For any restaurant, bar, or venue that serves alcohol, obtaining and maintaining a liquor license is a non-negotiable requirement and a major business expense. The process involves a significant initial fee to the state or local government to acquire the license, followed by annual renewal fees to keep it active.

A common and critical tax error is to treat these two types of payments the same way. The IRS has very different rules for the cost of acquiring a long-term license versus the cost of renewing it. This guide will clarify how to correctly categorize both initial and renewal fees for a liquor license to ensure your business remains compliant.

Liquor License Fees (Initial and Renewal) Category

The tax treatment of a liquor license fee depends entirely on whether it is for the initial acquisition or the annual renewal.

- Initial License Fee (Capital Expenditure): The one-time fee you pay to a government agency to obtain a new liquor license is a capital expenditure. IRS Publication 535 classifies a license, permit, or other right granted by a governmental unit as a Section 197 Intangible. This means the initial fee must be capitalized and recovered over time.

- Annual Renewal Fee (Current Expense): The recurring annual fees you pay to the state or local government to maintain your liquor license are a currently deductible business expenses. These are categorized under Taxes and Licenses.

Important Considerations While Classifying Liquor License Fees (Initial and Renewal)

Correctly distinguishing between the initial investment and the ongoing operational cost is the most critical step.

Amortization of the Initial Fee

The cost of acquiring the initial liquor license must be amortized ratably (in equal amounts) over 180 months (15 years), beginning with the month the license is acquired. You cannot deduct this large upfront cost in a single year. This 15-year amortization is mandatory for all Section 197 Intangibles.

Deducting Annual Renewals

Publication 535 states that regulatory fees and licenses paid annually to state or local governments are generally deductible. The annual fee to renew your liquor license fits this description and can be deducted in the year you pay it.

Tax Implications and Recordkeeping

The reporting for liquor license payments depends entirely on whether it is the initial fee or an annual renewal.

How to Report the Fees

- Initial Fee: The annual amortization deduction is calculated and reported on Form 4562. The total deduction from this form is then carried to your main business tax return (e.g., Schedule C, Line 13).

- Annual Renewal Fee: For a sole proprietor, this is deducted on Schedule C (Form 1040), Part II, Line 23, Taxes and licenses.

What Records to Keep

You must maintain meticulous records to substantiate all license-related payments. Your records should include:

- The official liquor license certificate and any application documents.

- Receipts or confirmations from the government agency for the initial fee and all annual renewals.

- Proof of payment for all fees.

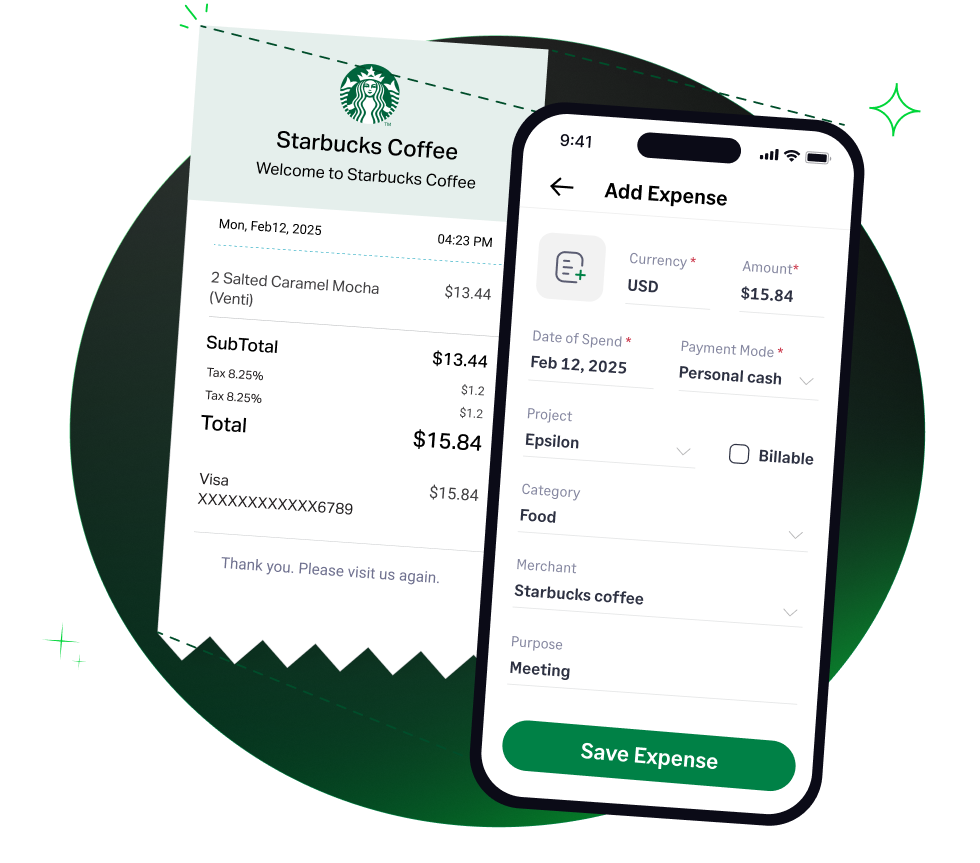

How Sage Expense Management (formerly Fyle) Automates Tracking of Liquor License Fees

Sage Expense Management helps you manage and document both the initial capitalized cost and the recurring renewal fees for your liquor license, ensuring every payment is captured and correctly categorized.

- Centralize License Documents: Attach your official liquor license and renewal notices directly to the expense records in Sage Expense Management.

- Track Every Payment: Instantly capture the receipt for the large initial fee and all subsequent annual renewal payments.

- Categorize for Tax Treatment: Code the initial fee as a capital asset and renewal fees as a Taxes and Licenses expense.

- Automate Your Accounting: We sync these expenses to the right GL account in QuickBooks, Xero, or NetSuite—either as an intangible asset or a current expense.

4.6/51670+ reviews

4.6/51670+ reviews