For nonprofit finance teams, discovering policy violations weeks later is like spotting a leak after the flood, too late to prevent the damage. By the time you catch it, the damage is already done, budgets are off, reports don’t match, and grant compliance is at risk.

If your team still reviews expenses after they’re submitted, you're not alone. Most nonprofits operate with manual checks that delay visibility and leave room for errors, especially when you're juggling reimbursable claims, card transactions, per diems, and multiple funding rules.

But it doesn’t have to be that way.

With Sage Expense Management, policy checks happen the moment a receipt is submitted. Not days later.

Why Manual Policy Checks Don’t Work for Nonprofits

Let’s say a volunteer books a hotel for a conference and goes over the nightly limit.

Or a program manager buys office supplies but forgets to submit the receipt.

Or someone accidentally uses the nonprofit card at an unapproved vendor.

In a manual system, you find out after the expense is submitted. Sometimes, you only spot it when you’re closing the books—or worse, during an audit.

And in nonprofit finance, that can mean:

- Violating donor or grant restrictions

- Running into trouble during IRS audits

- Delays in reimbursing your tea

- Wasted time on follow-ups and corrections

Sage Expense Management Flags Policy Violations Before They’re Submitted

Our platform solves this by checking every expense the second it’s created—on mobile, web, email, or even text.

The moment someone submits a receipt via mobile, web, email, or even text, the platform instantly checks it against your configured rules.

If it breaks policy?

- he expense is flagged instantly

- Explains the issue

- Prompts the user to fix it, before it reaches an approver

No more waiting till the end of the month to find problems.

No more errors buried in bulk reports.

No more risk of non-compliance snowballing.

Custom Rules Built Around Your Nonprofit's Workflow

With the Sage Expense Management platform, you can configure your own rules without needing IT help or spreadsheets. The powerful policy engine lets you set even the most complex conditions, tailored to your nonprofit’s unique workflows.

Set policies like:

- Receipt requirements

e.g., require receipts for all expenses over $25 - Spending limits

e.g., cap meals at $40/person, or hotels at $150/night - Blocked categories

e.g., restrict alcohol, entertainment, or unapproved vendors - Mandatory tags

e.g., every expense must be linked to a program, department, or grant - Mileage and per diem limits

e.g., automatically apply IRS-compliant rates

Real-Time Alerts For Employees And Approvers

With Sage Expense Management, nobody is left guessing.

- Employees are notified as soon as their expense violates a policy, with a clear message explaining why

- Approvers see visual alerts during the review process, so they can flag, reject, or approve with full context

- Finance teams get visibility without sorting through Excel or manually scanning receipts

The system acts as a digital auditor, flagging, guiding, and enforcing policy to prevent anything from falling through the cracks.

What This Looks Like In Practice

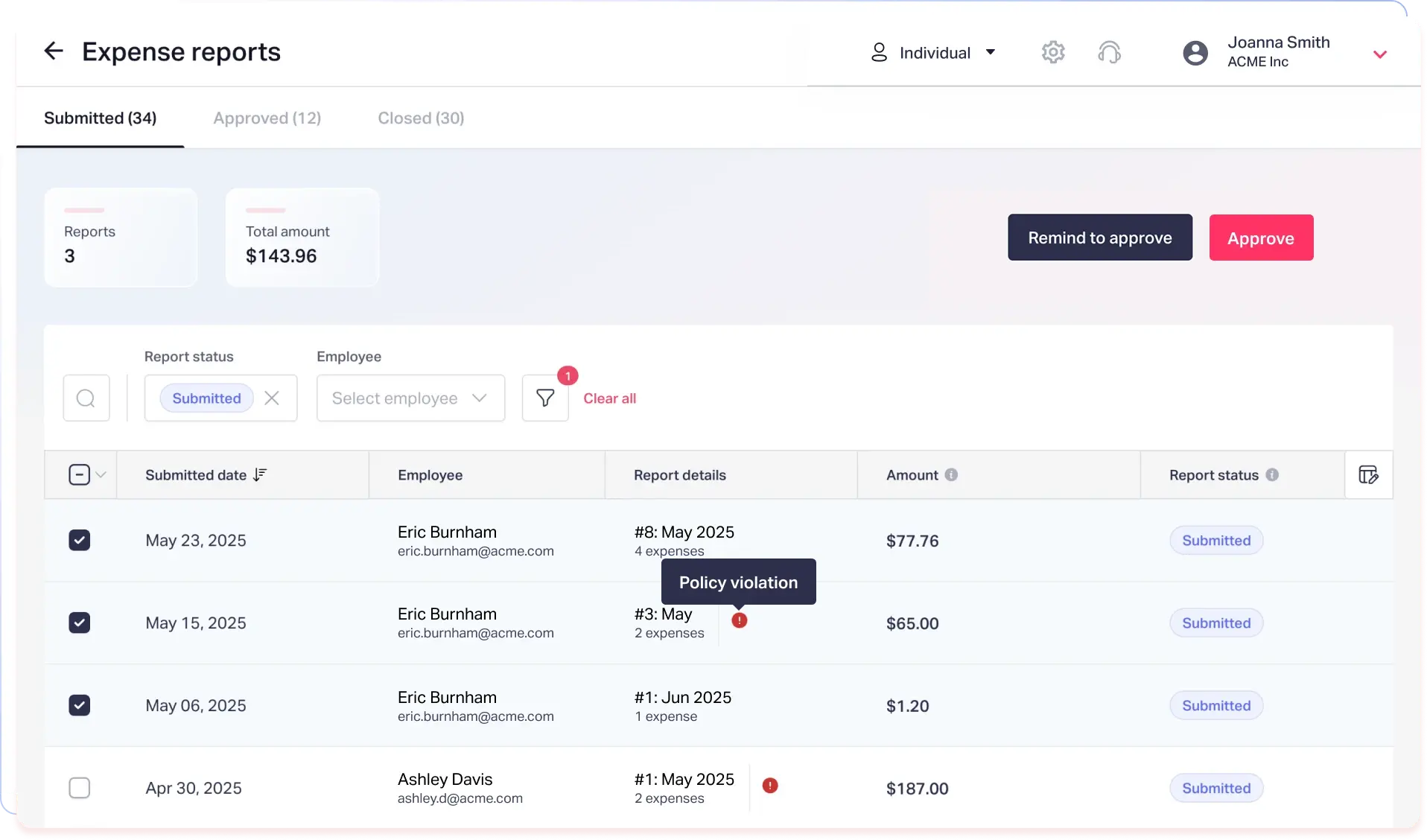

Let’s say a regional coordinator at a nonprofit logs a $600 lodging expense while attending a community outreach event.

Here’s what happens inside the platform:

- We check the amount, category, and vendor against your nonprofit’s pre-set policy rules

- The lodging amount exceeds the allowed nightly cap

- A policy violation is instantly flagged inside the report

- The employee is prompted to add a justification right away (e.g., “No other hotels were available in the area”)

- The report moves to the program manager or finance approver with the violation clearly highlighted

- Everyone sees the full audit trail, no back-and-forth emails, no guessing

What This Means for Your Finance Team

With real-time checks in place:

- You catch violations before they land in your inbox

- You reduce the chances of non-compliance with IRS, donor, or grant rules

- You get cleaner, audit-ready reports

- And you spend less time chasing clarifications and making corrections

Stay Ahead of Policy Violations Without Extra Work

Nonprofits already juggle enough responsibilities. Manually reviewing every expense or spotting policy issues after the fact only adds more pressure to already stretched finance teams.

With Sage Expense Management, policy checks happen the moment an expense is submitted. You get clean data, fewer surprises, and complete visibility into every transaction without slowing down your workflow.

It’s a simple way to stay compliant and in control, while your team focuses on the mission.