Over 33 million small businesses operate across the US, making up 99 percent of all companies in the country. The figures seem encouraging, but it has been challenging for the community, especially after the COVID-19 pandemic. Technological disruptions, supply chain bottlenecks, and shifting consumer behaviors have all created a volatile environment for the US economy, whose losses are estimated to reach $14 trillion by the end of the year.

In this article, we shed light on the multifaceted financial challenges businesses across industries encounter under current conditions and what they can do to steer successfully through these turbulent waters:

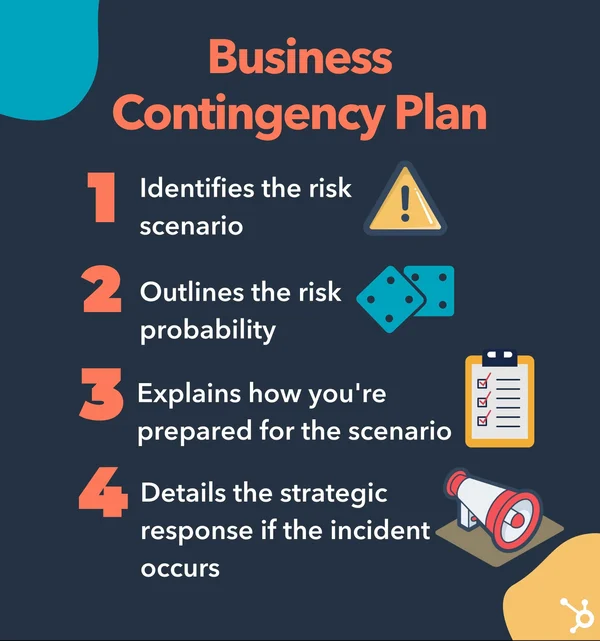

1. Lack of Contingency Planning

Regardless of scale, many businesses have historically operated under the assumption of stability and predictability. However, recent global events, such as the Coronavirus pandemic, have underscored the importance of contingency planning.

Without a well-defined contingency plan, businesses are vulnerable to unexpected disruptions, whether economic downturns, natural disasters, supply chain interruptions, or public health crises. The consequences can be severe, including revenue loss, operational disruptions, layoffs, and even business closures.

In today's unpredictable environment, businesses must recognize uncertainty as the new norm and prioritize contingency planning as a fundamental financial strategy. They must do so to avoid financial instability and potential long-term consequences.

2. Intermingling Personal and Business Finances

Comingling business and personal funds blurs the lines of financial accountability and can lead to many complications. Firstly, it undermines the legal structure of a business, such as an LLC or corporation, potentially exposing personal assets to business liabilities.

Moreover, it muddles financial records, making it arduous to track income, expenses, and taxes accurately. This quandary can trigger audits and penalties from tax authorities, causing financial strain. Interference with decision-making is another consequence, as personal expenses can drain essential capital from the business.

Furthermore, intermingling funds erodes investor and creditor confidence, making it difficult to secure financing or partnerships. In the long run, this practice can impede growth and hinder the ability to weather financial downturns.

3. Insufficient or Irregular Cash Flow

Insufficient cash flow is a prevalent and critical problem that many businesses encounter. It arises when a company's expenses surpass its incoming cash, impeding its ability to cover immediate financial obligations. This issue can have various causes, including delayed customer payments, excessive overhead costs, or poor financial planning.

Insufficient cash flow can have severe repercussions. It can lead to missed payroll, delayed supplier payments, and the inability to invest in necessary equipment or inventory. On top of that, it may force businesses to rely on high-interest loans or credit lines to bridge the gap, increasing financial strain in the long run.

Organizations can address this challenge by implementing effective business cash management strategies. These may include monitoring and forecasting cash flow, reducing unnecessary expenditures, incentivizing prompt customer payments, and establishing emergency funds for unforeseen circumstances.

Also Read:

4. Disregarding Essential Reporting Duties

Neglecting reporting duties to investors and stakeholders can have profound and detrimental financial consequences for businesses. Transparent and timely reporting is essential for maintaining trust, securing investments, and ensuring regulatory compliance. When businesses fail in these responsibilities, several serious issues may arise.

Firstly, it erodes investor confidence. Investors are left in the dark about the company's performance and prospects without accurate and regular financial updates. This can lead to investment losses, stock price reductions, and even legal action.

Secondly, it hampers access to capital. Financial institutions and potential investors rely on comprehensive reports to assess creditworthiness and investment potential. Incomplete or delayed reporting can deter lenders and scare away potential investors, limiting a company's ability to raise funds for expansion or operational needs.

Lastly, regulatory penalties can be severe. Neglecting reporting obligations can result in fines, legal action, and damage to the company's reputation.

5. Inadequate Capital Mobilization

The consequences of inadequate capital mobilization are far-reaching across various industries. It severely limits a business's growth prospects, for one. Without ample capital, companies find it a feat to expand their operations, invest in crucial research and development initiatives, or capitalize on emerging growth opportunities. This restriction can undermine their competitiveness and market presence.

What's more, inadequate capitalization leads to operational constraints. Insufficient funds can result in liquidity challenges, making it difficult to cover day-to-day operational expenses, meet financial obligations to suppliers, or even fulfill payroll commitments. This issue induces financial instability and also tarnishes a company's reputation.

Aside from that, capital insufficiency exposes businesses to heightened risks. With a lack of financial reserves, companies become more susceptible to economic downturns and unexpected market fluctuations. This may leave them ill-prepared to weather crises or adapt swiftly to changing market dynamics.

In addition, inadequate capitalization can lead to increased borrowing costs. Bridging the financial gap can push businesses to borrow money or use credit lines with high interest rates. This approach only elevates their overall financial burden and, in some cases, negatively impacts profitability.

Surmounting this challenge requires prioritizing effective financial planning, diversifying funding sources, and optimizing cash flow management. These strategies ensure that the necessary capital is available for the company to thrive rather than just survive.

Also Read:

6. Failure to Implement Financial Planning

Poor financial plan implementation is a pervasive challenge for businesses of any size, from small startups to corporate behemoths. It encompasses the ability to execute financial strategies effectively and can have dire consequences, such as misallocating resources.

Failure to properly execute plans can waste funds on non-priority areas or underfund critical areas, hindering the achievement of strategic goals. Another is restrictive cash flow. Ineffective financial planning may lead to a lack of liquidity, making it difficult to meet operational expenses or respond to unexpected financial needs, jeopardizing the business's sustainability.

A third consequence is a lack of investor and stakeholder trust. Consistently failing to implement financial plans can deter investors and creditors, limiting access to vital capital for growth and development.

Finally, it increases vulnerability to economic uncertainties. Without proper financial execution, businesses may struggle to adapt to changing market conditions, exposing them to risks and competitive disadvantages.

7. Ineffective Marketing Strategies

Ineffective marketing poses a formidable challenge for businesses, undermining their growth and profitability. When marketing efforts fail to resonate with the target audience, it leads to wasted resources and reduced ROI. Companies invest considerable time and money into marketing campaigns, but ineffective ones can drain their budgets without yielding the desired results.

Brand reputation can suffer from ineffective marketing as well. Inconsistent or off-target messaging can confuse consumers and erode trust, making it difficult to establish a loyal customer base. Additionally, missed opportunities for engagement and conversion result from poor marketing strategies, hindering revenue generation.

Of course, staying competitive is crucial in any industry. Ineffective marketing strategies can leave a business lagging behind competitors who are better at reaching their audience effectively and compellingly. This can lead to market share losses and decreased market relevance.

Addressing ineffective marketing demands constant evaluation, adaptation, and alignment with consumer preferences, ensuring businesses stay on the path to success.

8. Excessive Debt

When a company accumulates high debt levels, it can strain its financial resources and hinder its growth potential. Debt obligations, such as interest payments and principal repayments, can become burdensome, diverting funds that could otherwise be used for critical investments or operational expenses.

Excessive debts can also negatively impact a company's creditworthiness. A poor credit rating can raise borrowing costs and reduce access to capital, making securing loans or financing for essential business initiatives challenging. This difficulty can further hinder a business's ability to expand, innovate, or weather economic downturns.

Too much debt also increases financial risk. In times of economic instability or industry-specific challenges, businesses with substantial debt loads are more vulnerable to financial distress or bankruptcy. This risk can jeopardize the company's survival, the employees' livelihoods, and stakeholders' investments.

Avoiding excessive debts is possible when businesses implement prudent debt management strategies, reduce unnecessary expenses, and seek ways to boost revenue – all while diligently managing their financial obligations.

9. Delinquent Bill Payments

Delinquent bill payments can significantly harm businesses of any size in any industry. Overdue payments disrupt cash flow, leading to financial instability and potential operational disruptions. Restrictive cash reserves can also hinder a company from seizing growth opportunities or investing in necessary improvements.

Furthermore, delayed payments strain relationships with suppliers and vendors, resulting in penalties, altered credit terms, or, in extreme cases, discontinued partnerships. This situation can disrupt the supply chain, increase costs, and damage a company's reputation.

A business's credit rating is another serious casualty of delinquent payments. It can make favorable financing terms harder to come by, hindering expansion and strategic flexibility. By chasing overdue payments, a business consumes valuable time and resources that could be directed toward core business activities.

The impact is particularly disproportionate on smaller businesses with limited resources for efficient accounts receivable management. Addressing this challenge is crucial for sustained success.

10. Non-Adherence to Tax Regulations

In the US, failure to pay taxes leads to an Internal Revenue Service (IRD) Failure to File penalty of five percent on unpaid taxes monthly or part of a month where the tax return is late, plus interest on penalties if applicable. These guidelines can be critical, especially considering 20 percent of small businesses shut down within their first year of operations.

In any case, poor tax compliance exposes the company to legal and financial risks. These financial setbacks directly impact a business's bottom line, reducing profitability and diverting resources that could otherwise be invested in growth and operations.

Additionally, poor tax compliance can tarnish a company's reputation. Public perception of tax evasion or non-compliance can erode consumer trust and damage the brand's image, potentially leading to customer and market share losses.

Inefficiencies arising from non-compliance, such as inaccurate tax filings or late payments, can strain a business's internal processes and resources. Rectifying tax-related issues demands time and effort, diverting attention from core business activities.

Consequently, poor tax compliance can hinder a company's ability to access financing or attract investors, as lenders and investors often scrutinize a business's tax record as part of their due diligence.

Also Read:

Concluding Thoughts

Financial challenges are inherent in any business and demand vigilance and strategic maneuvering to avoid ruin. In most cases, overcoming these issues requires prudent financial management, adaptive strategies, and a commitment to sustainability.

When businesses embrace these principles, continually learn from their experiences, and seek innovative solutions, they are better equipped to handle financial storms and emerge stronger after each ordeal.

Indeed, in our increasingly dynamic world, confronting and conquering monetary challenges has become a hallmark of successful enterprises, setting them up for long-term growth and profitability.