Audits are painful, but they rarely start randomly. They begin when your financial data raises flags. For the controller, one of the most immediate signs of poor internal control is inconsistent expense categorization.

An audit hinges on consistency, proof, and strict adherence to rules like those detailed by the IRS. Failing to meet this standard signals a flawed financial process, inviting external scrutiny of every claim you make.

Three Categorization Errors That Invite Scrutiny

Your manual process is likely exposing your company to risk through these common categorization flaws:

1. The Inconsistency Flaw (The Biggest Red Flag)

The cardinal rule of compliance is consistency. Treating the same type of expense differently month-to-month—for instance, coding a recurring software subscription as "IT Hardware" in January and "Office Supplies" in February—signals a lack of formalized policy. Auditors view this inconsistency as a failure of internal control, invalidating the entire process.

2. The Allocation Flaw (Business vs. Personal)

Failing to clearly and consistently allocate costs between business and personal use is an immediate compliance risk. This is most common with vehicle use, home office utilities, and cell phone costs, where the deduction must be clearly and meticulously divided.

3. The Capitalization Flaw (Expense vs. Asset)

One of the highest-stakes errors is incorrectly classifying a capital purchase as a current deduction. High-cost items (e.g., machinery, equipment, major tools) must generally be capitalized and recovered through depreciation. Incorrectly deducting these as a simple expense signals a fundamental failure to adhere to accrual accounting principles.

The Cost of Audit Failure

These simple categorization flaws translate quickly into measurable financial risk:

- Disallowed Deductions: The IRS requires detailed substantiation for meals and travel. Inconsistent coding—such as misclassifying entertainment as a meal—can lead to heavy penalties and the disallowance of the entire deduction.

- Accountable Plan Failure: Deducting employee reimbursements relies on maintaining a strict Accountable Plan, which demands employees provide timely and adequate documentation. Inconsistent expense submission due to manual chasing puts your Accountable Plan status at risk.

- R&D Risk: The latest IRS rules mandate that Research & Experimental (R&E) costs must be capitalized and amortized over five years. If your expense data cannot clearly separate R&E costs from other supplies, you risk major penalties for inaccurate amortization.

The Sage Expense Management Shield: Enforcing Consistency

You can eliminate audit red flags by making categorization consistency mandatory, not optional. Sage Expense Management (formerly Fyle) acts as your compliance fortress by enforcing policy in real-time.

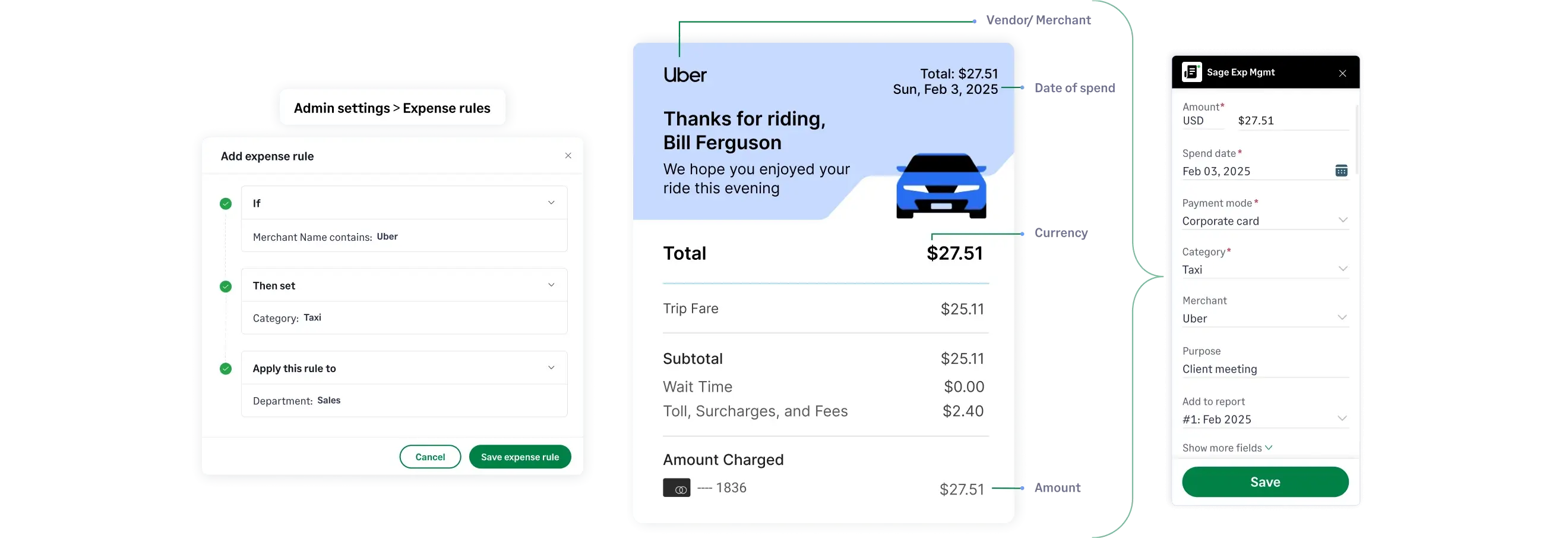

Policy-Driven Categorization

The system learns from historical data to auto-suggest the correct GL code, eliminating human guesswork and forcing consistency across all employee submissions.

Mandatory Custom Fields

Structured, dependable fields guarantee compliance on complex costs. For instance, choosing a "Cost Code" can trigger a mandatory "Cost Type" field, ensuring that tax-critical data is captured correctly upfront.

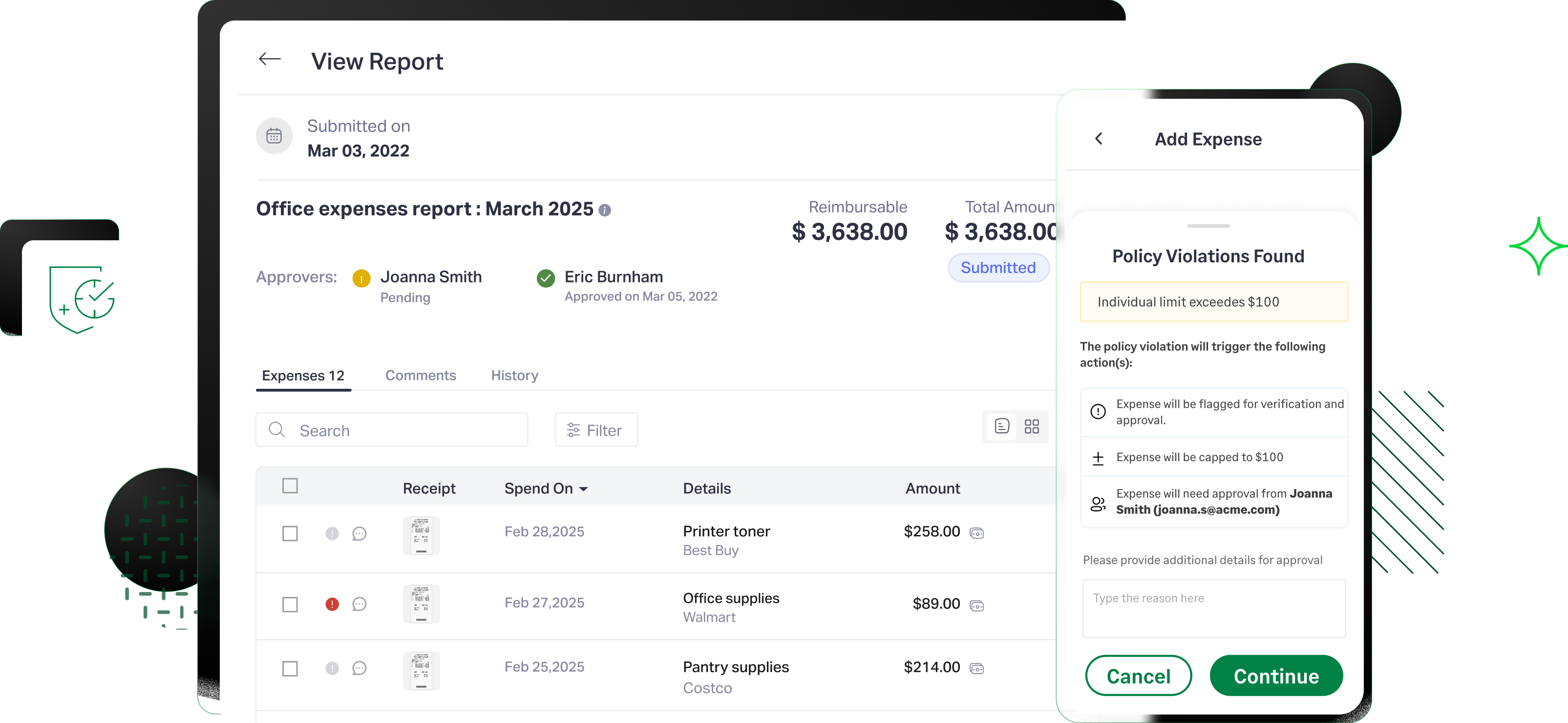

Real-Time Enforcement

The system flags non-compliant or inconsistent categories before submission, preventing the error from ever polluting your general ledger.

From Reactive Risk to Proactive Defense

Automated controls transform expense management from a source of constant audit risk into a system of verifiable compliance. Stop relying on employee memory and manual corrections. It’s time to move to a system that enforces the consistency, accuracy, and meticulous documentation auditors demand.

{{audit-red-flags="/cta-banners"}}