Businesses, whether SMBs or larger enterprises, make various payments to the Internal Revenue Service (IRS) and other taxing authorities throughout the year. A common question for accountants and business owners is: "Are these IRS tax payments considered deductible business expenses?" The answer is nuanced. While some taxes are deductible, federal income tax itself, for example, is generally not treated as a business expense that reduces your taxable business profit.

This guide aims to clarify how different types of tax payments are treated for business accounting and tax purposes, which ones might be deductible, and how tools like Sage Expense Management (formerly Fyle) can assist in managing the tracking of these financial obligations.

Understanding Tax Payments in Business Accounting

It's important to understand that "IRS Tax Payment Expenses" isn't a straightforward expense category like "Office Supplies," where all payments directly reduce business income. Instead, it involves understanding the nature of each tax payment:

Federal Income Tax

For sole proprietors and partners, federal income tax is paid on the net profit of the business and is considered a personal liability arising from business profits, not an operating expense of the business itself. For C corporations, federal income tax is an expense, but it's calculated on the net taxable income.

Other Business-Related Taxes

Many other types of taxes paid to the IRS or state/local authorities can be legitimate, deductible business expenses. These include the employer's share of employment taxes, certain excise taxes, and property taxes on business assets.

Tax-Related Costs

Costs associated with managing your tax obligations, such as tax preparation fees for the business portion of your return, are generally deductible business expenses.

Some Important Considerations When Dealing With Tax Payments

Nature of the Tax

The primary factor determining deductibility is the type of tax being paid. Federal income taxes are generally not deductible as a business operating expense for most business structures when calculating that income.

Federal vs. State/Local Taxes

- Federal Income Tax: Not a business expense for calculating federal taxable income for sole proprietorships and pass-through entities. C-corporations do list federal income tax as an expense on their financial statements, but it's calculated on taxable income.

- State and Local Income Taxes: For sole proprietors, these are typically itemized deductions on Schedule A (Form 1040) and subject to the $10,000 SALT cap, not direct business expenses on Schedule C. However, a state tax on gross income directly attributable to a trade or business can be deducted as a business expense. Corporations can generally deduct state and local income taxes as business expenses.

Employment Taxes

The employer's portion of Social Security and Medicare taxes, as well as federal (FUTA) and state unemployment taxes (SUTA), are deductible business expenses for the employer. Taxes withheld from employee wages are not an expense to the employer; they are liabilities held in trust and remitted to the government.

Property and Sales Taxes

- Real estate taxes paid on business property are deductible.

- Personal property taxes on business assets are deductible.

- Sales taxes paid on business purchases are generally added to the cost of the item. If the item is an expense, the sales tax is part of that expense. If the item is a depreciable asset, the sales tax is added to its basis.

Excise Taxes

Federal excise taxes that are ordinary and necessary expenses of carrying on your trade or business are generally deductible. Fuel taxes are usually included as part of the cost of the fuel.

Interest on Tax Deficiencies

- Interest on an individual's federal income tax deficiency (even if related to Schedule C business income) is generally not a deductible business expense; it's usually treated as personal interest, which is not deductible.

- However, interest charged on employment tax deficiencies assessed on your business is deductible as a business expense.

Penalties for Tax Violations

Penalties paid to a government entity for the violation of any law (including tax laws, late filing, or late payment penalties) are generally not deductible.

Recordkeeping

Maintain meticulous records of all tax payments, including the type of tax, the period it covers, payment dates, amounts paid, and any correspondence with tax agencies, including notices for interest or penalties.

Examples of Tax Payments & Related Costs (and their Deductibility)

Here's how various tax-related payments are generally treated:

- Federal Estimated Income Tax Payments (Sole Proprietor): Not Deductible as a business expense on Schedule C. These are payments of personal income tax on business profits.

- Employer's Share of Payroll Taxes (Social Security, Medicare, FUTA): Deductible by the business.

- State Unemployment Insurance (SUI/SUTA) paid by the Employer: Deductible by the business.

- State/Local Income Taxes (for a C-Corporation): Deductible by the corporation.

- State/Local Net Income Taxes (for a Sole Proprietor): Generally Not Deductible on Schedule C; may be an itemized deduction on Schedule A, subject to limitations.

- State/Local Gross Income Taxes (directly on business revenue): May be Deductible on Schedule C.

- Real Estate Taxes on Business-Owned Property: Deductible.

- Sales Tax on Business Purchases: Added to the cost of the item; deductible if the item is expensed, or capitalized and depreciated if the item is an asset.

- Interest Paid on Late Employment Taxes: Deductible.

- Penalties for Late Filing/Payment of Income or Payroll Taxes: Not Deductible.

- Tax Preparation Fees for Business Portion of Tax Return: Deductible (e.g., cost to prepare Schedule C).

Tax Implications of IRS Tax Payment Expenses

Deductible Business Taxes

- The employer's share of payroll taxes (Social Security, Medicare, FUTA).

- State unemployment taxes.

- Federal and state excise taxes are directly related to the business.

- Real estate taxes on business property.

- Personal property taxes on business assets.

- State or local gross income taxes directly attributable to the business.

- Sales taxes (as part of the cost of goods or expenses).

Non-Deductible Tax Payments for Business Expense Purposes

- Federal income tax payments (for sole proprietors, partners, S-corp shareholders on their share of income).

- Most state and local net income taxes for sole proprietors (on Schedule C).

- Penalties paid to government agencies for violations of law, including tax penalties.

Interest Deductibility

- Interest on underpayment of federal income tax for individuals is generally not a business expense.

- Interest on underpayment of employment taxes is a deductible business expense.

Timing of Deduction

For deductible taxes, the timing depends on your accounting method:

- Cash Method: Deductible when paid.

- Accrual Method: Generally deductible when the all-events test is met and economic performance occurs. However, for real estate taxes, accrual method taxpayers generally cannot accrue them until paid, unless they elect to ratably accrue the taxes during the year. Contested income taxes under accrual are generally deductible when the liability is finally determined.

Recordkeeping

It is vital to keep accurate records of which taxes were paid, the amounts, the dates, and the purpose. This is essential for correctly claiming deductions and for substantiating them if audited.

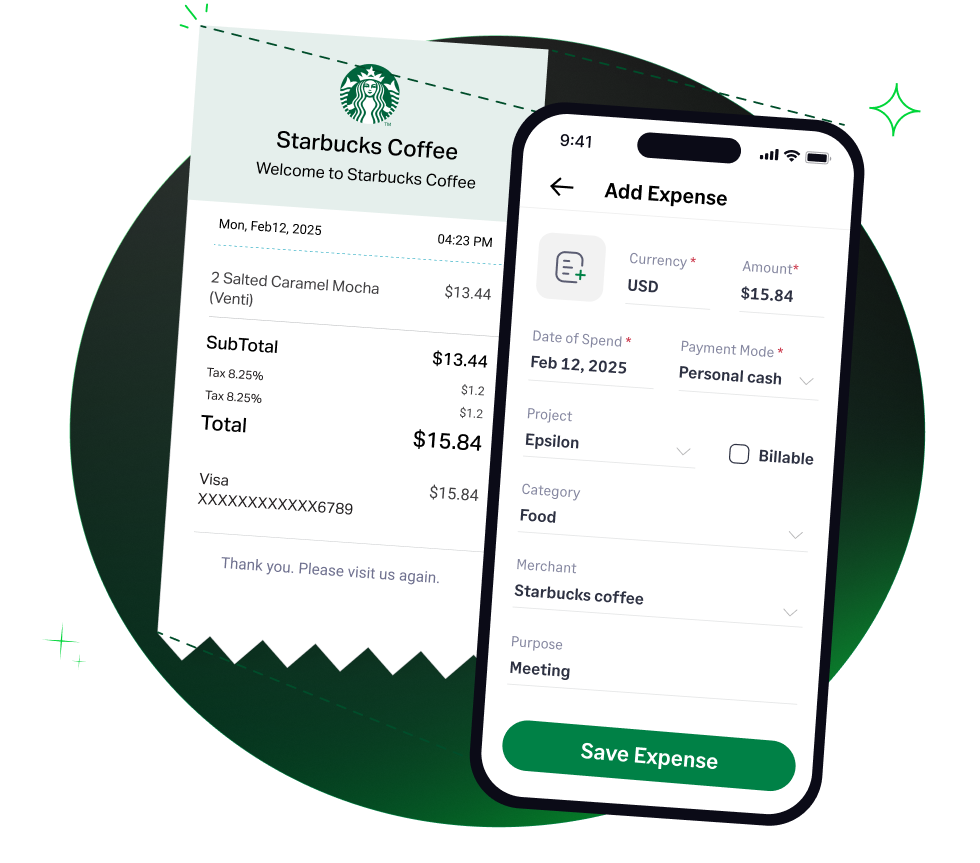

How Sage Expense Management (formerly Fyle) Automates Expense Tracking of Tax-Related Expenses

While Sage Expense Management does not directly handle tax payments to the IRS, it plays a crucial role in tracking the deductible expenses related to tax obligations and the payments themselves for reconciliation and bookkeeping purposes:

Tracking Deductible Tax-Related Costs

- Tax Preparation Fees: When you pay your accountant for tax preparation services, this expense can be easily captured in Sage Expense Management. If paid via a connected credit card, the transaction appears in real-time. Receipts or invoices can be submitted via email or the mobile app and automatically attached to the transaction.

- Other Deductible Taxes: Payments for deductible taxes made via company cards (e.g., online payment for state unemployment insurance) can be tracked and categorized correctly.

Accurate Categorization and GL Sync

We allow you to create custom expense categories. You can ensure that deductible tax expenses (like "Employer Payroll Taxes," "Business Property Tax") and costs like "Tax Preparation Fees" are correctly categorized. These categorized expenses can then be synced with your accounting software (QuickBooks, Xero, NetSuite, Sage Intacct), ensuring they are posted to the correct general ledger accounts.

Recordkeeping for Payments

Even for non-deductible tax payments (like federal estimated tax payments), we store the transaction record if paid via a business card, along with any confirmation notices. This aids in bookkeeping, where such payments might be recorded as draws or equity distributions for sole proprietors.

Audit Trail

We maintain a clear audit trail for all expenses managed through the system, including who submitted, approved, and when, along with attached documentation. This is invaluable for all expenses, including any deductible tax-related costs.

Spend Visibility

While federal income tax isn't an "expense" in the P&L sense for a sole proprietor, tracking all cash outflows, including tax payments, is important for overall financial management. our dashboards can provide visibility into various types of expenditures.

By using Sage Expense Management to manage receipts and track payments for deductible tax-related costs and to maintain records of significant tax payments, accountants and SMBs can improve organization, ensure compliance in recordkeeping, and simplify the data flow to their accounting systems.

4.6/51670+ reviews

4.6/51670+ reviews