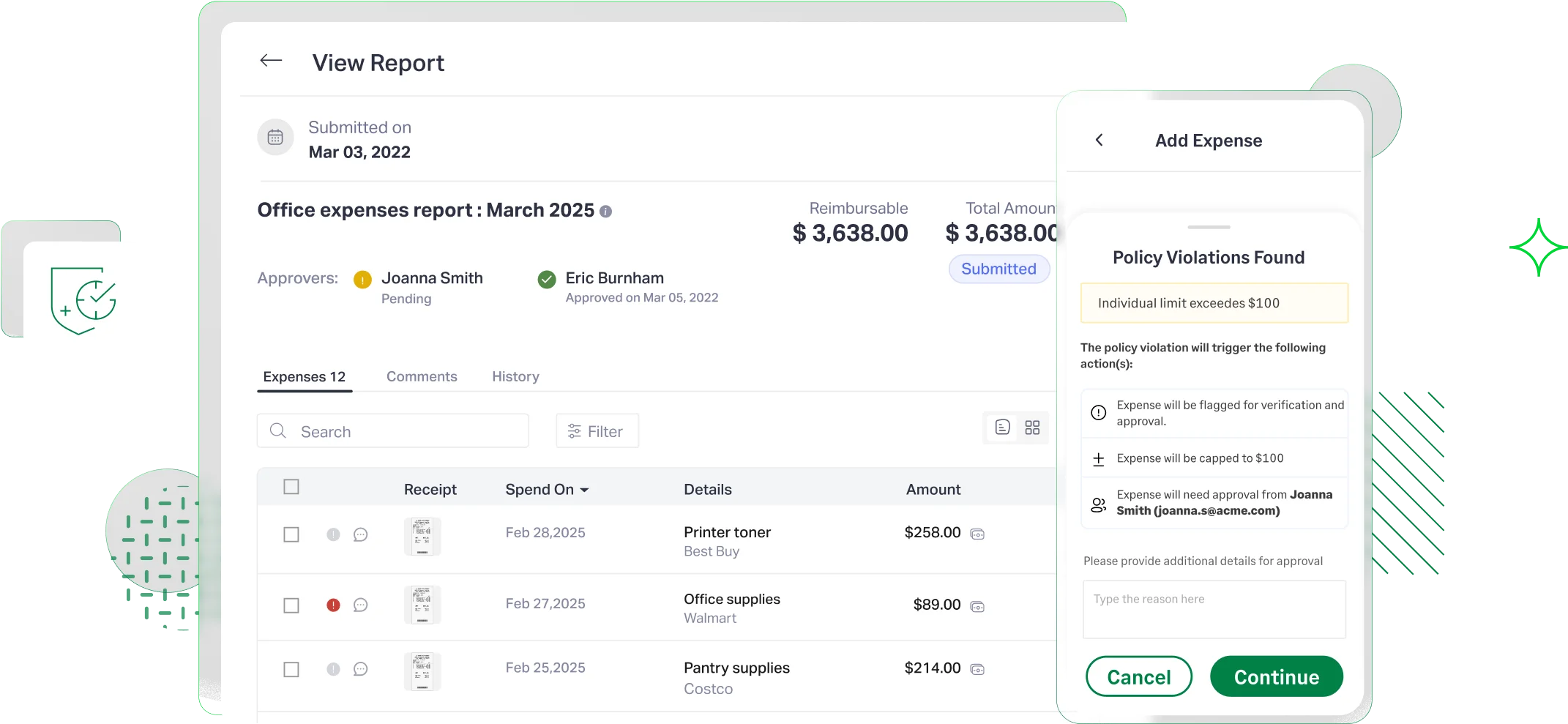

Real-Time Policy Checks

Its policy engine acts as a pre-approver, checking every expense for compliance issues before it even reaches a manager. The system instantly flags violations like missing receipts or over-budget spending, so approvers can review and approve clean, compliant reports with speed and confidence, no longer needing to act as policy police.

From Bottlenecks to a Streamlined and Trusted Workflow

A manual approval process actively slows down your business, damages employee morale, and stalls critical financial reporting. It turns a simple business function into a source of friction and frustration.

With Sage Expense Management, the entire approval process happens in minutes, not days. By automating your workflows, you provide employees with the fast reimbursements they deserve and give your finance team the timely data they need to close the books on time. You transform a bottleneck into a streamlined, trusted, and efficient workflow.

.jpg)