You did it. After months of planning and a complex implementation, your company's new ERP or accounting software is finally live. It’s a huge achievement and a major step towards a more modern, automated, and efficient finance function. The promise was clear: eliminate manual work, streamline reporting, and gain real-time financial insights.

However, a frustrating reality soon sets in. As credit card statements roll in, you find your team falling back into old habits: manually exporting expense data from one system and keying it into your powerful new ERP. It feels like a step backward, and it undermines the very purpose of your investment.

This persistence of manual data entry is a clear sign that your expense management system is a bottleneck. To truly unlock the power of your new ERP, you need an expense platform that integrates seamlessly, ensuring a fully automated workflow from the point of purchase to your general ledger.

Why Manual Data Entry Persists After an ERP Upgrade

A new ERP is a powerful engine, but it can't run efficiently if it's being fed low-quality fuel. A disconnected expense management process is a primary reason why finance teams remain stuck in manual, time-consuming tasks.

A Lack of Native Integration

The most common issue is that your existing expense management tool simply cannot communicate with your new accounting software. This forces your finance team to act as a human bridge, manually downloading CSV files, reformatting data, and re-entering every single line item. This process is not only time-consuming and inefficient, but it's also highly prone to errors.

Incomplete or Dirty Employee Data

Even with a potential integration, the data must be clean to be useful. If your employees are still struggling with a clunky system or trying to code expenses against a giant list of cost codes, with only numbers, the data they submit will be incomplete or inaccurate.

This requires your team to manually clean up and correct every report before it can even be entered into the ERP, defeating the purpose of automation.

Fragmented, Inefficient Workflows

An incompatible expense system perpetuates the same broken workflows you sought to eliminate. You’re still chasing employees for receipts, manually matching them to transactions, and wrestling with spreadsheets. This manual management is simply unsustainable for a growing business and can overwhelm the accounting team.

The ERP Integration Challenge Across Industries

While all businesses feel the pain of a disconnected system, the consequences are especially acute in certain sectors.

Mid-Market

Mid-market companies are prime candidates for ERP upgrades, frequently moving from systems to more powerful platforms to manage their growth. For them, a seamless expense management integration is non-negotiable.

The entire purpose of their ERP investment is to automate processes and gain greater financial control. A disconnected expense system forces them back into manual data entry, fundamentally undermining their strategic goal and leaving them with a powerful ERP that is still crippled by inefficient, old-school workflows.

Construction

In the construction industry, the ERP is the single source of truth for job costing, which is the lifeblood of the business. An unintegrated expense system is a major liability. It forces the finance team to manually key in hundreds or even thousands of receipts for materials, equipment, and on-site purchases, and then attempt to correctly allocate them to the right project and cost code.

This creates a significant data lag, meaning project managers never have a real-time view of budget vs. actuals. This delay makes it impossible to control spending proactively, creating a high risk of cost overruns that can erase project profitability.

IT & Tech

Fast-growing tech companies operate in a world of speed and agility. They deal with a high volume of complex expenses, from hundreds of recurring software subscriptions to global travel and hardware costs. During a merger or acquisition, the need to consolidate financial data quickly is critical.

Manual data entry from a separate expense platform is a major bottleneck that slows down financial reporting and prevents the real-time analytics needed to manage a rapidly scaling, often distributed, team.

Non-Profit

For non-profit organizations, the integrity of fund accounting is essential for maintaining donor trust and grant compliance. A primary reason for upgrading their accounting software is to better track restricted funds. An expense system that doesn't integrate directly with their new ERP creates a significant compliance risk.

Manually re-entering expenses for program costs or travel introduces the possibility of human error, where a transaction could be misallocated to the wrong grant. Such a mistake can lead to serious issues during an audit and can damage the organization's reputation with its funding sources.

How Sage Expense Management (formerly Fyle) Eliminates Manual Data Entry

Sage Expense Management is designed to complete your automation journey by ensuring a seamless, real-time flow of data from employee expenses directly into your accounting software.

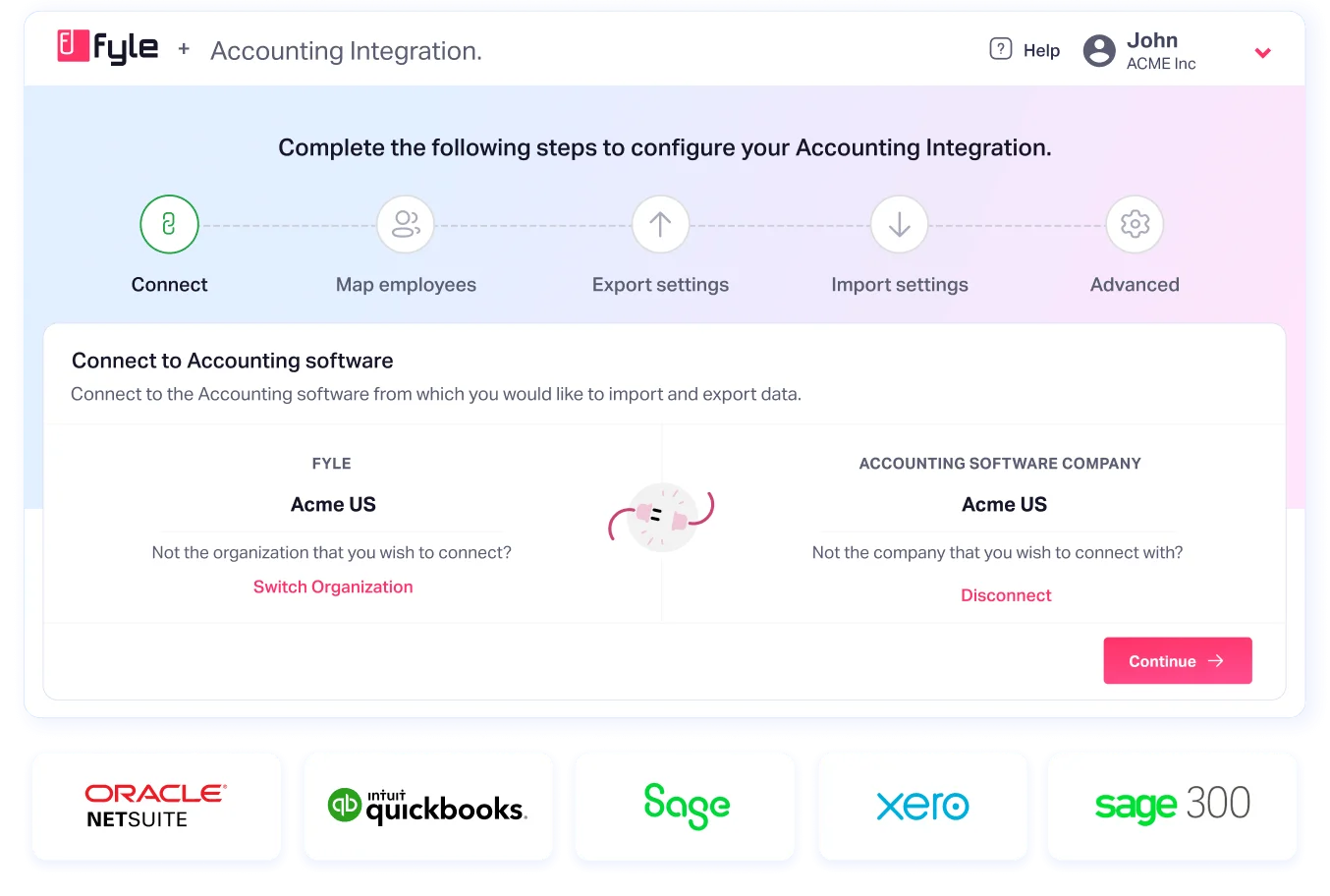

Automate Data Flow with Direct Integrations

Sage Expense Management offers deep, customizable integrations with the ERP and accounting systems that modern finance teams rely on, including QuickBooks Online, QuickBooks Desktop, Sage Intacct, Xero, and NetSuite. Our platform automatically imports your chart of accounts, projects, departments, and other key dimensions, ensuring that employees can code expenses accurately from the start.

Once approved, Sage Expense Management exports fully coded expenses as bills, journal entries, or credit card charges directly into your system, with no manual intervention required.

Ensure Clean Data with AI-Powered Capture

To eliminate manual entry, you must start with clean data. Sage Expense Management’s real-time feeds and effortless submission methods, such as texting a receipt photo or forwarding an email, ensure expenses are captured accurately at the point of sale.

Our AI-powered platform then automatically extracts and codes the data, drastically reducing the risk of human error and ensuring reliable financial reporting.

A Truly Automated Workflow

With Sage Expense Management, the entire process is automated. An employee swipes their card and submits the receipt in seconds. It automatically creates the expense and matches it to the transaction. Approvals are routed based on your custom policies.

Once verified, the complete, accurate data flows directly into your ERP. This fully automated workflow frees up your finance team from tedious tasks, allowing them to focus on more strategic tasks.

Realize the Full Potential of Your New ERP

You invested in a new ERP to build a more strategic and efficient finance operation. Don't let a disconnected expense system undermine that goal. By pairing your new accounting software with Sage Expense Management, you can eliminate manual data entry for good and create a truly automated financial workflow.

Ready to complete your automation journey?

Schedule a demo to see how Sage Expense Management's direct integrations can unlock the full power of your ERP.

.jpg)