Tax season is quickly approaching, and small businesses need to be prepared. The stakes are high, as failing to file taxes on time or accurately can cause penalties and interest.

To help you plan and file your 2025 taxes, we have co-authored this blog with Miles Brooks, the Director of Tax Strategy at CoinLedger, a global cryptocurrency tax solution.

This guide will walk you through everything you need to know to file taxes correctly and on time. We'll cover topics such as:

- Understanding your tax obligations as an SMB owner

- Gathering the necessary documentation

- Choosing the right softwares

- Tax filings on time

- Dealing with any tax-related problems

We also provide tips and tricks to help you save money on your taxes. So whether you're a seasoned small business owner or just starting, this guide is for you. By following these steps, you can ensure that you correctly file taxes, so you can focus on growing your business. So let's get started!

What is Tax Season for Businesses?

Tax season is a timeframe within a year when business owners across the U.S. diligently organize and prepare to file their income taxes for the preceding tax year. This period typically spans from January 1st to April 15th of every year.

All businesses, except partnerships, must submit their annual tax returns. The specific Form you should fill out depends on the organizational structure of your business. The business structure guidelines also determine the returns you must file regarding your entity.

For example:

- Sole proprietors typically file Schedule C along with Form 1040.

- Partnerships file Form 1065 and distribute Schedule K-1 to partners.

- Corporations use Form 1120 or Form 1120-S for S corporations.

Why Should SMBs Pay Heed to Tax Season?

- Timely payment of taxes ensures the financial stability of SMBs. Getting familiar with the US tax filing deadlines is crucial for all SMBs, as underpayment of taxes increases the likelihood of being targeted for a tax audit.

- The IRS is pulling up small businesses that do not report their income correctly. This includes businesses that fail to report all of their income or under-report their income. The IRS has many tools to identify businesses that are not reporting their income correctly, including data matching and audits.

- The IRS is also increasing its focus on businesses claiming excessive deductions it does not entitle them to. The IRS has several rules to prevent businesses from claiming excessive deductions, and they are becoming more aggressive in enforcing these rules.

- SMB owners may be eligible for credits or deductions related to specific expenses. Many tax credits and deductions are available to small businesses, and the specific credits and deductions available will vary depending on the type of business and the expenses the business incurs.

- Failing to report income correctly or claiming excessive deductions can cause fines, penalties, and even potential legal action. The penalties for failing to report income correctly or claiming excessive deductions can be significant, and sometimes, businesses may even be subject to criminal prosecution. Thus, businesses should ensure that they report their income correctly and only claim the deductions they are entitled to.

Tip: Stay organized, report accurately, and only claim legitimate deductions!

Taxes SMBs Have to File

SMBs have various tax obligations they need to fulfill. Although there are five general types of business taxes, SMBs' most prevalent state and local tax obligations typically revolve around income and employment taxes. Below are the five taxes that SMBs should file:

1. Income Tax

Income tax is the most fundamental tax for SMBs, imposed on the income earned by businesses within a jurisdiction.

Businesses are required to file an annual income tax return to report their earnings and calculate their tax liability. The applicable tax forms and rates depend on the business structure:

- Sole Proprietors: Use Form 1040 with Schedule C to report business income or losses.

- C Corporations: File Form 1120 for corporate income tax.

- S Corporations: File Form 1120-S and provide Schedule K-1 to shareholders.

- Partnerships and LLCs: File Form 1065 and issue Schedule K-1 to partners or members.

Each state may have additional income tax requirements for businesses operating within its jurisdiction.

2. Self-Employment Tax

The self-employment tax encompasses the employee's contribution and the employer's share of Social Security taxes and Medicare. This is because self-employed individuals fulfill both the role of an employer and an employee within their own business.

The self-employment tax rate for 2025 is 15.3%, and it is divided as follows:

- 12.4%: Social Security tax

- 2.9%: Medicare tax

Self-employed individuals must use Schedule SE (Form 1040) to calculate and report their self-employment tax. To manage this obligation, quarterly estimated tax payments are often required.

3. Estimated Tax

Estimated tax payments are essential for businesses and individuals who do not have taxes withheld from their income.

SMBs are required to make these quarterly payments to cover their tax liabilities, including income and self-employment taxes. Businesses must use Form 1040-ES (individuals) or Form 1120-W (corporations) to calculate and submit these payments.

2025 Quarterly Estimated Tax Deadlines

- January 15, 2025: Final payment for the 2024 tax year (income earned October–December 2024).

- April 15, 2025: First payment for the 2025 tax year (income earned January–March 2025).

- June 17, 2025: Second payment for the 2025 tax year (income earned April–June 2025).

- September 16, 2025: Third payment for the 2025 tax year (income earned July–September 2025).

- January 15, 2026: Final payment for the 2025 tax year (income earned October–December 2025).

Note: If any due dates fall on a weekend or holiday, payments are due the next business day.

4. Excise Tax

Excise tax, or excise duty, is a form of taxation imposed on specific goods and services. Regarding excise tax, SMBs do not make direct payments to the government. Instead, the responsibility of paying taxes lies with business owners who sell excise items. If your business does any of the following, you might have to pay excise taxes:

- Environmental taxes

- Communication taxes

- Air transportation taxes

- Fuel taxes

- Retail (truck, trailers chassis and body, and tractor)

- Ship passenger taxes

- Manufacturer taxes (coal)

Note: Look at the IRS Excise Tax Overview for a complete list of goods and services where excise taxes apply.

5. Employment Tax

Employment taxes refers to various taxes deducted from an individual's paycheck. It is often synonymous with the FICA tax, which funds Medicare and Social Security. Employment tax is typically a fixed percentage applied to all taxpayers.

If your small business has employees, you have certain employment tax responsibilities. This is also known as Payroll tax.

Examples of Employment Taxes

Social Security and Medicare Tax

Employers must deduct Social Security and Medicare taxes from employee paychecks and pay a portion of these taxes independently.

- The Social Security tax rate is 12.4%, with 6.2% paid by employees and 6.2% paid by employers.

- The Medicare tax rate is 2.9%, with 1.45% paid by employees and 1.45% paid by employers.

Federal Income Tax Withholding

To file your federal and state taxes you must withhold income taxes from employee paychecks based on the W-4 allowances they claim.

Federal Unemployment Tax

Employers pay a federal unemployment tax of 6% on each employee's first $7,000 income. State unemployment taxes may also be due, and the rates may vary.

What’s The Difference Between a Tax Credit and a Tax Deduction?

Tax deductions reduce your taxable income, while tax credits reduce the amount of tax you owe.

For instance, a $500 tax credit is worth the same as a $500 deduction, but it's applied differently. A deduction lowers your taxable income, which could put you in a lower tax bracket and save you even more money. On the other hand, a tax credit is applied directly to the amount of tax you owe, so it's worth the same, no matter what your tax bracket is.

Common Small Business Tax Deductions You Need to Know

Tax deductions are essential tools for reducing your taxable income, which in turn lowers your overall tax liability. As a small or medium-sized business (SMB) owner, understanding and claiming all eligible deductions can significantly impact your financial health.

Here’s a list of common tax deductions businesses should be aware of for the 2025 tax season.

1. Business Use of Home (Home Office Deduction)

If you use a portion of your home exclusively for business purposes, you can claim the home office deduction. This includes:

- A percentage of rent or mortgage interest

- Utilities (electricity, internet, water)

- Repairs and maintenance costs for the office space

Tip: Use Form 8829 to calculate and claim the deduction.

2. Business Travel Expenses

Travel expenses incurred for business purposes are fully deductible. This includes:

- Transportation (airfare, train, taxi, or mileage for car use)

- Lodging

- Meals (50% of the cost)

- Incidental expenses like tips and baggage fees

Note: Keep detailed records of travel purpose and receipts.

3. Vehicle Expenses

If you use your car for business purposes, you can deduct either:

- The standard mileage rate (72.5 cents per mile for 2026), or

- Actual vehicle expenses (gas, maintenance, insurance, depreciation)

Tip: Choose the method that offers the larger deduction and keep a detailed log of business miles driven.

4. Salaries and Wages

Payments to employees, including salaries, wages, bonuses, and commissions, are deductible. This also includes:

- Employer contributions to retirement plans

- Health insurance benefits

- Payroll taxes (Social Security, Medicare, unemployment taxes)

5. Rent and Lease Payments

If you lease office space, equipment, or machinery for your business, the rental payments are fully deductible. This includes payments for:

- Office buildings or retail space

- Equipment leases, such as computers and machinery

- Vehicle leases used for business

6. Supplies and Equipment

Costs associated with purchasing supplies and equipment needed to operate your business are deductible. Examples include:

- Office supplies like paper, pens, and printer ink

- Computers, software, and electronics

- Specialized equipment for your industry

Tip: For equipment, you may be able to claim depreciation using Section 179 or bonus depreciation rules.

7. Marketing and Advertising

Expenses for promoting your business are fully deductible, such as:

- Website development and hosting fees

- Social media and digital advertising

- Print ads, billboards, and other traditional advertising

- Costs of promotional materials like business cards or flyers

8. Utilities

The cost of utilities used for your business is deductible, including:

- Electricity

- Water

- Heating and cooling

- Internet and phone services

Tip: For home-based businesses, only the portion used for business is deductible.

9. Professional Services

Fees paid to professionals for business-related services are deductible. This includes:

- Accountants, bookkeepers, and tax preparers

- Legal consultants

- Business advisors and consultants

10. Loan Interest and Bank Fees

Interest on business loans, lines of credit, or credit cards used exclusively for business is deductible. Bank fees, such as account maintenance charges and transaction fees, also qualify.

11. Employee Education and Training

Costs related to employee development are deductible, including:

- Tuition reimbursement programs

- Workshops, conferences, and certifications

- Subscriptions to industry-related publications or software

12. Taxes

Some taxes paid by your business are deductible, such as:

- State and local income taxes

- Real estate and property taxes

- Payroll taxes

- Sales tax on deductible purchases

Also Read:

Tax Credits Businesses Owners Must Know

1. The Work Opportunity Tax Credit

Employers can claim a tax credit for hiring individuals from targeted groups, such as veterans. The amount of the credit depends on the category of worker hired, the wages paid, and the number of hours worked. For example, businesses that hire veterans can receive a credit of up to $2,400 for every new full-time hire.

2. Federal Research and Development Tax Credits

The Research and Development Tax Credit (R&D tax credit) was created in 1981 to encourage innovation in the United States. The credit is available to businesses of all sizes, including startups, and can offset both federal and state taxes. The R&D tax credit can also apply to various activities, not just traditional lab work.

For example, the credit can offset the costs of developing new products, processes and technologies, testing and validating new products, and improving existing products and processes.

3. Employee Retention Credit

Any employer who kept employees on payroll during COVID-19 can claim this tax credit. The credit is worth 50% of up to $10,000 in qualifying wages for each full-time employee in 2020. This tax credit has now increased to 70% of $10,000 in qualifying wages for each full-time employee (up to $21,000 credit for each employee) in 2021.

In addition to exploring tax credits at the federal level, small businesses can look into the hundreds of local and state credits available. Here are a few to begin with:

- Alternative Motor Vehicle Credit

- Empowerment Zone Employment Credit

- New Markets Credit

- Credit for Increasing Research Activities

- Plug-In Electric Drive Vehicle Credit

- Retirement Plans Startup Costs Tax Credit

- Health Coverage Tax Credit

For a more detailed breakdown, check out our guide on Small Business Tax Deductions and Credits

Tax Deadlines For 2025

January 2025

January 10, 2025

- Deadline for employees to report tips of $20 or more received in December 2024.

- Form: Form 4070 (Employee’s Report of Tips to Employer).

January 15, 2025

- Final estimated tax payment for Q4 2024.

- Forms: Form 1040-ES (individuals), Form 1120-W (C corporations).

January 31, 2025

Deadline to

- Issue Form W-2 to employees.

- File Form 1099-NEC for payments to contractors.

- File Form 1099-MISC for certain miscellaneous payments.

- Submit Form 940 for Federal Unemployment Taxes (FUTA).

- File Form 943 (agricultural employers) or Form 944 (small employers).

February 2025

February 18, 2025

- Deadline for employees who claimed a tax withholding exemption in 2024 to submit an updated Form W-4to their employers.

February 28, 2025

- Deadline for paper filing of W-2s and 1099s.

- Forms: W-2, W-3, 1099-NEC, 1099-MISC.

March 2025

March 17, 2025

- Annual tax return deadline for partnerships, S corporations, and multi-member LLCs.

- Forms: Form 1065 (partnerships), Form 1120-S (S corporations), Distribute Schedule K-1 to partners/shareholders.

March 31, 2025

- Deadline for electronic filing of W-2s and 1099s.

- Forms: W-2, W-3, 1099-NEC, 1099-MISC.

April 2025

April 15, 2025

- Federal tax return filing deadline for individuals, C corporations, and trusts.

- Forms: Form 1040 (individuals), Form 1040-SR (seniors), Form 1120 (C corporations).

- First estimated tax payment for Q1 2025.

- Request an extension using Form 4868 (individuals) or Form 7004 (businesses).

April 30, 2025

- Quarterly payroll tax filing deadline.

- Form: Form 941 (Employer’s Quarterly Federal Tax Return).

June 2025

June 16, 2025

- Deadline for U.S. citizens living abroad to file 2024 federal income taxes.

- Second estimated tax payment for Q2 2025.

- Forms: Form 1040, Form 1040-ES.

July 2025

July 31, 2025

- Quarterly payroll tax filing deadline for Q2.

- Form: Form 941.

September 2025

September 15, 2025

- Extended deadline for partnership and S corporation tax returns.

- Third estimated tax payment for Q3 2025.

- Forms: Form 1065, Form 1120-S, Form 1040-ES.

October 2025

October 15, 2025

- Extended deadline for individual and C corporation tax returns.

- Forms: Form 1040, Form 1120.

December 2025

December 15, 2025

- Fourth estimated tax payment for C corporations for 2025.

- Forms: Form 1120-W.

December 31, 2025

- Deadline for Required Minimum Distributions (RMDs) and finalizing charitable contributions or retirement account funding.

For a more detailed breakdown, go through Business Tax Deadlines: Key Dates for 2025

How to File Your Taxes: A Step-by-Step Guide

Filing taxes may seem daunting, especially if you’re new to the process. Here’s a step-by-step guide to help you file your business taxes smoothly:

Step 1: Determine Your Business Structure

The forms and filing requirements vary depending on your business structure. Identify your business type to know which forms to complete:

- Sole Proprietors: Use Schedule C (Form 1040) to report income and expenses.

- Partnerships: File Form 1065 (U.S. Return of Partnership Income) and provide partners with Schedule K-1 to report their share of income or loss.

- C Corporations: File Form 1120 (U.S. Corporation Income Tax Return).

- S Corporations: File Form 1120-S (U.S. Income Tax Return for an S Corporation) and provide shareholders with Schedule K-1.

- LLCs: File as per your classification (sole proprietorship, partnership, or corporation).

Step 2: Gather All Necessary Documentation

Organize and collect the required paperwork to ensure a smooth filing process. Key documents include:

- Financial Statements: Income statements, balance sheets, and cash flow statements to calculate income and expenses.

- Receipts for Deductions: Proof of deductible expenses like utilities, travel, office supplies, and advertising.

- Employee Records: Forms W-2 (for employees) and W-3 (transmittal of wage statements).

- Contractor Payments: Form 1099-NEC (non-employee compensation) and Form 1099-MISC (miscellaneous income).

- 1099-K: Received from payment processors for credit card transactions.

- Tax Payment Records: Records of estimated tax payments made during the year.

- Previous Year’s Tax Return: For reference and comparison.

Step 3: Choose Your Filing Method

Decide on a method to file your taxes based on your confidence and complexity of your finances:

- Hire a Professional: An accountant or tax preparer can ensure accuracy, compliance, and optimization of deductions.

- Use Tax Software: User-friendly platforms like TurboTax, H&R Block, or QuickBooks provide step-by-step guidance.

- Do It Yourself (DIY): If your business finances are straightforward, you can manually complete IRS forms and submit them.

Step 4: Complete the Appropriate Tax Forms

Filling out the correct forms accurately is critical. Use IRS instructions or tax software for guidance. Common forms include:

- Sole Proprietors: Form 1040 with Schedule C (Profit or Loss from Business).

- Partnerships: Form 1065 and Schedule K-1 for each partner.

- Corporations: Form 1120 (C corporations) or Form 1120-S (S corporations).

- Self-Employment Tax: Schedule SE (Form 1040) to calculate Social Security and Medicare taxes.

- Employment Taxes: Form 941 (Quarterly Federal Tax Return) and Form 940 (Federal Unemployment Tax Return).

Pro Tip: Use the IRS website to access forms and instructions, or let tax software populate them automatically.

Step 5: Submit Your Tax Return

Choose your preferred method to file your return:

- Electronically: File through IRS-authorized e-filing platforms or tax software. Electronic filing is faster and provides confirmation of receipt.

- By Mail: Print and mail completed forms to the IRS. Ensure the envelope is postmarked by the deadline to avoid late filing penalties.

Step 6: Pay Any Taxes Owed

Calculate your total tax liability and submit payments on time. Payment options include:

- Online: Use IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or tax software.

- By Mail: Send a check or money order payable to "U.S. Treasury" along with your payment voucher.

- Installment Plan: If you cannot pay in full, apply for a payment plan with the IRS.

Pro Tip: Paying electronically is faster and provides immediate confirmation.

Step 7: Keep Records

Maintain copies of your filed tax return, receipts, and supporting documents for at least three years (or longer if required by specific tax laws). This documentation is crucial for:

- Audits: Responding to IRS inquiries or audits.

- Future Reference: Comparing financial performance across years or verifying deductions.

The type of tax forms you’d need to know about, or file depends on your business structure. For instance, sole proprietors typically file Schedule C Form 1040, while corporations file Form 1120.

How Sage Expense Management (Formerly Fyle) Can Help Your Prepare for Tax Season

Tax season can be overwhelming, but our platform simplifies the process for SMBs. Here’s how:

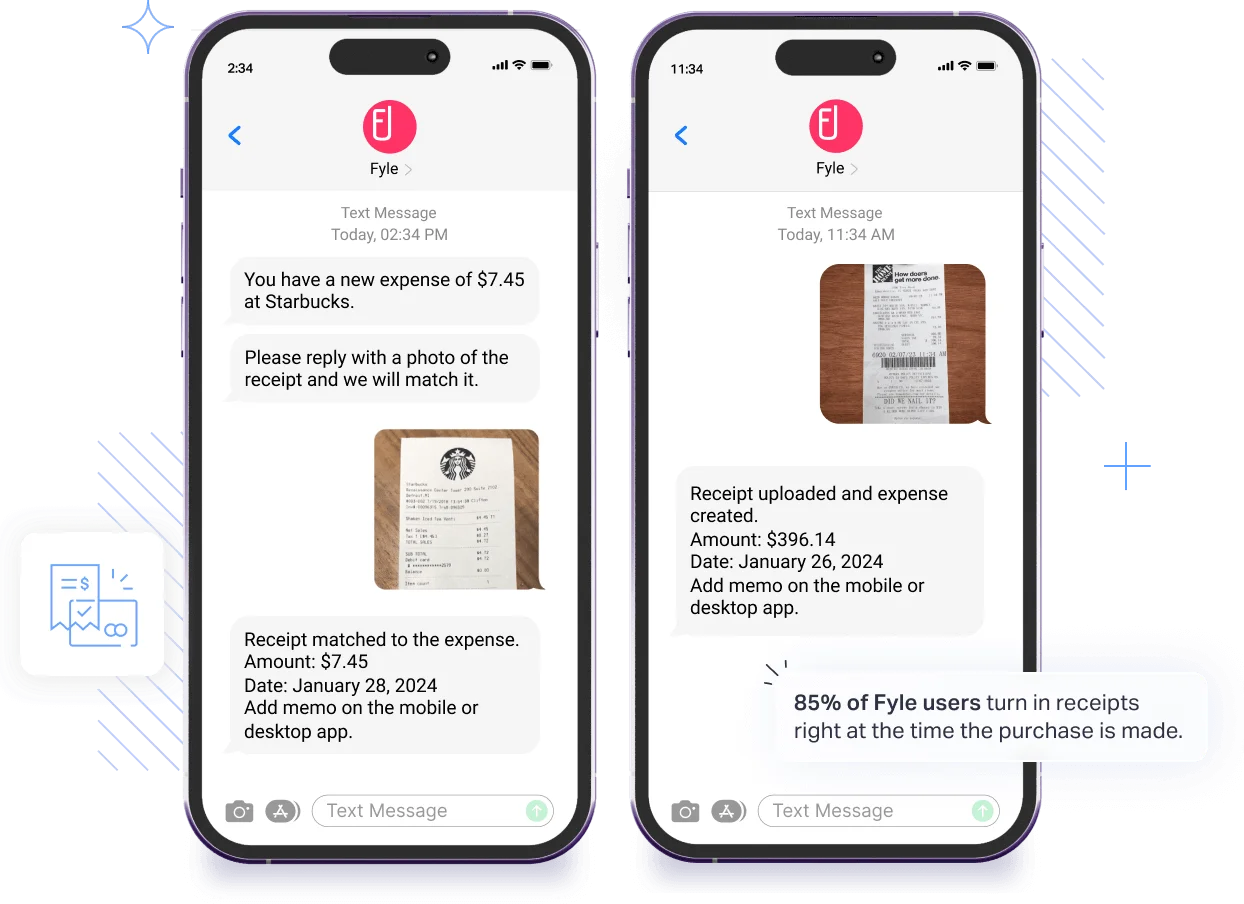

- Real-Time Receipt Collection: Submit receipts instantly via text message, Gmail, Outlook, or Slack.

- Automated Credit Card Reconciliation: Integrates with all major credit card networks for instant transaction notifications and automated reconciliation. .

- Policy Compliance Checks: Automated policy checks ensure compliance with IRS rules.

- Tracking Tax-Deductible Categories: Analyze spending by category, project, or merchant.

- Integration with Accounting Tools: Sync seamlessly with accounting tools like QuickBooks, Sage, Xero and more.

By automating time-consuming tasks, reducing the chances of errors, and integrating with your existing tools, our platform helps SMBs stay organized and efficient during tax season.

Whether it’s capturing deductions, reconciling expenses, or maintaining compliance, we provide the tools your business needs to handle taxes like a pro.

Tax Season 2025 Questions Answered

Filing Business Taxes: Do It Yourself or Hire a Professional?

The Internal Revenue Service (IRS) oversees the federal tax system, while county, municipal and other taxes are administered by local taxing authorities.

This means businesses and individuals must file taxes with the federal government and their local jurisdiction. While most individuals choose to enlist the help of tax preparers and accounting professionals to help file their business taxes, others prefer calculating their own tax returns.

Caution: SMB owners can file taxes themselves, but outsourcing or hiring tax professionals is always best. These professionals understand the nuances of tax law that you may miss, and they can ensure that your tax returns are filed accurately and that you receive the maximum possible tax benefits.

How can SMBs Request Tax Extensions?

If you need more time to prepare your tax returns, request a tax extension with the IRS. When you file for a tax extension, it's important to note that you must still pay by the original tax filing deadline.

Although you may not have your exact total tax liability, estimate and submit the payment for the amount you expect to pay. Once you file your returns, you may need to make an additional payment or be eligible for a refund if you overpaid.

How Can SMBs Avoid Penalties From the IRS?

Payment due dates are also known as deposit dates. With SMBs, payments are often required before tax filing dates. Both late tax filing and late payment result in penalties and fines.

All SMBs should know the specific tax deadlines of their state. While April 15th is the customary deadline for filing tax returns, it is advisable not to postpone this task until the last minute.

When Will I Receive My Tax Refund for 2025?

The IRS states tax refunds will be distributed within 21 calendar days of US tax filing.

Stay Updated with the 2025 Tax Season

As a small business owner, it’s crucial to familiarize yourself with the US tax filing deadlines at an early stage. Since taxes can be complicated, always prepare early and timely for the next tax season. Regularly check the IRS website for any updates and changes and to see what to expect over the following season.