For most nonprofits, managing expenses is still a manual, time-consuming process. Employees submit receipts weeks after an event. Approvals are handled through email chains. Expenses are verified, categorized, and copied into spreadsheets, then exported into accounting software.

This slows everything down, creates room for errors, and leaves little time for what really matters: your mission.

That’s where Sage Expense Management comes in. It automates the entire expense workflow, from submission to approval to export, so your finance team can work faster, stay compliant, and focus on impact instead of admin.

Why Manual Expense Workflows Don’t Work

Spreadsheets and email threads might seem simple at first. But as your team grows or grant reporting becomes more complex, the cracks start to show.

Manual workflows lead to:

- Missing or late receipts

- Inconsistent coding and reimbursement delays

- Repeated back-and-forth on approval status

- Errors in grant or project tagging

- Time wasted preparing monthly reports and exports

If this sounds familiar, you’re not alone. And you're not stuck with it either.

Also Read:

How Sage Expense Management Automates the Entire Expense Workflow

Sage Expense Management

isn’t just a receipt tool or approval tracker. It brings everything into one automated workflow.

Here’s how it works:

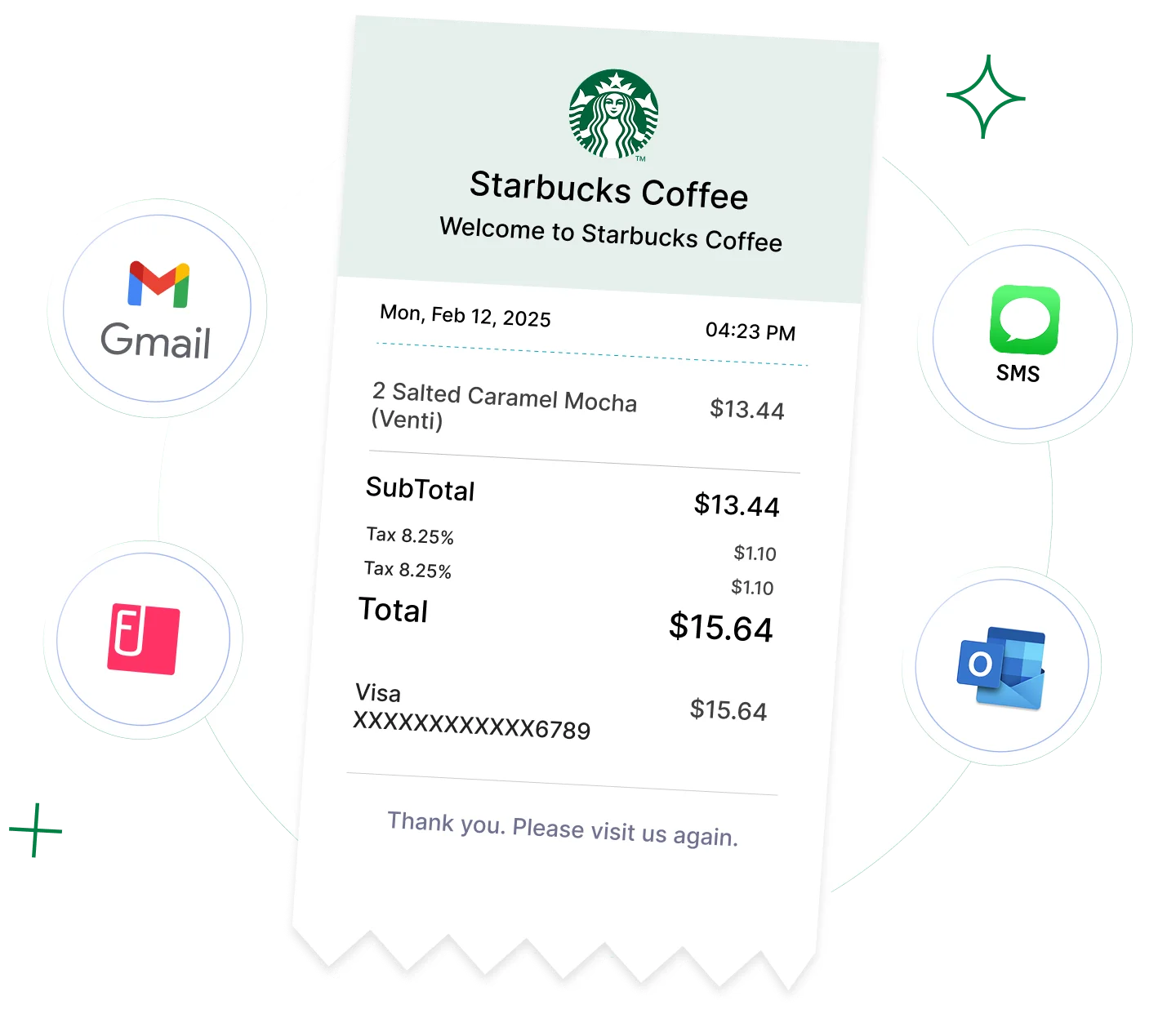

1. Employees and Volunteers Submit Expenses From Anywhere

Whether it’s a card swipe at a grocery store or mileage from a community visit, we make it easy for anyone to submit expenses in real time.

They can:

- Snap a photo of a receipt and text it to Sage Expense Management

- Submit expenses from the mobile app, web app, or even Gmail/Outlook

- Add mileage or per diem directly using IRS-compliant rates

- Tag the right project, department, or funding source using custom fields

No need to remember what was spent or save paper receipts for later.

2. Policy Checks and Auto-Coding

Once submitted, Sage Expense Management:

- Applies your nonprofit’s custom coding rules

- Flags out-of-policy spends

- Fills in fields like grant, fund, or department via dropdowns or pre-set values

- Let's you enforce mandatory fields or automate cost allocations

It ensures consistency across every report.

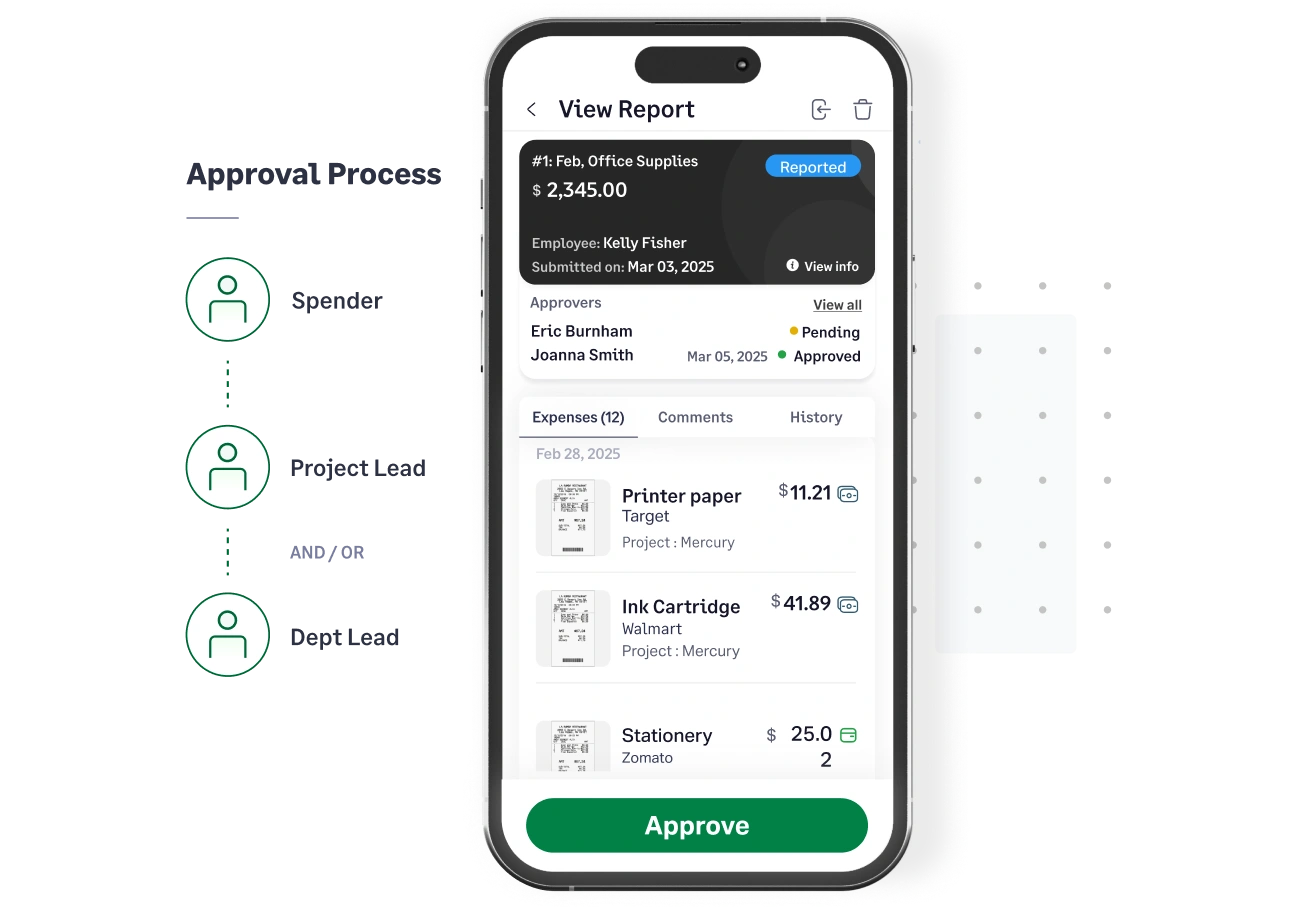

3. Approval Workflows Route Expenses to the Right People

We let you set up approval flows that mirror how your nonprofit actually operates.

You can:

- Route by role, department, grant, or project

- Set multi-level workflows (e.g., Volunteer → Program Lead → Finance Team)

- Approve directly from mobile or email with one click

- Add comments, request changes, or reject non-compliant expenses

Every action is logged, providing finance with full visibility without requiring them to chase approvers.

4. Audit-Ready Reports for Finance

Once approved, all reports are:

- Stored securely with attached receipts

- Tagged with relevant codes for audit trails

- Ready for review by finance before reimbursement or export

No loose receipts. No ambiguous coding. Everything is clean and consistent.

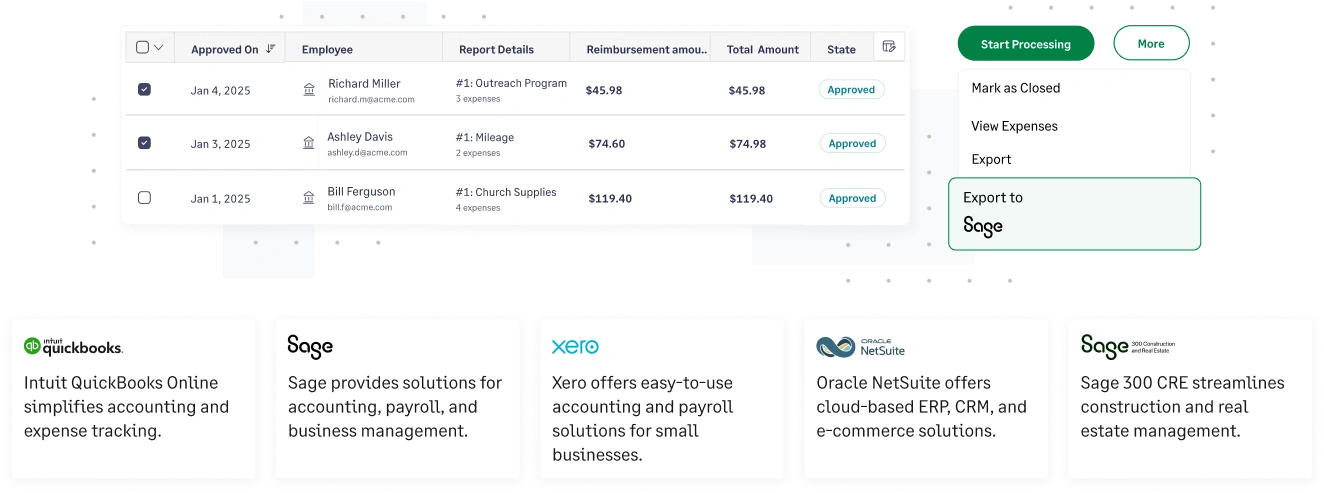

5. Seamless Export to Accounting Software

Sage Expense Management integrates with QuickBooks, Sage, NetSuite, Xero, and more.

With a click, you can:

- Export reports with pre-filled fields and matched receipts

- Push custom fields (like fund or cost center) into your system

- Avoid rework or copy-pasting from spreadsheets

- Save hours on monthly closing and grant reporting

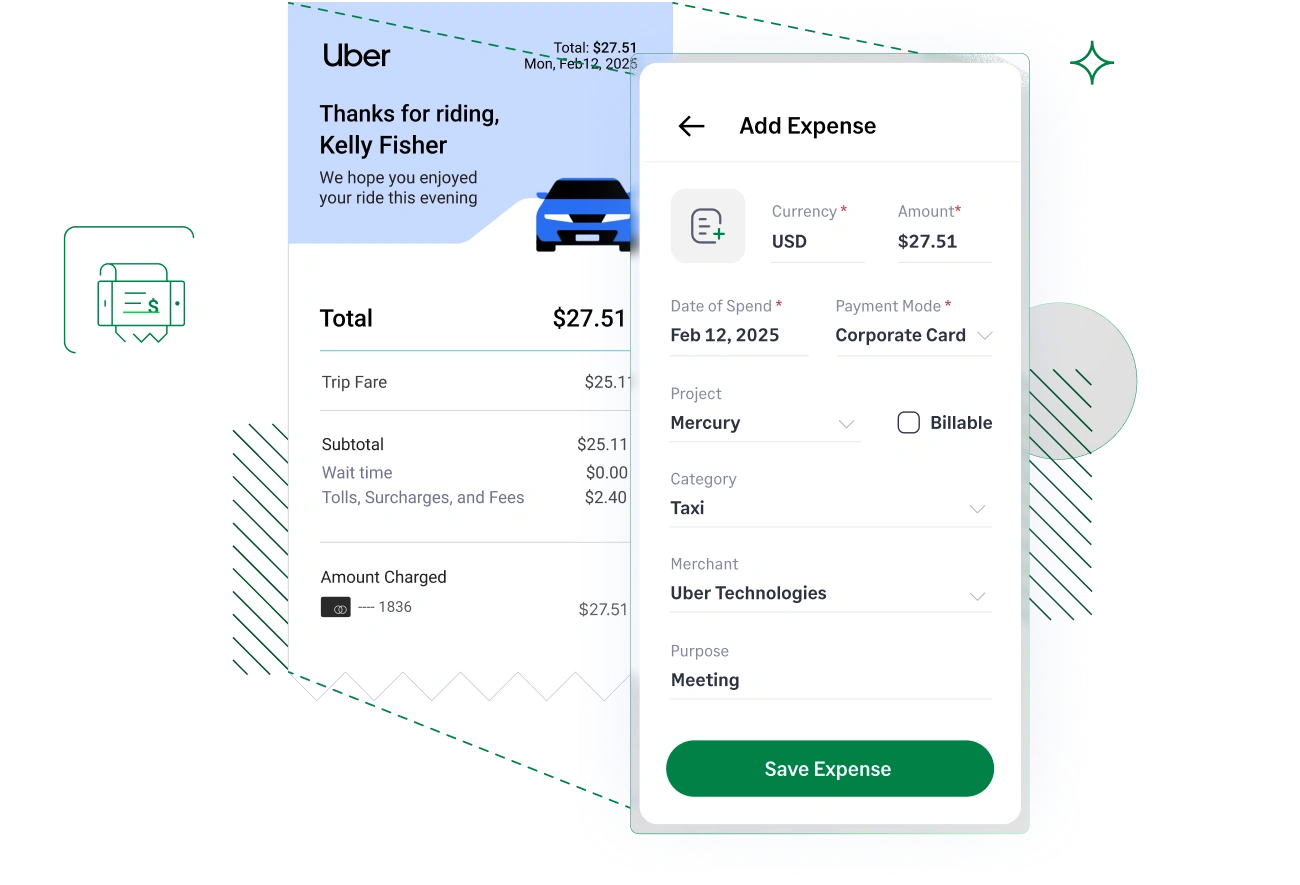

What This Looks Like in Practice

Let’s say a staff member travels to host a fundraising event. They submit:

- A hotel receipt on the company credit card

- A grocery run for snacks (reimbursable)

- Mileage for driving from the office to the venue

Here’s how Sage Expense Management handles it:

- They upload receipts via text and mobile app, and log their mileage

- It auto-matches the card transaction, calculates mileage, and checks for policy issues

- Expenses are routed to the Program Manager and Executive Director

- Both approvers review and approve directly from their inboxes

- Finance does a quick review, then exports the batch to QuickBooks Online

No missing receipts. No manual data entry. Full compliance and audit trail

.webp)

Ditch the Spreadsheets. Automate Your Expense Workflow.

Sage Expense Management helps nonprofits spend less time on admin and more time serving communities.

Whether you're tracking meals, mileage, or card purchases, it automates it all with no manual tracking or delayed reimbursements.

Just fast, compliant, and reliable workflows that work the way you do.